Sending money across borders is filled with friction, like long wait times, high transaction costs and markups on currency exchange. A startup called Parallax wants to make the process faster and cheaper with a cross-border payments system that can be used for stablecoin, crypto or traditional currencies. Parallax has raised $4.5 million in seed funding to tackle the $21 trillion cross-border payment market.

Initially focused on helping remote workers and freelancers get paid from abroad, Parallax, which was founded last year, plans to expand into other use cases, like remittances for migrant workers. It uses blockchain technology, supports users from more than 150 countries and says transfer of money is near-instant.

Parallax’s seed round was led by Dragonfly Capital, with participation from Circle Ventures (the issuers of the USDC stablecoin) and General Catalyst. Angel investors who contributed include Balaji Srinivasan, Zach Abrams, former head of product at Brex and Coinbase, and founders and operators at other fintech companies.

Co-founder and CEO Mika Reyes was born and raised in the Philippines before immigrating to the United States. Aside from dealing with payments of her own, she had friends in the Philippines who were working remotely for companies abroad, and saw the challenges they faced in receiving payments. Many use services like PayPal, Payoneer and Remitly, older incumbents such as Western Union, or traditional bank transfers. But those methods of sending money can take days, cost high fees and result in high markups on exchange rates.

“I experienced some of these problems myself, sending money abroad as an immigrant, doing some freelance work and trying to send payments cross border,” Reyes told TechCrunch. Many of the contractors and freelancers she spoke to preferred to get paid in stablecoins or crypto because it meant speedier transfers and low costs. But there are barriers to adoption of stablecoins and crypto.

“Freelancers that already use crypto see great benefits from it,” said Reyes. But for people who haven’t used crypto before, there are several hurdles. “There are many things you have to set up. You have to set up a wallet, you have to understand how to actually receive crypto in the first place. You have to set up your wallet address, which not a lot of people in the world understand or have access to. I think accessibility and the user experience is still a big gap. We want to bridge it together.”

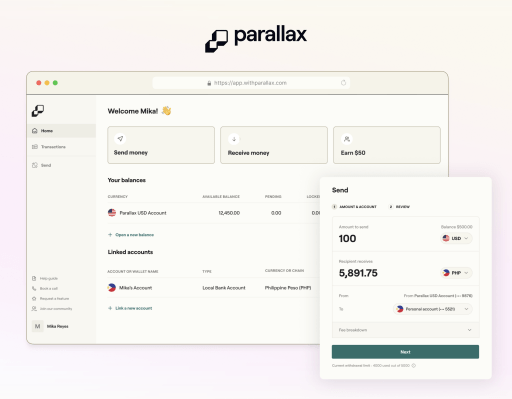

Parallax makes the customer experience more intuitive. To start using it, Reyes says people don’t even need to know what stablecoins are, though they can opt into receiving crypto deposits. “For the average user, even if you’re not immersed in the crypto world, they’ll still be able to understand Parallax and its user experience.”

Parallax founder and CEO Mikaela Reyes. Image Credits: Parallax

Parallax’s first product lets users open a USD virtual account to receive USD. Users can be located anywhere in the world (as long as it’s not a sanctioned country) and set up their accounts with ID like their passports. Parallax is also launching the ability to convert USD into local currencies, like Philippine pesos, before rolling out into more currencies. Users can access their funds by cashing it out into local bank accounts or digital wallets like GCash and PayMaya.

The company differentiates from competitors PayPal, Payoneer and Wise by providing faster transfers and less fee transactions through the use of stablecoin and crypto. Another way Parallax wants to set itself apart is by being more transparent, with a customer support team that quickly gets in contact with users and answers their questions thoroughly.

So far, Parallax’s user strategy has involved participation in freelancer and remote work communities online and posting blog articles about topics like sending money and finding remote work. It plans to hold wider launches, working with partners who have benefitted from Parallax to get the word out to their communities.

Once someone decides to use Parallax for their payments, the onboarding process is fast and simple, Reyes said. Its typical KYC process includes verifying IDs, then enabling password verification. Users can get verified within a couple minutes or, if additional reviews are needed, one to three business days.

So far, Parallax is seeing 202% average month-over-month growth. It has also received organic interest from users in Latin America and Africa who are paid in USD, despite not marketing there, and Reyes said one of the things the team plans to do with their funding is focus on those regions.

Cross-border payments is a massive market and there are many startups and larger companies focused on it, like Tazapay, Thunes and Airwallex. Reyes said the competitive moat for other startups that want to enter the same space include reaching high enough volumes to justify lowering fees, working with partners to make sure compliance is in place, and ensuring that they have the infrastructure in place to do both crypto and traditional fintech. Parallax is building some of their infrastructure in house, while working with partners for others, like for moving money through the blockchain and the process of off ramping, or getting funds into different payment systems in different countries.

Parallax’s funding will be used for hiring and its next phase of expansion. “We want to grow the team even more and then build up more of an infrastructure to enable those faster and cheaper payments for more users,” said Reyes.

In a statement about the funding, Dragonfly Capital lead investors Ani Pain said “In the backdrop of BRICS, conversations about the rise of emerging markets and SEA’s explosive growth, we think that Mika and the Parallax team are the lynchpin in making the transition to remote work seamless and borderless global economy succeed. Indeed, for us to bring a billion people into the crypto industry, we need easy cross-border payments.”