Plastic in ocean bad. Plastic not in ocean good. That’s, in a nutshell, the pitch for CleanHub. The company has designed a whole business model and a track-and-trace model around that, so brands can rest assured that their plastics don’t end up in the oceans. Who these brands are and what happens to the plastic instead is, unfortunately, a little bit of a mystery.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

CleanHub used a tight, 12-slide deck to get its point across. The only redaction in the deck is details about co-founder and co-CEO Louis’s previous exit. The deck does miss a couple pieces of information that I’d typically want to see, but before we get to that, let’s take a look at what’s in there.

- Cover slide

- Team slide

- Vision slide

- Problem slide

- Value proposition slide 1

- Solution slide

- Marketplace vision slide

- Product slide

- Technology overview 1

- Technology overview 2

- Value proposition slide 2

- Market size slide

Three things to love

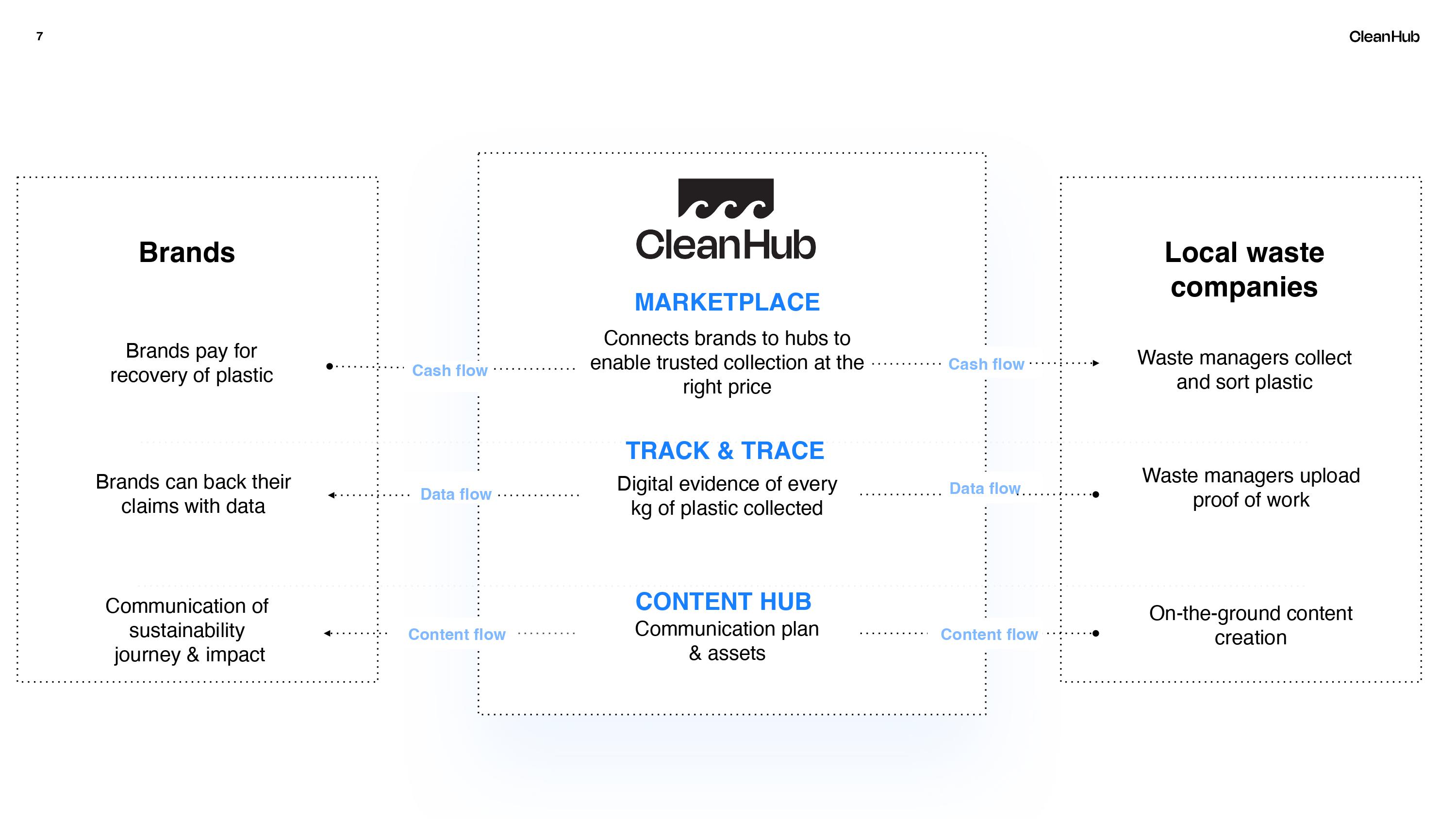

CleanHub is building a marketplace for the circular economy of plastic. That’s a bold and challenging space to be in: Marketplaces are notoriously hard to build, and plastic garbage is a tough sell. Still, there are some cracking slides to convince us otherwise.

A great overview

[Slide 7] Gotta love a good overview slide. Image Credits: CleanHub

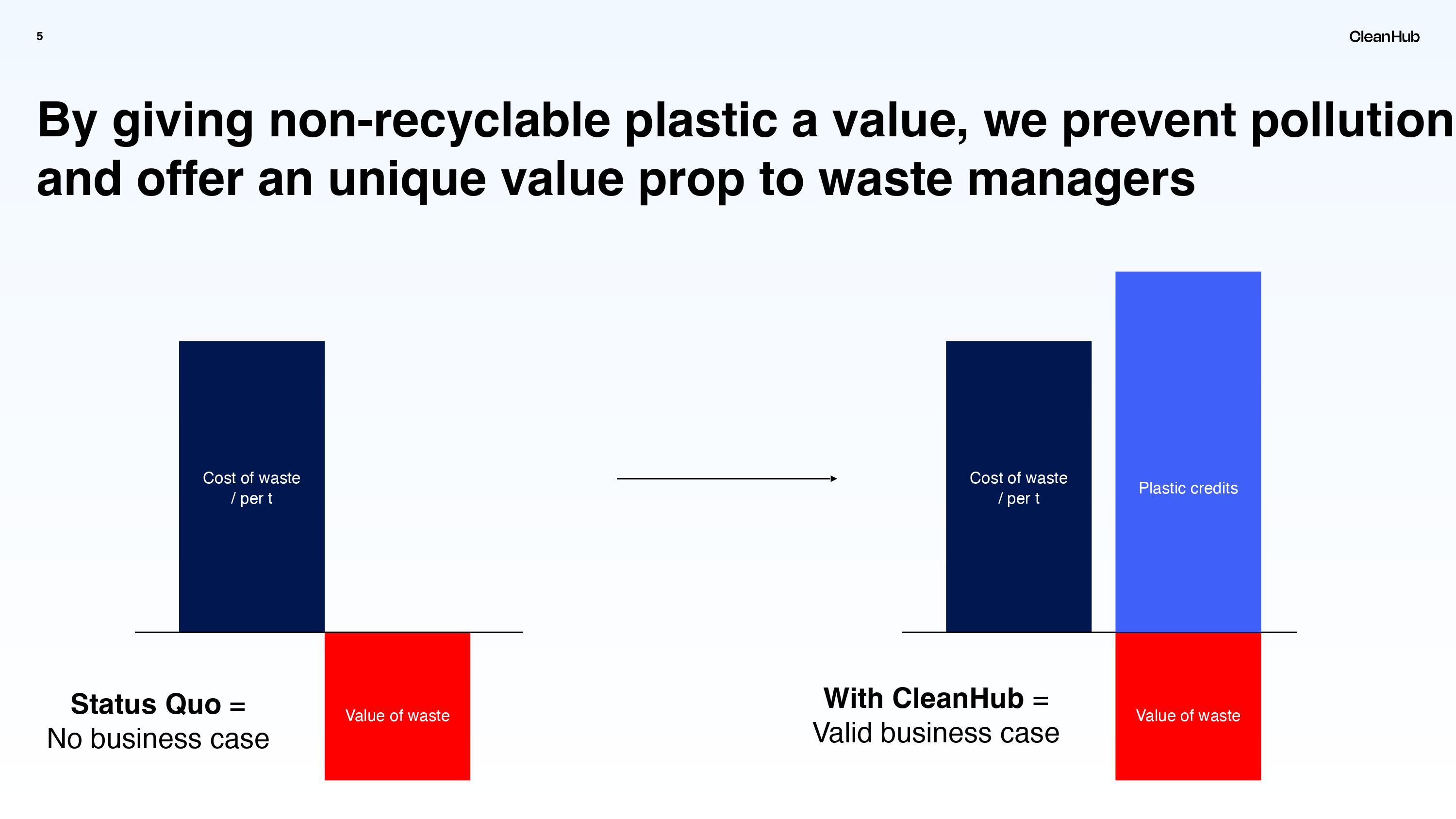

Giving waste value

[Slide 5] Like carbon credits, but for plastic. Image Credits: CleanHub

I don’t fully understand how this would work (more on this below), but prima facie, this is a story I haven’t heard before, and it arouses my curiosity.

Team team team!

[Slide 2] If you’ve got a great team, brag about it as hard as you can. Image Credits: CleanHub

CleanHub has two co-CEOs, which gives me pause. The CEO’s role is typically well-defined, and two in this case isn’t always better than one. I would push the team here, focusing on conflict-resolution skills. The answer as to why there are two CEOs could trigger a number of red flags about team cohesion and staying power.

In the rest of this teardown, we’ll take a look at three things CleanHub could have improved or done differently, along with its full pitch deck!

Three things that could be improved

CleanHub is coming at this with a great heart and mission: leverage capitalism to do something about plastic waste. I love it.

And yet, there is a wall of questions that this deck leaves unanswered.

How does the marketplace work?

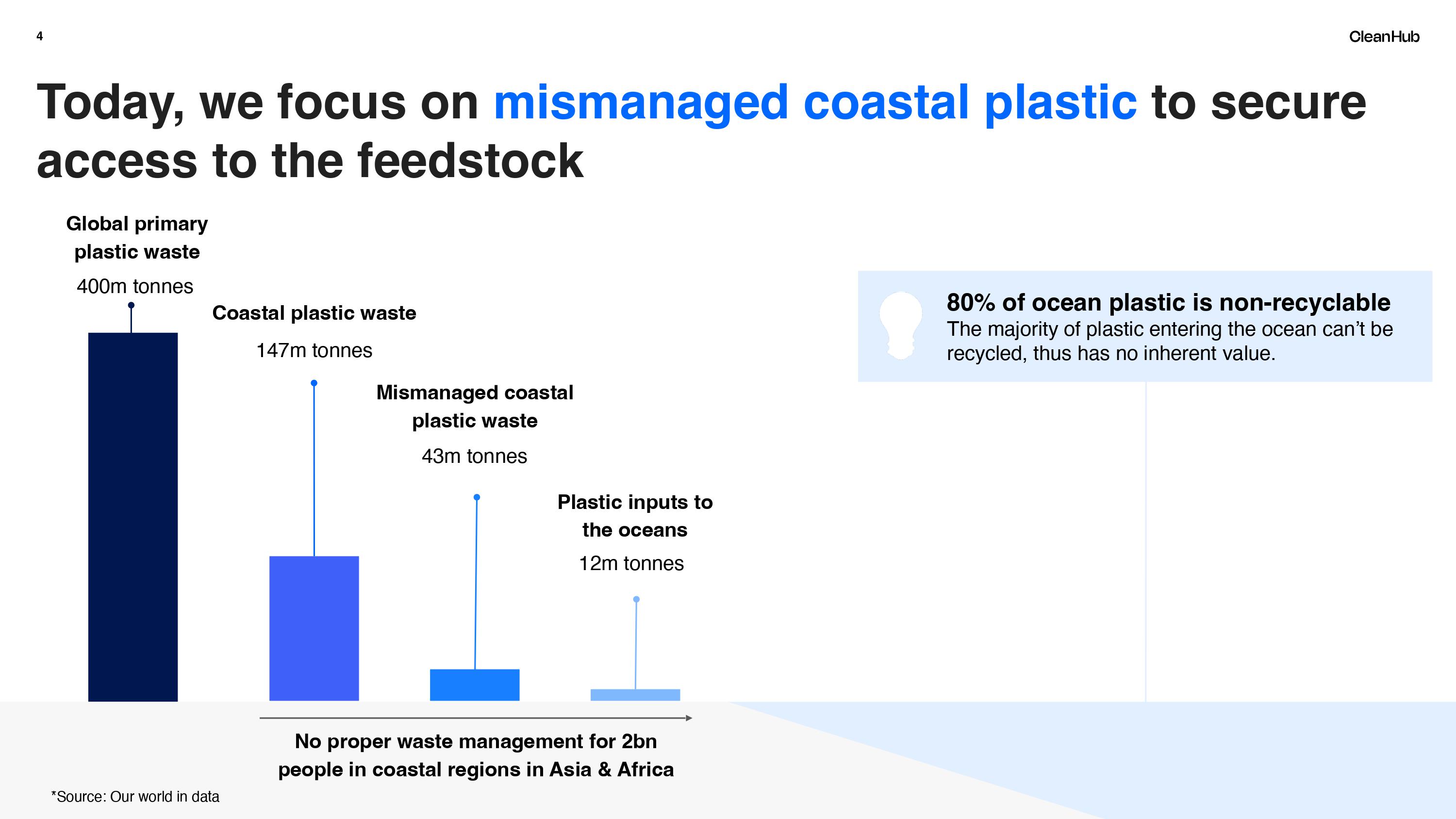

[Slide 4] What does “no inherent value” mean? Image Credits: CleanHub

The thing that makes this harder is that CleanHub is explicitly going after nonrecyclable plastics. Without a clear explanation of what happens to this plastic and who wants to buy it, it’s hard to imagine how this model would work. CleanHub should explain here how it intends to create value out of the nonrecyclable plastic.

Why this, why now?

The deck has some good information in it, but it fails to tick some of the pretty basic boxes for things I expect to see in a pitch deck. It doesn’t say what the company is planning to do with the money, which is a problem: You’re raising money to accomplish something, so it makes sense to explain what that something is.

I imagine there aren’t a lot of competitors in this space, but I’d have liked to see a slide about how this problem is currently being solved. Even if the slide only says “lol, we’re the only team trying to solve this,” that would be a data point. And a “Why now?” slide would give insight into outside forces the company has to contend with: Are there regulatory changes coming? Are there financial incentives?

What’s the traction?

[Slide 9] The tech looks good, but who is using it, and do they want it? Image Credits: CleanHub

The concept of the marketplace is interesting, and using AI and computer vision to track it makes sense, but I want to know how this company measures its success. How many tons of plastic have been successfully removed from the oceans? How many transactions have been made on the planet? How much plastic is the company tracking? How much revenue has been created? It’s talking about creating credits to give waste plastic a value, which is great, but what’s the value of those credits to date? Where’s the graph of it growing over time?

Finally, on the far right, there is a reference to “On arrival at the cement plant,” without explaining in any depth why a cement plant would want this plastic, and what they might be willing to pay for it.

[Slide 10] What do any of these percentages mean? Image Credits: CleanHub

I am frustrated with this deck because it tells, rather than shows. Its heart is in the right place, but there seems to be a huge amount of real risk that hasn’t been designed out of the business yet. That makes sense, at the earliest stages of the company, but as a founder, it’s your job to think about the MVP: What is the smallest amount of work you can do to validate that what you are doing is possible?

I see a team that has focused on solving one of the easier parts of the equation: a way to track a bale of plastic through a system, using AI and computer vision. The much harder part, in my estimation, is how it will find buyers and sellers, and how will it spend its venture capital dollars to de-risk the business. The deck answers very few of these questions.

It feels like I’m reading the middle of a conversation and missed the explanation for why it exists and who needs it. And then I somehow also missed the “here’s what we’ll do next” part of the conversation. At the very least, a good pitch deck answers those three questions.

The full pitch deck

If you want your own Pitch Deck Teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!