Launching a startup usually means obsessing about whether product-market fit (PMF) has been achieved in its early days. More broadly, PMF is a term we use to describe a product or service that has generated enough organic demand from consumers. This demand is both sustainable and economically worthwhile for a startup to continue offering said product.

How can you find PMF in the most efficient and frictionless way possible? I argue that the answer to this question is paid acquisition. This article will help you select the best paid channel depending on your startup idea, deploy a battle-tested waitlist strategy, optimize messaging tests and more.

Which paid channel to select?

Typically, I recommend Meta as the first paid channel to explore for a multitude of reasons: targeting capability, relatively cheap traffic and a visual format for testing both graphics and copy.

How can you find PMF in the most efficient and frictionless way possible? I argue that the answer is paid acquisition.

By contrast, Google and paid search traffic is preferable if your offering is of high search-intent volume or in a complex B2B segment. For example, advertising a supply-chain AI startup targeting freight companies on Meta would be too complex and unlikely to find the right audience.

The easiest method for determining which paid acquisition channel is right for your startup is with the following three questions:

- Is my offering highly visual (clothing, product-based, etc.)?

- Does my product/service require an immediate solution to an event (moving homes, doctor’s visit for cold, etc.)?

- How complex is my offering?

If you answered that your product/service is highly visual, you’d be leaning toward a paid social channel such as Facebook or TikTok. However, if you answered that your offering is either immediate-solution oriented, location-based or complex, you should pivot toward a paid search channel, effectively Google.

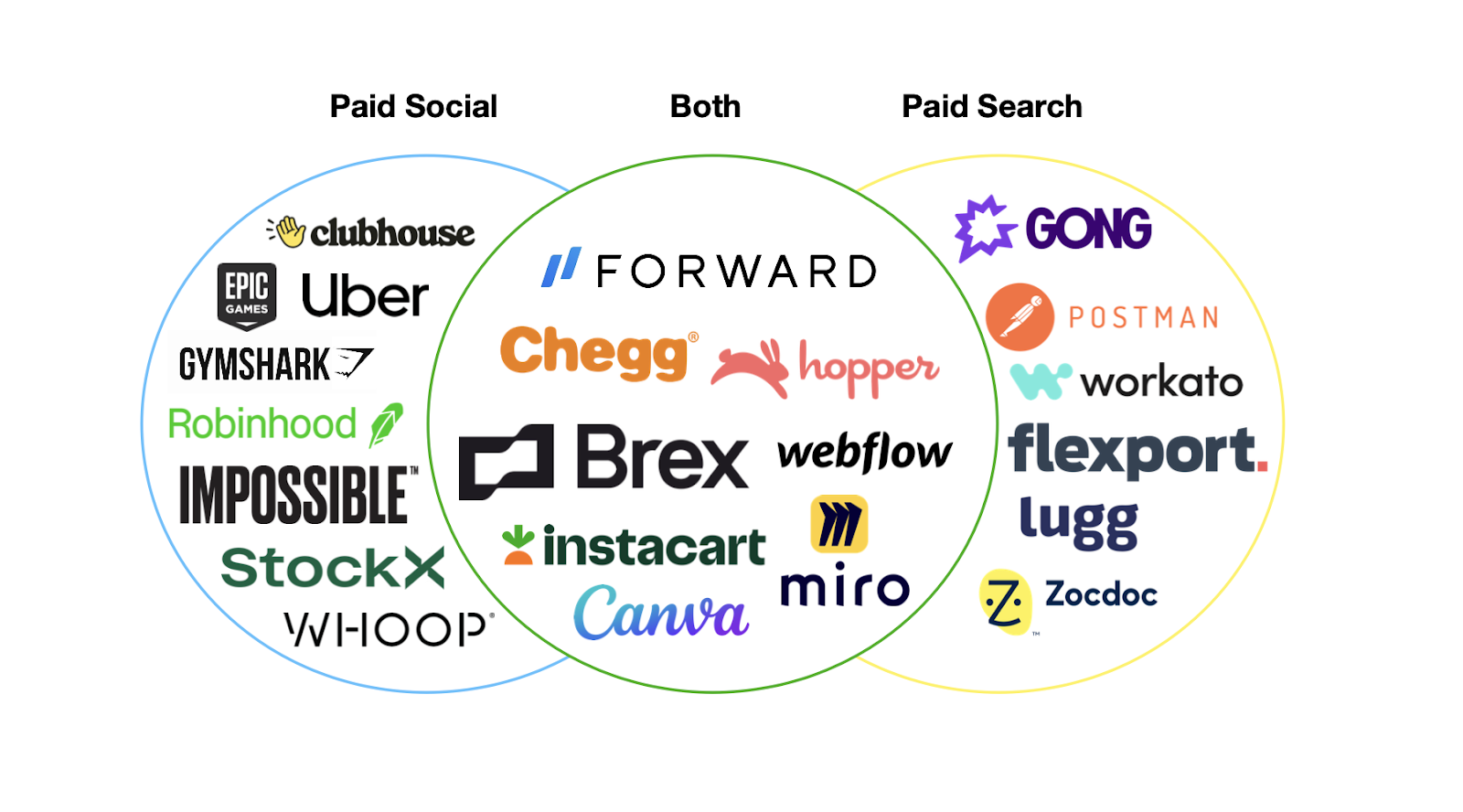

Example channels that startups could have selected to find PMF. Image Credits: Jonathan Martinez

The Venn diagram above illustrates which channels these established startups should have tested if they were looking to validate PMF. Certain startups, such as Forward Health or Canva, can get away with advertising on both channels because they’re visual, not complex, and have a large target market.

Most consumers can leverage a new healthcare plan or graphic creation, which is inherently very visual. Conversely, a startup such as Lugg, which helps people move homes, should leverage Google as their company offers a solution that consumers often need immediately and at very specific times.

As an additional note, if you’re looking to advertise on Meta, BusinessofApps is reporting that the latest cost per thousand impressions (CPMs) is hovering around $15 in 2023. This means that to have an estimated 1,000 people view your offering, you’ll be paying around $15. Not bad at all!

Battle-tested waitlist method

In college, I tested countless startup ideas with friends who were as excited about starting a business as I was. Unfortunately, none of them ultimately succeeded. However, an important, long-term success came from developing a strategy that I then employed many times to assess PMF. I’ve broken it down into five easy steps:

- Identify paid channel.

- Create a landing page.

- Create ad assets.

- Launch campaign on paid channel.

- Measure performance and iterate.

After identifying a paid channel, use a cost-friendly service such as Leadpages to create a landing page. As of this writing, you can start with a free trial with them and bump up to a paid subscription for a mere $49/mo. I won’t get into the specifics of creating a landing page as there are various sources on the web for best practices.

However, this is where the waitlist comes into play and it’s imperative to create a way for consumers to quickly join said waitlist. It’s a quick way to capture consumer intent in the form of emails or phone numbers. Next, if you are launching on paid social, you can use a tool like Canva to create ad designs. Otherwise, you can simply go ahead and launch your campaign.

The waitlist method is a cheap and effective way to understand consumer propensity for your offering. Your product or service doesn’t even need to be ready for release. Meta and TikTok have made it incredibly easy to collect consumer information without a landing page through their Lead Form ads. This is my preferred method as it only involves creating ad assets and then a lead form campaign.

The lead form can also be used to collect answers to questions you’re looking to answer early on, alongside the customer information. One major caveat to the waitlist method is that you must have a strong email and/or texting follow-up strategy to keep consumers engaged. Take advantage of tools such as Zapier to connect all your incoming leads to a service like Mailchimp, which can then send emails as leads come in.

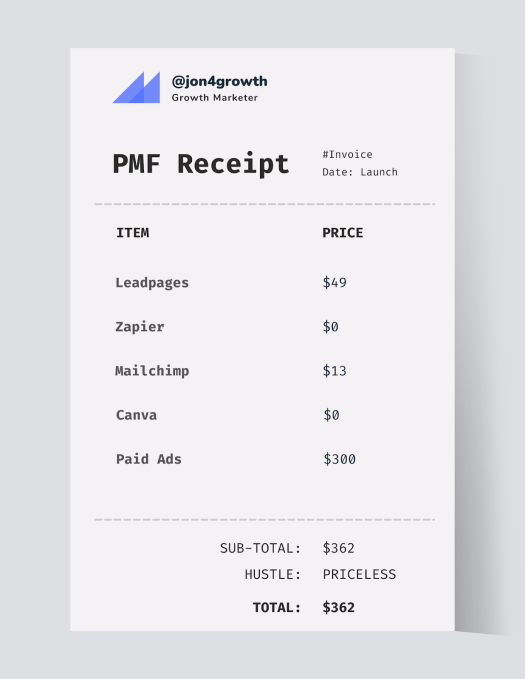

Estimated waitlist method cost:

Estimated waitlist method cost. Image Credits: Jonathan Martinez

The best part: You can test pretty much any idea for a few hundred dollars! It’s also important that you test methodically and iterate quickly as both data and leads come in.

Determining viability

The million-dollar question is whether your startup has achieved PMF in relation to your paid acquisition efforts. Below are a couple of back-of-the-envelope methods to help you figure out how far you are from where you need to be:

- 25% decrease in acquisition costs.

- Conversion rate forecasting.

- Lead survey reactions.

Take comfort that whatever paid acquisition costs are on week one, you will almost certainly be able to drop costs by 25% as you and the paid channel learn which assets are resonating best. Whenever my team launched a new product line or market while I was employed at Coinbase, we knew that we would eventually optimize costs down from whatever the initial customer acquisition costs (CACs) were in the first week.

This holds true for nearly all paid acquisition campaigns. A major caveat is that costs eventually go up at certain levels of scale, but you likely won’t notice it scaling from $200 to $2,000, or even $10,000.

Alongside optimizing costs, you should get into the practice of forecasting what your down-funnel costs, such as CAC, look like based on forecasts using conversion rates. As an example, if you were using waitlists and asked how likely leads would purchase your product at $X price, you can start to formulate your down-funnel costs outside of purely the lead cost.

Your early lead reactions should also give you a great qualitative look into how responses are to your offering. Are they excited? Are they meh? It shouldn’t be numbers on a sheet and gauging excitement should be done by speaking with leads. Here are some questions to ask, with X being your offering name:

- On a scale (1-10) how dissatisfied would you be if X wasn’t available?

- Would you purchase X if we had slots tomorrow?

- What are your initial reactions to X?

Quick iterations are vital

You launch a campaign and instantly have thousands of impressions on your product. That’s the most beautiful facet of paid acquisition.

Your early days should be spent with constant iteration on your messaging and offering. How often should you iterate? A rule of thumb is to get 25-50 conversions per asset so that you have enough data to assess the effectiveness of each style.

What should be noted is that it’s much easier to validate a product such as a skincare line that’s priced at $19 versus a software aimed at creative agencies that is priced at $299. Lead acquisition costs will differ greatly depending on how expensive your offering is, so keep that in mind when setting a validation budget.

Launching a product for thousands to give their instant feedback on is why we’re lucky to live in an age where paid acquisition exists in the likes of Meta, TikTok and Google, giving you access to growth superpowers if they are leveraged correctly. So, get your prospective startup ideas ready and let’s begin.