There haven’t been many neobanks cropping up lately, so I was a little surprised to learn that Lupiya recently raised a $8.3 million Series A. The company claims it is trying to make the world better “by creating a landscape that promotes an economically empowered Zambia.”

For the 69th installment (nice!) of the Pitch Deck Teardown series, let’s take a peek at how Lupiya told its story to close this round.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Lupiya’s deck is impressively compact at just 10 slides. A compact deck makes for a great way to tell the story quickly, but it also means you risk missing a couple of things.

The company said it has edited its traction slide to protect some sensitive details, but it did share some of the numbers with me in confidence. Suffice it to say, the company has some pretty impressive metrics to back up its progress since it was founded in 2016.

Here are the slides in the deck:

- Cover slide

- Problem slide

- Solution slide

- Market size slide

- Business model slide

- Competition slide

- Traction slide

- Team slide

- Ask and use of funds slide

- Closing slide

Three things to love

There are always going to be some pieces missing in a 10-slide deck, but overall, I’m extremely impressed with what’s there. Here are three highlights:

A clear, metrics-forward problem statement

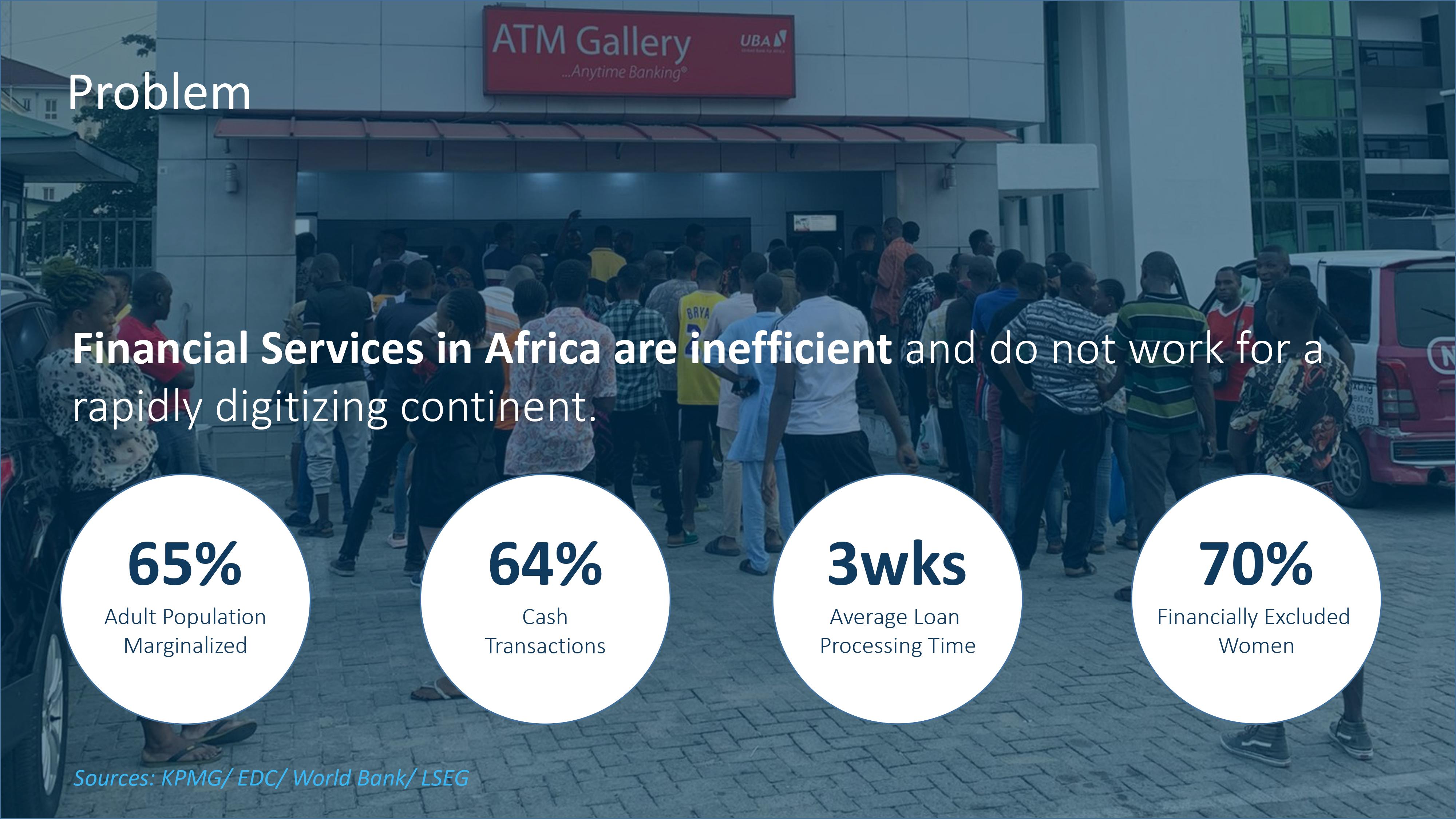

[Slide 2] Problem slide. Image Credits: Lupiya

Well, take a leaf out of Lupiya’s book: Bring the numbers to show the scope and severity of the problem. It’s almost like a sneaky preview of the market size rolled in with the problem statement. Very well done.

Clear and clean business model

I don’t know about you, but I found it pretty interesting to see the numbers Lupiya has baked into its business model, especially when compared to the numbers I’m used to from banking services elsewhere in the world:

[Slide 5] Business model slide. Image Credits: Lupiya

In any case, I like a good, clean, simple business model, and this ticks that box.

Solution brevity

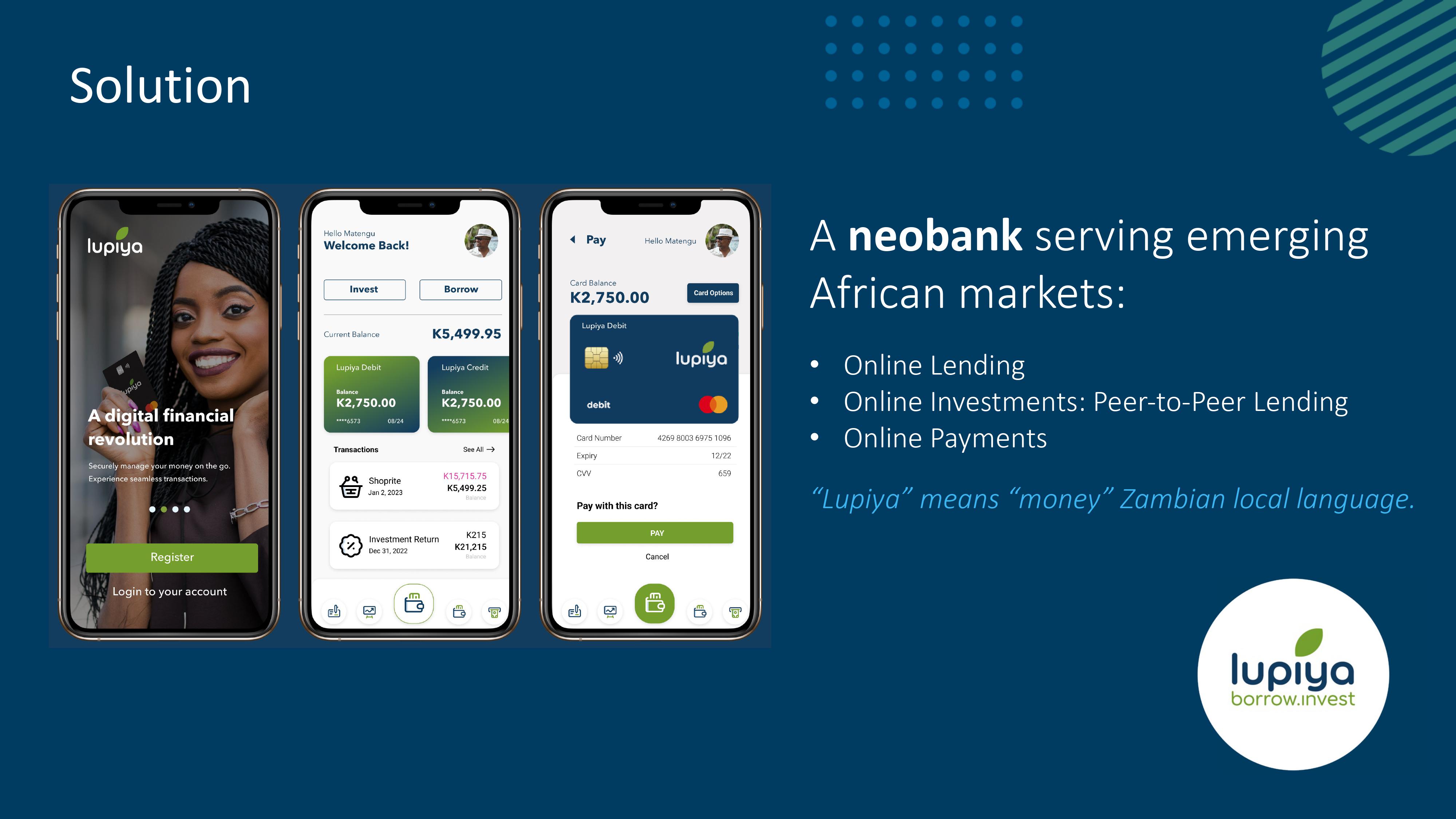

[Slide 3] Solution/product slide. Image Credits: Lupiya

In the rest of this teardown, we’ll take a look at three things Lupiya could have improved or done differently, along with its full pitch deck.

Three things that could be improved

Unlike last week’s pitch deck teardown, where I could scarcely believe that the team had raised money at all, I can totally see how Lupiya has managed to raise the funding.

That said, there were definitely a few gaping holes in its pitch deck.

Dodgy market sizing

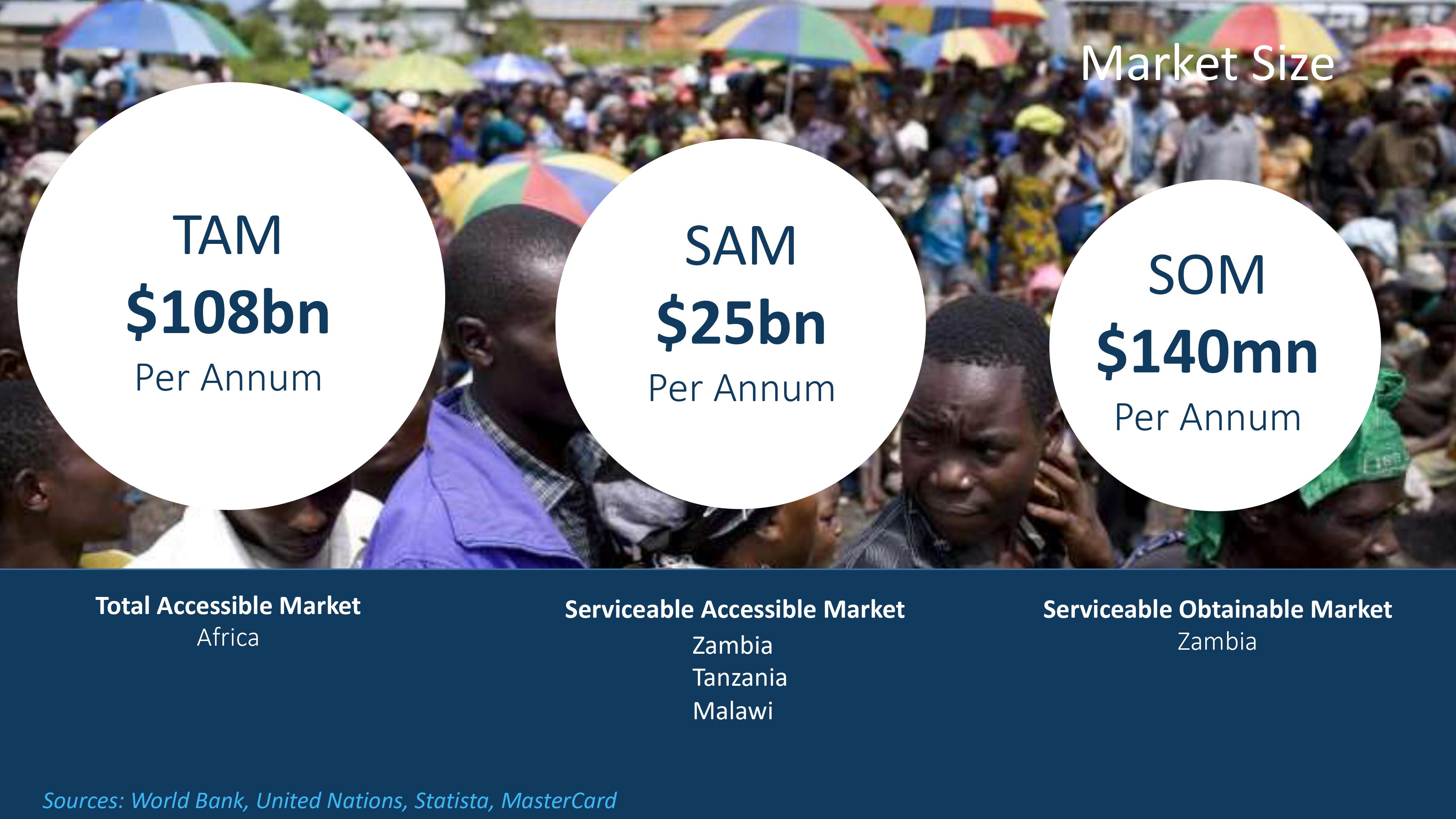

[Slide 4] Market size slide. Image Credits: Lupiya

This slide therefore becomes a pretty big red flag. As an investor, I’d want to dig into how the founders are thinking about their target market.

The worst assumption here, however, is the SOM (serviceable obtainable market): It seems like the company is saying it is poised to hoover up the entire Zambian market. That is unlikely, since even the best player in a market will have competition and will not be able to penetrate the entirety of it.

Assuming that Lupiya is planning to enter the three markets it lists under its SAM (serviceable available market), a better way to tell this story would be to say that the SAM is the TAM (total addressable market). From there, identify which segments of the market you can go after (private banking, loans, business banking, online banking, etc.) to arrive at your SAM. Then the subset of the customers you can actually reach will become your SOM.

Yeah, but whatcha gonna spend the money on?

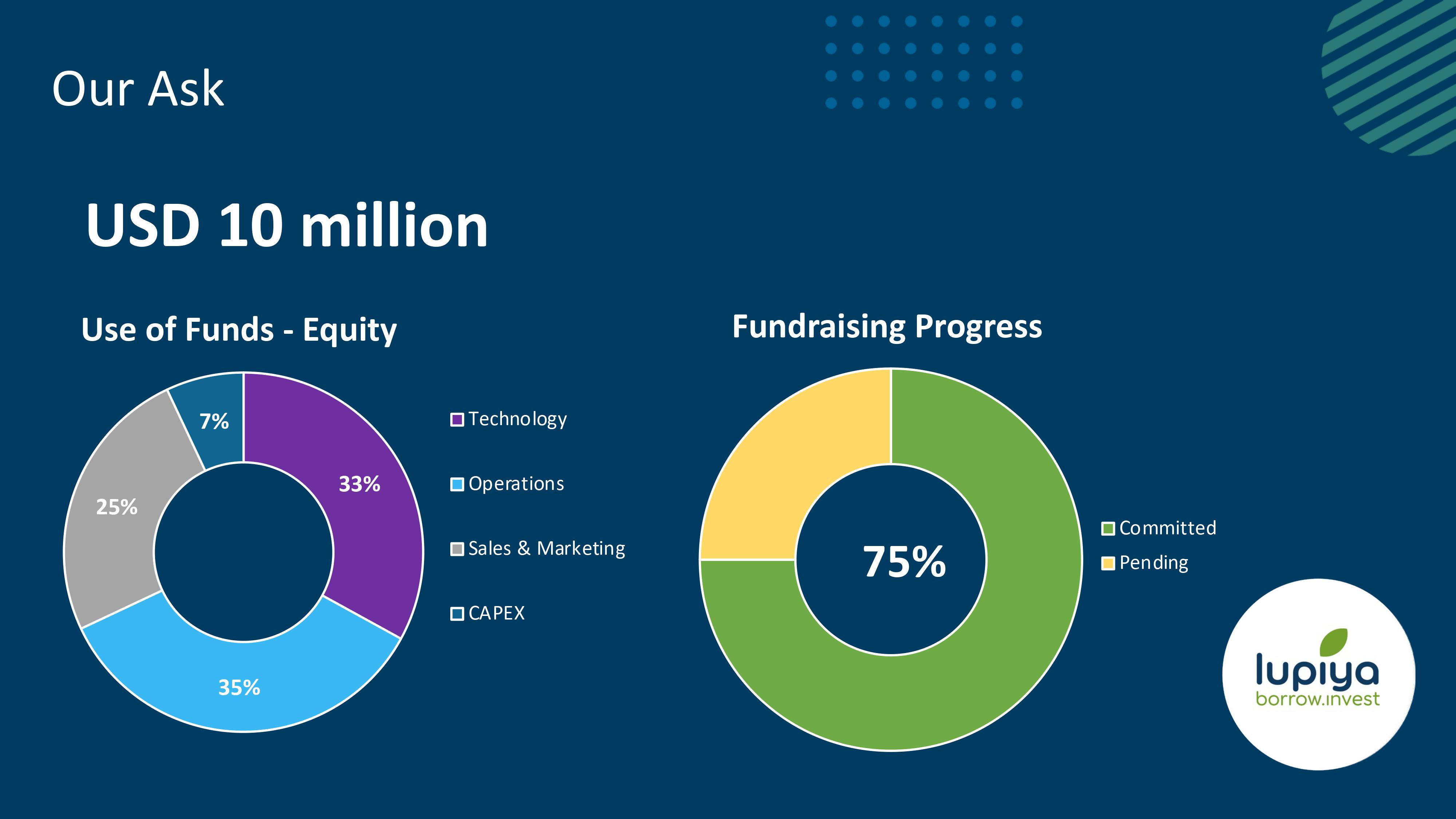

[Slide 9] Ask and use of funds slide. Image Credits: Lupiya

Having said that, expressing your use of funds as percentages is rarely helpful. It doesn’t show what you’re planning to do with your business.

No glimpse of the future

The weirdest part of this pitch deck is that it is almost exclusively focused on the company’s past. It shows what the company has been doing so far, but it does not even hint at what it is hoping to accomplish in the future. That’s a mistake, because while your investors do need to understand your past, they are investing money to take you into the future and want you to paint a picture of what that future could look like.

Are you planning to develop your product? Expand to new markets? Increase the value per customer? Reduce your customer acquisition costs? Tell your investors. Those plans are key to whether you raise or not. Hell, they’re the reason you’d be raising in the first place.

Bonus: Backed by who now?!

Lupiya’s cover slide drops a hell of a fact on us:

[Slide 1] Hey, I’ve heard of those companies. Image Credits: Lupiya

It’s like watching a TV show because its trailer tells you it has Robert Downey Jr., Will Smith, Tom Cruise and Chris Hemsworth in it, but then none of them make an appearance in even one episode.

You can’t do that. I am confused: What does “backed by” mean? Did they invest any money? Did they give you server space? What is going on here? It feels weird.

It’s also strange that the company is telling people that it won the Best Series A Startup award in 2021 when it didn’t raise its Series A until 2023. Besides, those awards are only vanity metrics. Lose them; they aren’t impressing anyone.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!