MobileCoin, the startup known for building Signal’s crypto payments feature, has appointed a new CEO as it works on expanding its encrypted money transfer service to global users in need of a more modern remittance solution. Sara Drakeley is taking the helm as MobileCoin’s new chief executive officer. Replacing her previous role as the firm’s chief technology officer is Henry Holtzman, former chief innovation officer at MIT Media Lab.

In an interview with TechCrunch, Drakeley remarked on the key role Bob Lee played in shaping the development of MobileCoin. Lee, who was killed in a fatal stabbing in April, was the CTO of Square and creator of the Cash App before joining MobileCoin as chief product officer because he saw the potential for crypto to enable peer-to-peer transactions on a global scale.

“Cash App is only in the U.S. and what we’re building is global,” said Drakeley. “The other thing [Lee] recognized is that with the traditional financial system, it’s so complicated. He would say: ‘You know, you think blockchain is complicated. Look at the traditional financial system. There are all of these middlemen. You think things are settling instantly, but actually, it’s just queuing up and these big machines will ultimately settle at night.”

“With blockchain, you just have a single transaction between two parties. It is way simpler,” Drakeley added.

MobileCoin, which has raised over $100 million from investors, including Binance Labs, plans to eventually monetize through transaction fees and value-added services, such as lending. “Once you’ve got a base economy and money moving through a system, there are lots of ways to monetize it,” Drakeley said.

Privacy and regulation

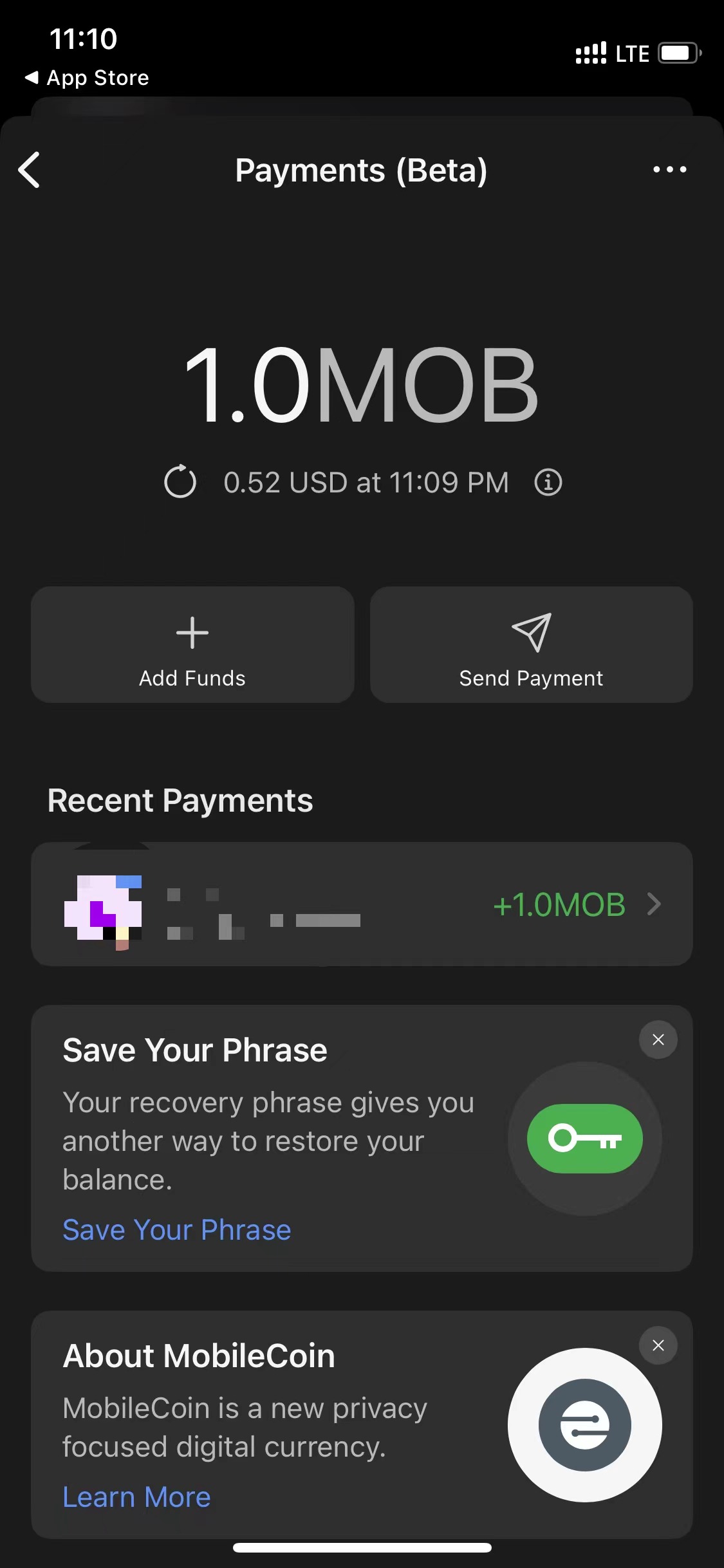

In 2021, Signal, the end-to-end messenger popular among privacy-conscious users, launched the beta version of the MobileCoin-powered payments solution. The feature has officially come out of the testing phase, allowing any user around the world to instantly send MobileCoin’s native Mob token to other Signal users with negligible network fees — all without leaving any identifiable trails behind.

The combination of encrypted messages and anonymous transactions has raised quite a few eyebrows. Some worry that the technology could be leveraged by criminal organizations to communicate, make payments and ultimately evade investigations. So far, Moby, MobileCoin’s standalone payments app, has partnered with Paybis, which carries out the standard Know Your Customer and Anti-Money Laundering procedures in the conversion between crypto and fiat.

What the crypto wallet on Signal looks like when it’s first activated. Image: TechCrunch

As for regulating on-chain activity, Drakeley said she feels “promising” about some of the technological developments that ensure people’s rights to “safety and security” while still allowing them to “abide by the compliance and regulations.”

“Identity on-chain is a really hot topic right now, and lots of people are interested and invested in how that’s going to develop, with the assumption that identity is part of how you ultimately solve AML and KYC. It’s very important, I think, to regulators that there is a holistic identity verification solution,” she observed.

“There are other pieces of metadata that you can attach to a transaction that can help establish trust. And that can help establish that risk profile. Those are things you can attach even in a way that still protects people’s people’s data,” the CEO added.

Crypto payment wave

Drakeley, who worked at SpaceX and Disney Animation Studios before joining web3, is stepping into her new role at a time when crypto payments are generating plenty of interest from investors and developers.

Nigerian startup Kotani, for example, recently raised $2 million to help African migrant workers send money home via stablecoins. a16z-backed Eco is a player out of San Francisco touting its crypto-based “global Venmo.”

The differentiator of MobileCoin, according to Drakeley, is that it supports “private” transactions, a contrast to other blockchain-based money movements of which details are publicly available on-chain. “Can you imagine if you go to a coffee shop, and you pay for your coffee, and in that instant with that one payment, the barista knows your salary?” said Drakeley, adding that, unlike some Ethereum scaling solutions, MobileCoin’s network is fast and cheap enough to support microtransactions.

“We as an industry have built so many technologies that don’t have privacy, where it’s so hard to add that privacy back in. You can see how much effort has gone into trying to add a Layer 2 of privacy to Ethereum. Even with all that effort, it’s still not really solving the problem, because you’ve also got the high fees and the amount of time it takes for a transaction to settle,” she said.

To make crypto payments practical for day-to-day scenarios, MobileCoin has spent the last five years working on its privacy-preserving protocol, originally based on the Stellar blockchain, to power blockchain transactions that can run even on low-bandwidth mobile devices. The focus on low energy consumption, in particular, has helped Moby garner interest in developing countries with a large remittance inflow, such as Mexico, Nigeria and the Philippines, according to Drakeley.