The era of tech giants overstaffing and overpaying has ended, at least for now. But talent is flooding the market, and those still employed have been left to shoulder all the work — there’s a huge opportunity for savvy recruiters to scoop up top performers.

Today’s job market is a confusing paradox. While unemployment is at a record low and there’s a labor shortage in healthcare and hospitality, tech has seen nonstop layoffs that hit 166,044 workers in Q1 2023 alone. That’s more than all of 2022’s then-record 161,411 tech layoffs.

What’s most unprecedented is that these layoffs are hitting software engineers, including top talent at FAANG companies that were previously considered untouchable. This is in sharp contrast to the 2008 recession, when the U.S. high-tech industry gained about 77,000 jobs in Q4, most in software development, despite the overall U.S. labor market losing 38,000 jobs.

327,475 people in tech were laid off from Q1 2022 to Q2 2023. Image Credits: SignalFire

The reversal of fortunes for engineers is particularly brutal coming off of 2021’s startup fundraising boom and relentless optimism. Companies preempted growth with hiring sprees far ahead of their metrics in hopes of continued growth.

But by the summer of 2022, the Great Resignation and “quiet quitting” gave way to mass layoffs by four of the big five in tech — Meta (Facebook), Apple, Amazon, Netflix and Alphabet (Google), known as FAANG. All but Apple made sizable cuts, including deeper cuts for software developers.

Executive summary

SignalFire’s State of Talent Report explores macro conditions and top-talent movement trends in tech to identify practical strategies for winning in the current hiring market. Top findings include:

- Hiring power is shifting to startups as post-pandemic layoffs and budget cuts cause a “Great Restart” of compensation norms at Big Tech companies that can no longer overpay to win the best talent.

- An unprecedented 166,000 tech layoffs happened in Q1 2023 — more than in all of 2022 — and included formerly untouchable software engineers.

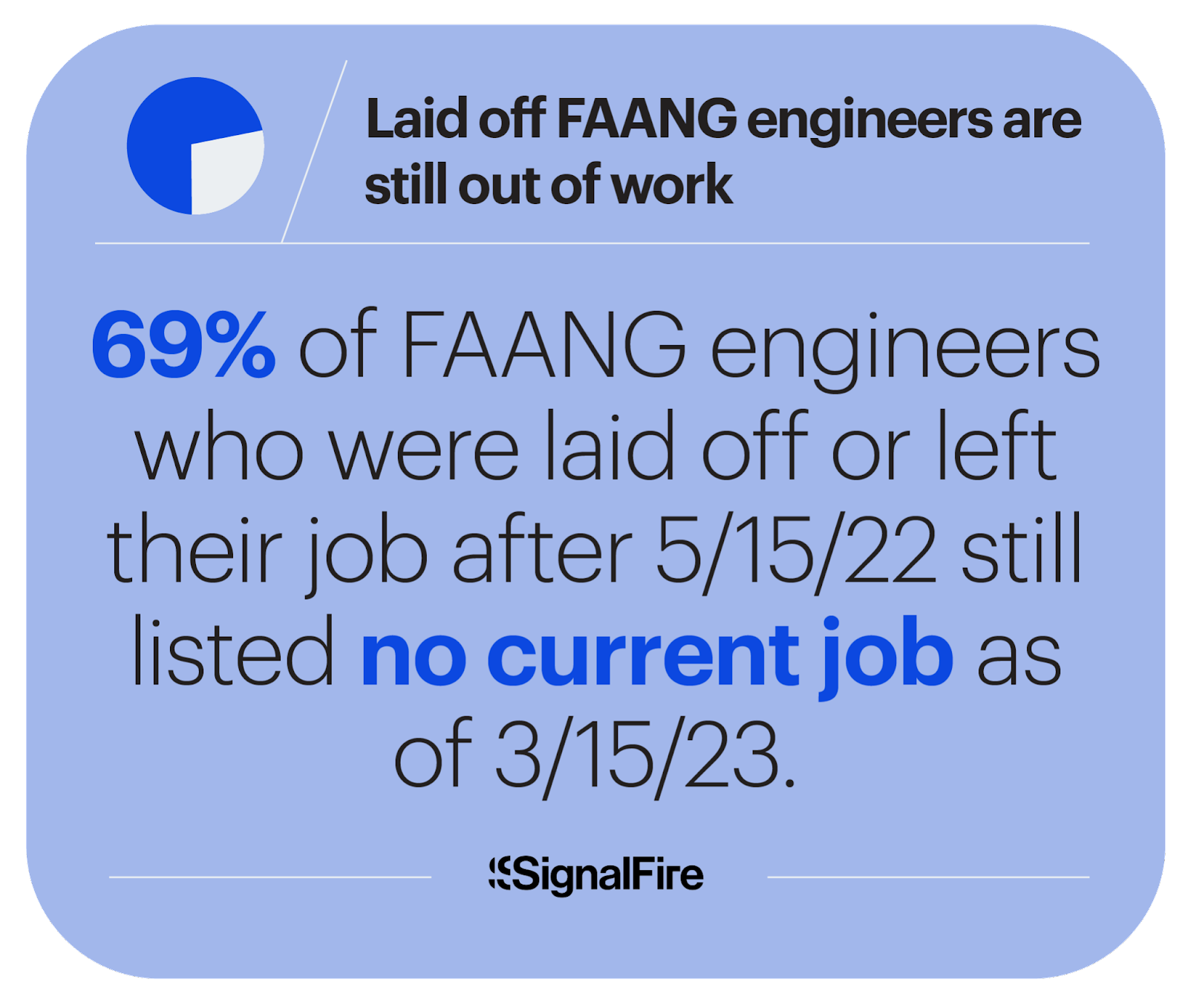

- Big Tech talent has flooded the market — 69% of FAANG engineers who were laid off or left after May 15, 2022 still listed no current job as of March 15, 2023.

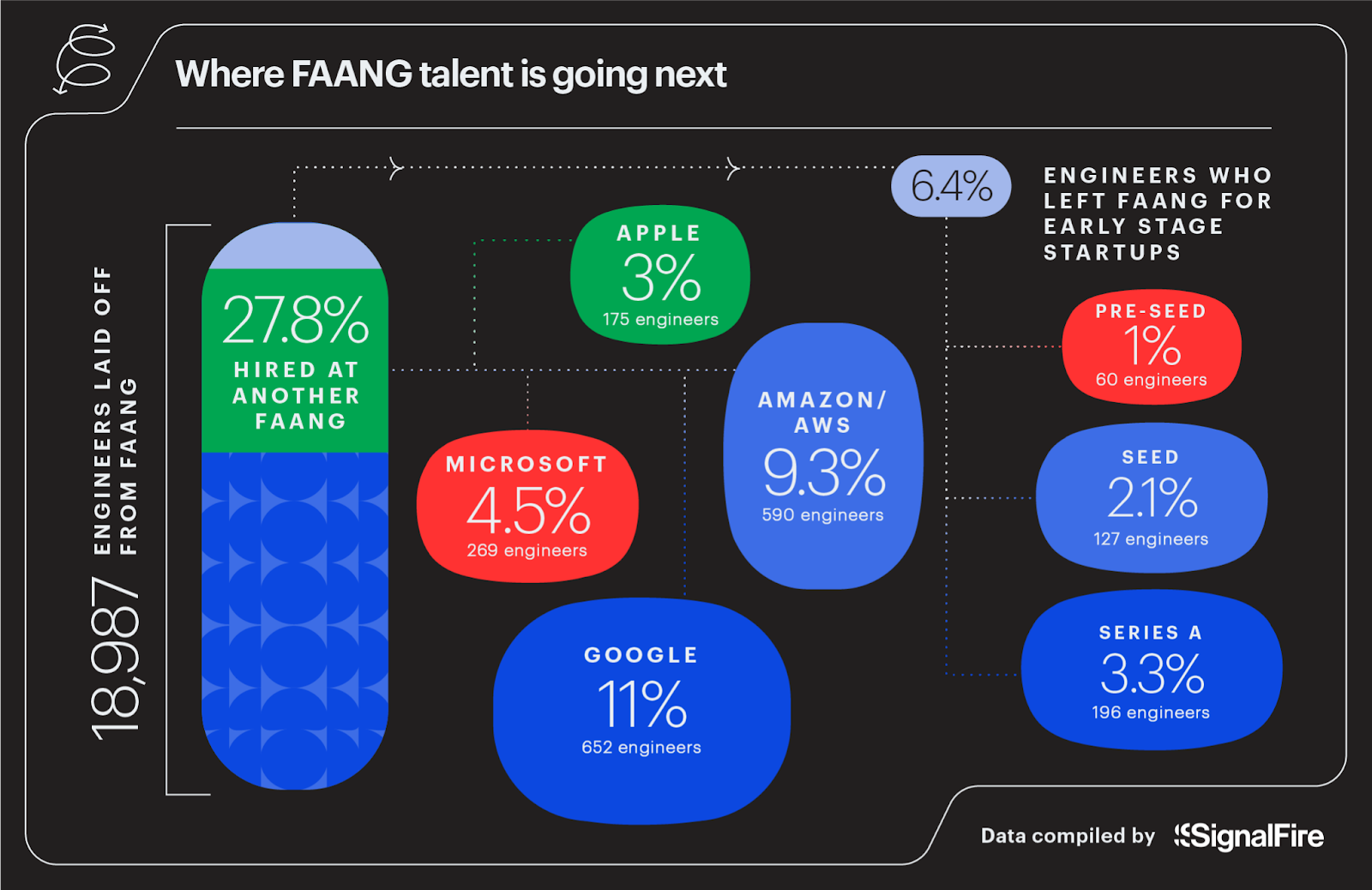

- 28% of rehired FAANG engineers played musical chairs and switched to another tech giant, while 6% went to early-stage startups — an 82% increase over 2021.

- Startups can capitalize on this power shift by recruiting passive talent who have survived Big Tech layoffs — they’re often loyal top performers who are overworked after teammates were cut.

- SignalFire can help startups find and hire top passive talent with its Beacon AI engine and recruiting team.

View the State Of Talent Takeaways deck for more highlights.

Mass layoffs and the “Great Restart”

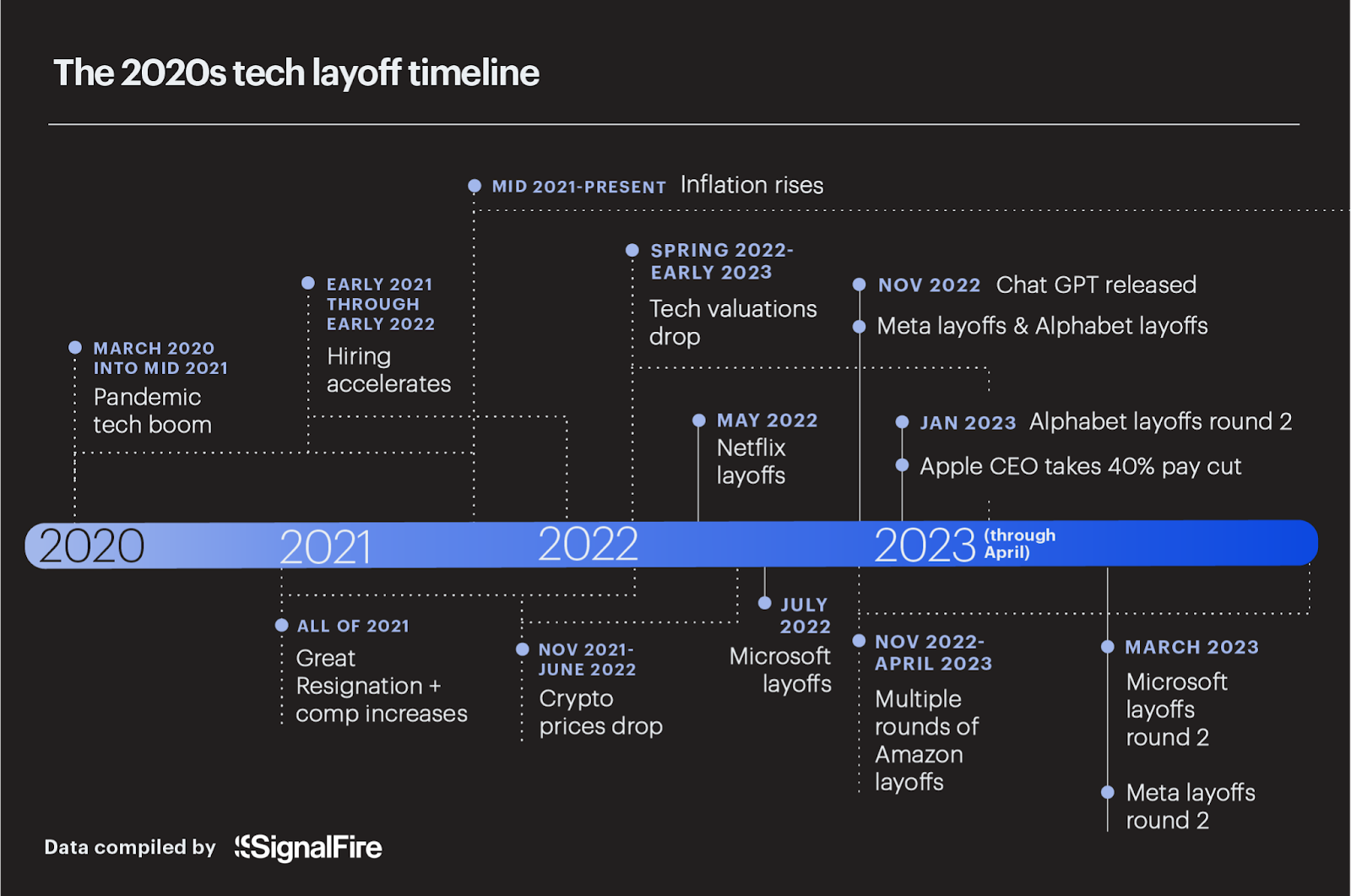

To explain the tech talent market’s sudden implosion, here’s the timeline that led to an imbalance in talent supply and demand.

Tech has seen nonstop layoffs that hit 166,044 workers in Q1 2023 alone. That’s more than all of 2022’s then-record 161,411 tech layoffs.

- The 2020 pandemic accelerated the move of commerce, collaboration and entertainment online, causing a boom for many tech companies through 2021.

- Hiring accelerated in 2021, creating a candidate-centric market that, coupled with the Great Resignation, drove many companies to use above-market compensation to attract and retain top talent.

- Entering 2022, the cost to do business in general steadily began to rise with inflation, coupled with a return to in-person activities, disrupting demand for online services that had fueled pandemic tech growth.

- Midyear 2022, tech valuations and cryptocurrency prices recalibrated down.

- Ambitious hiring ahead had been a strategic lever to hit ambitious revenue targets, and as those targets were missed, both public and private companies adjusted to decrease burn and extend their runway.

The result: Companies chose to equalize the decreased demand for their products and services by reducing their workforce. Notably, top engineers were not spared.

2020s tech layoff timeline, March 2020-March 2023. Image Credits: SignalFire

In this report, we share a data-based analysis of the shifting talent landscape starting May 15, 2022 — when some of the most significant changes were starting to take place — through March 15, 2023, which captures the bulk of relevant data but is not inclusive of all activity to date.

We demystify the talent market on behalf of top engineers, as well as the companies where that top talent might find a new home. We specifically looked at engineers who are in the top 25% relative to their peers — as calculated by SignalFire’s Beacon AI data platform, which leverages a proprietary machine learning algorithm we developed to gauge the quality of engineers — both individually and collectively at their companies.

We used a cohort data approach encompassing the Bureau of Labor Statistics and Layoffs.fyi to capture a point in time when tech layoffs peaked, sticking with the data long enough to understand outcomes for that impacted cohort. More on our methodology can be found in the appendix at the end of the report.

How we got here

The Bureau of Labor Statistics reported that the number of U.S. workers who quit their jobs during the Great Resignation between January and December 2021 made it a record-breaking year, with nearly 47.8 million total workers quitting their jobs. That is twice as many as left or were laid off during the Great Recession of 2009 and 2010.

Layoffs in tech: data compiled by SignalFire based on Layoffs.fyi. Image Credits: SignalFire

Over the years leading up to the implosion, fundraising grew in both velocity and size. Pitchbook NVCA Venture Monitor highlights that 2021 saw a peak in the number of deals closed (18,521) and dollars invested ($344.7 billion) followed by a substantial drop in 2022, with four consecutive quarters of declining deal counts. The conjecture is that investor demand went down in both early- and late-stage investments.

To avoid a down round — or perhaps due to a lack of new funding available altogether — companies began to focus on extending their runway by reducing burn. Headcount and salaries are almost always the biggest line item on a company budget. Many companies had used capital to hire in advance of expected revenue growth and then missed revenue targets. They were suddenly strapped with unsustainable burn due to payroll increases.

Cue layoffs.

As the chart below highlights, layoffs in tech nearly doubled in 2022 compared with 2020; and after just the first quarter of 2023, this is already another record-breaking year for layoffs.

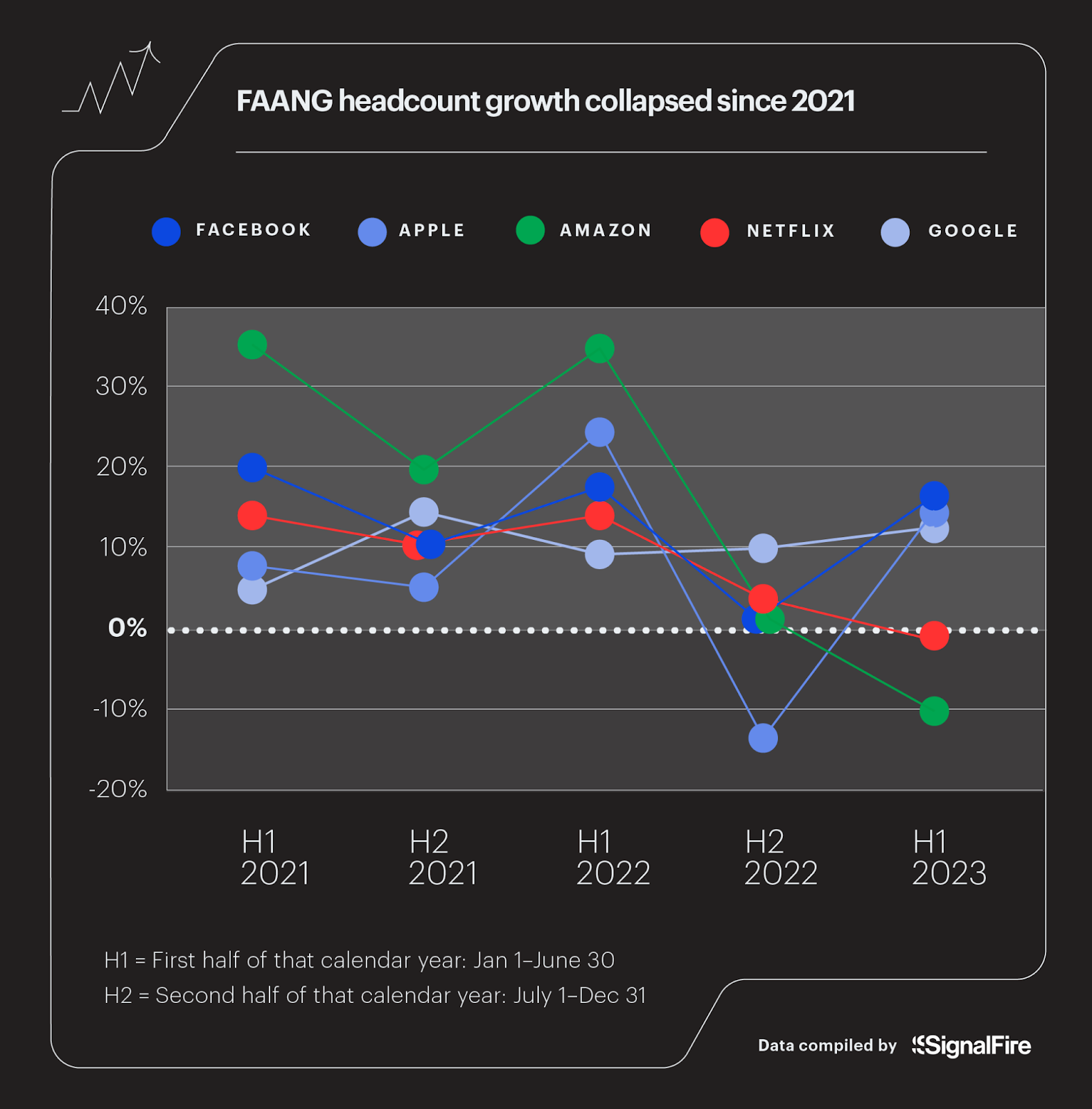

FAANG headcount growth collapsed since 2021. Image Credits: SignalFire

FAANGs out

For the past decade, FAANG companies were seen as the safe bet for job seekers, known for rich compensation packages and high job security. Starting in the summer of 2022, a new reality set in with hiring freezes and layoffs.

It began with a relatively small motion in late Q2 2022: Netflix, the smallest of the FAANGs, laid off 450 employees. With more than 14,000 engineers alone, this reduction in force (RIF) could have been seen as a blip, except that bigger layoffs across FAANGs quickly followed.

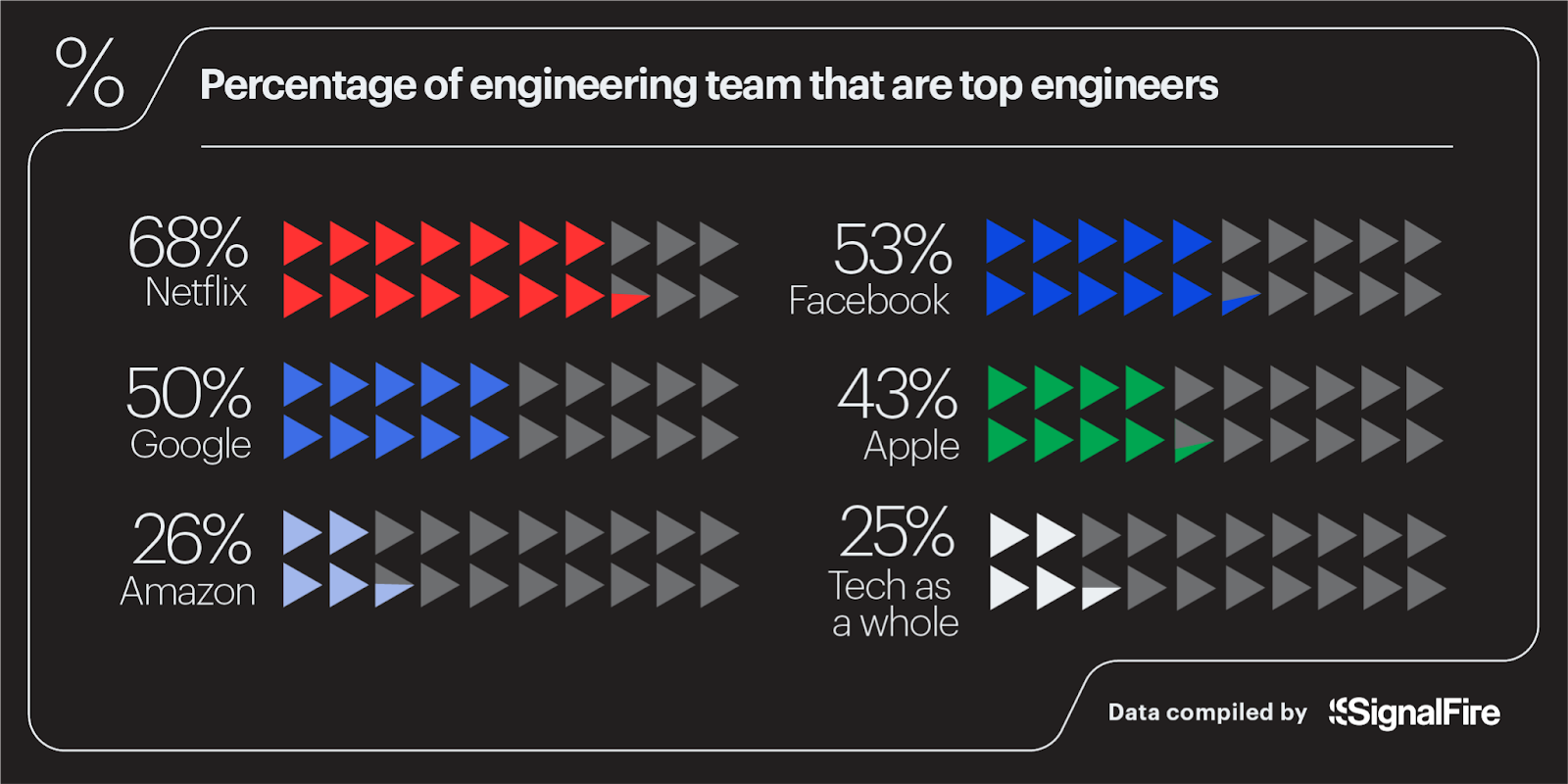

The biggest FAANG company, Amazon, has done multiple mass layoffs totaling well over 25,000 workers to date. Notably, their talent density is the lowest in all of FAANG: Just 26% of their engineering workforce is top talent, a mere 1% above the overall industry average of 25%.

From Netflix’s first layoff in mid-2022 to the end of Q1 2023, more than 55,000 workers have left or been laid off by FAANG companies alone. Apple is the only FAANG that did not engage in a corporate RIF, though its CEO did take a $50 million pay cut as a means to decrease operating expenses, and it reduced its retail employee count.

Percentage of FAANG engineering teams that are top engineers. Image Credits: SignalFire

We say “left” FAANG companies because some talent movement uncovered in the data may be voluntary. FAANG compensation is in part competitive due to liquid stock compared with private company counterparts. When that stock materially drops and employee stock options are underwater, we can expect some employees to look for other opportunities.

Taking the data in historical context, though — a higher rate of engineers have left their roles than during previous economic downturns — we are confident that many of these workers were affected by layoffs.

Where are engineers now? Still looking or working at another FAANG

In another unexpected turn, workers who were laid off still seem to be largely out of a job. FAANG software engineers made up just over a third of the 51,655 workers who left those jobs between May 15, 2022 and March 15, 2023 — 18,987 software engineers total. As of March 15, only 31% of those engineers list a current job on their LinkedIn profile, leaving 69% in the market for work.

This low fraction of workers who rejoined is notable, because the average U.S. worker who faced unemployment in 2022 did so for an average of 22.6 weeks, and typically software engineers are in much higher demand. They tend to shift to a new role in a fraction of the time of the standard workforce.

Most laid-off FAANG engineers are still out of work. Image Credits: SignalFire

While there is statistical significance showing those who have landed a new job are more likely to be top engineers (46% of the 31% who are working again, compared with only 35% of those 69% still in market), there were still a material number of top engineers (4,635) looking for jobs as of March 15.

Data also suggests that there’s a game of musical chairs happening among FAANGs — four of the top five destinations for the engineers that ultimately landed new roles were other FAANG companies. (Microsoft, which also had major layoffs in January of this year, rounded out the top five.) Only Meta, which cites a hiring freeze, is not among the top destinations.

This indicates that these companies were or are actively hiring talent similar to that which they were in the process of laying off or making plans to lay off, as most large-scale RIFs take several weeks of planning — a seemingly counterproductive strategy.

Where FAANG talent is going next. Image Credits: SignalFire

A collective 28% of hired candidates were recycled into the top five large tech company destinations, those same companies that laid off the collective group in the same time period (as highlighted in the infographic above). Also notable, 6.4% went to venture-backed early-stage, pre-seed and Series A companies, which represents a significant 82% increase from the year prior.

Given the small size and budgets of seed and Series A teams, these companies have historically been unable to compete with FAANG offers. Now 193 engineers have joined more than 100 small companies.

Lastly, according to our data, only 1.7% of these engineers have updated their job titles to something that indicates they are founding a company. Considering companies like Airbnb, WhatsApp, Uber, Slack and Square were all founded in the midst of the previous recession in 2009 — as were giants like Microsoft in previous recessions — it is expected that the next cohort of unicorns may be founded from the likes of FAANG engineers who have recently left their jobs.

With meaningful advancements in AI and large language models, we predict many companies will be founded to expand the capabilities of technology. Yet to date, only a small portion of these engineers are self-described founders, possibly due to the tough startup fundraising market. This leaves ample room for founders from all backgrounds to make a bold move in AI and other evolving technologies.

What does this mean for venture-backed startups?

There is a power shift in the job market. While both FAANG companies and their engineers were previously untouchable, the cracks are starting to show, leaving room for venture-backed startups with solid financial runway and upside to attract and retain top talent for their teams without breaking the bank. Next, we’ll break down how hirers can take advantage of the changing landscape.

Hiring strategy after the Great Restart

Mass layoffs actually create an opportunity for smart hirers. It’s not just that tons of workers have flooded the market and are eager to find new jobs. Top talent that has survived at companies through their layoffs are getting reassigned the workload of their cut teammates, often without proper recognition or pay.

These overworked, undercompensated high performers are particularly open to new offers, making it the perfect time to do outbound recruiting to passive talent.

Hiring passive talent: Senior movers and midcareer stayers

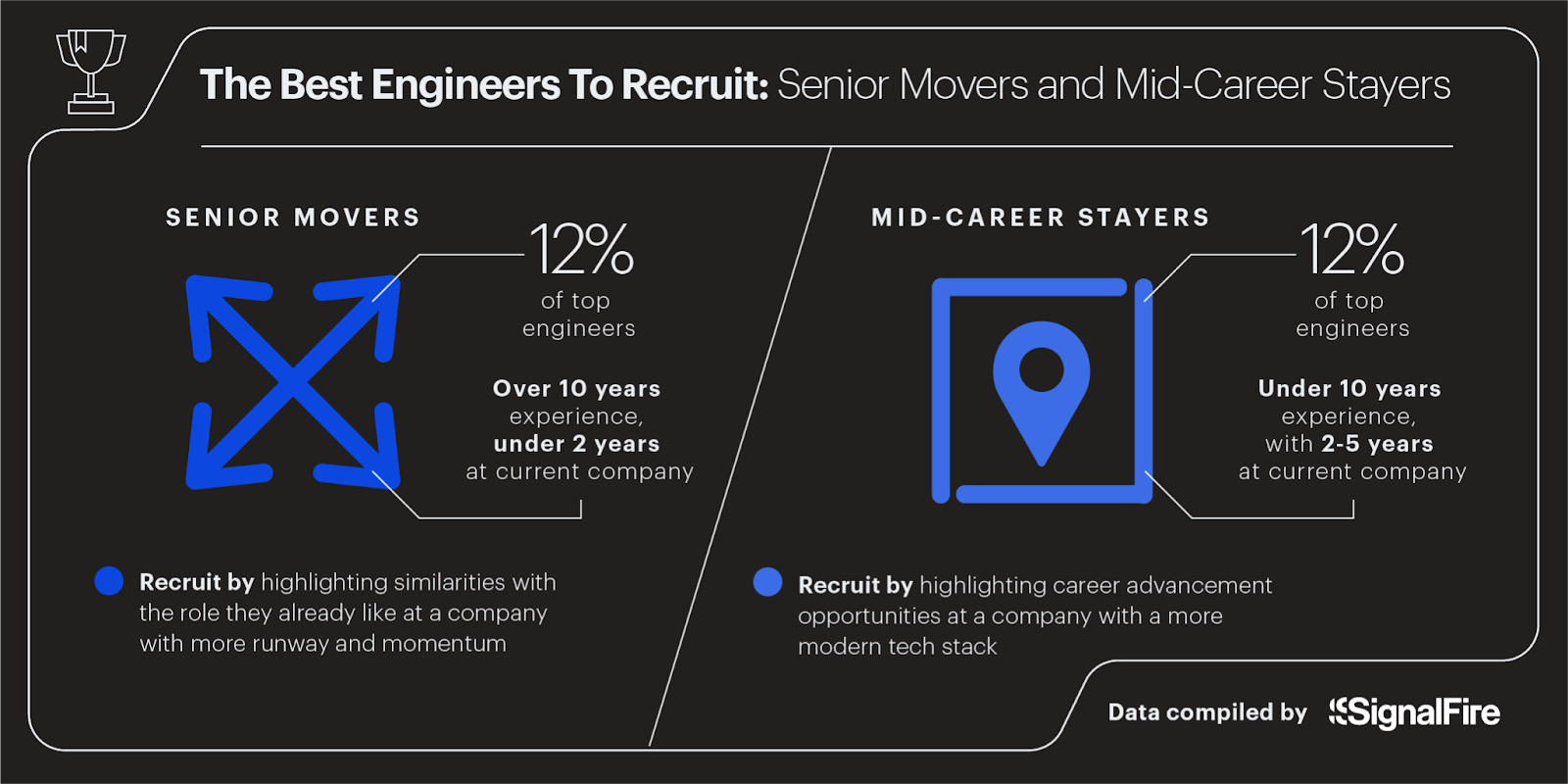

There are two prevailing career patterns that our Beacon AI discovered that each account for 12% of top-ranking engineers, a larger concentration compared to other cohorts. When recruiting passive candidates, companies should target these two types of employees with the following outreach strategies:

- Senior movers: Workers with over 10 years of total experience but under 2 years of tenure at their current company. Senior movers are typically more comfortable with their role but want to work somewhere successful. Hirers should highlight similarities to the roles where the longest tenure was achieved, along with financial runway and business outlook.

- Midcareer stayers: Workers with under 10 years of total experience, but with 2–5 years of tenure in their current role. Midcareer stayers may be more focused on career growth trajectory, with more responsibility leading larger teams that they aren’t getting at their current job. Hirers should highlight career advancement opportunities and working with modern, more future-proof technologies compared with their current stack.

The best engineers to recruit are senior movers and midcareer stayers. Image Credits: SignalFire

SignalFire portfolio companies can use our Beacon AI recruiting engine to filter for passive candidates across all companies who are most likely to change jobs, as well as relevant talent confirmed to be in the market. Beacon tracks more than 600 million people in the tech ecosystem, and it’s how we made more than 1,000 job candidate intros to our portfolio companies last year.

Sourcing laid-off and permanently remote talent

If you need to fill roles fast or want to avoid overpaying to lure away passive talent, Layoffs.fyi maintains lists of RIF’d employees. With a little digging, you can find great senior movers and midcareer stayers who got caught up in massive cuts despite their quality.

There’s one new type of talent becoming available: employees who strongly prefer or require remote work, but their companies are shifting back to mandatory in-office policies. Hirers from companies that plan to stay remote should seek out this talent by highlighting their flexible work environment.

Studies show that nearly 50% of workers would accept up to 5% lower wages in exchange for a remote job, and that remote work is especially beneficial for increasing diversity and inclusion in teams.

Data suggest remote work is a great option for many but with some caveats. Remote work is typically better suited to more experienced talent who need less oversight and training. There’s also a growing sentiment among some business leaders that remote work is best suited for teams that already have product-market fit and are working methodically to scale, whereas in-person is especially helpful for creative collaboration, rapid iteration and coming to alignment on the best strategy. Teams should be strategic in their decision to hire distributed teams; SignalFire has developed this remote work guide to assist in assessing a company’s best path forward.

Level-headed hiring and pay transparency

While some companies have responded to the market with temporary hiring freezes, this is shortsighted. A freeze followed by an unfreeze back into the previous ways will only loop back with the same inefficient result and painful layoffs.

Businesses should instead build a prioritization model that links revenue milestones and urgent business needs to headcount expansion. This helps synchronize leadership, finance and talent teams to prevent overhiring ahead of growth.

One other major change to adapt to is pay transparency. The introduction of pay transparency laws in states like Colorado, New York, California and Washington has quickly shifted both company requirements and top talent expectations. Now it’s not only good business to have clear and consistent pay practices, but it’s also the law to disclose them.

First, use solid data sources to triangulate a competitive and sustainable pay band. Then, be able to explain to candidates why you pay what you do to build trust and confidence that you pay fairly and can sustainably afford the payroll.

For guidance on how to navigate pay transparency, consider this map by the team at Compa and this resource center from ADP to support state-by-state hiring.

How to convince talent to join in a shaky market

If you want to recruit choosy candidates that have been spooked by recent layoffs, budget cuts and valuation corrections, hirers need to answer two major questions:

- What kind of financial outcome is likely?

- What will my growth story be at this company?

While companies cannot guarantee a specific outcome on either of these items, they can build a compelling narrative and employer value proposition that highlights ample runway, a disciplined burn rate and potential exit scenarios.

Demonstrating that you’ve already right-sized your company and valuation for the current market can convince candidates there’s a clear path to RSU value growth or that their stock options won’t end up underwater. Consistently adjusting headcount planning to match the business’s needs can help.

To give candidates confidence in their own career path, you’ll want to highlight a safe and healthy work environment and company culture that rewards loyal top performers. For guidance on how to do that effectively, check out SignalFire’s guides on Employer Brand and Remote Work Strategy.

Conclusion: Don’t repeat the overhiring of the past

Good times do not always continue to roll. The core strategic takeaway of this report is that startups have more power than ever to recruit the top talent. But tactically, they must avoid misaligning headcount and finances in hopes of hiring early to further accelerate growth or risk a costly setback. If revenue stumbles, fundraising tightens or the market falls and you can’t quickly readjust, your layoffs and disgruntled remaining employees may become the talent that more disciplined startups are happy to snap up.

View the State Of Talent Takeaways deck for a recap of the highlights

Appendix: A note on data and limitations

We used three major datasets for this analysis: the Bureau of Labor Statistics; Layoffs.fyi and our proprietary AI data platform, Beacon, which utilizes data from a wide array of people and company datasets. All datasets are helpful and also have their limitations. BLS data provides the best macro view of the market but does not break down to individual employers. Layoffs.fyi is an incredibly helpful view into company-by-company layoffs on a timeline, but their lists are opt-in, leaving data holes to be plugged. At SignalFire, Beacon tracks more than 495 million employees and 80 million companies to guide the fund’s investing and assist portfolio companies with scaling their teams and revenue. This data shows an incredible amount of nuance about talent density and movement, but it does not account for the reason behind that movement (e.g., resignation or layoff); and the data is inherently delayed as individuals self-report when their employment ended.

Focusing on engineering talent allowed us to do two things — get a macro view of the tech job market while maintaining a deep focus on a talent pool that is historically less affected by the broader market. What makes this moment unique? We also found that by sticking to FAANG companies, we could see an incredibly telling story about talent moving from large, top companies in the market.

While we focus on FAANG throughout this report, we also acknowledge a changing landscape that includes Microsoft. There is a noted shift beginning in the market, from FAANG to MAAMA. For the purpose of historical data we focus on FAANG, but as we start to include current and future data, we integrate Microsoft.

We have data on the raw numbers of engineers who changed roles as a percentage of all engineers, but we do not have access to reasons for departures (e.g., what percentage of those engineers left voluntarily versus involuntarily). However, based on the spike in movement, we can assume engineers were laid off in greater proportion to their makeup within the company compared with previous years’ layoff data.

Taking these limitations and assumptions into consideration, this report aims to provide a perspective into the talent market that weaves together these key data sources for the most accurate picture of talent market movement.

SignalFire may engage affiliate advisers, retained advisers and other consultants as listed above to provide their expertise on a formal or ad hoc basis. They are not employed by SignalFire and do not provide investment advisory services to clients on behalf of SignalFire. For more information on their specific roles, please contact us.

Portfolio company endorsements: Certain portfolio company founders or affiliate advisers listed above may or may not be current investors in a SF fund in which they receive a fee reduction. Such fee reductions were not provided in exchange for or an incentive for their feedback nor contingent upon the individual’s approval for SignalFire’s continued use. Please refer to our website for additional disclosures.