Over the years, I’ve seen a lot of startup decks covering all sorts of industries, verticals and stages. And I’ll admit that decks for education-based startups are pretty rare, and a team of folks trying to set up a brand-new, remote-only university is rarer still. Tomorrow University raised around $10 million recently. The university writes about the fundraise on its blog.

Right off the bat, I have a ton of questions, so let’s see how well the deck answers those!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Last week, I wrote a post about how 30-slide decks are a thing of the past. Tomorrow University has perhaps overcompensated a little in the other direction, with a very terse 10-slide deck. It’s possible to tell your story in just a few slides. Guy Kawasaki, for one, famously advocates for a 10-slide deck, but the vast majority of founders haven’t got a firm enough handle on their story to pull that off.

According to the deck, the university is planning to offer an MBA program, so I’d expect this deck to be truly top-shelf, first-class, with very thorough financials and plans. In the language of universities: “This deck does not meet the minimum expectations.” We’ll get to that. For now, here are the slides Tomorrow University chose to include:

- Cover slide

- Historical context slide

- Goal slide

- Mission slide

- Solution slide

- Product slide

- Traction slide

- Market slide

- Team slide

- Closing slide

Three things to love

I had a pretty disappointing university experience, so I’m fully on board with the notion that the university experience overall could use an overhaul. This deck speaks my language in many ways.

Bringing some “real life” to education

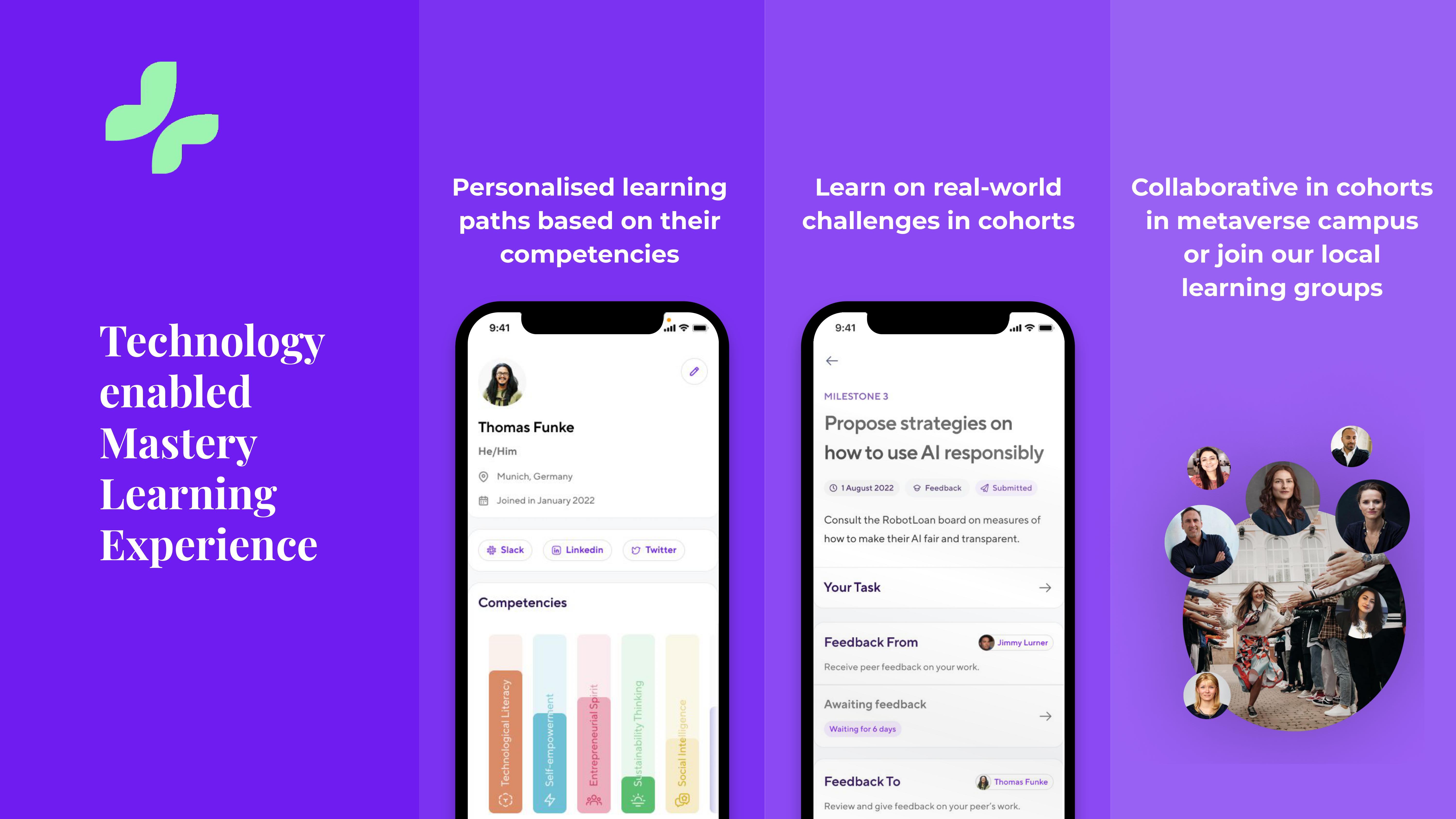

[Slide 5] Here’s how Tomorrow University imagines the universities of the future. Image Credits: Tomorrow University

Interesting traction

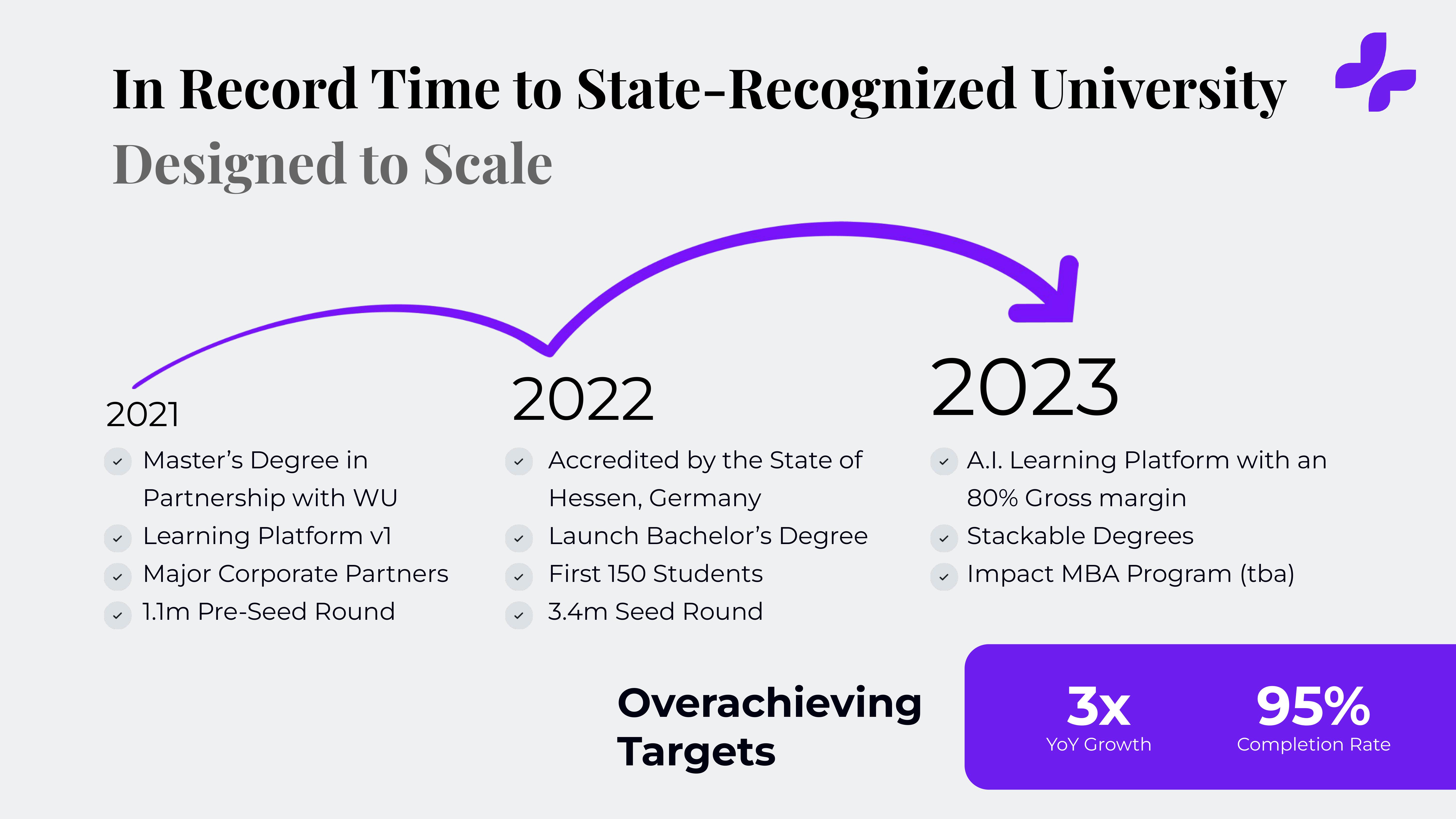

My two biggest questions before reading the deck: Is it accredited, and how is it measuring success? It turns out both questions were answered on the same slide. Well done!

[Slide 7] This traction slide does a lot of heavy lifting in the Tomorrow University deck. Image Credits: Tomorrow University

For one, having a traction slide this thin on numbers is a little suspicious. It says it has 3x growth, but it doesn’t include what that growth is. Because that isn’t specified on the slide, my mind is invited to guess. Is it the revenue? Is it the number of students? If it’s the latter, it means that it went from 50 students in 2021, to 150 students in 2022, to 450 students this year. It has also raised around $30,000 per student in the program so far, which seems a little weird.

What does “in partnership with WU” mean? I assume that this is the University of Vienna, but that isn’t clarified anywhere in the deck. Also, how does accreditation work in Germany and Europe more broadly? The slide suggests that Tomorrow University is accredited in Hessen, which is a state in Germany that incorporates the cities Wiesbaden and Frankfurt. But is that sufficient to build a reputation as a university? The main accrediting body for higher education in Germany is the German Accreditation Council, so why wasn’t it the one to give Tomorrow University’s accreditation? Should it have? Is there a plan to?

Suffice it to say, I lack the cultural or local knowledge to really judge this slide, but I know if this came across my desk as an investor, I’d have a lot of questions for the founders. These are questions that, frankly, would be pretty predictable and might have warranted a slide in the deck or the appendix entitled “Accreditation road map” or similar.

As a startup, what you can learn from this slide is not to assume that your investors have all the pieces of the puzzle. If you operate in a regulated space (such as healthcare, education, or finance), make sure you have some slides on standby to talk investors through the regulatory landscape and where you are in the process.

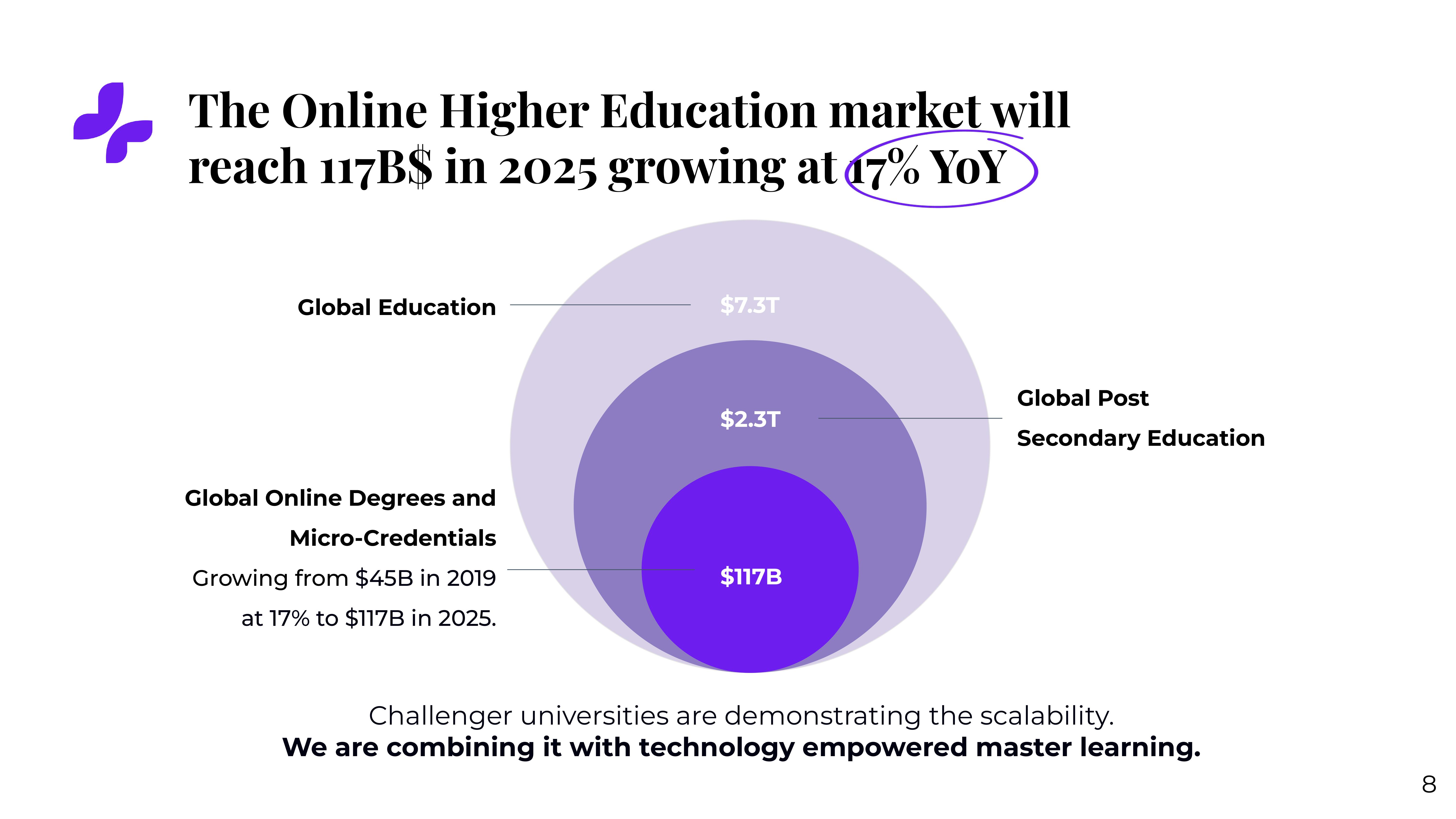

Maaaaaarket siiiiiize

This market size is so huge it deserves a bunch of extra vowels.

[Slide 8] Yowzers! Image Credits: Tomorrow University

There’s a lot of value in going after enormous, well-established, ripe-for-disruption markets, especially if you have a good go-to-market plan. The best way to do this is by showing the size of the market and then explaining how you’ll slice off your chunk of the pie.

As you may have gathered, it was a little hard to find parts of this that I really liked and that Tomorrow University did really well. With that said, let’s look at three things Tomorrow University could have improved or done differently, along with its full pitch deck!

Three things that could be improved

Oh, boy, there was a lot to dislike here, and that’s a shame; I love the idea of Tomorrow University, and I wish it had been around when I was scoping out university options. It sounds like it’d have been right up my alley.

My main issue: I’m not sure whether Tomorrow University knows who its target audience is.

What are you going to do?

If you’re raising $10 million, you should have some sort of vague idea of what you’re going to do with the money. For most founders, that’s very front of mind: A burlap sack of crisp bills is what’s preventing you from pushing your organization in the right direction. But in these 10 slides, nowhere does it say what it plans to do with the money.

In fact, most of the deck reads more like a manifesto than a fundraising deck. Don’t get me wrong, I love a good manifesto — my most and least favorite manifestos were written in German — but they aren’t typically very helpful when it comes to raising funds. Look at slides 1, 2, 3, 4 and 10. Each one talks about the future of education as a whole, without many specifics. “The next generation university for the ones who change the world,” sounds awesome, but every founder in the world should be able to come up with a good, specific “what” and “why.” It’s the “how, who and when” that make people want to invest, and Tomorrow University fails to explain all three.

There are no financials, no projections and no operating plan. The deck doesn’t say how many students Tomorrow University wants to target, how many courses it will offer, how it will attract the students, and what it will charge them. Most importantly, it’s missing info on how Tomorrow University will spend the $10 million.

I’m incredibly surprised this company was successful in raising money, and I suspect there is a wall of additional data missing from this deck. This is fine; you can totally use dashboards and spreadsheets as part of your pitch process. Pro tip, though: Put a screenshot of the data in the deck with a link to the live data. That makes it easier to send to investors; you can walk them through the live numbers as part of the fundraising process.

Fumbling the team slide

The team slide is the most important slide in the deck. It needs to answer a few questions: Who are these founders? What are their roles in the company? Why are these founders the best people to bet on to build this company?

Tomorrow University’s team slide doesn’t answer any of these questions:

[Slide 9] Wow, this tells us nothing. Image Credits: Tomorrow University

None of Christian Rebernik’s experience screams, “Yes, this guy can build a digital university.” Kudos on one thing, though: It highlights that all of his experience is with products in regulated spaces, which education falls under.

Thomas Funke’s LinkedIn tells a story of being a lecturer and thought leader in entrepreneurship for most of his career. Why isn’t that reflected on this slide? And even then, how does being a lecturer and a digital adviser translate into being a good CEO for this organization?

Try doing this thought experiment: If you could write up a description of the perfect founder for this startup, what would it be? A combination of these two founders — perhaps with some experience in senior leadership in a higher education institution — would be a pretty close match to that description. The deck is making the investors do too much work to figure out why this is a great founding team.

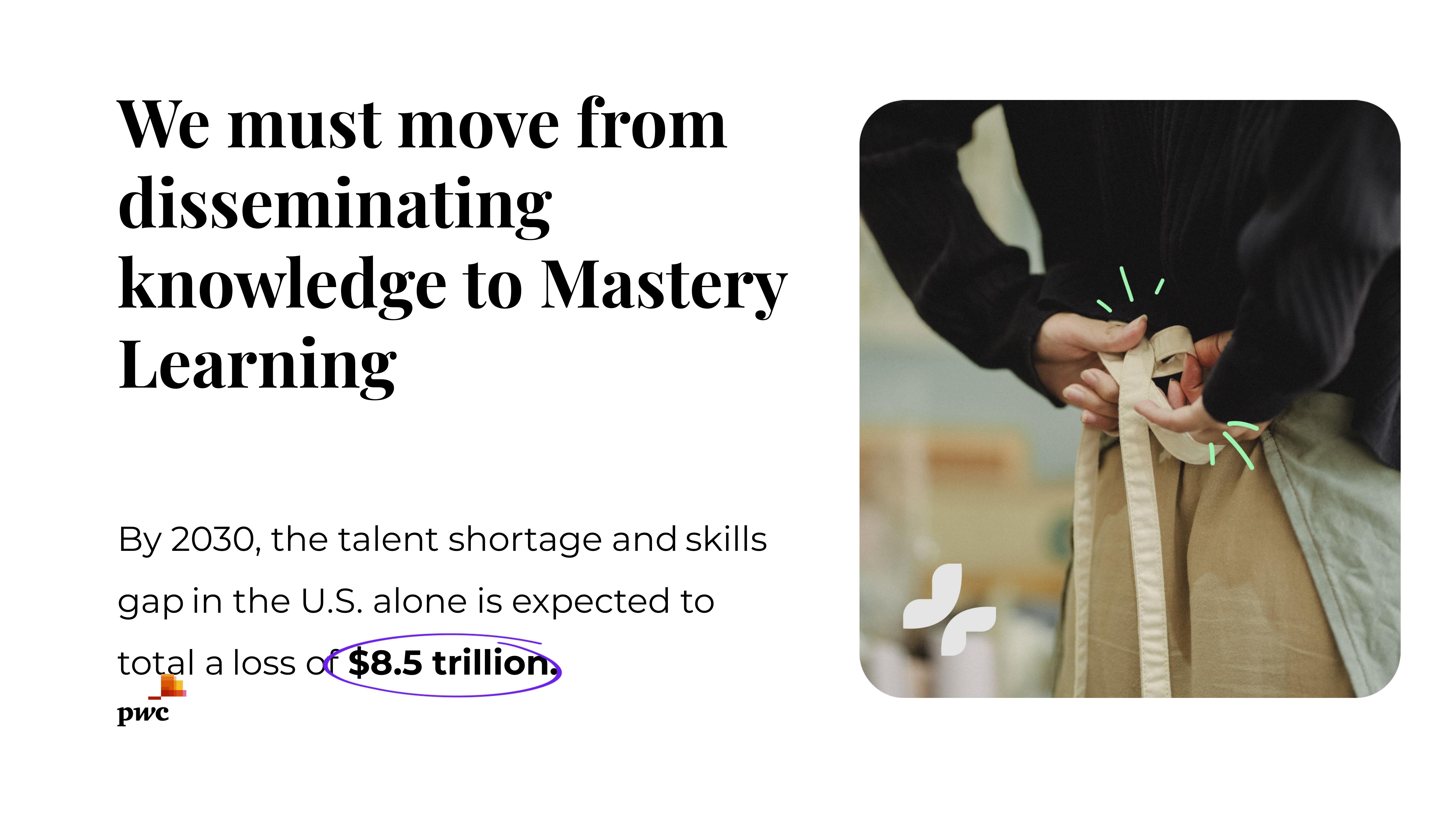

Explain the why

[Slide 2] Sure. But why are we using up a slide to say this? How does this connect to the fundraising narrative? Image Credits: Tomorrow University

[Slide 3] How will Tomorrow University fix this, then? Image Credits: Tomorrow University

Overall, this all reads a lot like bumper stickers; individually, they sound wise and insightful, but without connecting them or exploring the “why,” it’s unclear why this is worth doing. And, wearing my investor hat, it’s hard to see how this will offer a return on investment.

It’s not even that I disagree with anything on these slides, but the founders aren’t explaining what they are planning to do to address any of these problems. They do a good job of laying out the problem, but then don’t follow through with their solution. And even further: How will money help solve this?

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!