Historically, environmental health and safety software hasn’t been a massive market — at least compared to others in the software-as-a-service segment — and it’s admittedly not the most enthralling startup category. But that’s changing, according to a new survey released by research firm Verdantix.

EHS software acts as a data management system for capturing and analyzing information related to occupational health and safety, waste management and sustainability. Companies use EHS software to track emissions and investigate workplace incidents, for example, as well as conduct health and safety training and grant entry to restricted spaces.

Verdantix’s Green Quadrant: EHS Software 2023 survey shows that the EHS software market had more than 50 transactions in the past two years and predicts that it’ll grow from $1.6 billion in 2022 to around $2.7 billion by 2027. Verdantix predicts it’ll buck the global economic downturn, furthermore, due to differentiators like the use of AI and automation.

“Over the past two years, the market landscape for EHS software has undergone a paradigm shift, as EHS providers have expanded their product offerings to meet the ravenous appetite for robust environmental management solutions brought on by the ESG megatrend,” Verdantix industry analyst Chris Sayers said in a statement. “As EHS functions seek to interlink with other business operations, providers are turning to emerging technologies as a point of differentiation and redefining the functional possibilities of EHS software.”

Per the Verdantix report, since ETF Partners invested around €10 million (roughly $11 million) in EHS vendor Enablon in 2011, private equity firms and strategic investors like Wolters Kluwer and Fortive have spent more than $4 billion to buy into the EHS software market. The absence of the world’s largest enterprise software vendors — including IBM, Microsoft, Oracle, Salesforce and SAP — has left a lot of oxygen in the market for midsize businesses to grow.

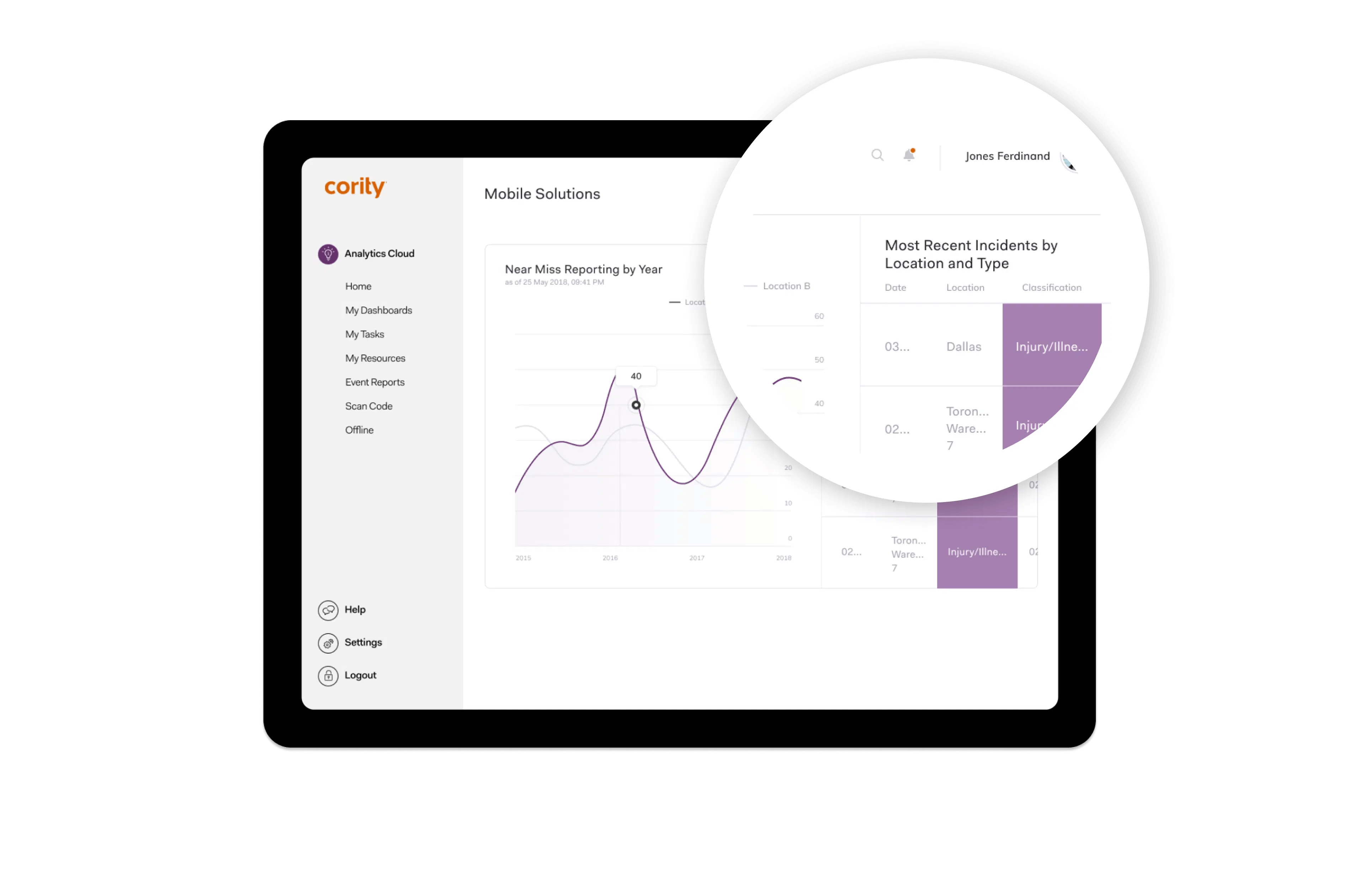

Verdantix points to vendors like Cority, which is private equity-backed and expanding its ESG and sustainability functionality. After raising $100 million in venture capital before being acquired by Thoma Bravo in 2019, Cority — which sells software to manage risk and compliance related to employee safety and environmental impact — grew its customer base to over 800 clients.

The analytics dashboard of Cority’s EHS software. Image Credits: Cority

Alcumus is another EHS success story that Verdantix highlights in the report. Purchased by Apax Partners for more than $800 million in 2022, the 3,000-customer-strong company offered a suite of technologies to provide digital solutions, content and services for safety, contractor risk, chemical compliance (e.g., the Toxics Release Inventory in the U.S.) and related ISO certifications.

Alcumus’ revenue reached £54.7 million ($66.80 million) in 2020 — an 18% increase year over year. One source estimates the company’s current revenue at $141.3 million.

Why the massive success? EHS software, it could be said, sells itself. Companies without it run the risk of overburdening their managers with administrative tasks, taking away from high-value work like implementing environmental management systems and making the work environment safer. EHS software can help identify hazards while managing corrective actions, streamlining things like keying in data, preparing for audits and creating reports. In the best case, it can even increase a company’s risk visibility by recruiting employees to report safety issues.

The threat of increasing fines and legal consequences from noncompliance has also played a role, no doubt. In the U.S., the Occupational Safety and Health Administration last year hiked penalties for workplace health and safety violations to keep pace with inflation. Across all industries, U.S. companies now spend an average of $5.47 million on compliance annually.

Grand View Research estimates that, in 2019, “industrial waste management accounted for over 50.1% of the global EHS market share in terms of revenue in 2019, owing to the presence of stringent international regulations regarding industrial waste transportation and disposal.”

“Strict regulations regarding the release of effluent in the North Sea and the Baltic Sea are expected to propel [EHS] product demand,” Grand View Research writes. “The demand is [also] anticipated to be driven by the developing medical technology and rising global spending on health services. The presence of stringent bio-waste disposal norms is expected to further propel the demand … [And] the increasing prevalence of accidents and diseases due to the improper disposal of toxic materials is expected to drive demand in the segment.”

The pandemic, too, probably accelerated the adoption of EHS software. In the 2021 edition of Verdantix’s EHS report, which surveyed around 300 corporate EHS leaders, 36% of the respondents cited COVID-19 as having fast-tracked the digital transformation of their EHS initiatives. More than 80% said that digital transformation of their company’s EHS function will continue to be a high or moderate priority for the foreseeable future.

“There is an increasing need for EHS software by various companies to help increase the ability to monitor the health and safety of workers during COVID-19 by automating reporting and management of cases, communication with workers, increased self-assessments and voluntary check-ins,” Mordor Intelligence wrote in a recent white paper. “Government guidelines have also called for employers to conduct COVID-19 risk assessments to establish needed controls. It is essential to conduct these risk assessments systematically and to have a centralized management method, which the EHS software can offer.”