As an entrepreneur, you’ll find yourself adjusting your business as you encounter opportunities and obstacles. Adjustments are a natural part of growing and operating a business, and you’ll find that most of the time, slight refinements and tweaks can keep your company going and thriving.

There may be situations, however, that require more significant changes to your long-term plans. You may even need to explore ways to pivot your business entirely.

Since early-stage companies have limited time and money, it’s essential to work closely with investors and other stakeholders early when you’re planning a pivot as well as throughout the process so that you get to the correct pivot point sooner and accurately.

When planning a pivot, it’s your job to develop and explain your plan of action to all stakeholders, including investors, board members, members of your team and advisers.

Partner with your investors before a pivot

A pivot is no time to fly solo, so approach the pivot as a team effort. Investors have a vested interest in the success of your business. After all, it’s their money that’s at stake!

There’s no shame in pivoting. On the contrary, it’s a sign of strength.

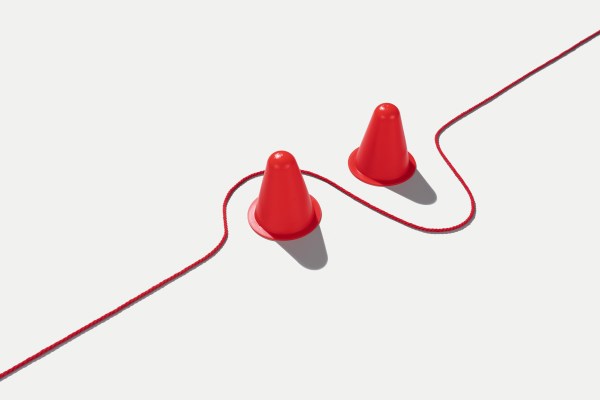

You should also remember that as the founder, you’re extremely close to your business. The idiom “You can’t see the forest for the trees” is applicable here. You need input from your investors, board members and other stakeholders because they can see the broader picture.

When your investors are part of your pivot plan, they’ll have the opportunity to provide valuable perspectives, ideas and connections to others who can help make your pivot successful.

Best practices for working with investors

Quite often, the CEO will be the first to realize that the company needs to pivot. When you’re beginning the planning, be sure you’re ready to let go of the status quo. You need to embrace the mindset that your company may not thrive or survive if it doesn’t pivot.

Start by informally introducing the pivot idea to investors and other stakeholders. Solicit their feedback and ideas for the best path forward and answer their questions. When you’ve thoroughly thought through the plan, put it in writing. Describe what the pivot will look like — for example, if you’re moving your business online, explain how you’ll cease most or all brick-and-mortar operations with a pivot to online-only or mostly online operations.

Include a snapshot of the current state of your business, the challenges, the desired end goal and the steps you’ll take to get there. Be sure to include how your financials will look in the best, worst and midcase scenarios.

Then, review your budgets and cash position, set goals and milestones, and lay out your plan to quickly secure new investments if you’ll need funding for the pivot to succeed.

Once you have a plan, solicit input from other key stakeholders to sanity check your plan: Do they fully understand your transition vision? Get their feedback and use it to fine-tune your plan. Ideally, most of your stakeholders will have been involved with the anticipated transition from the start, but if not, explain the plan, the projected milestones and the steps you intend to take.

Remember to answer all questions, and be open and transparent at all times. Questions will vary depending on the products and markets — for example, a new life science approach will trigger questions about FDA timelines or other regulatory approvals. In technology or CPG (consumer packaged goods) companies, questions tend to focus on anticipated revenue and timelines to achieve the revenue.

The biggest question will likely be the rationale for your new approach. They’ll also want to know what would happen if you were to stay on the current course and do nothing, so prepare to answer that, too.

Work on your external communication plans

Discuss your external communication action plan with investors, solicit their feedback, let them challenge your thinking and adjust as necessary. If the changes are minimal — it could be new products, products to be sourced or pricing — simply update your website with the new information.

If the change is dramatic, such as switching from brick-and-mortar to online operations, you’ll need a more comprehensive communications approach — you may need public relations and media support for direct customer communications and social media.

Even though you’ll communicate everything relevant to customers about the pivot, they may still have questions. Give them a full explanation of how you’re handling the change, and that you’re making these adjustments to better serve them and all stakeholders. Maintaining customer trust is paramount as you go through this change.

Types of pivots

Regardless of the type of pivot, there are three critical threads common to each: The mindset to accept the need for change; a quickly crafted strategy and action plan; and the need to closely involve investors and stakeholders for their feedback and to maintain trust.

Crisis operational pivot

A Ukrainian entrepreneur I know had a very successful consumer products home goods business selling products all over the world. Just two weeks after Russia invaded Ukraine, her home, office and factory were completely destroyed.

She announced to customers and prospects that her business was temporarily on pause. While she was still in Ukraine, the team and investors knew that urgent communication was key.

Within a week of losing everything, she moved to Poland with her two young children while her husband stayed back to fight in the war. She worked quickly to create a plan for the new situation. She explained to investors that she needed a manufacturing arrangement ASAP and worked with them to find a source to get her goods produced.

By working with her investors, she was able to quickly pivot, and within 60 days, had set up new headquarters and was back to shipping and selling products worldwide.

This is an extreme example of dealing with the unexpected under harrowing circumstances and working with investors to rapidly come up with a solution.

Customer segment pivot

Sometimes, you may find you have the right technology but you’re solving a problem for a challenging market segment. In such a case, a good pivot would be to target a different market segment.

One company I invested in had developed a patented diagnostic product for the clinical market. This product would have taken longer to get to market due to FDA approvals required in a human clinical market, which was already crowded with competitive offerings.

The business had patent claims for other markets as well, so after many conversations with investors, advisers and board members, and extensive market analysis, the founder and team chose a new market.

They brought in additional advisers and people with extensive experience in the veterinary market and soon pivoted. The vet space had lighter competition for their diagnostic tests, and there wasn’t as much of a regulatory framework as for human diagnostic testing. The product is selling well and achieving good traction, and the founder maintains regular communications with stakeholders.

Channel pivot

One of my investments was a beverage company that only operated through brick-and-mortar retail. They had planned for a huge rollout with large retailers beginning March 2020, including an emphasis on in-store demonstrations. Then the pandemic hit.

The CEO quickly developed a new plan to move most operations online, called a meeting with all investors and solicited feedback. Because many of the investors had expertise and connections in CPG e-commerce, they were able to give the entrepreneur valuable feedback and ideas that were instrumental to his company’s successful pivot.

The company quickly pivoted to an e-commerce strategy; it was online and fully operational within 45 days. Throughout the critical pivot period, the founder presented monthly updates via Zoom meetings and communicating through email. Because of the transition to e-commerce, this company’s sales are now up 300% from before the pandemic.

Communicate with stakeholders when planning for success

A pivot is meant to alter your business to take advantage of opportunities or mitigate circumstances that could put a big dent in your business’ growth.

The best thing you can do is implement your plan while allowing stakeholders to help refine it. Regularly revisit the new business plan and forecasts, and keep a watchful eye on what success looks like. If initial changes fail to lead to expected results, don’t be afraid to pivot again — even in the middle of an ongoing pivot.

If you find you need to pivot again, continue to collaborate with all of your stakeholders. A pivot is a team effort. Each stakeholder should feel they have a stake in the pivot’s success and that trust within the entire team, including you as the founder and all stakeholders, should never waver.

After the pivot

I can’t emphasize enough how important it is to communicate your progress to investors at least once a quarter after a pivot. Let them know how sales, product development and operations are progressing.

Every pivot has good news and not-so-good news, so be sure to convey the good and the bad. Investor and stakeholder advice will help lead you to a successful pivot only if the information they get from you is accurate.

There’s no shame in pivoting. On the contrary, it’s a sign of strength. If your business needs rapid, dramatic change, a pivot is an opportunity to bring about greater success and will make it stronger.

Keeping all stakeholders involved as part of the team, including investors, is key. Your business isn’t a one-person show. Knowing your investors are completely aligned with your vision and strategy will make success even more likely, and you’ll sleep much better at night.