Heading into 2022, hopes were high that a number of companies that have long awaited their liquidity moment would finally go public. Names like Chime, Stripe, Instacart, Egnyte, Databricks and others. You could throw Figma (anticipated nine-figure revenues in 2021) and Picsart (greater than $100 million run rate) into the mix as well.

Hell, Reltio and Clio recently hit $100 million ARR, and there were a host of other names that we could have put into an IPO list for the current year if the market had held up a few quarters longer.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

But that didn’t happen, of course, and with fintech valuations plumbing new depths, software revenue multiples compressing, delivery models digesting a more IRL userbase and the like, we’ve seen an effective freeze of all IPO activity by technology companies with material venture backing.

And yet, we have a tech IPO cooking. It’s not what you expected. Say hello to Starbox Group Holdings, which is looking to raise around $23 million at a valuation of around $200 million.

And yet, we have a tech IPO cooking. It’s not what you expected. Say hello to Starbox Group Holdings, which is looking to raise around $23 million at a valuation of around $200 million.

Not familiar with the Cayman-based, Malaysia-focused business? We weren’t either. Let’s take a quick peek at its numbers and then lament the current state of the IPO market — such as it is.

Thank you, Starbox

Bellwethers come in varying levels of intensity. If Chime went public in Q3, it would be a critical event for venture-backed fintech valuations, and especially so for the neobanking subcategory that has attracted huge sums of capital and consumer interest around the world.

Starbox isn’t much of a bellwether, as it is both small and relatively unknown; it doesn’t seem likely that a host of startups will get comped to its results. Still, the company’s IPO could provide some signal about the current state of technology debuts in the United States, which would be welcome.

When dying of thirst, one doesn’t check the label on the water bottle found lying on the ground. You just drink it. So let’s twist the cap and have a look.

Starbox self-describes as a “cash rebate, digital advertising, and payment solution business ecosystem,” which didn’t quite assemble in our heads as a cogent explanation. Digging into the company’s filing, it appears that this is the model:

- Retailers (“Merchants”) join GETBATS, offering “cash rebates on their products or services” to potential customers.

- Customers (“Members”) join GETBATS to shop, enticed by offered rebates.

- Data from retailers and customers collected on GETBATS is used to “help advertisers design, optimize, and distribute advertisements through online and digital channels.”

- Ads are shown on SEEBATS (an ad-supported streaming service), GETBATS and via influencers.

- Advertisers are charged “service fees,” which drove “approximately 99.75% and 99.53% of [the company’s] total revenue” in its fiscal years ending “September 30, 2021 and 2020.”

Got it? Cool.

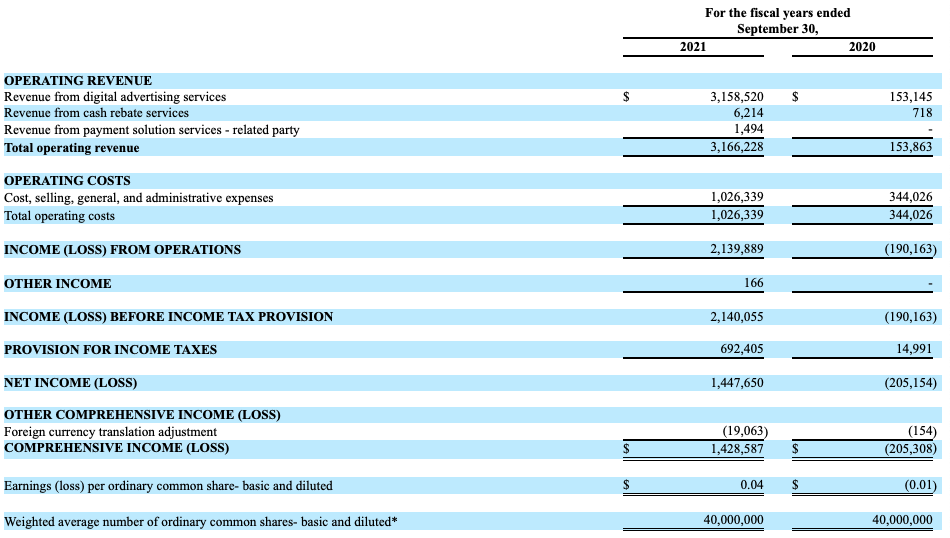

The company has managed to grow its multiparty system. At the close of its 2020 and 2021 fiscal years, the company grew GETBATS’ customer base from 66,580 to 514,167, its retailer base from 478 to 723 and transaction volume from 1,759 to 295,393. How has that growth translated into revenues and losses? As follows:

Image Credits: Starbox SEC filing

Quite obviously, the company is very small, even after posting rather rapid percentage growth in its most recent full fiscal year. And the company even made money. Sadly, TechCrunch was unable to find any more recent financial information in Starbox’s F-1 filing. Given the paucity of more current financial information shared, we anticipate another filing from the company with more data. We’ll update you when we know more.

A tiny e-commerce-advertising IPO is not what we’ve been hoping for, but it’s what we have ahead of us. Looking around, there was a recent, modestly sized debut from Lytus Technologies, an Indian IT services company, that did well when it began to trade. It’s quiet out there.

What could break the logjam?

A brave company with enough scale in a sufficiently busy category going public and doing well. That could mean holding into its final private-market valuation and not losing ground post-IPO.

Last year, that would not have been much to ask for. This year, it’s a tall order. And bravery is in short supply today, with public markets gyrating as the price of money changes and we find ourselves somehow in both a tight labor market and on the precipice of a recession. While the ground is shifting, there isn’t much demand to be first on the dance floor.

So here we sit, clutching the Starbox offering like a candle in the dark, to throw one more hackneyed metaphor into the mix. It’s what we have for now. If you are reading this and are part of the leadership of a multiunicorn, please know that we are tapping our feet. Get to it!