It’s been a little over a month since the Arbitrum Foundation drama, where the foundation transferred funds from Arbitrum DAO without the community’s approval, sparking an uproar. But if you ask Steven Goldfeder, CEO and co-founder of Offchain Labs, that blunder was just one of the early steps on the journey to decentralization.

In late March, Arbitrum’s decentralization mission hit a hurdle: Its foundation had proposed to transfer 750 million ARB tokens, worth about $1 billion at the time, to its own wallets, but before the DAO could finish voting on the proposal, the foundation, a centralized entity, sent the majority of the tokens to itself. That backfired when the community voted against the move.

Predictably, that didn’t go down well with the community. In response, the Arbitrum Foundation proposed to expand ARB token holders’ oversight of the budget as well as their voting powers. At the time, the foundation said it would not move the 700 million ARB tokens that were transferred to its Administrative Budget Wallet until the community approved “an acceptable budget.” It also said it would propose new actions to make governance of the DAO “more accessible.”

This was followed by a couple rounds of votes in which the community approved proposals addressing what would happen to the ARB tokens moved to the foundation’s wallet, and amendments to the DAO’s governance, constitution and bylaws.

The dust seems to have settled now, but these events indicate the DAO’s governance voting model is working (for now) and may lead to greater transparency and community control.

For Goldfeder, the course of events, while damaging, eventually led to a good thing. “It was unfortunate that this was the way it happened,” Goldfeder said. “The right intentions were there and I was hopeful the foundation and DAO community would resolve this.”

Goldfeder’s company helped develop Arbitrum, a layer-2 scaling platform for Ethereum. He’s also a launch partner and community member, but he was careful to note that he doesn’t speak on behalf of the DAO or the foundation.

“If anyone had any qualms or questions about who’s in control there, this situation made it clear to the foundation and Offchain [Labs] that the DAO is in control because the very first governance proposal failed. It’s hard for anyone to bypass it,” Goldfeder said.

As of May 1, Arbitrum had $6.15 billion in total value locked across 5.8 million users, according to its website. Its optimistic rollups make up 66.5%, or the majority, of L2 market share.

Rollups are a data compression mechanism that involve “rolling up” a number of transactions into one to maximize speed, scalability and cost efficiency, among other things. Arbitrum gathers transactions, settles them on its sidechain, then bundles it on to Ethereum’s chain to settle it there.

“The Arbitrum DAO is a testament to decentralization,” Goldfeder added. “On the governance forums, people have said no one has decentralized in this way. I was hopeful the community would figure it out, and ultimately, that’s been the case. […] The end result with transparency is a much better result than the beginning.”

What differentiates Arbitrum from other layer-2 blockchains is that it has self-executing governance, meaning that the protocol is decentralized and DAO-controlled. “If you look at competing chains, the entire treasury is controlled by the foundation,” Goldfeder said.

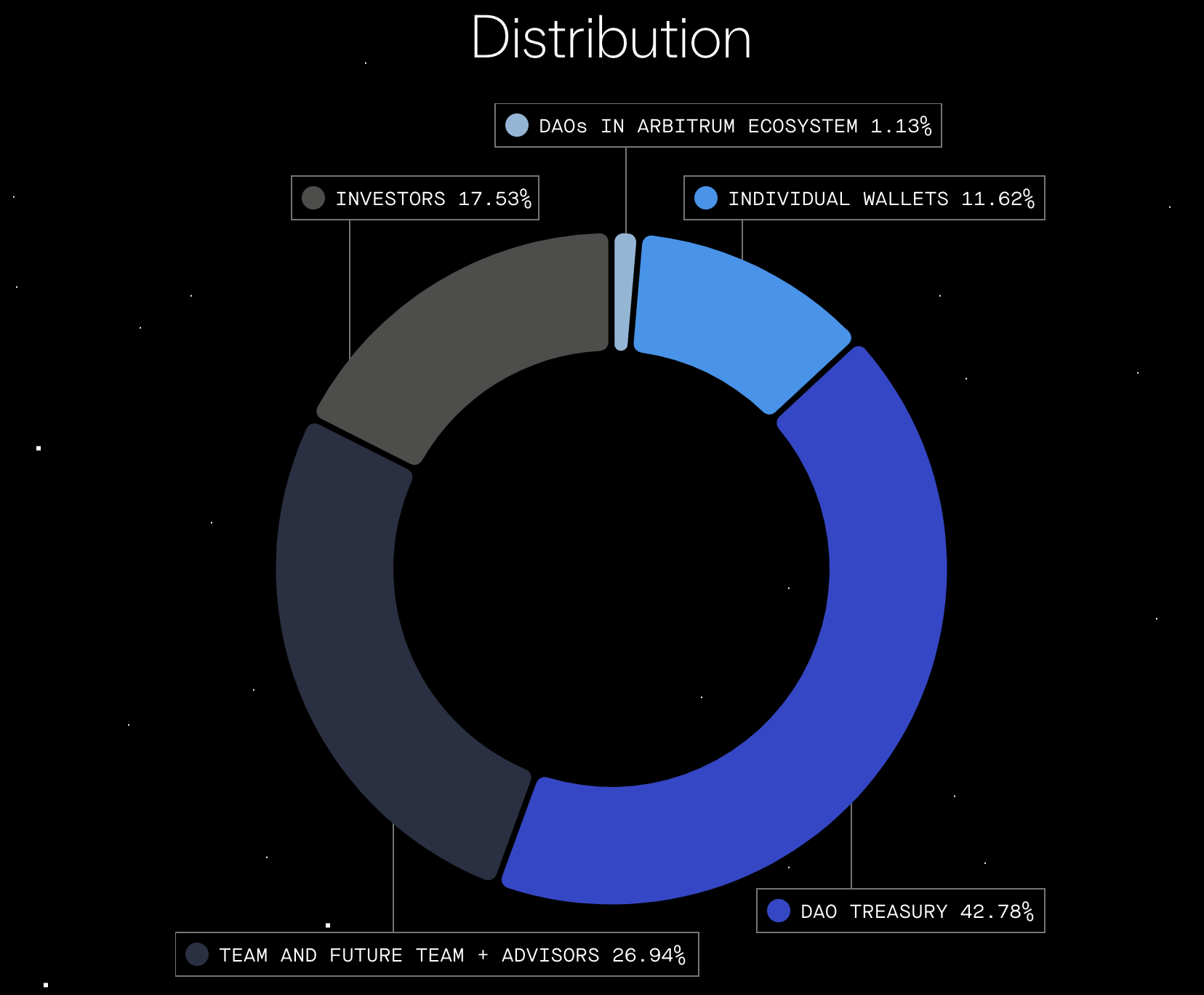

The Arbitrum DAO controls about 43% of the treasury, while the team controls about 27%, according to Arbitrum Foundation’s website.

Image Credits: Arbitrum Foundation

The purpose of the foundation is to service the DAO, Goldfeder said, in reference to the voting mishap. While the foundation has about six full-time employees, the DAO has “ultimate control” over the protocol and the foundation’s leadership, with “the ability to remove and appoint directors.”

Why make Arbitrum a DAO?

“It’s a question of decentralization,” Goldfeder said. “Some people get caught up about the token, but it’s not about that. It’s about upgradability — the ability to upgrade the technical chain itself over time.”

The ARB token, which was an extremely hyped-up airdrop that transpired mid-March, was built and distributed to early users and DAOs building on its network. It was an effort to hand over control from Offchain Labs and the foundation to its community members, or ARB holders, who can govern the network by voting on proposals.

Making Arbitrum a DAO puts the ability to upgrade and change the protocol in the hands of the community, Goldfeder added. “The Arbitrum DAO is an extreme form of decentralization.”

“From my view as a community member, but also someone who was a launch partner, [the Arbitrum DAO] is the most decentralized [DAO] I’ve seen,” Goldfeder said. “You’ll hear that from everyone, but if you look at the code, it’s true. It has complete control over the treasury; the fees go directly to it — some are paid out to the cost of the chain. But no one other than the DAO can go ahead and implement things.”

Going forward, Goldfeder is hopeful the DAO will continue to focus on technical improvements and security as well as the community’s values of being fully decentralized.