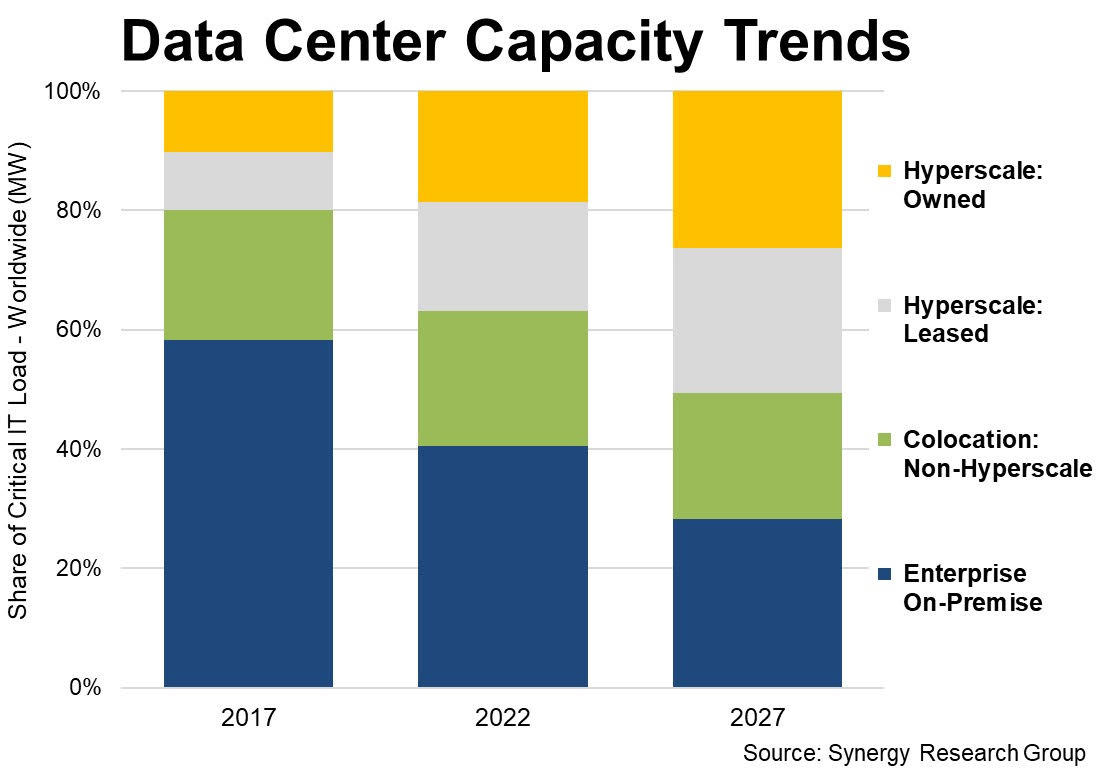

In 2017, on-prem data centers accounted for nearly 60% of capacity. By 2027, Synergy Research is projecting that number will be cut in half, but that data doesn’t tell the whole story. New research from Synergy finds that on-prem data center growth is actually hanging in, but over the next five years, growth will remain essentially unchanged. At the same time, hyperscale data centers operated by the largest cloud companies will continue to grow at a hefty rate.

It’s not exactly a death knell for on-prem, but capacity is clearly shifting to the cloud. Today, Synergy reports there are 900 hyperscale data centers worldwide, with that number split pretty much evenly between those facilities that are owned by the cloud providers and those that are leased. On-prem still accounts for 40% of usage.

Synergy is predicting that in five years, the cloud providers will control over half all capacity and the on-prem number will fall to 30%. People have been predicting for years that most enterprise workloads would eventually move to the cloud, but like many technology shifts, change has happened more slowly than perhaps those in the industry thought.

Image Credits: Synergy Research

In 2019 at AWS re:Invent, then AWS CEO Andy Jassy expressed impatience at the rate of change. He clearly wanted people to start moving to the cloud faster, and his keynote speech was peppered with advice on how to do that.

“It’s easy to go a long time dipping your toe in the water if you don’t have an aggressive goal,” Jassy said at the time, and perhaps this new data and the trend lines predictions Synergy is making show that we could be finally getting to a tipping point in the cloud.

For AWS, however, it might not be growing the way that Jassy hoped. While growth has slowed pretty dramatically overall for the cloud infrastructure market, it has plunged for AWS in particular, dropping into the teens in its most recent report, compared with 37% growth in the year prior. In terms of market share, that translated into 32% for AWS, still the clear leader, but Microsoft has continued to creep up with 23% last quarter. Google was in third place with 10%.

Those numbers might paint a confusing picture, but in spite of the short-term slow-down we are seeing, Synergy believes that as the economy begins to steady, the trend to the cloud will only accelerate, and that will translate into less on-prem data center capacity in the not-too-distant-future.

Synergy’s spending numbers tell a clearer story: “Ten years ago, enterprises were spending over $80 billion per year on IT hardware and software for their own data centers, while spending well under $10 billion on nascent cloud infrastructure services. Fast forward to the present day and spending on data center hardware and software has only grown by an average 2% per year, while spending on cloud services has ballooned, growing by an average 42% per year to reach $227 billion in 2022,” Synergy reports.

All that is to say, that while on-prem data centers aren’t going away anytime soon, they are beginning to diminish as a percentage of IT spending and data center capacity, and that trend seems unstoppable.