Intuit, the U.S. financial and accounting software giant, has unveiled its first customer-facing generative AI-powered solution: a digital assistant to assist small businesses and consumers.

Called Intuit Assist, the digital assistant is embedded across Intuit’s platform and products, namely TurboTax, Credit Karma, QuickBooks and Mailchimp, with a standard user interface to offer personalized recommendations using contextual datasets to the company’s more than 100 million small business and consumer customers across the world. The offering also provides human assistance using Intuit’s live platform when needed.

The assistant was developed using the software behemoth’s generative AI-based proprietary operating system named GenOS, which was launched in June to help Intuit developers incorporate AI across the company’s products.

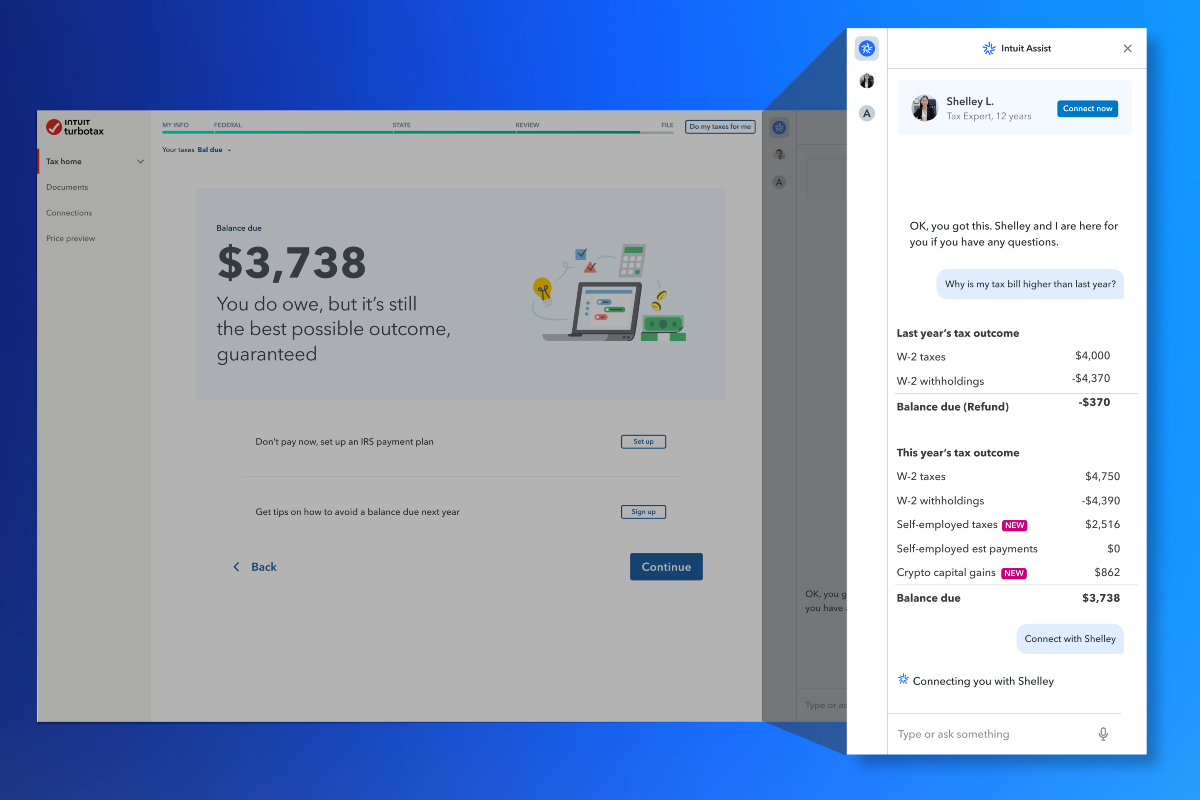

Within TurboTax, Intuit Assist uses the company’s tax domain expertise, rich data and proprietary, AI-powered Tax Knowledge Engine to determine consumers’ specific tax situation and navigate the tax code. It will create a personalized tax checklist based on data a customer shares at the start of the tax preparation process to provide answers to their questions, customized insights and recommendations. The assistant will also work with TurboTax Live to assist human experts with personalized answers based on aggregated insights, the company said.

Image Credits: Intuit

Similarly, for Credit Karma users, the digital assistant will help them provide personalized answers to their money questions. It will use customers’ financial data to offer distinct answers and recommendations, including a personalized set of financial options.

The assistant will also be a part of QuickBooks to help small businesses by, for example, showing cash flow hot spots and identifying top-selling products and spending anomalies. It will also help small and midsize businesses get started with QuickBooks if they are new to the platform and will help to import data from their website to personalize the profile. Further, the assistant will help generate invoice reminders, which can be customized in terms of tone and length, the company said.

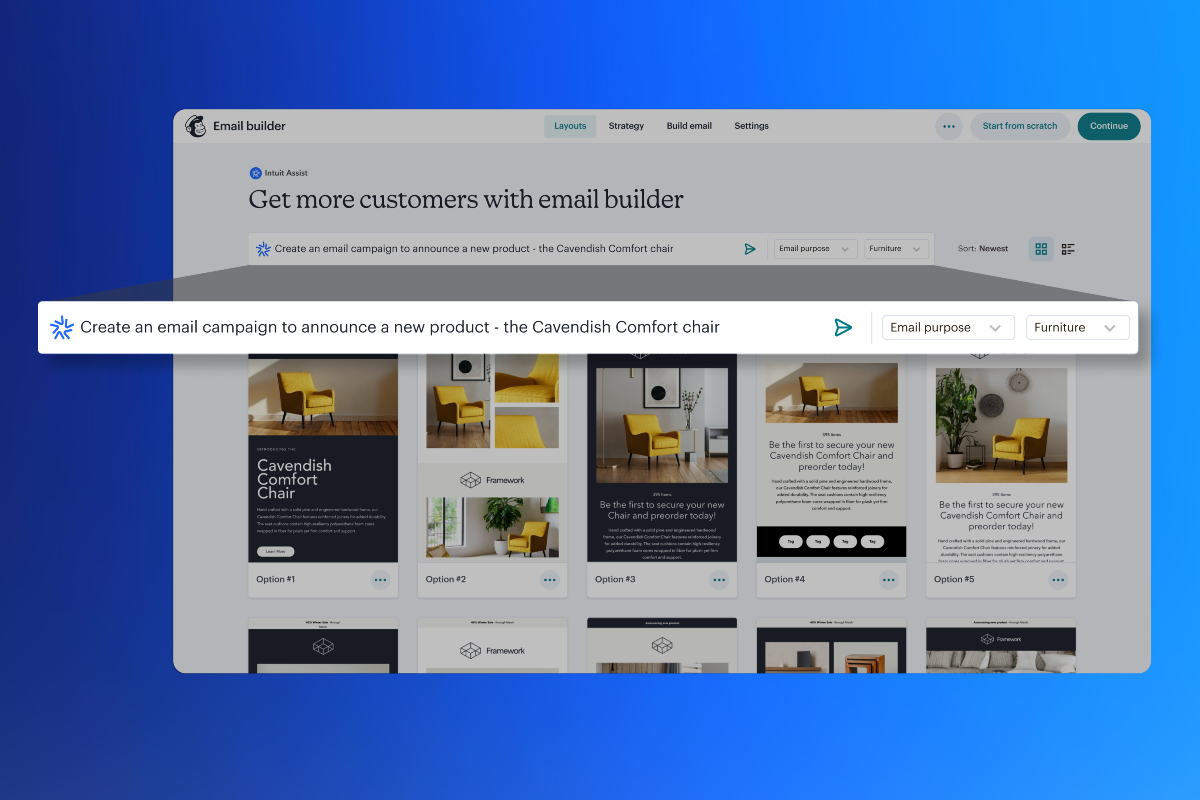

For small businesses, entrepreneurs and marketers running email campaigns using Mailchimp, Intuit said its generative AI-based assistant will help them personalize their marketing at scale and create their campaigns based on their brand’s identity and market intent. It will allow them to change the tone, text and image faster.

Once the campaign is designed, Intuit Assist can help schedule it to be sent and added to the company’s marketing calendar. Additionally, it can generate automated draft email content using product and service data from QuickBooks. The assistant can also add customers to the Mailchimp sales pipeline for long-term tracking in case businesses have longer sales cycles or lead qualification processes.

Image Credits: Intuit

At the core of Intuit Assist is GenOS, the operating system that comprises four blocks: GenStudio to interact with large language models, GenRuntime to allow automatic orchestration, GenUX to provide customer-facing applications for user interaction and user flows based on large language models and, finally, large language models themselves, which include both the third-party ones and Intuit’s in-house models.

Intuit chief data officer Ashok Srivastava told TechCrunch that GenOS could switch between the company’s own large language models and those developed by third parties based on the need of the context. The company did not want to have a “myriad of point solutions” — separate options for different products — and thus chose a single solution.

“I’m fully aware that other companies are investing in large language models, and I congratulate them on that. We’re not only doing that, but we’re [also] building an entire operating system on top of it,” Srivastava said in an interview.

Intuit has been looking at AI as its next focus area for some time, and its CEO Sasan Goodarzi well conveyed it in the past. In 2020, the company even laid off hundreds of employees with obsolete skills and added a similar number of new roles to mark the shift.

The early move toward AI advancements helped Intuit get some attractive numbers: 810 million AI-driven customer interactions per year, over 25 million conversations processed using natural language processing per year, 65 billion machine learning predictions per day, 2 million AI models in production that are refreshed daily and around 900 AI, machine learning and data science patents.

“We started investing in generative AI long before people made the big splash last year,” Srivastava said. “When we invest in creating revolutionary experiences for our customers, it will enhance our business.”

Having said that, deploying generative AI involves challenges. One of which is how companies deal with customer privacy. In the case of Intuit, it is even crucial as the company is working with its customers’ financial and transactional data.

Srivastava told TechCrunch that the company developed a set of principles and created an AI governance team to ensure that it has the “right level of transparency” in AI and is “adhering to privacy and security.”

“We review the use of AI across the company and ensure that it adheres to our AI principles. These include ensuring that the work that we’re doing powers prosperity. It’s enhancing human talents so that the human talent, whether it’s the human experts’ talent, consumers’ talent or small business owners’ talent . . . is enhanced, that it’s fair and that the AI is being used to improve the financial lives of everyone, including groups that have historically been excluded from access to financial services, accountability, we follow a very thoughtful approach to ensuring that we’re accountable for the use of explainability,” he stated.

The other problem with generative AI is hallucination, in which AI systems generate inaccurate, unrealistic or entirely fabricated information, data or content. Currently, no generative AI model can completely eliminate incorrect responses. Even OpenAI CEO Sam Altman has not yet outrightly promised its fix. The problem could have significant consequences when it comes to taxes and financial advice.

However, Srivastava said Intuit’s approach to using large and relevant datasets helps ensure it is delivering “accurate answers to customers and mitigating the risk of hallucination or other types of inaccurate or inappropriate answers.”

“When Intuit Assist provides an answer or gives guidance to a customer, it’s drawing on the deep expertise that Intuit has developed over many years, plus the data that gives us a 360-degree view of the customer. This helps make sure the answer given by Intuit Assist is not generic or hallucinatory, but is relevant and grounded in the customer’s own data, and reflects the years of domain expertise that Intuit has built around powering prosperity,” he said.

Intuit Assist in TurboTax is currently accessible to customers, with planned enhancements set to debut for the 2023 tax season, while the assistant is available to select Credit Karma members in the U.S. and will be rolled out more widely in the coming months. It is also available to select beta customers on QuickBooks and will roll out to all U.S. users in the coming months. Moreover, it is currently accessible to a specific group of Mailchimp customers, with a broader expansion slated for the upcoming months.

“Leveraging our vast amounts of rich data and years of investment in AI and GenAI, we’re unlocking the power of our platform to reimagine AI-assisted customer experiences,” Goodarzi said in a prepared statement.