Ride-hailing giant Lyft will start displaying ads in-app, as well as via in-car tablets, rooftops and bikeshare stations.

“Lyft has a captive audience throughout their entire ride journey – waiting for their car, matching with their driver, and in ride – and brands can now reach riders in relevant and tailored ways across our suite of Lyft Media products,” said Zach Greenberger, Lyft’s chief business officer, in a statement.

I know what you’re thinking. Thank goodness, more ads! Even better, ads via the app that know exactly where you are and where you’re going! Getting dropped off at a friend’s place who happens to live near a movie theater? Don’t be surprised if you see an ad for whatever is playing at that cinema when you check your ETA.

Lyft getting into ads shouldn’t surprise anybody. Uber launched its own ads unit in October 2022, and the company forecasts ad revenue will hit $650 million this year. Compared to the $8 billion in revenue Uber pulled via mobility, delivery and freight in Q2, $650 million is chump change. But the room for growth is there, and Lyft undoubtedly sees a chance to bring in more revenue in an asset-light way.

Lyft’s stock has slipped 6% since the company reported its second-quarter earnings. The company met Wall Street analysts’ revenue expectations, projected steady growth for the year and increased its ridership numbers. Yet, revenue per active rider decreased, as the company chopped its fares in an attempt to keep its prices competitive with Uber’s.

Over the past year, Lyft has done some belt-tightening in order to focus on its core ride-hailing business. That includes shutting down its in-house car rental service and exploring a possible sale of its shared micromobility unit. Those units are both decidedly not asset-light models. Advertising could present a low capex way to add a revenue stream.

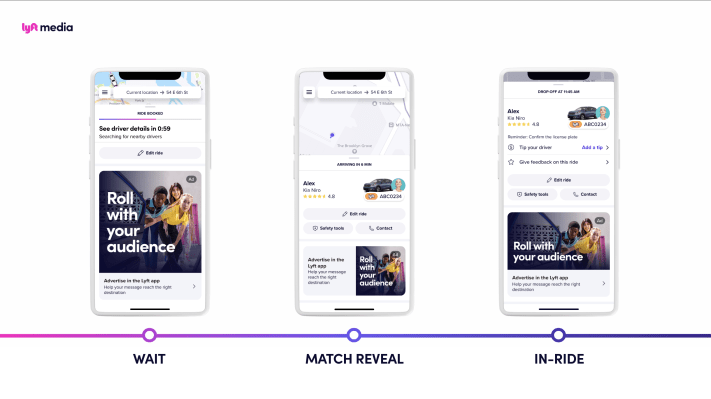

Lyft said its in-app ads will show up on riders’ ETA screens, when they match with a driver and during their trip. Ads will also play on in-car tablets, which drivers can request to “boost their earnings with advertising revenue and higher tips,” according to Lyft.

The company didn’t respond in time to TechCrunch to explain what percentage of ad revenue will go to drivers, if drivers need to pay for the tablets, how much those tablets might cost, or how having a tablet in the backseat can boost tips. Lyft said that drivers who give at least 60 rides per week and have an an-enabled tablet in their car can increase their tips by more than 10% on average.

The company’s current ad partners include Bilt Rewards, Audible and Universal Pictures. Lyft said it’s partnering with Kantar Brand Lift Insights to help brands understand metrics like awareness, purchase intent and brand association. The company will also incorporate Rokt’s ad serving technology and programmatic solutions.

At launch, brands can advertise nationally in the app, across in-car tablets in 12 markets, on car digital screens in five markets and across bikeshare in four markets, according to Lyft.