Most of our product subscriptions sit passively in the background and keep sending us things until we don’t want them anymore. However, what happens when we don’t want the subscription in the first place?

Enter ScribeUp, a free subscription management company that is taking a proactive approach to that problem so that users aren’t charged for an unwanted subscription. Today the company announced $3 million in seed funding from Mucker Capital.

CEO Jordan Mackler, who started the company in 2020 with Yohei Oka, told TechCrunch that they saw legacy solutions in two buckets: one that allowed users to find and cancel their subscriptions in an automated way, or two, provided users with the ability to proactively, but manually, manage subscription bills as they come in.

“A lot of the personal finance subscription managers out there today do an amazing job of automating the aggregation of your bills into one dashboard,” Mackler said. “They find these bills that are on your credit card, pull them in front of you and help you cancel those bills. However, they’re only able to first interact with subscription bills once they already hit your accounts.”

Instead, Mackler and Oka set out to combine both the find-and-cancel method and the proactively managed solutions with the payment logic of a virtual card to create a new business model.

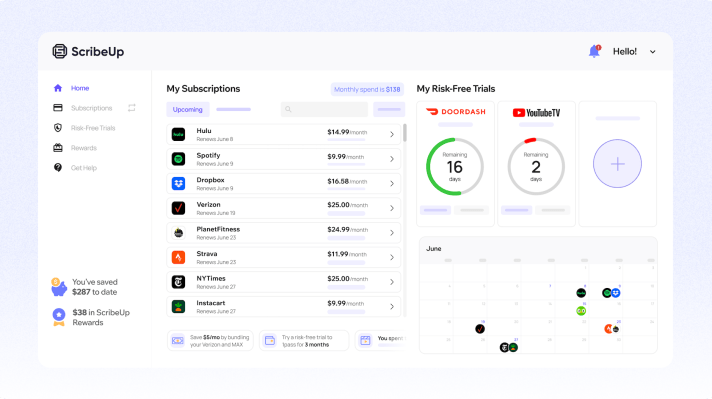

First, ScribeUp scans the user’s linked financial accounts to identify all subscriptions and recurring payments. Users then connect subscription payments to the ScribeUp Card, a virtual payment card, which protects against unwanted charges and provides a one-click cancellation of subscriptions.

Some interesting layers of the virtual card are that users don’t have to give out financial account information to online services. Users can also sign up for trials of subscription services and ScribeUp will automatically block unwanted charges when the trial ends.

“The virtual card is packed with all this different payment logic that is able to interpret charges, understand how that maps to a user’s journey and then make instantaneous decisions as charges come in that empower uninterrupted services, but also blocking bills that we know are unwanted,” Mackler said. “We felt like that last piece offers a magnitude of change for the consumer itself. Now you sign up for a free trial, use our virtual card and if you forget about this, we’ll send you reminders that you forgot about the trial.”

ScribeUp is a free service and recently started bringing in interchange revenue via partnerships. While there are a lot of startups taking on subscriptions, like Stay Ai and Smartrr, Mackler said his company is often compared to Rocket Money, which he said takes a more reactive approach to managing subscriptions, doesn’t offer the risk-free trial or unwanted bill guarantee and is also a subscription model itself.

ScribeUp’s concept seems to be catching on. Since launching in July, the company has amassed more than 10,000 active users and is saving them, on average, $700 annually from unwanted subscriptions.

Speaking about how the company will use the new $3 million, Mackler said there are new features in the pipeline, including price hike defense, bill reminders and other personalized ways to save on subscription services.

“The funding really allows us to flex our muscles in the way we’re innovating in this space,” he said. “We will continue to divert ourselves from the competitive landscape that exists today.”