While working at his first startup, BrainGenie, a math and science skills practice website, Tim Zheng experienced firsthand the challenge of maintaining a small business — and expanding it. After trying a number of sales prospecting tools and finding that they weren’t that effective in getting the word out to customers, Zheng decided to build his own — Apollo.io — which he later spun off into an independent firm.

Today, Apollo offers a platform that combines sales intelligence and execution workflows with a business-to-business (B2B) buyer database of over 270 million verified contacts. The company recently raised $100 million in a Series D round at a $1.6 billion valuation, nearly double its previous, led by Bain Capital Ventures with participation from Sequoia Capital, Tribe Capital, and Nexus Venture Partners — making it one of the first sales tech unicorns minted in 2023.

With more than $250 million in the bank, Apollo plans to invest in product and R&D efforts in addition to expanding its team from 450 employees to 1,000 across engineering, marketing, design, product, legal and people operations by 2025.

“We have released 20 new go-to-market workflows in the last year, and this funding will increase this rate of development to centralize the entire go-to-market stack for businesses,” Zheng told TechCrunch in an email interview. “Apollo’s unique approach to product-led growth — where 60% of funds are invested into product development and everything is built in-house — has resulted in a rapid increase in users and revenue.”

Zheng makes the case that traditional go-to-market tech stacks are overstuffed with disparate tools that are complex to set up, difficult to integrate and cost-prohibitive for most businesses. He points to Salesforce’s 2022 State of Sales Report, which found that sales teams use an average of 10 tools to close deals and reps spend only 28% of their week actually selling, with the rest devoted to tasks like deal management and data entry.

So how does Apollo solve that problem? By consolidating the tech stack, Zheng says.

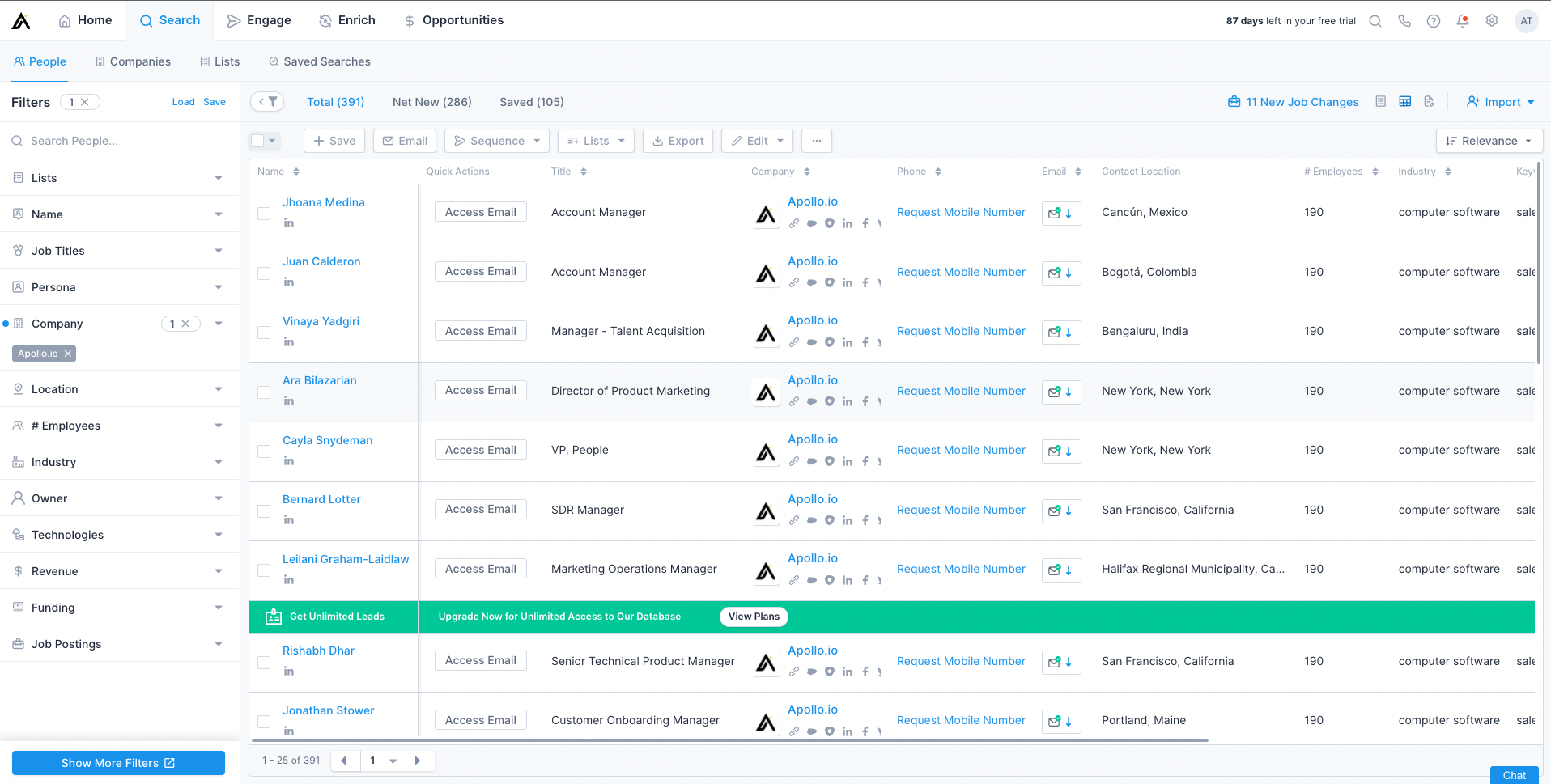

Apollo provides a prospecting flow designed to help sellers minimize their time bouncing between tools, plus apps for booking and hosting meetings as well as extracting insights and “deal intelligence” from meetings. Companies can leverage Apollo’s B2B data network by connecting it to their customer relationship management systems, enriching their first-party data and — in the process — finding and targeting new leads.

Apollo, on trend, also delivers an AI-powered assistant tool focused on sales prospect targeting. Drawing on data from Apollo’s B2B database of contacts, including sales engagement data, prospect data and buying intent signals, the tool attempts to increase engagement by sending fewer — but more relevant — emails to sales prospects.

“From the product perspective, Apollo stands in a class all its own,” Zheng said. “That’s because most competitors come at the sales tech stack from a siloed position, but they’re point solutions that don’t do everything. It’s insane that, in 2023, it’s so difficult to reach and engage with other people or prospects.”

Speaking of competitors, there are several in the burgeoning sales tech space — see startups like FlashIntel and ZoomInfo. According to Future Market Insights, the sales platforms software market could grow from $71.5 billion in 2022 to $193.1 billion in 2032, driven by the demand for digital sales tools.

A 2019 Gartner poll found that 72.4% of companies have plans to make a sales development tech purchase. Respondents to the same poll ranked predictive analytics tech — tech along the lines of Apollo’s AI assistant — as their second-highest buying priority for sales development.

Zheng sees ZoomInfo as Apollo’s main competitor. He argues that the ZoomInfo experience is inferior, however, because many of its tools arose from acquisitions of other companies.

Image Credits: Apollo.io

“While ZoomInfo claims to be unified, they have simply acquired other companies to achieve ‘unification,'” he said. “Apollo was built-from-the-ground-up to be one unified go-to-market solution, is free to get started and, with our product-led growth motion, allows monthly pricing rather than expensive multi-year contracts.”

Them’s fighting words. But Zheng’s arguing from a position of strength. Apollo’s revenue has grown 900% since 2021, and it now serves three million users across 500,000 customers (40,000 of which are paying), including Qualtrics, Customer.io and Census.

“Apollo was built from the ground up to be an all-in-one solution across the entire sales funnel, natively unifying data, sales intelligence and sales execution throughout the entire buying process,” Zheng said. “Markets and investments are down and many companies are cutting costs and reducing headcount. We have avoided this fate by being efficient in terms of operating costs. In fact, we were capital efficient before it was cool … This new raise means we can improve on the efficiencies we already bring to our customers by solving new pain points, eliminating redundancies and ultimately making go-to-market faster and more efficient across their organization.”