MakersHub, an accounts payable startup that enables construction, industrial and manufacturing companies to eliminate manual data entry for bills, launched its MakersHub Pay product onstage in Startup Battlefield at TechCrunch Disrupt.

These kinds of companies tend to have dozens, if not hundreds of line items on bills, and capturing and properly coding each one is critical to their ability to job cost and estimate the cost of future jobs.

Phong Ngo, co-founder and CEO of MakersHub, faced this issue when he was president of General Plasma, a supplier of nanotechnology equipment. He had a CFO, accounting manager and even third-party accounting help, and despite all of that, the books were never accurate or complete, Ngo said.

For example, bills and receipts were not entered or coded correctly and data would be missing. As a result, cash flow projections or job costing reports took several days to pull together from multiple spreadsheets and would not provide the whole picture of how the business was doing.

“I started out electrical engineering for an equipment manufacturing company where I did large production facility automation systems for aerospace and automotive semiconductors,” Ngo told TechCrunch. “What really amazed me was that we have always run into an issue of being bogged down by the back office problem of dealing with vendor management and bill pay to understand our costs for which I didn’t have a real solution.”

Then Ngo met Charley Howe at The Wharton School’s Executive MBA program in San Francisco. They bonded over how to solve that problem. Howe spent 18 years on Wall Street before moving over to Citi Ventures where he co-led investing into early- and growth-stage fintech startups.

Together they started MakersHub and began developing its proprietary WiseVision technology that extracts and contextualizes all data on bills and receipts, including every line item and data field more accurately than legacy systems. Then the company leverages language models to make sense of the data. MakersHub also wove in some localized learning so that each user teaches the system from their actions.

Simply put, the technology is designed so customers can have the following:

- Instant bill and receipt data capture.

- Rules-driven approval and authorization flows.

- Auto-mapped records to QuickBooks.

MakersHub Pay

Ngo and Howe say, on average, MakersHub can help customers complete their accounts payable tasks — from the initial review and approval to paid — 90% faster.

“There are a bunch of legacy AP systems that purport to do some of this,” Howe told TechCrunch. “We actually set out more on the procurement side, but were continually asked by people if we could build something for everything they buy, not just the things bought via the procurement system.”

That set off a discussion around what else could be innovated in accounts payable and ultimately led to them looking at the digitization of payments.

Now MakersHub Pay is the newest feature, which they described as a “next-generation payments embedded within your accounts payable flow.” By placing the accounting system at the center of a company’s financial nervous system, MakersHub ensures payments data precisely maps to the accounting system records and the bank statement of payor and payee, Howe said.

The goal was to help small businesses shift away from paper checks or paper invoices to issuing both of those digitally with some amount of efficiency.

“Our users, who very highly value both the degree, breadth and accuracy of the underlying information, need that information to flow across a sequence of disparate systems, which those legacy platforms don’t do,” Howe said.

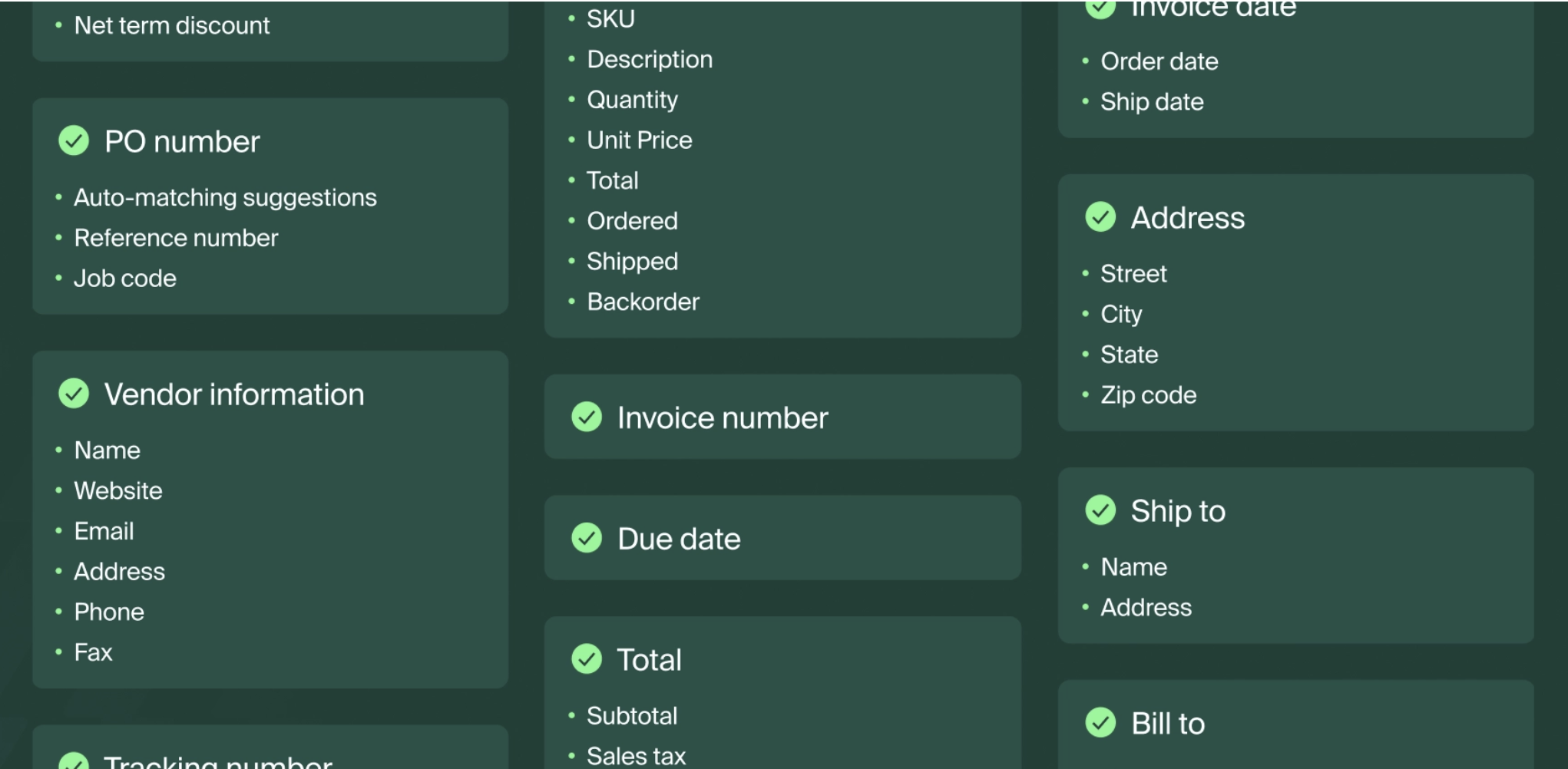

MakersHub captures nearly 40 data fields on bills and receipts. Image Credits: MakersHub

Next steps

The company has grown steadily since the first quarter of 2023 when it launched with a handful of design partners.

Ngo and Howe turned on its embedded payments functionality in the last months and some 20 customers are currently running approximately $10 million in gross merchandise volume through MakersHub.

With that additional capability, the pair say the company is now “a full-service payment processor without using any kind of third-party pay back, like Stripe or others.”

“We felt it was very important for us to be able to control the user experience and have as wide a set of options from a business model flexibility perspective,” Howe said.

In terms of fundraising, it has raised $4.5 million in venture-backed capital so far. The company is structuring the go-to-market side of the business and actively hiring for several go-to-market roles so Ngo and Howe can transition out of those roles.

“Our mindset has been to grow in a manner that is controllable, durable, prove out the problem, prove out the solution and process the learnings that are there at 100% of our capability to process them,” Howe said. “We’re now at the sweet spot where we believe that we have a mousetrap that really works, and we’re going to look to start scaling pretty aggressively in the next couple of quarters.”