CertifID, a startup developing fraud prevention tech for the real estate market, today announced that it raised $20 million in a funding round led by Arthur Ventures at “over double” its previous valuation.

CertifID primarily develops products to fight wire fraud. The startup’s co-founder, Thomas Cronkright, launched the company in 2017 after losing $180,000 to fraud at his real estate title agency in Grand Rapids, Michigan.

Typically, in wire fraud involving real estate transactions, criminals find information about upcoming real estate closings by hacking into email accounts — often potential homeowners. Posing as legitimate reps of financial institutions, they email homebuyers fraudulent wire transfer instructions.

More than 13,000 people were victims of wire fraud in the real estate and rental sector in 2020, with losses of more than $213 million — an increase of 380% since 2017, according to FBI data.

Cronkright later teamed up with Tyler Adams, a former lead product manager at BCG’s corporate investment and incubation division, to build a platform to protect home buyers, home sellers and real estate businesses from this form of cybercrime.

“The real estate industry is facing a wire fraud problem that has accelerated significantly in recent years,” Adams, who serves as CertifID’s CEO, told TechCrunch via email. “The FBI recently reported victim losses from real estate business email compromise increased 72% from 2020 to 2022 … CertifID was created to help create a world without wire fraud.”

A “world without wire fraud” is a tad hyperbolic. But CertifID does offer tools to fight it.

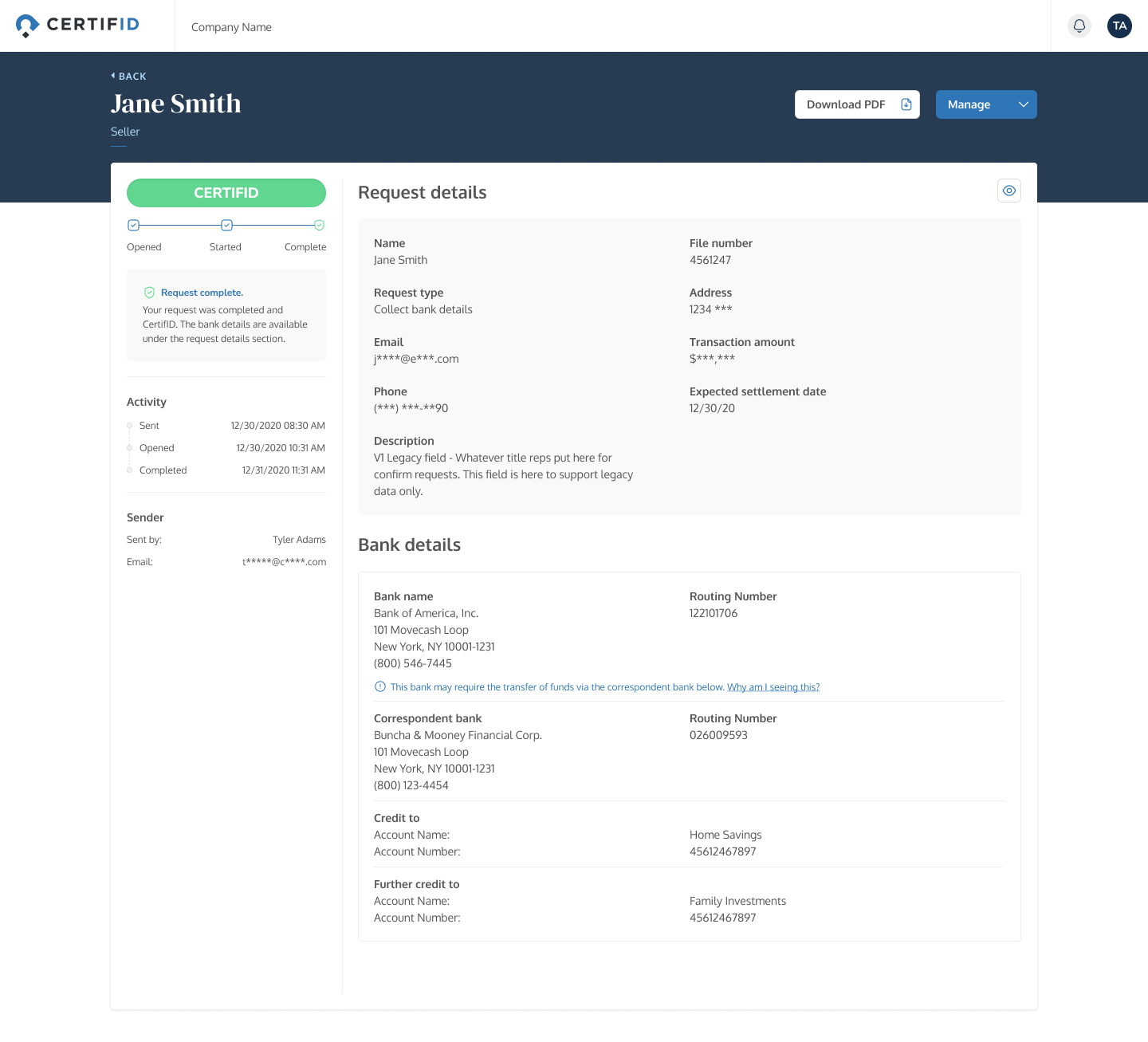

For title agents and real estate law firms, CertifID handles transactions, insuring up to $1 million every time money changes hands. Home buyers receive wiring instructions and are given the option to purchase a money protection plan for added coverage. Meanwhile, home sellers are asked to provide banking information and submit to an identity verification process to prevent fraud attempts.

Under the hood, a rules-based engine along with an AI model trained on “internally vetted data,” “expert decisions” and reviews of its own decisions powers CertifID’s payment disbursement and identity verification processes. (This reporter wonders about the quality of that data, but CertifID didn’t go into great detail.) The model evaluates various markers of fraud, incorporating new data points as malicious actors embrace new approaches.

“We believe automation and AI have incredible potential to the market,” Adams said. “But we also recognize that fraud and abuse of trust leverage the human factors of technology disproportionately, and approach the problem of fraud with a human-centered approach.”

With the new funding, CertifID says that it plans to support ongoing product development and scale operations to meet demand for its products. CertifID claims to have “several hundred” title and real estate business customers and partnerships with federal law enforcement to support fraud recovery efforts where its verification software isn’t used.

CertifID’s management dashboard for wire fraud prevention. Image Credits: CertifID

To date, CertifID has raised over $40 million — a mix of equity and debt.

“Despite a downturn in the housing market, CertifID continued to see increased demand in its products and services,” Adams said. “Fraud has continued to increase through a pandemic, a bank crisis and ongoing twin threats of inflation and recession. And it’s expected to continue to rise into the foreseeable future. With the majority of the real estate industry yet to adopt anti-fraud technology, the company expects continued growth ahead.”