Sparx, a startup out to manage financial operations for enterprises, secured $3.1 million in seed capital to continue developing its free suite of automated products meant to save companies money on their recurring expenses.

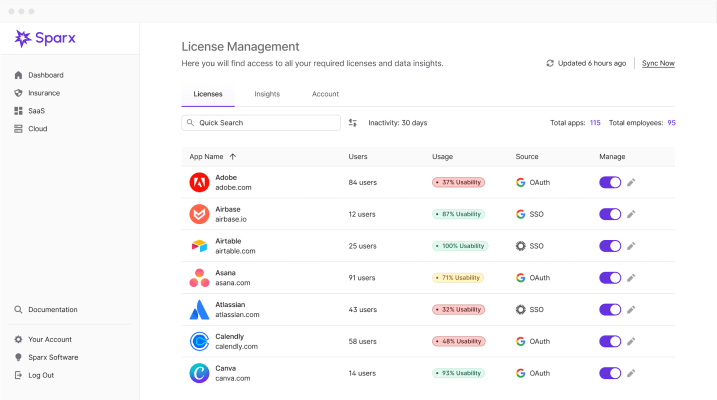

Childhood friends Ricky Pati and Niko Fotopoulos started the company after also working together at other early-stage companies. They saw an opportunity to use artificial intelligence to find hidden excess spending across SaaS, cloud and insurance expenses. Then to leverage automation to implement cost savings measures.

“Sparx is at its core a Truebill for businesses,” CEO Pati told TechCrunch. “Just like what Truebill did for consumers, we identify areas of non-usage or overspend, and we help automate workload and curb such spend in these areas.”

The global spend management software market is forecasted to double to over $46 billion in the next seven years, and that has made it a rather hot topic as of late. My colleague Mary Ann Azevedo recently wrote about Brex and Ramp introducing their own AI-powered offerings.

Pati doesn’t view Ramp as a direct competitor, and says the same about companies in procurement management, like Tropic. However, he does explain that unlike those two companies, Sparx’s biggest differentiators are that it is free and covers more than just SaaS expenses with its cloud and insurance offerings. It also, on average, saves customers 54%.

“Our customers are coming to us to cut overspend, not to get another $200,000 software license,” Pati said. “We have a true holistic platform that CFOs and ops professionals can use to automate savings across all recurring expenses, not just a portion of expenses. We view ourselves more like a compound startup rather than a point solution.”

Meanwhile, the new investment is backed by Drive Capital, Thrive Capital, Human Capital and Wicklow Capital. Sparx intends to deploy the new funds into scaling operations and marketing and sales.

Sparx is very much in its early stages, having just released its beta six months ago. However, during that time, the company reached profitability in August and is approaching seven figures of annual recurring revenue, Pati said. It also calls more than 100 business customers, including BMW, Invisalign, Zillow and Bill.com.

And it isn’t necessarily targeting enterprises. Pati and Fotopoulos say pizzerias are using Sparx to manage procurement of pepperoni prices. To do this, they say the future of the company — and its ability to compete — will involve custom workflows.

“What we want to do is create something that has the form factors that can be used by every mainstream American business, from small business to enterprise,” Pati said. “By doing so, we’re going to have to create very custom workflows. Interest rates are going to be higher for longer — they’re not coming down — and that’s going to affect every company.”