Chargeflow, a startup using AI to fight chargeback fraud, today announced that it raised $11 million in a seed round led by the VC firm OpenView Venture Partners. The tranche builds on Chargeflow’s previously undisclosed $3 million seed round closed several months ago, bringing the startup’s total raised to $14 million.

Chargeflow was launched in 2021 by Ariel Chen and his brother Avia Chen, both Israeli-American entrepreneurs. They previously co-founded Babe Cosmetics, a beauty brand developing a line of skincare products, which they sold to focus on Chargeflow.

“Although Babe Cosmetics was thriving, it encountered a significant problem with chargebacks,” Ariel and Avia told TechCrunch via email. “This glaring issue, coupled with our expertise in ecommerce, tech and fintech, ignited our determination to find a solution — but we couldn’t find an existing one.”

So Ariel and Avia started Chargeflow, which taps machine learning to generate custom “dispute evidence” — e.g. delivery confirmation receipts, signed orders and so on — for each chargeback and automatically submit it to the corresponding bank or credit card company.

Chargebacks are more complex than you might think. Credit card networks use different chargeback codes, and each code requires different evidence to overturn a chargeback.

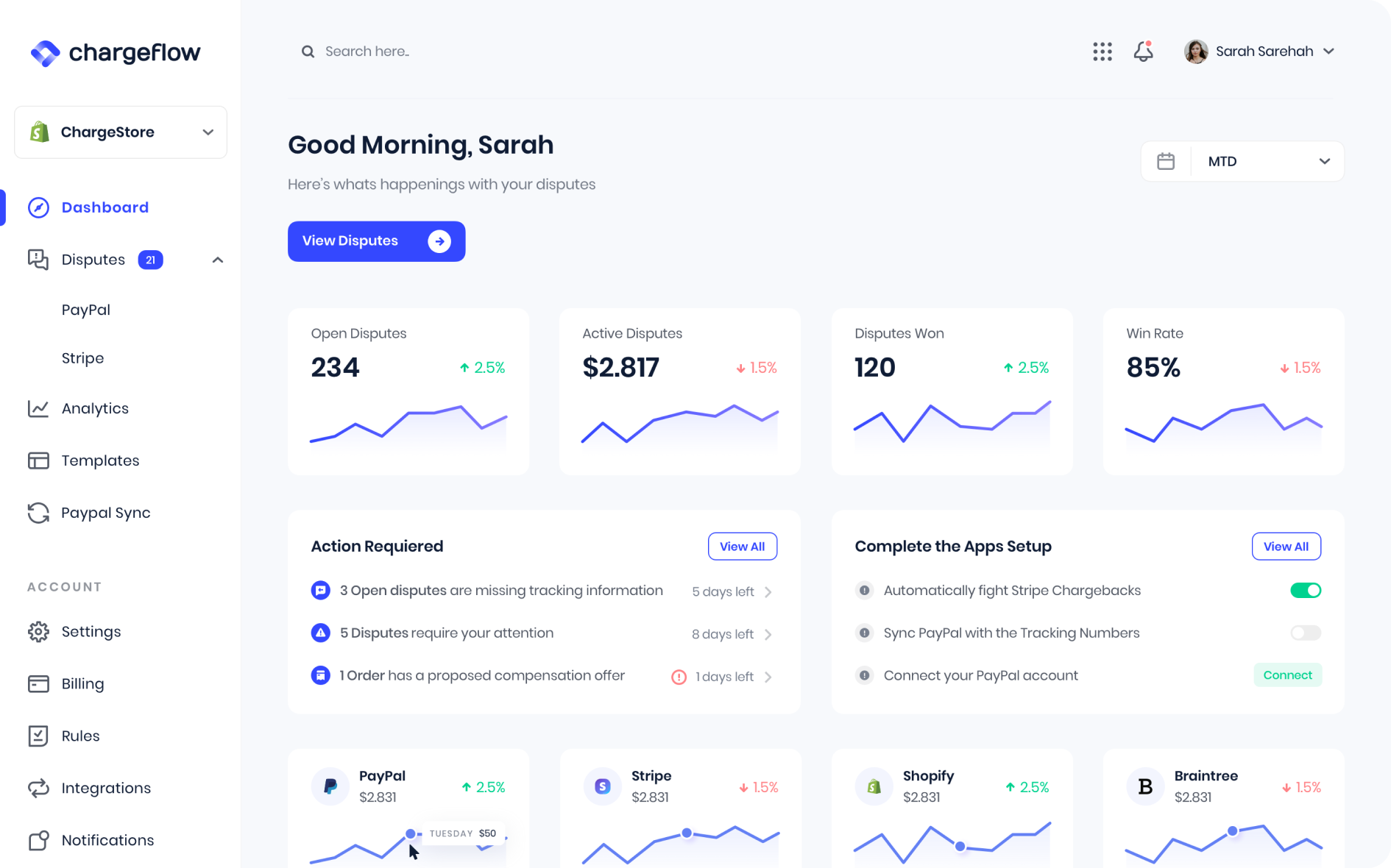

A view of the Chargeflow backend. Image Credits: Chargeflow

Any barrier to overturning fraudulent chargebacks costs businesses time — and money. According to a 2022 survey, 65% of merchants reported an increase in chargeback fraud from the year prior. Merchants lose an estimated $34 for every $1 in chargebacks, and this figure is expected to increase to $193 in 2023.

To maximize the chances of a merchant win, Chargeflow matches incoming disputes to a business’ order data, checks the code and its associated requirements and generates a dispute response using custom-made templates. Human experts review the AI-generated responses before they’re submitted.

“On average, it takes about one to two man hours of labor to fight a single chargeback,” Ariel and Avia said. “Chargeflow automates and eliminates the need for manual chargeback dispute and reduces that labor cost to zero.”

Integrating with existing e-commerce platforms, payment service providers and other, related tools, Chargeflow calculates the projected success of chargeback disputes by comparing transaction data, only billing merchants based on successful recovery of disputes in their favor.

Chargeflow claims to have thousands of customers. But there’s an abundance of vendors in the chargeback-fighting space — see Chargehound (which PayPal acquired in 2021), Justt, Midigator and Equifax-owned Kount, to name a few.

But Ariel and Avia didn’t express much concern about Chargeflow’s growth prospects.

“Chargeflow is well positioned to help merchants and business mitigate the problem and ensure higher business margins while reducing overhead expenses,” they said. “Despite the economic slowdown in other tech sectors, Chargeflow is growing rapidly.”

The proceeds from Chargeflow’s latest raise will be put toward enhancing its tech development efforts and strengthening its growth trajectory in the U.S., Ariel and Avia said. They’ll also support Chargeflow’s hiring efforts; the company’s looking to double its roughly 40-person headcount to 80 by the end of the year.