It’s rare to find a pitch deck that forces me to dig deep to unearth something to criticize. The last time was with Orange’s seed deck, and in this week’s installment, I had to dive deep into the deck that Super.com used for its $60 million equity, plus $25 million venture debt round.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Super.com operated with a deck that tells a great story. It consists of 17 slides:

- Cover slide

- Mission slide

- Traction slide 1

- Traction slide 2

- Team slide

- Customers (interstitial slide)

- Customer profile

- Target customers / market size

- A Savings Super App (interstitial slide)

- Why Now slide

- “Why a super app” slide

- Product slide

- Product road map slide

- User behavior slide

- Solution slide (“SuperCash is core to the experience”)

- Value Proposition slide (“Personalized Experiences”)

- The Ask slide

Three things to love

It’s hard to choose from all the stuff that works in this deck because the Super.com team really knocked it out of the park. But here are three highlights, which, incidentally, are the three most important slides you can have in a pitch deck. I’m utterly unsurprised that the company successfully managed to raise money.

You’ll raise if you’ve got traction…

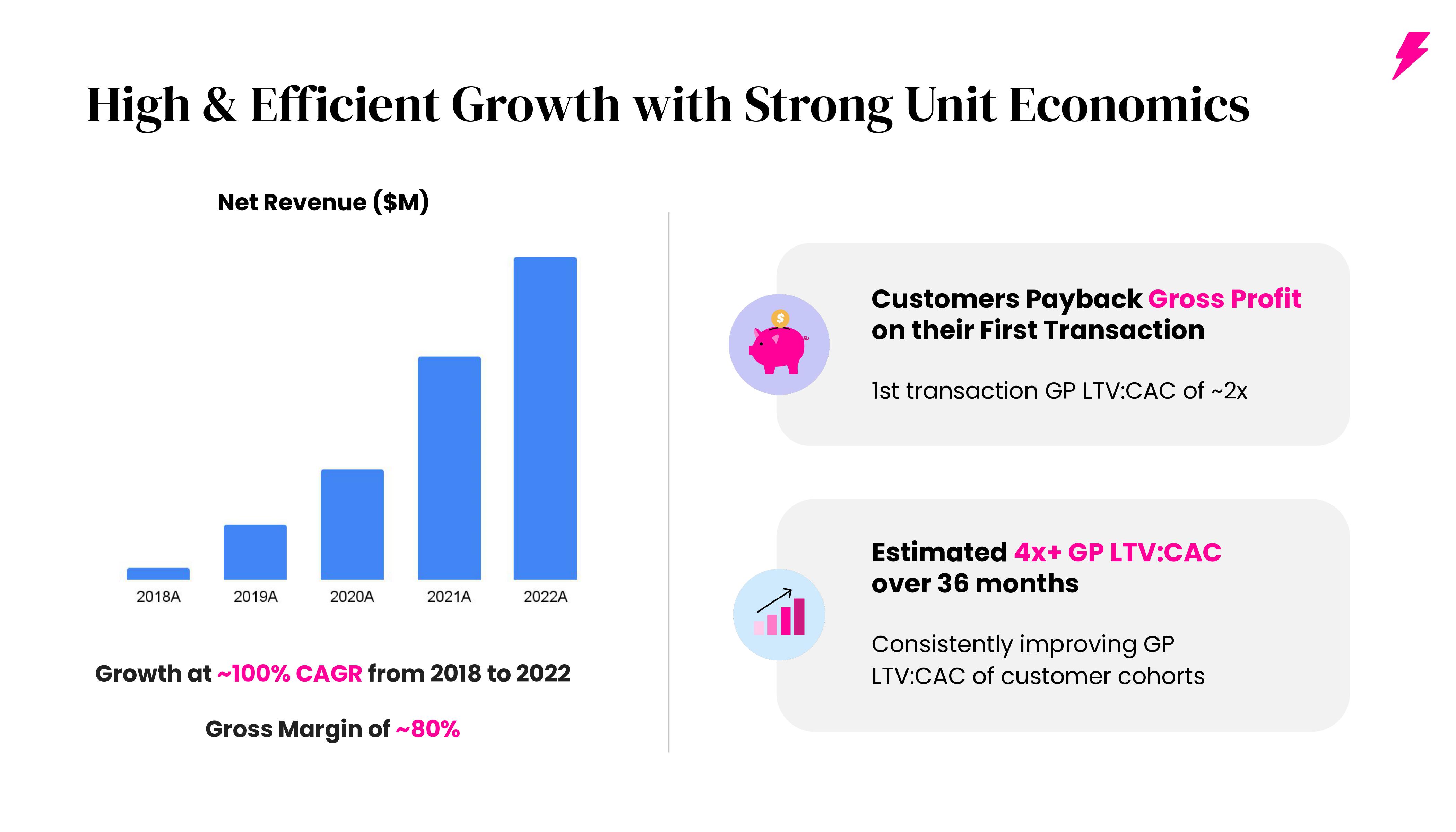

Super.com starts its pitch with two traction slides in what can only be described as a masterful flex:

[Slide 3] Traction snapshot. Image Credits: Super.com

[Slide 4] Traction over time. Image Credits: Super.com

I’ve said it before: If you can show incredible traction, you don’t really need much else. Super.com does that, but it also has the goods for the rest of its story.

And an incredible team…

Super.com knows its strengths, and it segues from talking about its mission with its traction into a conversation about its team. Co-founders Henry Shi and Hussein Fazal have built a deep bench of incredible team members:

[Slide 5] What a team. Image Credits: Super.com

This is what an absolutely world-class team slide looks like.

Each of the business verticals — travel, finance and the shop — are led by some world-class people, who are all CEO material in their own right. The company’s CFO is ex-Bank of America, and the CMO used to head marketing at Chase.

In addition, the company has attracted Joanne Bradford (president at Honey, COO at SoFi, and head of global partnerships at Pinterest) and Anan Kashyap (ex-CFO at Ethos and Poshmark) as independent board members.

In a huge market

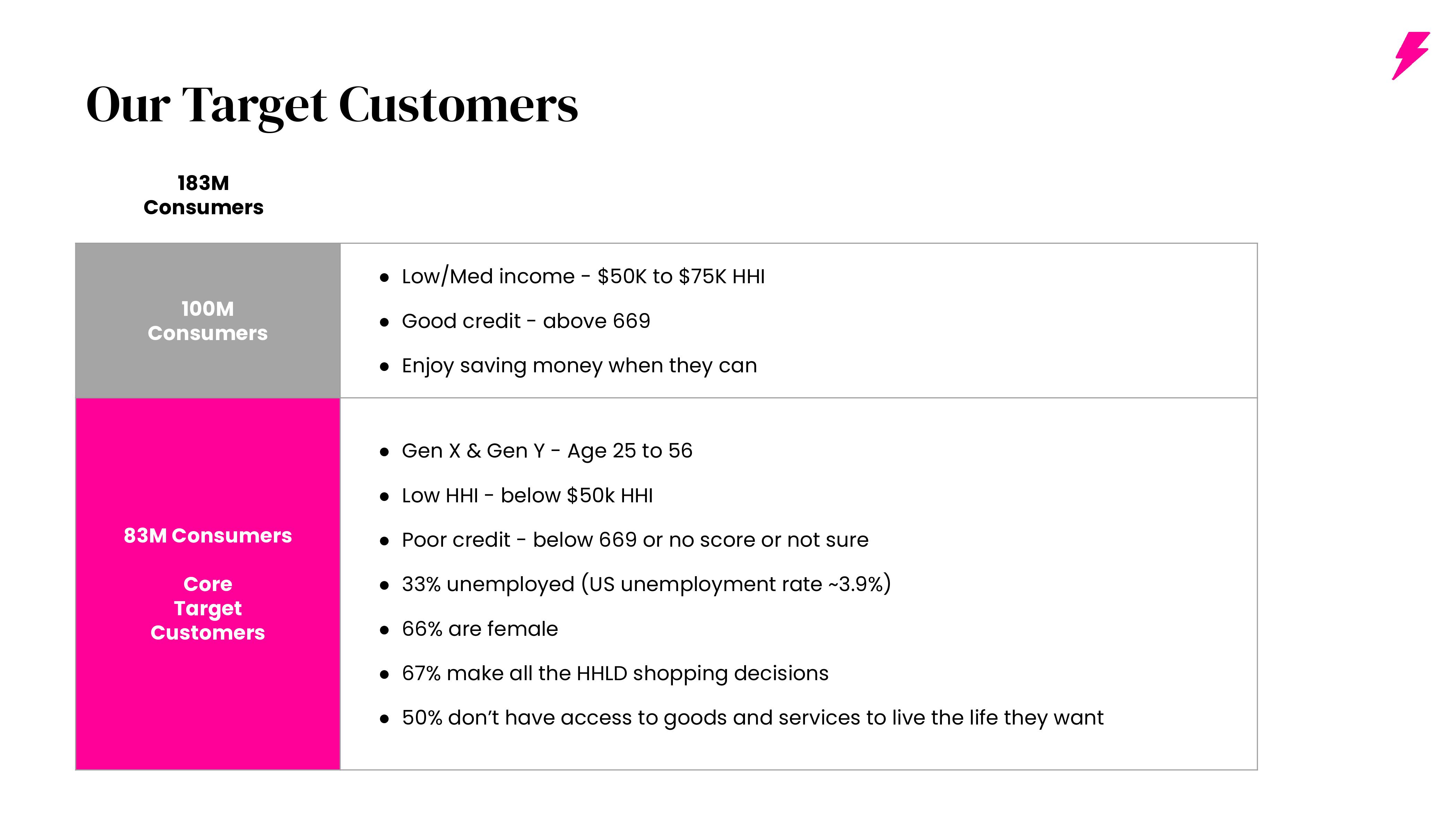

Most of the time, I recommend doing a top-down TAM/SAM/SOM analysis to arrive at your market size, but Super.com chose a bottom-up approach:

[Slide 8] A slightly unusual market size slide in that it expresses it in customers, not dollars. Image Credits: Super.com

If this were a pre-seed deck, I’d tell the founders to get it together and do better. But for a company that already has 80 million users, I want to know where it is going to grow. This slide does a good job of answering that question.

The company’s CEO, Fazal, gave me some important context:

We serve the customers who need it the most — typically lower household income, with no to low FICO scores, typically looking to save before they buy. There are about 183 million in that customer base. As we are seeing the wealth inequality gap in the U.S. growing, we have a unique opportunity to make a difference in the lives of more than 100 million Americans. We’re really well-positioned to do this given our active customer base: It’s customer-driven expansion.

That’s a hell of a story.

In the rest of this teardown, we’ll look at three things Super.com could have improved or done differently, along with its full pitch deck!

Three things that could be improved

At first scroll, I really struggled to find fault with the company’s slides. But looking closer, I noticed that there was some important data missing.

How are ya gonna grow?

When you have 80 million customers, it means that you have a huge area to “land and expand” — bring customers on board for one product, and then sell them additional products.

[Slide 7] This is a huge group, but eventually you’re going to run out of customers to sign up to your platform… Then what? Image Credits: Super.com

As a startup founder, you must be clear about where your growth is going to come from. You need a plan, and investors are going to want to see it.

Competitive landscape

The deck also gives no information on the competitive landscape. I challenged Fazal on that, and he admitted that it was a tricky part of the conversation:

“If I’m honest, the competitors are a little bit tricky because each vertical has its own competitors,” Fazal explained. “So if you think of the hotel booking business, you compete with Expedia and Booking.com.”

For credit-building cards, Super.com is competing with secured credit cards and startups like Petal, which sidestep the need for existing credit scores to build a new credit score.

“If you are trying to get savings on gas, you’re probably competing with fuel rewards and Gas Buddy,” Fazal said, but he couldn’t think of a competitor that does everything his company does. “But to think of one overall place where you’re saving money and earning, maybe Rakuten is the closest comparison.”

Still, any competitor in the travel, savings or credit-building spaces is still a rival that can draw customers away. For Super.com, I suspect it’s a mistake to not talk about the competitive landscape at all.

As a startup, you should not get too cocky about your market position. Every company has weaknesses, and other startups are always vying to disrupt the disruptors at every turn. Being aware of your shortcomings, and perhaps even bringing them front and center in a pitch deck, might land better with an investor.

Still, I don’t want to slap Super.com around too much on this front because Fazal is right. Any company like Super.com starts seeing the benefits of network effects since each customer is different, and the company can offer different services to different customers. Smaller companies will find that hard to compete with.

That’s a shitty “use of funds” slide

When I first saw Super.com’s Ask and Use of Funds slide, I sighed a breath of relief, because, well, this isn’t a great slide.

[Slide 17] “Yeah, just more of what we have been doing, basically” isn’t a great “use of funds” story. Image Credits: Super.com

When I brought it up with Fazal, we ended up laughing about it:

“I’m sure you will have some comments about this slide, about use of funds,” Fazal said. “We were looking to raise $60 million to grow our existing savings, use cases and expand into others. The existing things we’re doing well, the question is, how can we continue to offer value there? And then for the things that we don’t do yet, how can we continue to add these use cases and test these use cases?”

As much as I have an issue with this slide, there’s an earlier slide in the deck that actually tells part of this story very elegantly:

[Slide 13] This slide needs a voice-over, but once you understand what it’s saying, it’s pretty great. Image Credits: Super.com

The pitch, in a nutshell, is to strengthen, expand and experiment. With a huge active user base, the company outlines that it has a tremendous opportunity. I can’t really argue with that.

Another interesting point the company makes here — albeit somewhat obliquely — is that some of these activities are rare enough that the customer may forget about you. If a low-income customer only uses Super.com for travel, which happens maybe two times per year, that isn’t great. However, if Super.com manages to convenience customers by offering better prices through cash-back schemes, filling up the car, or dining out, it has a much better chance of becoming a deeper, more integrated part of a customer’s life.

The story isn’t great, and as an investor, I’d really want to know where the growth is going to come from. But with this kind of traction, I’ll have to let Super.com off the hook. A company doing this well gets to pour more money in the top and see what happens. They’ve proven that they know what they’re doing.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!