India’s technology ecosystem is facing an uphill battle to catch up to global leaders in the generative AI race. Despite being home to one of the world’s largest startup ecosystems, the South Asian economy has yet to make a material impact in the rapidly advancing AI arena.

No homegrown Indian contenders have emerged to challenge the dominance of large language model titans such as OpenAI’s ChatGPT, Google Ventures–backed Anthropic, or Google’s Bard.

“While there are over 1500 AI-based startups in India with over $4 billion of funding, India is still losing the AI innovation battle,” say analysts at Sanford C. Bernstein.

To their credit, many of India’s major startups are using machine learning to enhance aspects of their business operations. For instance, e-commerce giant Flipkart uses machine learning to refine customer shopping experiences, while Razorpay utilizes AI to combat payment fraud. Unicorn edtech Vedantu recently integrated AI into its live classes, making them more accessible and affordable.

Industry insiders attribute India’s dearth of AI-first startups in part to a skills gap among the nation’s workforce. Now the advent of generative AI could displace many service jobs, analysts warn.

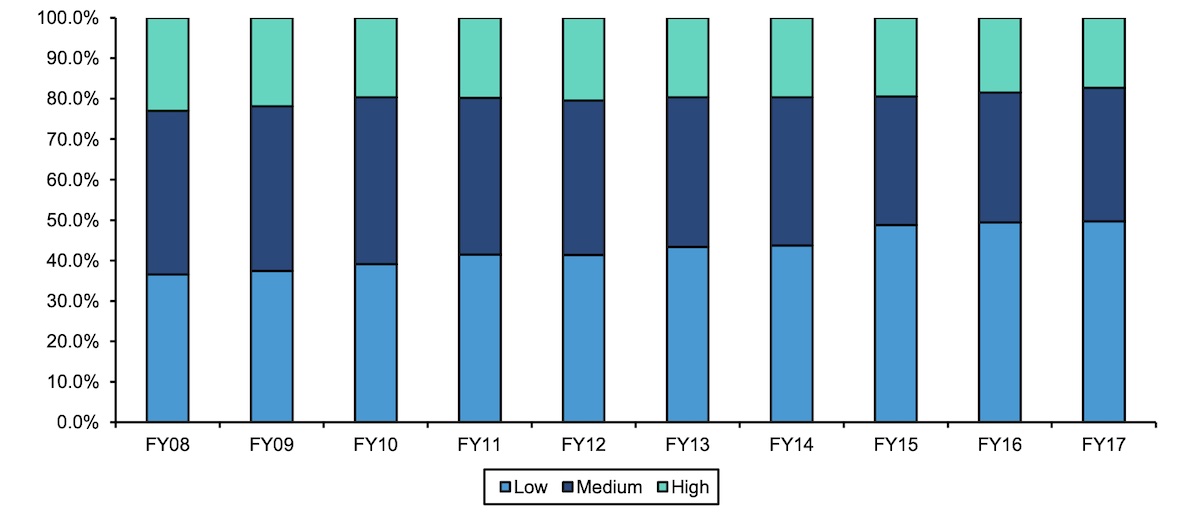

“Among its over 5 million employees, IT in India still has a high mix of low-end employees like BPO or system maintenance. While AI isn’t at the level of causing disruptions, the systems are improving rapidly,” Bernstein analysts said.

Dev Khare, a partner at Lightspeed Venture Partners India, recently assessed the disruptive potential of AI and warned that jobs and processes in industries such as market research, content production, legal analysis, financial analysis, and various IT services jobs could be impacted.

However, for India, this disruption also presents an opportunity. A rapid gain in agriculture sector, which employs over 40% of the country’s workforce, is challenging, and similarly automation in the manufacturing industry may be unnecessary due to the abundant and affordable labor force.

Employment mix of low-skilled, medium-skilled and high-skilled workers in TCS, Infosys, Wipro and HCL. Image Credits: Bernstein

With timely upskilling and resource optimization, the services sector stands to benefit the most. Indian consultancy giants are already recognizing it. Infosys, for example, revealed last month that it is working on several generative AI projects to address specific aspects of clients’ businesses. TCS, on the other hand, is exploring cross-industry solutions to automate code generation, content creation, copywriting, and marketing.

In response to this landscape, New Delhi has declared that India will not regulate the growth of AI, taking a different approach from many other countries.

“AI is a kinetic enabler of the digital economy and innovation ecosystem. Government is harnessing the potential of AI to provide personalized and interactive citizen-centric services through digital public platforms,” India’s Ministry of Electronics and IT said last month.

Glimmer of hope

With the more established segment of India’s startup ecosystem staying muted in the generative AI race, young firms are stepping up to the occasion.

Startups like Gan, which enables businesses to repurpose videos at scale; TrueFoundry, which assists in building ChatGPT with proprietary data; and Cube, which facilitates AI-powered customer support on social media, are among those leading the charge.

The surge of interest has prompted nearly all venture funds in India to develop investment strategies in the emerging space.

Anandamoy Roychowdhary, partner at Surge, Sequoia India & Southeast Asia, pushed back that Indian startups have just started to explore applications around generative AI, saying several have been working on this space for many years.

“What cannot be denied though is the spectacular pace of projects and startup creation post the launch of ChatGPT. The Sequoia India and SEA team have been early to this trend, having partnered with 7 to 8 AI companies across earlier Surge cohorts,” he told TechCrunch.

Sequoia India and SEA is evaluating at least five firms in this space each week, he said.

Accel, another high-profile venture firm that has been operating in India for over a decade, said Wednesday that AI is one of the two main themes across the new cohort of its early-stage venture program.

However, some founders expressed concerns that these AI startups are unlikely to focus on creating their own large language models due to the lack of funding and conviction from investors to support such high compute and other infrastructure expenses.

An investor, who requested anonymity to speak candidly, cautioned that the current frenzy around AI deals somewhat echoes aspects of the crypto craze in 2021.

“Everyone wants to do genAI but no one knows how/what to do. This is the crypto arms race all over again,” the person said. “I doubt most Indian VCs ever really dug deep and understood crypto, because otherwise they wouldn’t have made so many utterly crap investments.”