Resourcify, a waste management and recycling platform, today announced that it raised €14 million ~($14.94 million) in a Series A round led by Vorwerk Ventures with participation from Revent, Ananda Impact Ventures, Speedinvest, BonVenture and WEPA Ventures.

It’s a win for Gary Lewis, Resourcify’s CEO, who joined forces with Felix Heinricy in 2018 to launch the startup with the goal of providing “digital solutions” to the problem of recycling and waste management. Together, Lewis and Heinricy aimed to foster the recycling, remanufacturing and re-use of products and materials by helping companies connect with local recyclers.

“Resourcify is a cloud-based recycling platform that identifies valuable materials and fosters connections between global corporations and local recyclers,” Lewis said via email. “Our mission is to combat waste, eliminate harmful practices like burning and empower companies to effectively manage waste on a large scale.”

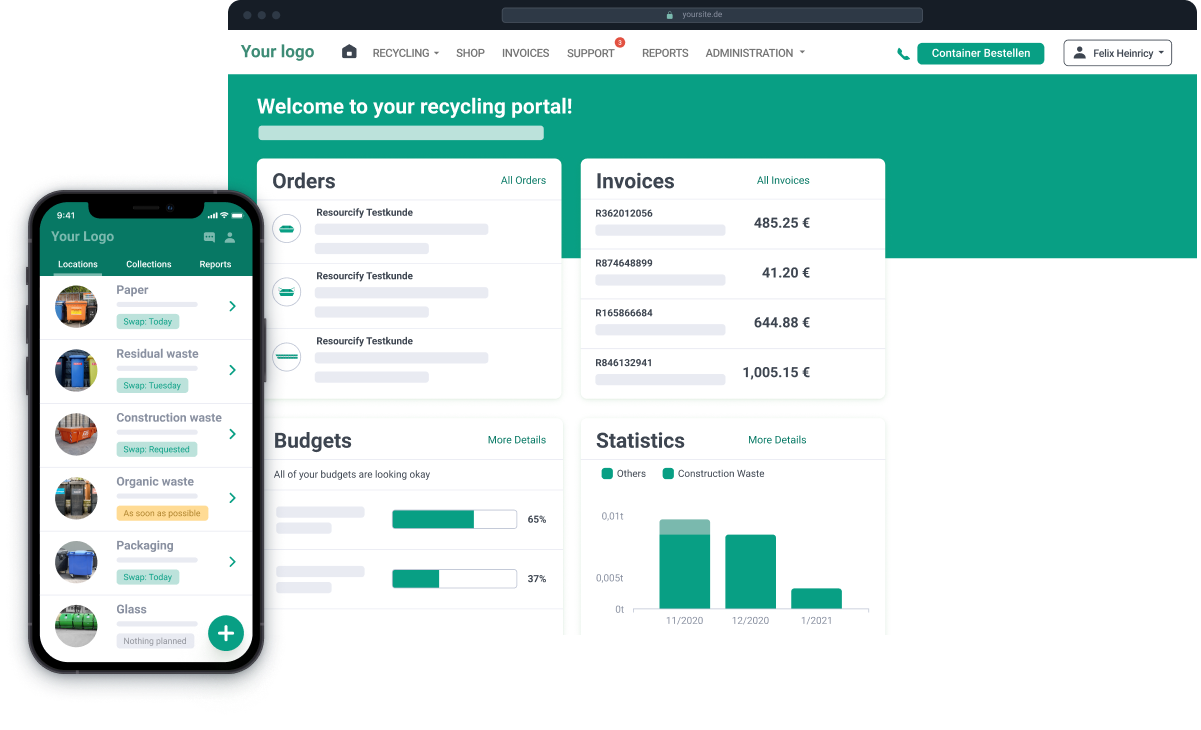

What Resourcify attempts to do, at a high level, is analyze the different ways companies can recycle the materials that they use rather than dispose of them as waste. For example, the platform might look at local recycling routes that’d make sense for a particular customer, while at the same time supporting the customer’s efforts to improve their recycling reporting and invoice management practices.

Resourcify helps to manage recycle pickup locations, on-site handling of recyclable materials, materials transport and more from a central customer-accessible dashboard. Leveraging a database of materials, recyclers and recycling routes, Resourcify applies machine learning to highlight opportunities for cost savings.

“One of the key challenges we all face is the transition from traditional waste management to a comprehensive circular economy,” Lewis said. “It’s important to note that much of the waste industry still operates in a non-digital and non-automated manner, and in many cases, waste is even incinerated rather than recycled. This underscores the urgency of modernizing these processes to minimise environmental impact.”

Image Credits: Resourcify

Lewis acknowledges that Resourcify isn’t alone in the market for digitizing recycling orchestration, which is projected to grow 11.6% from $3.28 billion in 2020 to 2030, according to Research and Markets.

In the U.S., there’s Rubicon Global, a recycling platform that recently made headlines following their merger with a SPAC. Road Runner, another U.S.-based rival, focuses on data insights.

But Lewis asserts that Resourcify is in a unique position because it offers a single solution across “the entire value chain of waste management, recycling and circularity.”

“We have developed circular programs from the ground up in Austria, Denmark, France, Germany, Spain, Sweden and the U.K. with global players like Johnson & Johnson,” he said. “These programs not only allow us to create fully circular material loops, but also differentiates us from all other players in the industry.”

Today, Resourcify, which has around 60 employees, manages over €115 million worth of waste for 15,000 businesses and more than 50 paying customers, including McDonald’s. Revenue has tripled year-over-year over the last few years, and a source familiar with the matter tells TechCrunch that Resourcify’s latest funding round values the company at roughly €50 million (~$53.37 million).

Resourcify will use the new cash, which brings its total raised to €23 million (~$24.55 million), to grow its customer base and expand internationally, Lewis says.

“One notable aspect of waste management and recycling is its resilience to economic fluctuations,” Lewis said. “Even during tough economic times, the need for waste collection and recycling persists. This positions Resourcify favourably for growth, regardless of potential economic challenges. Moreover, our commitment to providing end-to-end value chain solutions nurtures lasting client partnerships, encouraging our clients to stay with us for the long term.”