Last year was a tough one for Zendesk, with several months of uncertainty. But the company appears to have emerged from that instability, none the worse for wear, with a new private equity owner and a fresh CEO to lead it into its next phase.

The customer service software company began life in 2007, raising over $85 million along the way, per Crunchbase. It went public seven years later and grew to over $1 billion in revenue. It was fairly smooth sailing until last year.

The landslide of troubling news began innocently enough in February 2022 when Zendesk rejected a $17 billion takeover bid. It believed that the offer was too light, and in a TechCrunch+ analysis, we agreed that it was the right move. It appeared to be worth so much more.

Later that month, Zendesk’s own investors rejected a $4.1 billion offer to buy SurveyMonkey, one that it purported would not only generate more revenue, but also help it move into the adjacent field of customer experience. Investors were not swayed.

After two failed deals in less than a month, it didn’t take long for activist investor Jana Partners to start sniffing around, and they were not happy, not one little bit. By June, investors were hammering the stock, vexed with the direction of the company. While it defiantly vowed to stay private, by the end of the month, it had agreed to be sold to an investor group led by Permira and Hellman & Friedman for $10.2 billion, considerably less, you will note, than the deal it rejected the previous February.

Longtime CEO and co-founder Mikkel Svane stepped down in November, and customer service software industry veteran Tom Eggemeier was brought in to replace him, first as interim chief executive and eventually permanently.

After all that turbulence, it would be easy to think that overall financial performance had suffered as a result, but as you shall see, that really wasn’t the case. We sat down with Eggemeier to find out how he steadied the ship and put the company back on track.

Stand and deliver

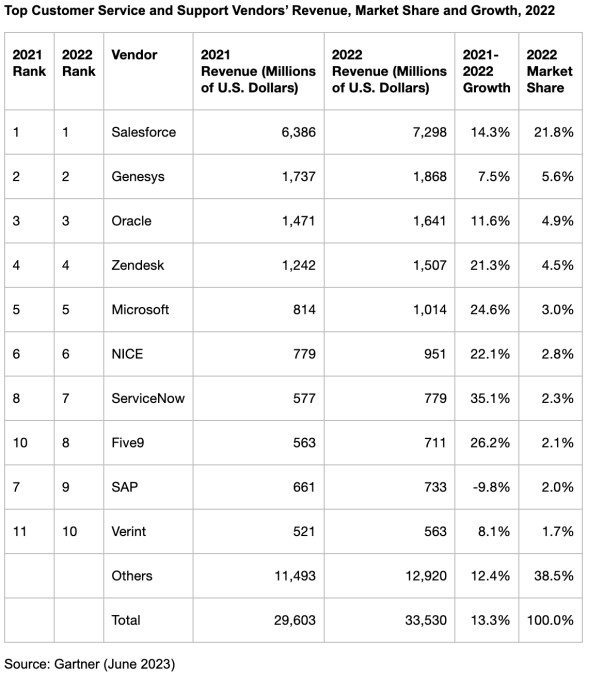

Let’s start by examining Zendesk’s market share numbers. According to Gartner, the company is firmly in fourth place in the customer service market, the same place it found itself the prior year. So even after all that drama, its market position didn’t change, showing that even in a time of economic and company instability, Zendesk was able to maintain its position and, more importantly, its customers.

Consider that Zendesk sits behind three corporate giants: Salesforce, Genesys and Oracle. And it’s well ahead of Microsoft, which is in fifth place.

Image Credits: Gartner

Kate Leggett, an analyst who covers CRM and customer service at Forrester, says Eggemeier was well suited to take over as CEO. “Tom Eggemeier ran sales, marketing and support for Genesys, worldwide before becoming the president of Genesys,” she said. “He will be able to lead Zendesk to profitable growth and operational discipline as Zendesk invests more heavily in innovation, system integrator partner networks and service and customer success functions.”

The company made its final public earnings report last October, reporting revenue of $417 million for the quarter, growing 20% year over year, good for a healthy run rate of $1.6 billion. Eggemeier tells TechCrunch+ that while the company hasn’t been able to maintain that rate, as many SaaS companies have struggled to maintain double-digit growth this year, it is still growing at double digits, 10% year over year in 2023, which would put it on a run rate of around $1.8 billion in total revenue for this year.

With a TAM in the neighborhood of $85 billion, Eggemeier expects to reach $2 billion by next year or early 2025, but he has much bigger ambitions for Zendesk. “We’re in this situation where we’re going from almost a $1.5 billion company when Mikkel left, but we have goals to be a $5 billion or $10 billion company,” he said.

Back to the future

It’s not easy taking over for a founder-CEO, especially after last year’s turmoil, but Sudhir Rajagopal, an analyst who covers customer experience at IDC, says Eggemeier has been a steadying hand.

“They have done a good job of staying on course with product innovation and their bet on doubling down on AI has certainly been fortuitous in terms of timing with the AI rush from clients. YoY revenue has grown and from a customer standpoint, I don’t believe the perception has been hit — in fact, quite the opposite,” he said.

Holger Mueller, an analyst at Constellation Research, agrees that the company emerged relatively unscathed. “Zendesk is a great example of how corporate turbulence can be just ‘noise’ for customers as long as two things stay in place: customer support and product development. Those have not been affected significantly — so Zendesk customers [remained],” he said.

There is more good news for Eggemeier as he approaches his second year in the role: Customer service in particular is a market poised to take advantage of AI, and just this week Zendesk announced a new generative AI product, Zendesk AI.

Rajagopal said Zendesk is well positioned to take advantage of AI after acquiring Cleverly a couple years ago. “Cristina Fonseca, who founded Cleverly, now leads AI at Zendesk. She has an innovative vision, a sound understanding of not just AI technology, but how to apply that towards customer service use cases. Buyers are clearly looking for customer experience outcomes, not tech or innovation for the sake of it,” he said.

The transition has not been without pain. Zendesk announced it was laying off 8% of the workforce in June, which now stands at over 5,200 employees. In a letter to employees, Eggemeier attributed the layoffs to overhiring from 2020–2022, a reason many companies gave for workforce reductions this year.

He believes that in spite of having to make that move, the company is on the right track and has a bright future. “So we’re profitably growing. We’ve got good gross and net [customer] retention. We are really focused on making sure that we maintain our customers. I give a lot of credit to Mikkel and the team who laid a really good foundation. I think we’re growing upon that foundation, so I think we’re in a good situation.”