Semiconductors are critical to the economy of almost every country in the world. However, the industry is facing significant challenges.

Even with fabs operating at full capacity, companies have struggled to keep pace with demand, pushing lead times to six months or longer. Moreover, the impact of the pandemic, a talent crunch and spiraling design complexity mean an industry that should be riding high is under increasing pressure.

Amid soaring demand, semiconductor markets have boomed, with sales growing by more than 20% to around $600 billion in 2021. However, global chip shortages have caused manufacturing slowdowns in industries from autos to agriculture, and led to debates over the reliability of an industry that is vital to the global economy.

In the U.S., the federal government has responded with a swath of legislation, including the CHIPS for America Act, which authorizes $52 billion in funding for the expansion of the domestic semiconductor industry. The new rules aim to protect industries against supply shortages and reduce their reliance on fabrication plants in Asia. Companies including Intel, Samsung, Texas Instruments and GlobalFoundries are planning on adding more capacity in the U.S., and Europe is also seeing significant investment.

The recent ramp up in productive capacity reflects the consensus that, notwithstanding the current environment, the longer-term outlook for the semiconductor industry remains positive. From domestic kitchens to the most advanced manufacturing plants, semiconductors are embedded in modern economies. Combine that with the rise in home working, and it’s not difficult to predict the industry’s direction of travel.

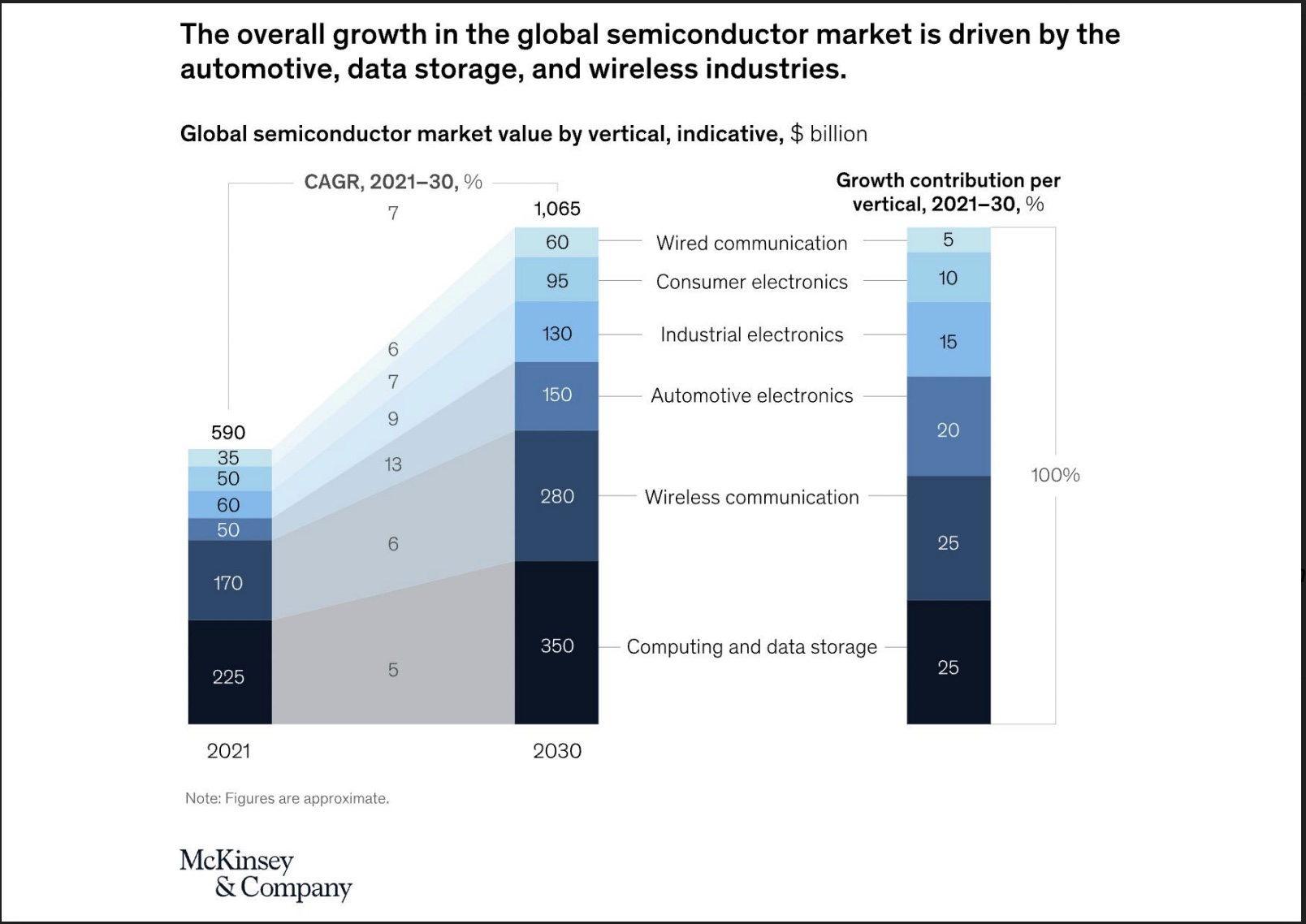

We estimate 6% to 8% growth per year up to 2030, amid expanding demand for digital services, the growth of artificial intelligence and machine learning (AI/ML), and mass migration to electric mobility. On that trajectory, we predict a trillion-dollar industry by the end of the decade.

Image Credits: McKinsey & Company

Against this background, the pressure is on for manufacturers to ensure they are ready to maximize the opportunity. That will mean identifying where they can add the most value, and putting in place the capabilities that will support continuous innovation and operational flexibility — both necessary preconditions of success in the coming decade.

From a demand perspective, we expect 70% of growth up to 2030 will be driven by just three industries: automotive, computation and data storage, and wireless.

The fastest-growing segment is likely to be automotive, where we could see a tripling of demand for applications such as autonomous driving and electrical powertrains. As cars become more like computers, we see the industry accounting for 13% to 15% of demand by the end of the decade, compared with 8% in 2021.

In parallel, the computation and data storage market growth will expand by 4% to 6%, fueled by the need for servers to support applications such as AI and cloud computing. In the wireless segment, smartphones will account for the majority of expansion, amid a shift from lower-tier to mid-tier segments in emerging markets, and backed by the growth of 5G.

Through deep analysis of their resources and capabilities, the task for decision makers as they ramp up capacity is to tailor their capabilities to the most promising segments. As well as building factories, that will mean getting it right on R&D and sourcing.

As in many other industries, the recent trend is toward a winner-takes-all environment in which the top 20% of companies capture most of the profits. This does not necessarily need to be the case indefinitely. However, if less competitive companies are to keep pace, they need to make bold decisions now on how they want to play. This may be to go scale, but equally could be about identifying a niche and committing to it.

A little counterintuitively, semiconductor companies have fallen behind other tech companies when it comes to applying advanced technologies. In a 2021 survey, McKinsey found that just 30% of respondents said that they are already generating value through AI/ML. Indeed, we estimate that semiconductor companies currency reap just 10% of AI/ML’s potential.

In addressing that deficit, speed is of the essence, and inorganic approaches may make sense — creating a fast route to agility and technology know-how. Research shows that effective use of AI/MI could cut manufacturing costs by 17%, and R&D costs by as much as 32%, so the price of acquisition is likely (theoretically) to be balanced by efficiencies.

Another potentially exciting growth area is compound semiconductors. These are built with silicon carbide and gallium nitride, which could provide performance benefits against traditional silicon.

As the global economy and financial markets come under pressure from slowing growth and faster inflation, semiconductor companies have seen hits to their valuations in recent months. Decision-makers, therefore, may find it more difficult than usual to plan for growth and expansion.

However, amid waves of volatility, the longer-term outlook is unlikely to change significantly. The onus on corporate leaders therefore is to see through current uncertainty, establish a vision for the future, and act to make it happen.