There’s a pretty decent chance you’ve heard of a little company called Uber. It was a Crunchies finalist back in 2011 (for Best Location Application, alongside Runkeeper, Foursquare, Airbnb and Grindr), and it’s been doing rather well ever since.

As I am writing this, Uber has a $69 billion market cap (nice) and it’s a global superstar startup.

But it wasn’t always like this. Fifteen years ago, the company set out to raise a $200,000 round of financing with a different name (UberCab) and a different business model (limos you hail from your smartphone using SMS). In 2011, it launched in San Francisco, followed quickly after that in a number of other cities.

A lot has changed in the past 15 years. For one thing, the original iPhone had only just been launched (without the ability to install apps!), and fundraising has become a lot more sophisticated.

The Uber deck has been floating around the internet for a while; we shared it as a gallery back in 2017, and these days it isn’t really seen as a good example of how to do a pitch deck. Even still, let’s take a stroll down memory lane and see what Uber got right in its original pitch — and where it made some spectacularly silly mistakes.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

- Cover slide

- Problem slide (“Cabs in 2008”)

- Solution slide (“Digital Hail can now make street hail unneccessary”)

- Solution slide (“UberCab Concept”)

- Product slide 1 (“1-Click Car Service”)

- Value proposition slide 1 (“Key Differentiators”)

- Mission (“Operating Principles”)

- How it works slide 1 (“UberCab Apps”)

- How it works slide 2 (“UberCab.com”)

- Positioning slide (“Use Cases”)

- Value proposition slide 2 (“User Benefits”)

- Value proposition slide 3 (“Environmental Benefits”)

- Product slide 2 (“UberCab Fleet”)

- Go-to market slide 1 (“Initial Service Area”)

- Technology overview slide (“Technology”)

- Competitive advantage slide (“Demand Forecasting”)

- Market size slide (“Overall Market”)

- Market segmentation slide (“Composition of Market”)

- Go-to-market slide 2 (“Target Cities”)

- Scenario planning (“Potential Outcomes”)

- “Why now?” slide (“SmartPhones Aug 2008”)

- Road map slide 1 (“Future Optimizations”)

- Marketing slide (“Marketing Ideas”)

- Road map slide 2 (“Location-Based Service”)

- Traction slide (“Progress to Date”)

Three things to love

There are some beautiful historical gems in this slide deck, some of which are just delightful idiosyncrasies of a time gone by. Others are legitimately insightful glimpses into where Uber would be growing, visible even in this very early deck.

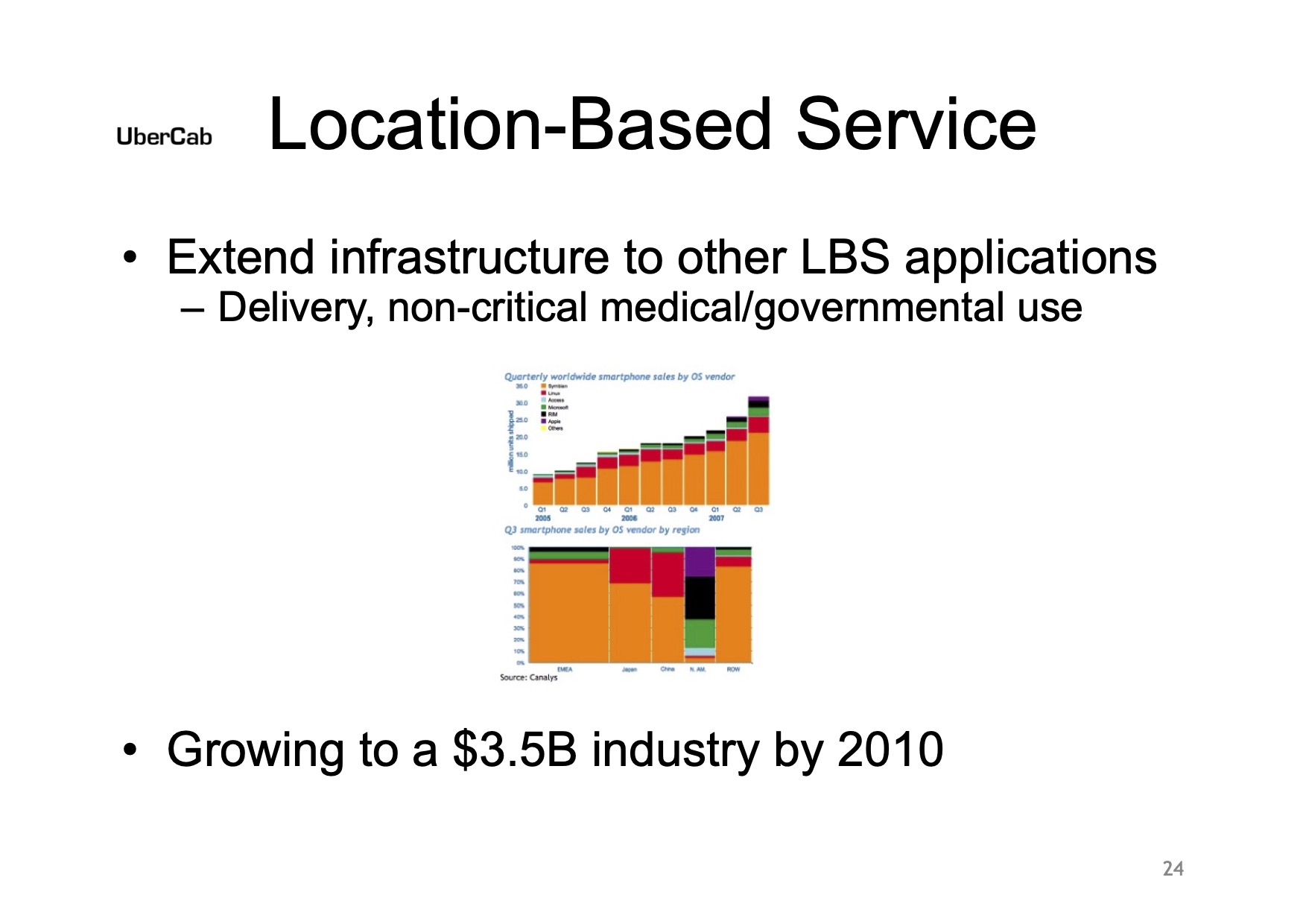

Uber knew location-based services would be huge

[Slide 24] Uber knew from the start that it might have adjacent markets as an option. Image Credits: Uber

The Lyft-pioneered hailing-a-ride-from-a-random-stranger model came later, but Uber knew that delivery was going to be a key source of growth. The company projected that this would be a $3.5 billion industry by 2010. Considering that Uber Eats raked in around $8 billion in 2021 and nearly $11 billion last year, it’s pretty safe to say Uber’s projections turned out to be right.

That was a particularly fascinating thought back in 2008 because Uber had yet to launch and didn’t have a clear vision for how it was going to launch UberX.

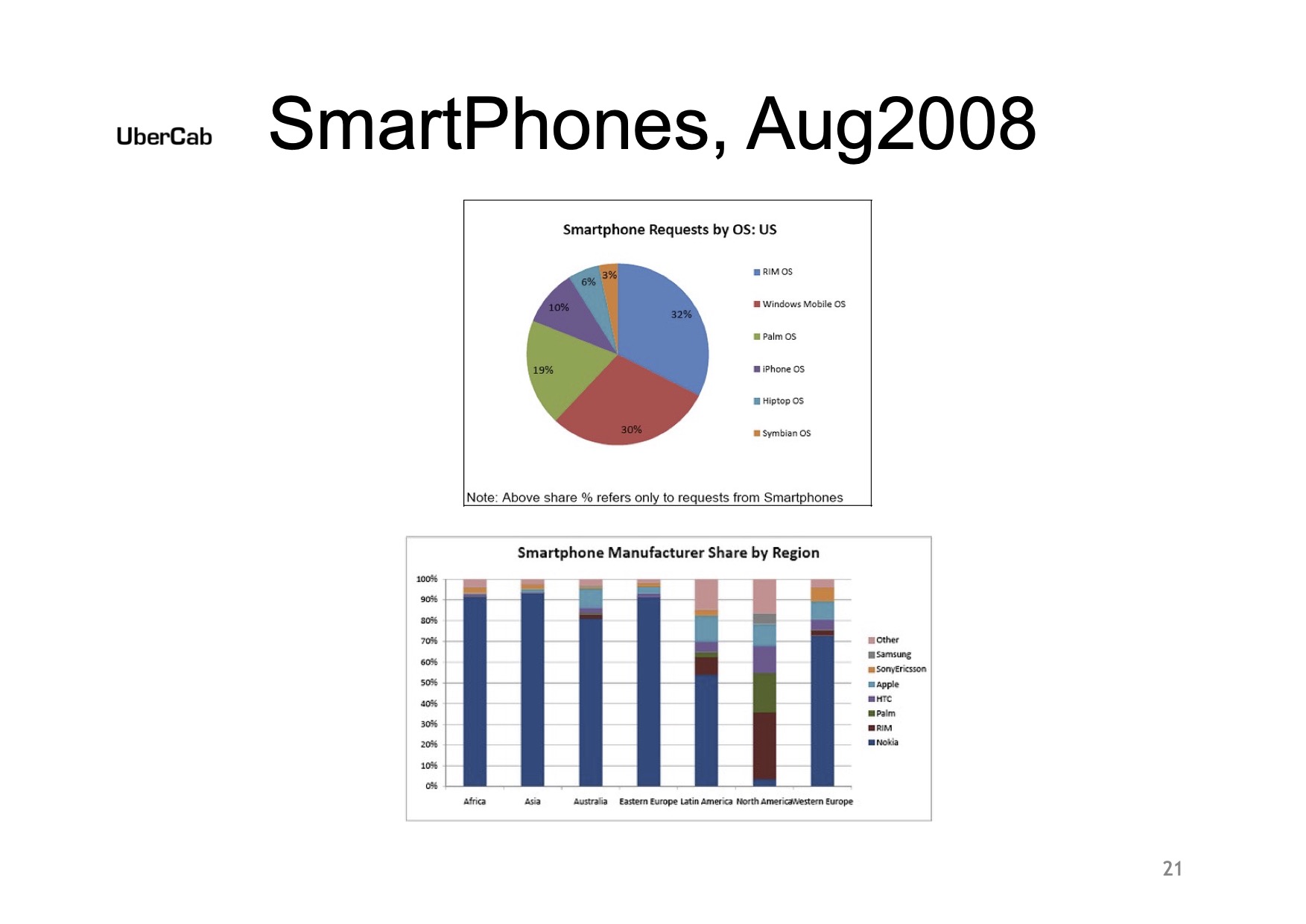

Made possible by smartphones

Of course, with the benefit of hindsight, this is a fantastically obvious one, but …

[Slide 21] SmartPhones. They’re a thing. Image Credits: Uber

The interesting — and crucial — thing was that the smartphone (and ubiquitous data availability on cellphone plans) was ultimately the technology that unlocked Uber’s current business model: Drivers can drive, passengers can hail, etc. The company doesn’t make much of a prediction of where the market is going, but it knew one thing: SmartPhones [sic] were an important part of the path going forward.

As a startup, Uber is showing that it is, in effect, building a company on two emerging technologies: location-based technologies and smartphones. That’s pretty genius, everything considered. And there’s an important thing that can be learned from this when you’re building your own pitch deck: Tying your company to major macroeconomic or technology shifts is a great way to catch a tremendous tailwind.

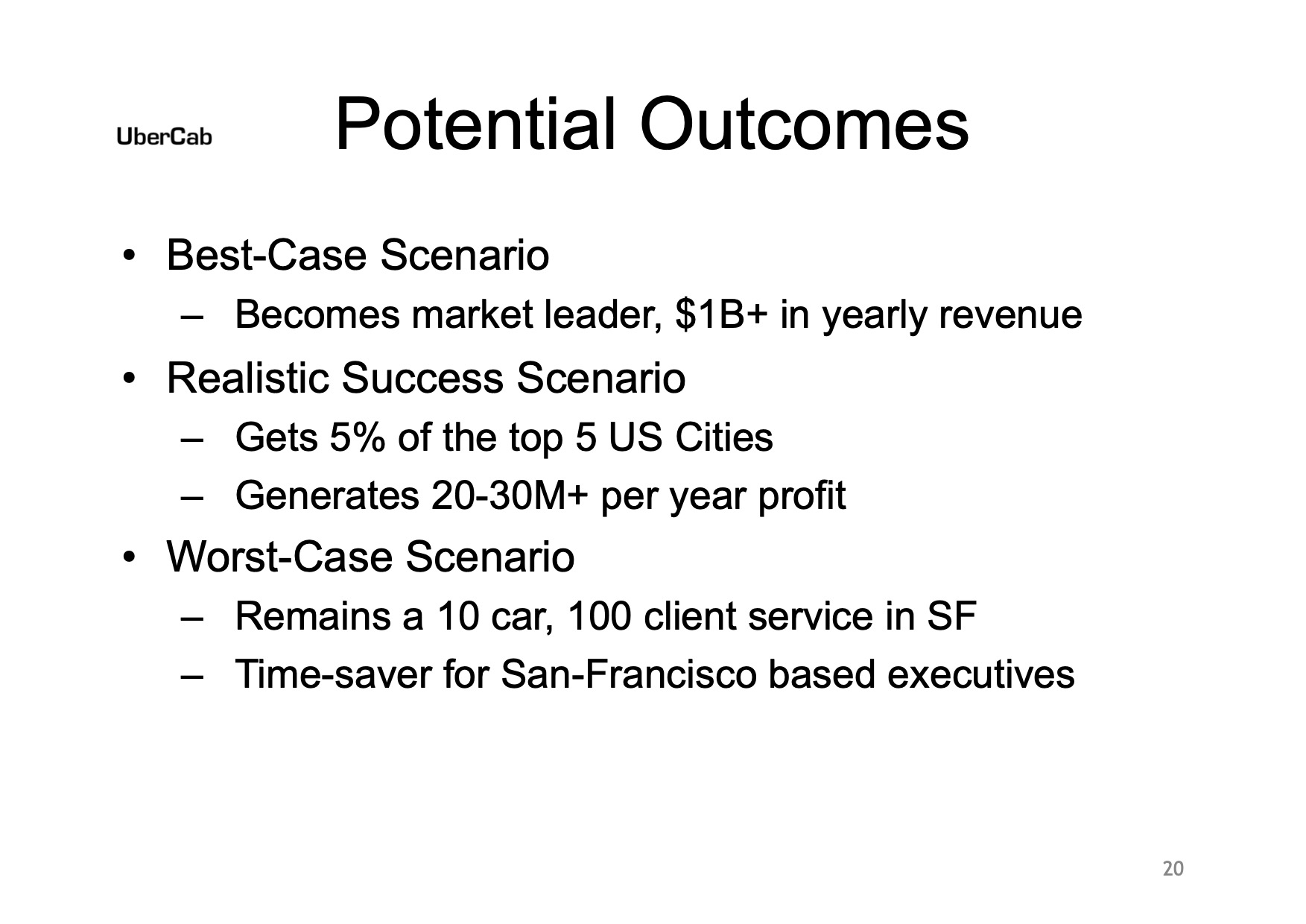

What’s the (best/worst) that could happen?

[Slide 20] OK, this is just funny. Image Credits: Uber

Uber’s founders, in their wildest dreams, imagined that the best-case scenario was $1 billion in annual revenue. To be fair, the $8.6 billion it generated in 2022 is more than $1 billion, so the company was, indeed, right. But it also hoped for a “realistic” scenario of $20 million to $30 million per year of profit. That’s an interesting one — because for ever-so-many years, Uber was running at a significant loss as it was optimizing for aggressive growth over profits. I love this slide so much.

The lesson here? Get rid of any sort of predictions about your exits or outcomes. Size the market and call it a day.

In the rest of this teardown, we’ll take a look at three things Uber could have improved or done differently.

Three things that could be improved

Uber got many things objectively wrong, but it had no way of knowing how successful it would become. However, the company did make some pretty painful mistakes in its pitch that — even at the time — could have been done better. Here’s a selection:

The narrative is a mess

The thing that strikes me more than anything about the UberCab deck is how there’s no clear narrative — it jumps all over the place. Scroll back up and take a look at the slides; there are three product slides, but they aren’t grouped together. There are a number of value proposition slides, and all of them take on a slightly different value prop.

More than anything, the deck is extraordinarily defensive; it’s almost as if the founders are trying to convince themselves that this is a good idea.

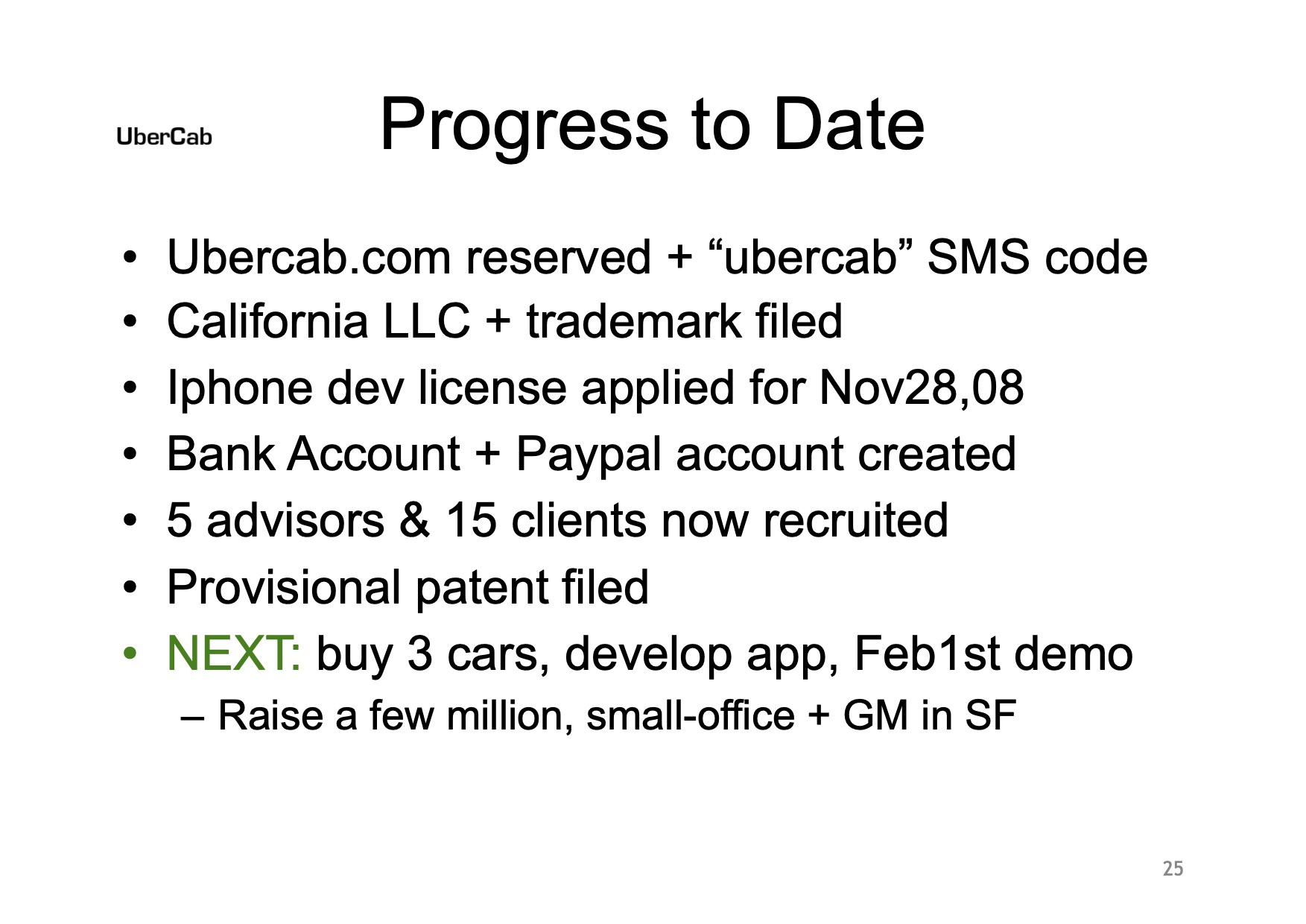

That’s … not how traction works

When you have an early-stage company, it can be hard to figure out how you weave the narrative of your traction and milestones to date. But this traction slide — labeled “Progress to Date” — is legendarily bad.

[Slide 25] This is god-awful. Image Credits: Uber

On the bright side, founders, it’s extremely likely that literally anybody reading this will have more impressive traction than Uber did when it raised its first round of financing.

- Having “UBERCAB” as an SMS code is cute, to be fair.

- They “reserved” a domain? Did they buy it? Did they register it? What does that even mean? Even in 2008, that wasn’t the language people used about web domains, which makes me worried about whether the company’s founders even really understand the internet.

- Applying for a dev license … isn’t a milestone or traction of any sort. Receiving the license might be, but even then, that’s pretty weak.

- Creating a bank account and a PayPal account? Can you imagine putting that on a slide deck today? It’s bare-bones table stakes for a business; if you list it on your progress slide, it shows that you’re really scraping the bottom of the barrel.

- Fifteen clients? The company doesn’t specify what a client is — is it a passenger? Is it a partner? That’s confusing, but in any case, 15 of anything is unimpressive for a business-to-consumer company.

- Buy three cars? Whyever? I’m pretty sure that rental companies or leasing solutions existed in 2008 — buying expensive assets (and especially the Mercedes S class cars the company talks about elsewhere in the deck) is grossly financially irresponsible.

- “Develop app.” Well. Yes.

Even giving the founders the benefit of the doubt about this slide, there’s an even worse problem with it: It is the very last slide in the deck. If they were presenting it to an investor, that’s the slide that would be up on the screen as they are fielding questions. Way to underwhelm your potential investors.

This is the reason why most pitch decks have a “contact us” or “any questions?” slide at the end — at least your investors won’t be staring at your very worst slide as they are trying to poke holes in your business.

On the bright side, founders, it’s extremely likely that literally anybody reading this will have more impressive traction than Uber did when it raised its first round of financing.

Um, it’s a cab

The most puzzling slide in Uber’s deck, however, is its Use Cases slide:

[Slide 10] Wait, what?! Image Credits: Uber

The completely inexplicable thing here is that Uber is just explaining what taxis are and when people might choose to take a taxi rather than drive themselves. The “Wi-Fi in cars” thing is a bit novel, perhaps, but hotspots and usable internet on the move were essentially nonexistent.

In summary: This entire slide is redundant, and it takes up important real estate in a deck where the company is describing legitimately innovative solutions.

The thing you can learn from this slide as a startup is this: Don’t insult your investors. Yes, you sometimes have to go back to basics, but … people know what taxis are. You don’t have to reiterate that.

The full pitch deck

In this section, we usually link to the company’s pitch deck, but it’s all over the internet, so instead, we’ll just do this. Enjoy:

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!