A year ago, Mike Butcher reported that Faye hopes to do for travel insurance what Lemonade did for general insurance, and that’s as good a summary of what Faye does as anything. The company was kind enough to share its (lightly redacted) pitch deck with me so I could take a look under the hood to see the narrative it wove to close its $10 million.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Faye raised its Series A round with a 19-slide deck, a few of which have been lightly redacted to shield sensitive data from curious eyes:

- Cover slide

- Summary slide

- Team slide

- Problem slide

- Market-size slide

- Insurance market overview slide

- Product overview slide

- Product features slide 1

- Product features slide 2

- Product features slide 3

- Product features slide 4

- Go-to-market slide

- Financial growth metrics slide

- Customer growth metrics slide

- Customer validation slide 1

- Competitive landscape slide

- The Ask slide

- Customer validation slide 2

- Closing slide with mission statement

Three things to love

Let’s get this out of the way right off the bat: This is a truly excellent pitch deck. I’m going to add it to my rotation of decks that are great examples of how to distill a potentially complex story into an easy-to-follow narrative.

Love a good summary slide

As I mentioned in my post about summary slides, the combination of the cover and summary slides sets the context for the rest of the conversation. Faye did a great job with showing how a good, concise slide can set the pace.

[Slide 2] Setting the pace. Image Credits: Faye

If we take all of the numbers at face value, the next step of the story is to convince investors that this is the right team to take on this market.

Which takes us to slide 3, the company’s team slide. Unfortunately, it isn’t that great, so we’ll talk about it in the “What could be improved” section later in this article. For now, let’s skip to another slide that did a great job of adding to Faye’s story.

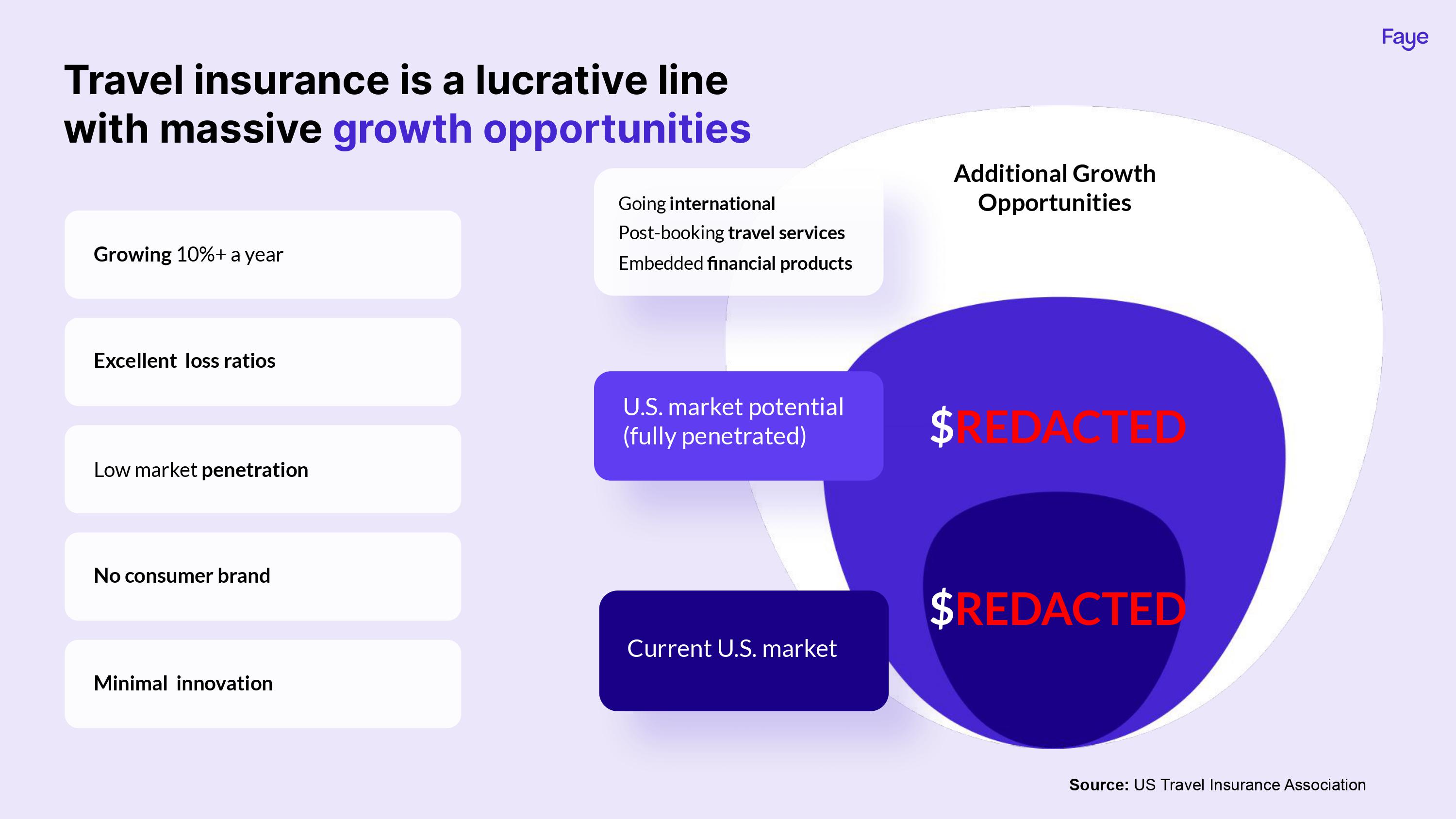

Great storytelling on the market-size slide

[Slide 5] What a great way to use market sizing to your benefit. Image Credits: Faye

Faye numbers aside, this is a rare example of a market-sizing slide that also provides the rest of the context. I thought it was done really well.

Showing that the market size is (presumably) huge, and then essentially saying, “But the TAM could be bigger by growing the service offering and international roll-out,” is very shrewd. It shows that there’s a great opportunity available right now and that the opportunity could grow further.

The data points on the left are excellent, too, as they contextualize the business in the greater market.

This slide teaches us that you can tell a comprehensive story without muddling the message. I imagine the voice-over for this slide would be something along these lines:

The market we are going after is $xx right now, and could be as big as $yy once we have fully addressed it. What’s truly exciting here, however, is that the market is easily disrupted. There is little innovation, no recognized consumer brands, the brands that do operate have low market penetration, and the entire market is growing 10% year-on-year.

The narrative ties it all together, painting travel insurance as a very interesting opportunity.

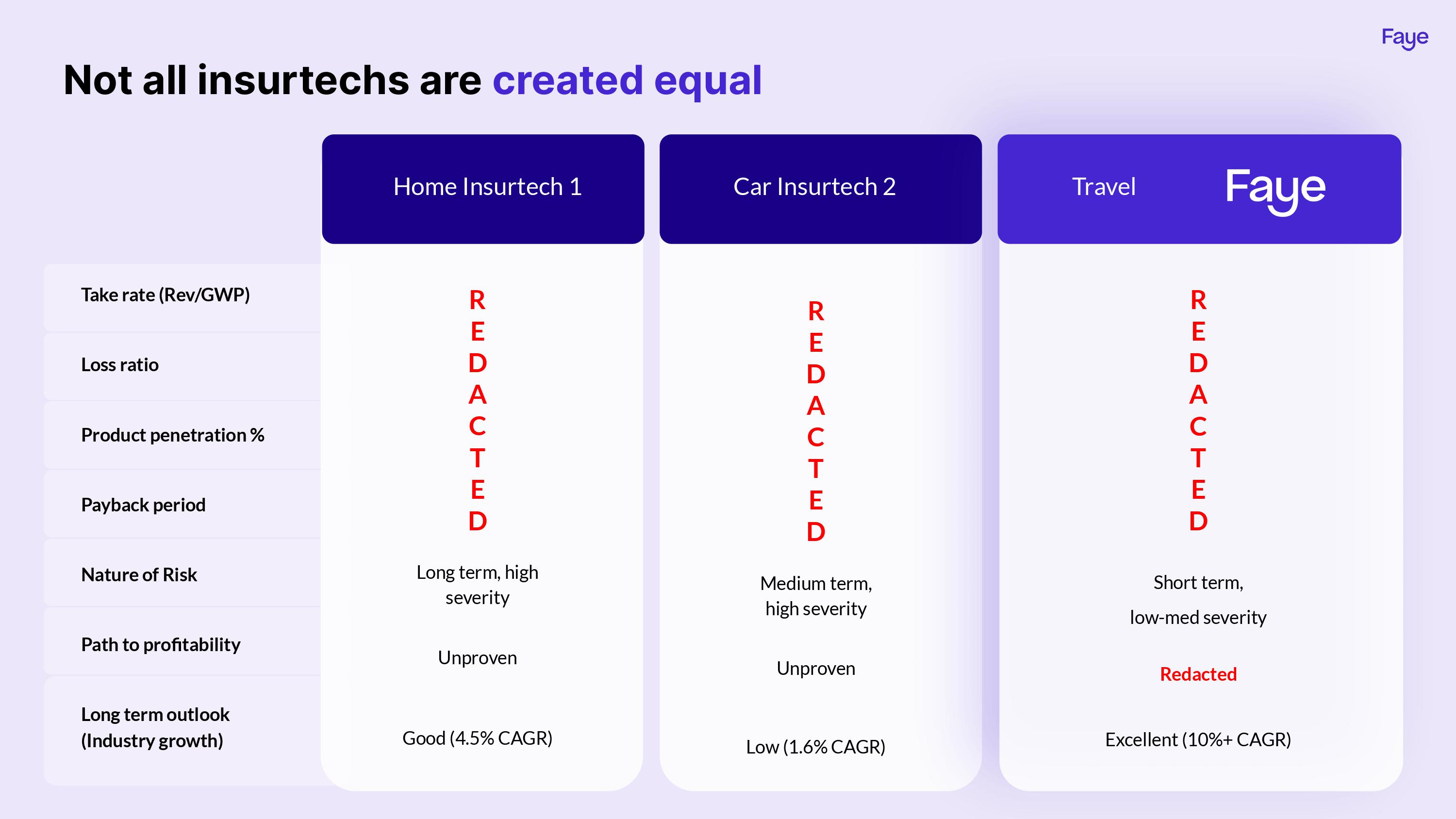

Intermarket comparison

Faye is targeting travel insurance, using some adjacent markets (car and home insurance) as comparisons to show that travel insurance is a better opportunity. Again, the numbers here are redacted, but as far as storytelling goes, this is a really good approach:

[Slide 6] Insurtech galore. Image Credits: Faye

In the rest of this teardown, we’ll take a look at three things Faye could have improved or done differently, along with its full pitch deck!

Three things that could be improved

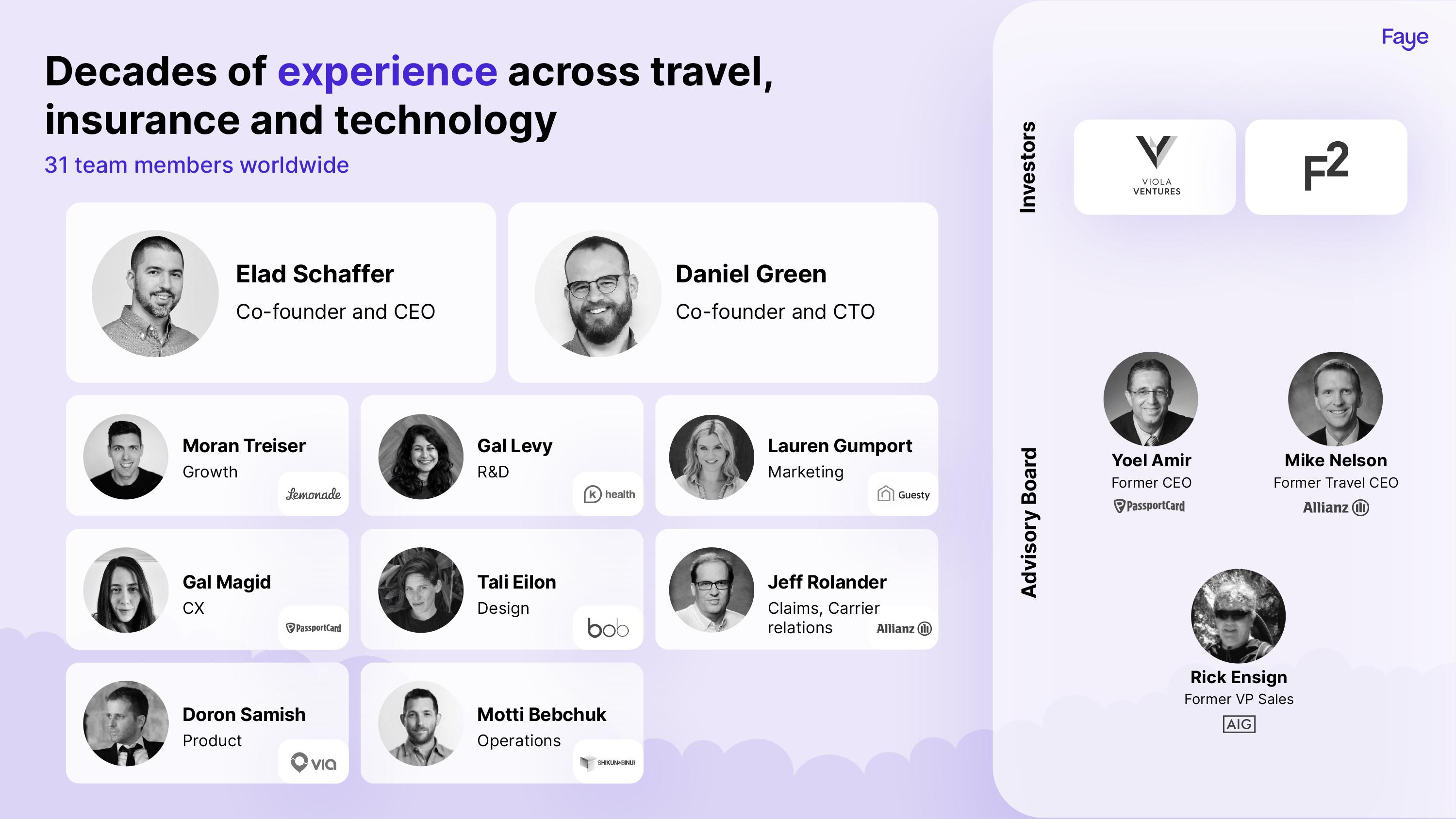

I’ve already said that the team slide could do with a bit of love, so let’s start there.

This is not how you make a team slide

[Slide 3] The team. Image Credits: Faye

But there’s something missing: There’s nothing about how the two co-founders are a good fit for the market and neither does it explain why this team is particularly well suited to building this company. Faces and logos are great, but it’s quite vague.

CEO Elad Schaffer’s LinkedIn shows an impressive background, but it appears he has no insurance or B2C experience, and his CTO Dan Green has a bunch of experience, but little that speaks to insurance tech.

In any case, I feel like this team slide is telling the wrong story. It’s also right at the beginning of the deck, so my assumption would be that the founders are proud of this team and believe it offers a huge competitive advantage.

However, just from the slide and the LinkedIn sleuthing, I can’t see what that advantage may be.

Much ado about product

Let me put a fine point on it: Your investors don’t care about your product nearly as much as you think.

Yes, you need to explain the problem you are solving, your solution and the product that delivers that solution (here’s more about the difference between “solution” and “product”), but this deck just keeps harping on about the product. I counted five slides covering various aspects of it.

But this deck misses a crucial factor: The value proposition and how the company positions its product’s features in the broader context. That’s important if you want to weave a compelling story.

[Slide 8] A wall of features, no clear benefits. Image Credits: Faye

Coca-Cola doesn’t sell carbonated water, high-fructose corn syrup and caramel coloring. Adidas doesn’t sell shoes. Bank of America doesn’t “sell” bank accounts. These companies sell lifestyle and a drink to slake your thirst, “being a better you” and a safe place for your hard-earned money, respectively.

Faye could learn from that: Does it sell peace of mind? Does it guarantee a better trip? Those are the emotive selling points that help sell its product. An investor wouldn’t care whether “trip inconveniences” or “pet care” are part of the package. They want to see how customers connect with the overall product offering.

Think about what’s actually important about what you are selling. Five slides of product features is a lot less powerful (and far less useful) than zooming out and explaining the emotional connection you’re selling.

On its website, the company greets you with: “Travel insurance with your best interests at heart. Incredible coverage. Real-time travel care. Quick claims processing.” Honestly, that strikes me as very unambitious. Lower on the homepage, the company has “Travel insurance built to help things go right.” I think that ought to be the main message of the investment story.

The strategic vision is in there, but it’s buried under layer after layer of tactical detail.

Poor go-to-market

I imagine that travel insurance is a very event-driven business: Someone plans a trip and decides to get insurance for that trip. That means you have to catch people exactly at the time they make that purchase.

I suspect that a lot of people do one of three things:

- They already know, or have heard of, an insurance company they know and like.

- They ask their friends for recommendations and if they are happy it.

- They search for “travel insurance” or “what’s the best travel insurance,” or something like that.

To target all of the above, you need to ensure that your reactivation rate of prior customers is high. And you need to be top of mind when someone asks their friends for a travel insurer. Also, you need to be on top of the search results on all review sites and be mentioned in all articles about travel insurance. That probably means having a comprehensive referral program, a great earned-media program and a robust paid-search program.

Instead, we get this:

[Slide 12] This is a brainstorm not a go-to-market plan. Image Credits: Faye

As an investor, I want to see exactly what the customer acquisition cost per channel is, what the plans are for expanding, and how each of these strategies are playing out. Putting “brand partnerships” on a slide does nothing. I want to see the receipts for the results to date as well as the plan for how to grow that channel. Ideally, that should be paired with the hiring plan and budgets to make that channel successful.

This slide mostly reads as if someone told Faye that it needed a go-to-market slide and it did the bare minimum to get that slide into the deck. If this is the extent of the plan, I would think twice before choosing to commit dollars.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Update: The original version of this article had the wrong CTO linked on LinkedIn, and feedback related to the wrong person. This has been corrected above