In the final days of the third quarter, it’s becoming clear that some areas of startup investment are losing luster. Declines are hardly surprising amid a more conservative venture capital market, a falling stock market, and global macroeconomic and geopolitical uncertainty. Still, even with large caveats, the pace of change in certain startup sectors appears material.

One category of startup investment that proved rock solid quarter after quarter in recent years was business and productivity software, a cohort of companies that PitchBook groups under a single descriptor, allowing us to track it rather carefully. Data indicates that after a long period of strong venture interest, business/productivity software companies are seeing their allowance sharply docked.

Given the declines, we’re curious today whether the reductions to investment in this particular startup grouping will prove to be more severe than what the larger venture capital market posts in Q3.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

As always with venture capital data, we’re pulling present-day information from a living dataset, by which we mean that we are looking at preliminary data points; more information will flow into databases like PitchBook and competitors like CB Insights and Crunchbase as Q4 kicks off and final deals from the preceding period are collated.

All the same, the narrative that is forming appears clear enough for us to make some calls, and perhaps even a prediction or two. To work!

All the same, the narrative that is forming appears clear enough for us to make some calls, and perhaps even a prediction or two. To work!

Losing steam

That productivity software is losing steam is not a surprise. Few other categories of startup investment rose as high as the productivity-focused sector during the pandemic. It makes sense: Productivity services were critical as work went remote — often overnight. However, with most of the world now working to merely live with the danger posed by COVID-19 instead of trying to actively suppress it, we’re hearing more and more chatter about returning to offices. Which means that the shot in the arm that many of these startups enjoyed for some quarters is now at least partially over.

Venture investors may be hunting up something new.

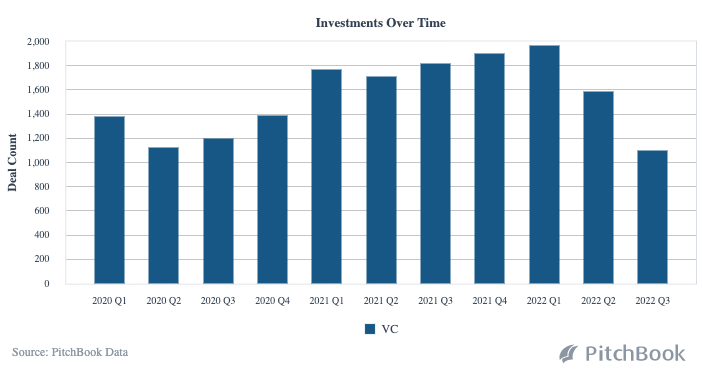

Observe the following chart that The Exchange pulled out of PitchBook’s platform, tracking deal count in the business/productivity space:

Image Credits: PitchBook

You can see a decline at the onset of COVID-19 in Q2 2020, and then a pretty steady rise through to the first quarter of 2022, when it became clear that more folks were going to venture out without a mask (we’re not making a value judgment on that behavior here, mind). The number of deals posted in the second quarter, the lowest since Q4 2020, was nothing, however, compared to what we see in the most recent period. Deals appear to be in free fall in the formerly buoyant space.

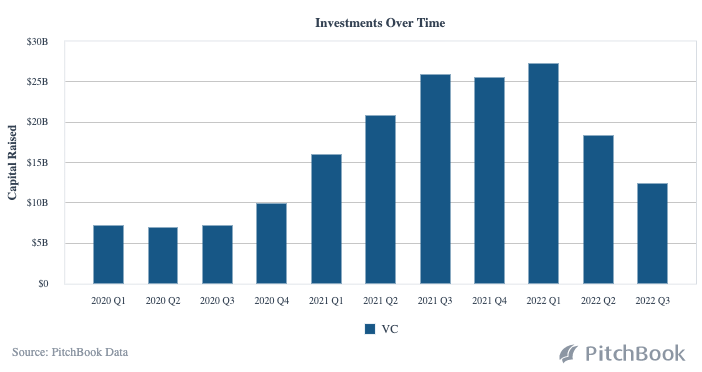

As you would expect, the dollar value of the above-detailed venture deals is also falling:

Image Credits: PitchBook

The dollar value of deals has dropped even faster than the number of deals, measured in percentage terms. The pullback is real. And perhaps accelerating.

If things hold steady, Q4 2022 could see the deal and dollar value of business productivity software investments fall even further. Perhaps Slack sold at the right time?

The next question that we need to answer is how the above declines square up with aggregate Q3 venture capital trends. We’ll wait to get the final numbers to make that determination with confidence, but it wouldn’t shock us if we are seeing this market slow in excess of venture capital totals more generally.

But don’t cry for productivity software startups; some sectors may have it even worse. Edtech, for example, peaked earlier in deal terms (Q1 2021) and even earlier in dollar terms (Q4 2020), and is set to post its third consecutive quarterly decline in deal volume and fourth consecutive decline in dollar value.

Indeed, the entire software market is in retreat. A similar search highlighting companies tagged simply with “SaaS” shows sharp declines in deal and dollar terms, meaning that the larger genre of startup work that encompasses much of edtech and productivity software is not looking too healthy.

If we do find that venture totals are slowing less rapidly than the above categories, we’ll be able to say with some confidence that venture capitalists are pulling back and refocusing, even if it is unclear at the current moment precisely where those potential excess dollars may be flowing.

We suspect those categories could include climate tech, health tech, developer and designer tools, and, yes, web3. More data to come, but it appears that, at a minimum, we’re seeing startups that were previously the apple of investors’ eyes become something less attractive — perhaps to the benefit of other sectors. More to come when we get full Q3 data.