Singapore-headquartered Pillow plans to discontinue all its services and app in the coming weeks, it warned customers Friday, citing regulatory uncertainty that has claimed countless other crypto startups in recent quarters.

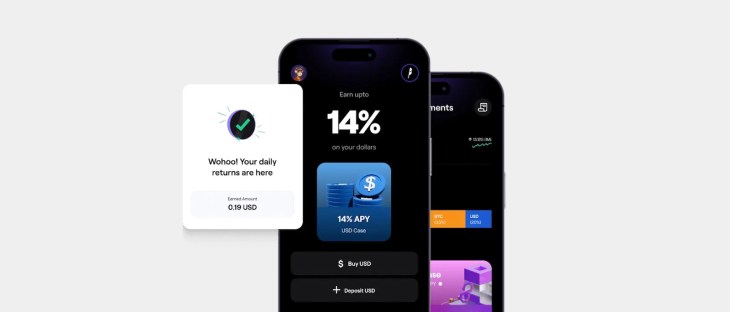

Pillow allowed customers to invest in Bitcoin, stablecoins and altcoins, and promised returns of up to 18% — a figure that dropped to 14% as the market started to cool. It had raised about $21 million altogether and counted Accel India, Quona Capital, Elevation Capital and Jump Crypto among its backers. Pillow revealed its $18 million Series A funding in October last year.

In a post on Telegram, the two-year-old startup asked customers on Friday to withdraw all their funds from the Pillow app and said it will be terminating all its current services on July 31, 2023.

The move follows Pillow’s chief rival Flint shutting down its services last month due to what it termed as “regulatory hurdles” and “negative market sentiment.”

Both the startups, founded and operated in India, counted the South Asian nation among their largest markets. The Reserve Bank of India, the nation’s central bank, has been pushing lenders to stop engaging with crypto startups for over a year, making it virtually impossible for web3 startups to operate in the country.

Crypto giant Coinbase, one of the world’s largest exchanges, found this out the hard way. It suspended support for its UPI payments instrument on its app in India last year, making its eponymous exchange nonfunctional for any purchase orders less than four days after launching the trading service in the world’s second-largest internet market.

Coinbase chief executive Brian Armstrong alleged last year that there are “elements in the government there, including at Reserve Bank of India, who don’t seem to be as positive on it. And so they — in the press, it’s been called a ‘shadow ban,’ basically, they’re applying soft pressure behind the scenes to try to disable some of these payments, which might be going through UPI.”