Investors are throwing money at AI startups (though maybe not as much as you might think), so it’s no wonder that we’re starting to see them leaning on the technology to leverage their most precious resource: Time.

In an effort to reduce bias and capture a more diverse group of founders, Kentucky-based Connetic Ventures has developed a piece of software that acts as its top-of-funnel. Called Wendal, the platform assesses founders according to 13 entrepreneurial traits to determine if a meeting will prove fruitful or not for investors. The test takes 15 to 20 minutes, and the fund promises to give founders a decision within three days.

Wendal’s genesis was sparked during an idea-storming session for angel investors who wanted to efficiently and effectively find and support startups across Indiana, Kentucky and Ohio.

“In San Francisco or New York, you can raise money, hang a sign up and have enough deal flow to support an actual fund,” said Chris Hjelm, partner at Connetic.

Outside of these major funding hubs, you have to be more discerning. The question was how. Knowing that the team is at the center of any startup, the fund went down what Hjelm described as a “behavioral psychology rabbit hole” and sought the help of an industrial psychologist to define the optimal entrepreneurial behavioral profile. They then built Wendal.

I tried the platform out myself, and my fictional company (based heavily on my real company that failed spectacularly) was recommended to the investment team.

Wendal is not all that’s unique about this firm: It also has no carry component. Unlike most VC firms that get to keep 20% of the money they generate for their LPs, Connetic wants to make itself available to retail investors through financial advisers. It charges a 1.9% fee instead of a direct upside on a startup’s success.

All of that had me curious about this venture fund, so I caught up with Hjelm to talk about the fund, the metrics that Wendal measures, how it plans to make its fund structure work, and more.

Equity in the machine

By taking the pitch and the human factors out of the equation, Connetic believes it has developed a much more equitable model to determine who should receive funding. But any AI system is only as good as its training data, so it’s logical to wonder about Wendal’s fairness or its capability to determine whether a startup’s founder is right for a given market. But Hjelm believes the platform has been built to be equitable and that the data bears out this assertion.

“Everything we’ve built, we train for fairness. So the top-of-funnel equals bottom-of-funnel,” Hjelm told me. “We don’t ask questions like, ‘Are you a multi-time founder?’ or ‘What school did you go to?’ We’re trying to not introduce variables that might be biased toward those that traditional venture capitalists look for.”

“Some of the dimensions we measure are leadership, extraversion or introversion, patience, attention to detail, emotion or passion, awareness, conscientiousness, grit and emotional intelligence,” he added.

According to Hjelm, Wendal’s recommendations amount to 56% white men, 31% women, and 33% minority founders, which apparently mirrors the demographics of the applicants. Hjelm also recounted how a 16-year-old founder made it through Wendal’s process and secured a meeting with the Connetic team.

“We passed on the deal, even though everything checked out, like good valuation, good traction, and he kept me updated,” said Hjelm.

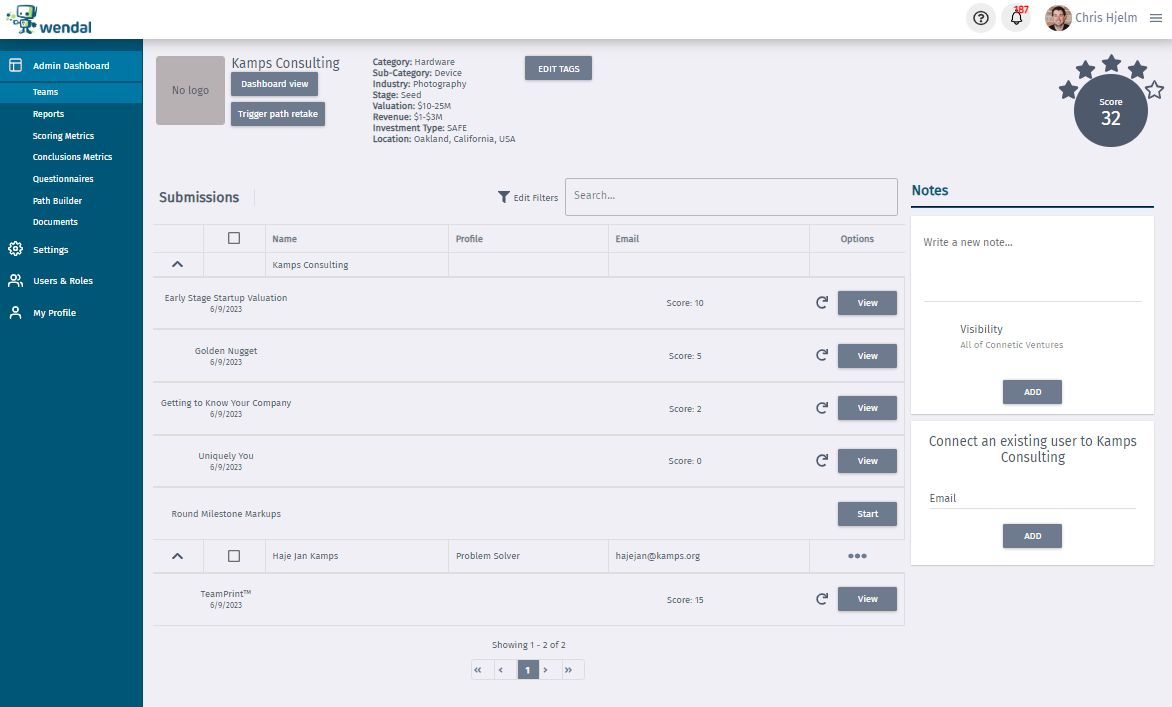

A screenshot of how Wendal evaluated my fictional company. I’m a “problem solver,” apparently. Image Credits: Connetic Ventures

Does this prove that Wendal can pick out startups or teams without taking into account the factors that often come into play, like where you were educated, if you’ve been there before, and if you’re a white male? Hjelm explained that Wendal assigns each startup a star rating, suggesting whether or not investors will enjoy a successful investment in the company. The results appear to be promising.

“Wendal gives every company a star — a composite star rating of one through five stars,” said Hjelm. “One-star companies have a win rate of about 8%, two [stars] is 12%, three [stars] is 18%, all the way up to five stars, meaning investors have a successful exit 37% of the time. Overall, that means that Wendal can pick startups better than an angel investor, probably on par with venture capitalists, based on the data we’ve read.”

And for founding partnerships or startups with multiple founders, Wendal can assess complementary traits to ensure that a founding team is as strong as it can possibly be.

Because Wendal can dispassionately make a call on a startup’s potential for success without engaging humans early in the process, the Connetic team can spend more time with the startups that get through, leading to better results all round.

“We spend more time with a smaller subset of companies,” said Hjelm. “If you can focus your attention, out of 1,000 companies, if Wendal can show us 80 that are more likely to be successful, then you use traditional decision-making to make better decisions.”

A unique plan for growth

Connetic is focused on pre-seed and seed-stage funding, and Wendal is optimized for this as well.

“Early-stage founders are very unique,” said Hjelm when I asked him about this focus. “They like breaking shit, they get a thrill from all this stuff. And then once they hit scale, it’s more operations and implementing procedures. We’ve had so many founders leave at the Series D stage. Our hypothesis is that a successful management team is completely different at an early-stage startup versus a late-stage startup.”

Connetic writes an average of 15 to 20 checks each year, most of which are between $250,000 and $500,000. Startups can apply from anywhere across North America, except the Bay Area and Boston.

The firm’s plans for growth set it apart from many venture capital funds — it allows anyone to invest in the fund.

“We want to be accessible to every investor. We’re going to be selling it through financial advisers and charge a 1.9% management fee; no carry.”

Hjelm said for this strategy to make sense financially, it’ll need a $500 million fund.

“It’s kind of a big bet. Our managing director was a registered investment adviser and he knows this space. We’ll be on Fidelity and Schwab, and you can buy Connetic through your brokerage account,” he said. “We had a financial adviser meeting on Thursday who said, ‘This is awesome, we’d love to test this with you. We could wire you $30 million,’ so the amount of capital we could access through this strategy is kind of insane.”

For Connetic, the aim is to be as accessible as possible to any founder or investor. You don’t need to be in San Francisco or Boston, have a particular background or a warm introduction. All you need is an internet connection.

I’m curious whether the 1.9% management fee makes sense in an industry where the standard is a 2% fee and a 20% carry. The generally accepted narrative is that having “skin in the game” would incentivize investors to make the best possible investments on behalf of their clients. It’ll be very interesting to see how this model plays out over the next few years.