Back in March, I wrote about how BoxedUp pivoted to enable high-end video production gear sharing and its $2.3 million seed round. At the time, the company’s founder Donald Boone stuck out, so when I started the pitch deck teardowns, I knew I wanted to feature BoxedUp in one of the installments.

Today, we’re taking a close look at the pitch deck that helped Boone raise the company’s first round of institutional capital.

I am grateful to BoxedUp for sharing a completely unredacted deck with us — all the details the company used to raise the money are in there, so it is a particularly representative deck.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

- 1 — Cover slide

- 2 — Team highlights slide

- 3 — Business cycle slide

- 4 — Market size slide

- 5 — Problem slide 1

- 6 — Problem slide 2 (shows the price of equipment)

- 7 — Problem slide 3 (problem as experienced by equipment owners: under-utilized premium equipment)

- 8 — Problem slide 4 (problem as experienced by creators: poor rental options and high price)

- 9 — Solution slide

- 10 — Go-to-market strategy

- 11 — “Previous customers” slide

- 12 — Target audience slide

- 13 — Business model slide

- 14 — Traction slide

- 15 — Projection slide

- 16 — Competition slide

- 17 — Market size slide

- 18 — Cover slide (“Where BoxedUp is going”)

- 19 — Road map slide

- 20 — Team slide

- 21 — End slide

- 22 — Use of funds and fundraising progress slide

Three things to love

BoxedUp quickly demonstrates a deep understanding of the market it is in and makes a compelling case for why high-end video and audio equipment makes sense.

As the company outlines in its deck (slide 6), a full set of video equipment for a high-end shoot can cost $100,000 — about the same as a high-end luxury sedan. You wouldn’t buy a convertible for a weekend trip; you’d rent one, so there’s no reason you wouldn’t do that when shooting a music video either.

An excellent illustration of bottom-up market sizing

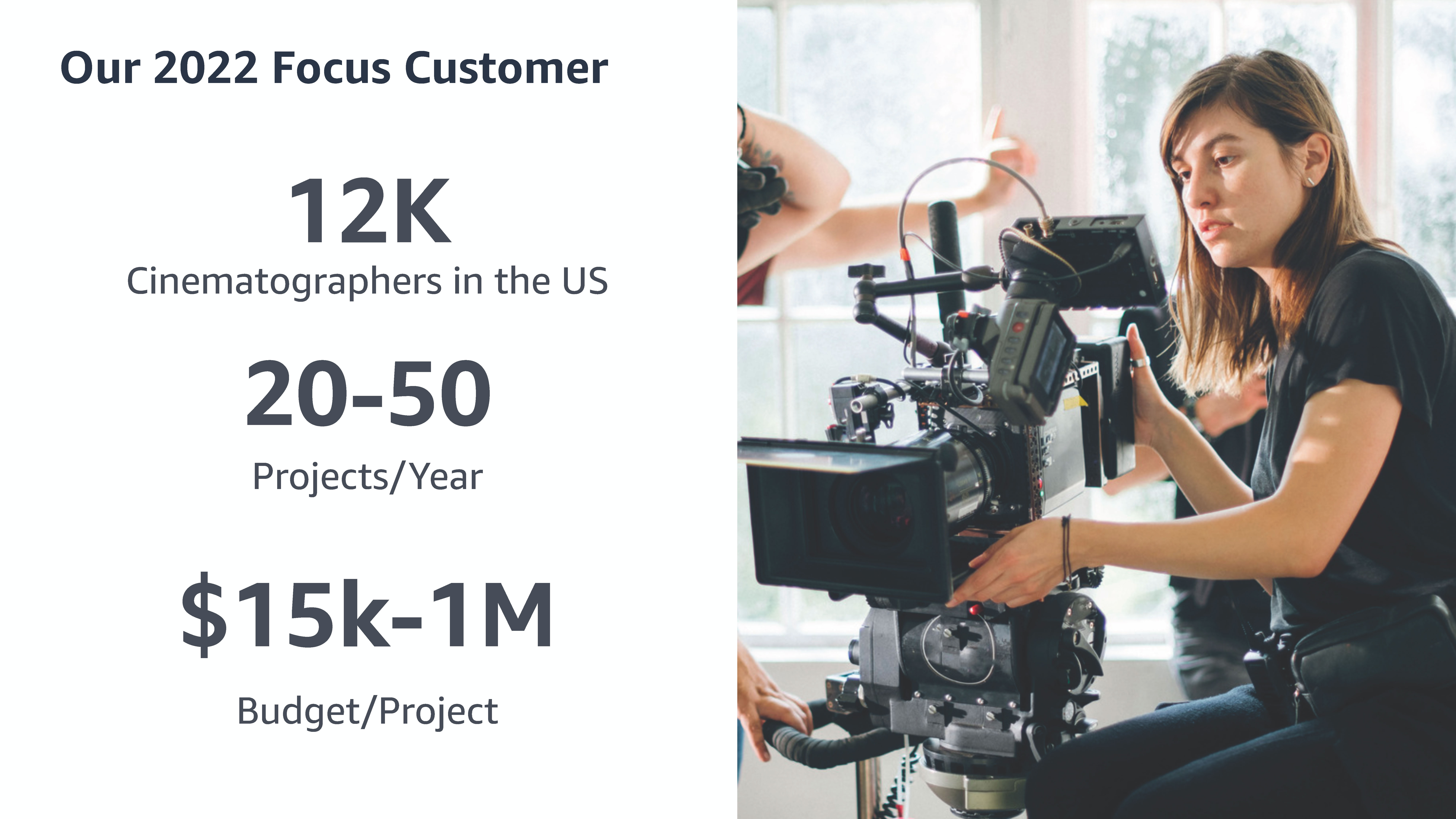

[Slide 12] BoxedUp makes the point that it has a huge beachhead market. Image Credits: BoxedUp.

We can talk about whether those numbers are realistic and what share BoxedUp is likely to grab of that budget, but it tells me one thing for sure: If the founder can defend those numbers in one market, they have a venture-scale business in their hands.

From startup to scale-up

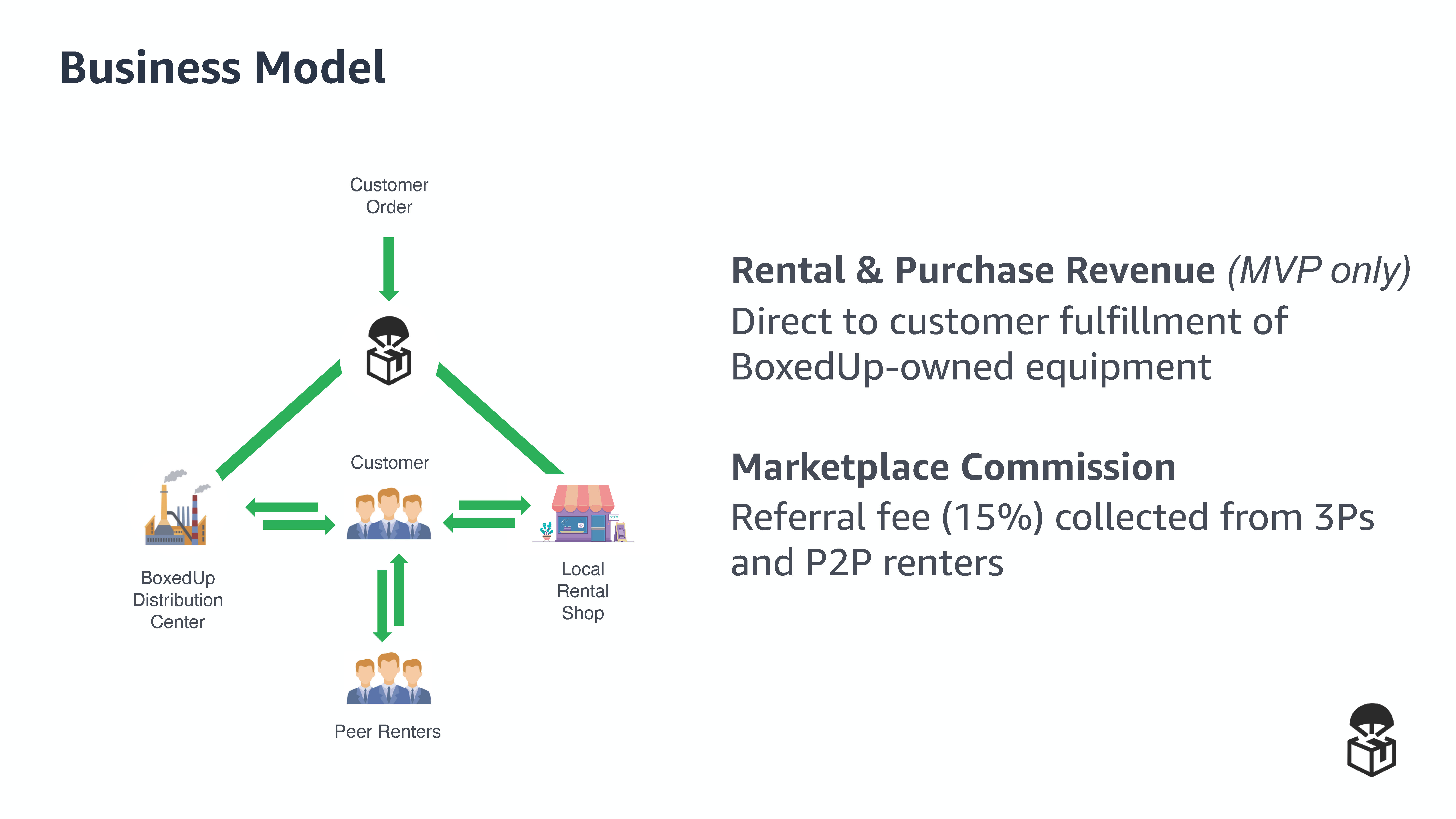

[Slide 13] Marketplaces are notoriously hard, but the company preempts hard questions by tackling the transition head-on. Image Credits: BoxedUp.

Getting to a point of equilibrium is notoriously hard. Too much inventory and the equipment owners get restless because nobody is willing to rent anything. Too many renters, and that side of the equation falls apart, because it gets too expensive (owners are likely to crank up the price), or there isn’t any equipment available.

It’s a delicate dance, but BoxedUp has an elegant solution: Solve the supply side of the market by buying a bunch of equipment it can rent out. That means it can focus its marketing efforts on the renters and fully control the experience. Once it gets traction, it can communicate what it learned to the supply-side along with data about what types of equipment customers want and are willing to rent.

Traction, market segmentation and storytelling

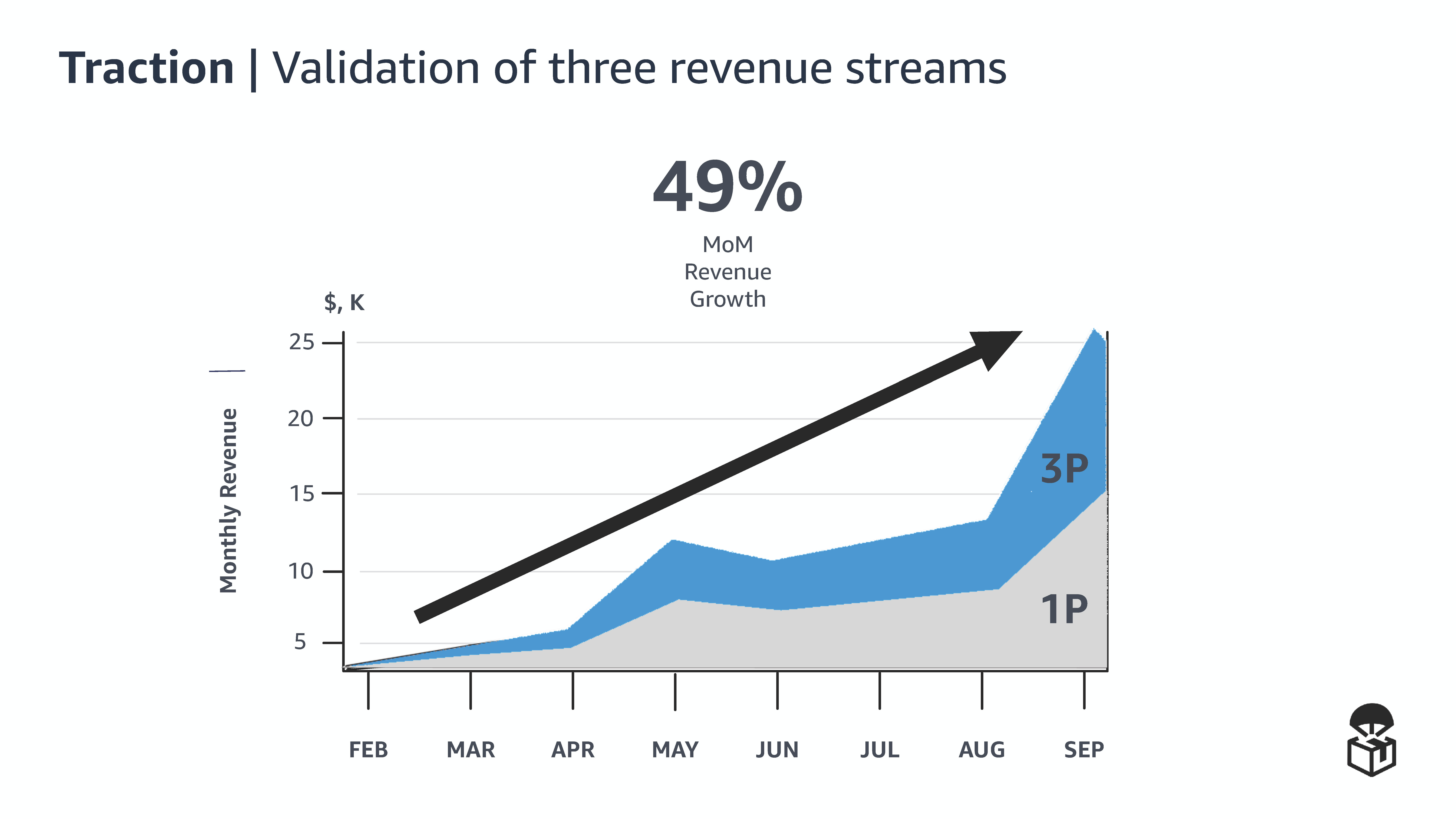

[Slide 14] Rapid revenue growth and smooth growth across both its business models paint a promising picture. Image Credits: BoxedUp (opens in a new window)

Slide 12 explains the size of the market for its initial customer; slide 13 shows how the company is tackling one of the hardest problems with a marketplace economy (supply and demand side imbalance); and slide 14 shows that the strategy is working. There’s about a 50-50 split between first-party rentals (i.e., BoxedUp’s own equipment on the platform) and third-party rentals (i.e., marketplace rentals).

Of course, these numbers reflect the business in September and we don’t know what happened since, but if the company managed to keep its growth trajectory, I’d be very surprised if I don’t end up writing about the company raising a monster Series A round very soon.

Getting storytelling and narrative arcs right is crucial in pitches, and these slides do three things extremely well: There’s very little content on the slides, so there’s no confusion about what the founders want you to look at; they tell a clear and unambiguous story; and the three slides work in perfect concert.

In the rest of this teardown, we’ll take a look at three things BoxedUp could have improved or done differently, along with its full pitch deck!

Three things that could be improved

BoxedUp successfully answers some of the hardest parts of a marketplace startup story in its deck and deserves major kudos for that part of the pitch.

Other aspects of its deck were a little bit more confusing to get a handle on, however.

Slides that don’t stand on their own

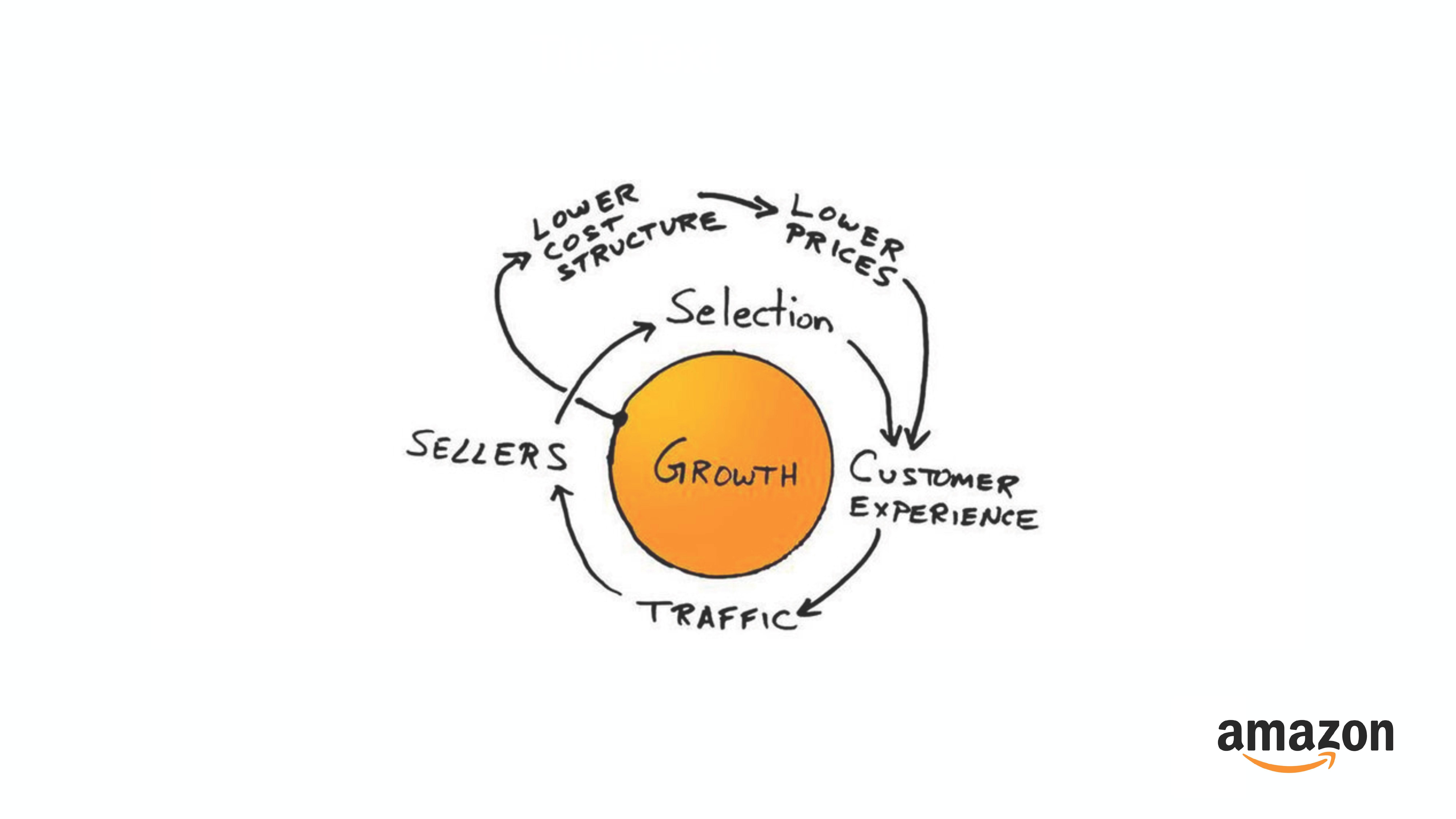

[Slide 3] I … don’t know what this slide means. Image Credits: BoxedUp

In my opinion, pitch decks need to do double duty: They must help enhance the story when you’re pitching and are there to give context and voice-over for the deck. The very best slides, though, can do that and also stand on their own.

This becomes relevant in two scenarios. Some investors insist on seeing a deck before they decide to take a meeting. Sometimes, quickly flicking through a pitch deck is enough to make them give a quick “no.” That is a blessing, as it means you don’t have to waste your time pitching to an investor who would have never invested in the first place.

The other scenario is that after you’ve completed your pitch meeting, an investor will often ask you to send over the deck. In deal flow meetings, where the investment team discusses a potential deal, they might pull up the deck, or a partner who wasn’t in the original meeting might look at it without the benefit of having heard it used in a pitch.

BoxedUp’s deck has a number of slides where I can see the potential and imagine how the founder would talk an investor through it, but I could also be misunderstanding the slide. That’s a recipe for disaster.

On slide 3 (above), for example, I don’t know what those arrows mean. I don’t know what the Amazon logo is doing there. I don’t understand how BoxedUp aims to utilize that growth cycle in the context of its plans and fundraise. It’s also the third slide in the deck after the cover slide, and the team slide, so I don’t really know what the company does.

I’d either add more context, move it to later in the deck or remove it altogether.

Fuzzy market sizing

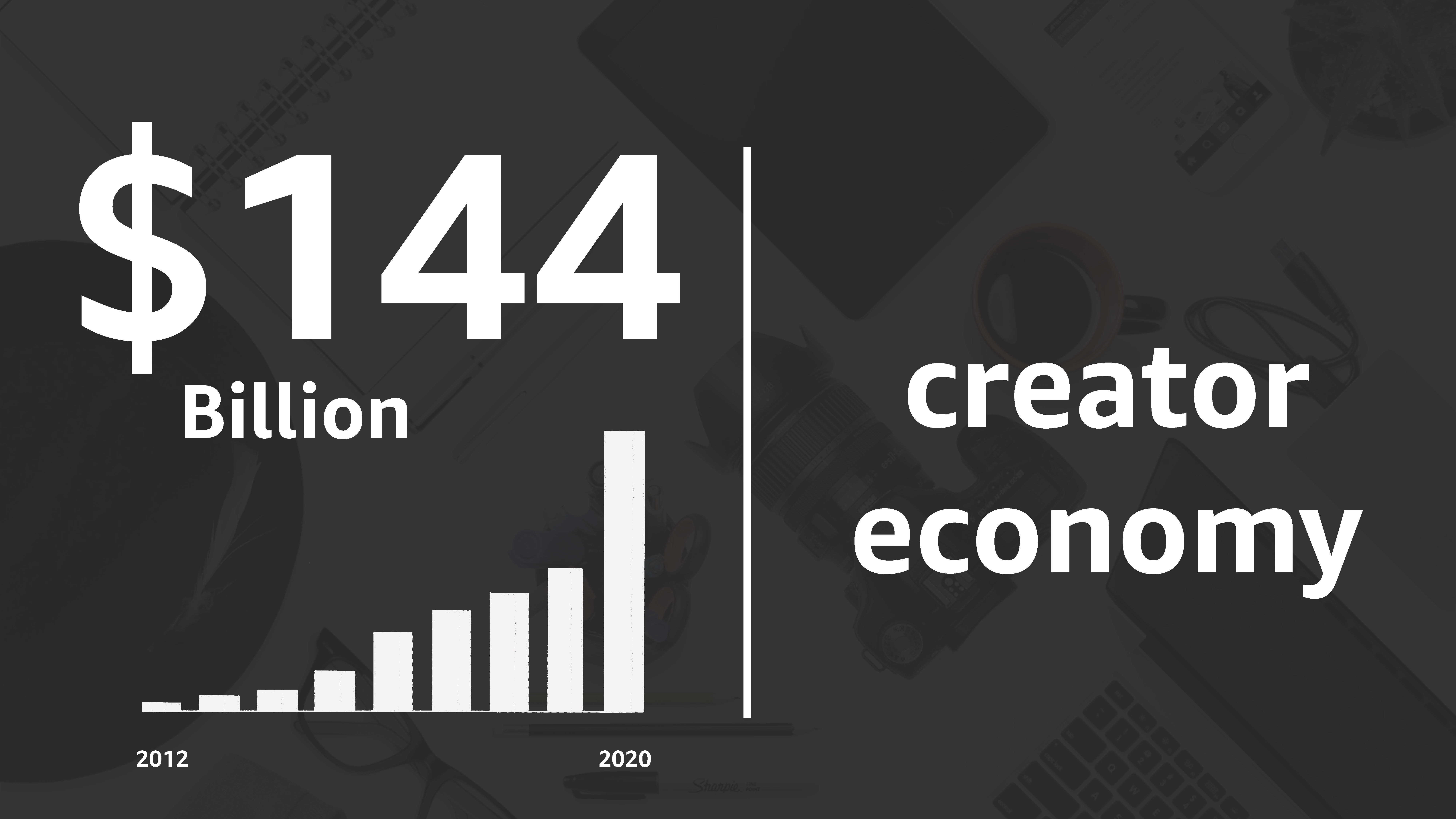

[Slide 4] The creator economy is huge, yes. How does this relate to BoxedUp? Image Credits: BoxedUp

The top-down approach involves finding the total addressable market (TAM), then identifying the serviceable market (SAM — what part of the TAM you can actually service), and then drilling down to the part of the market you can realistically obtain (SOM). We have another article here on TechCrunch+ that goes into depth on that:

The issue with slide 4 is that BoxedUp lists the creator economy as worth $144 billion. That number is big enough to set off alarm bells for two reasons. First, my gut tells me that’s too big, so I make a mental note to find out where that number might be coming from. The other issue is that even if the creator economy is that big, I can’t immediately see how that is related to BoxedUp’s total addressable market. Even if it executes better than every other startup I’ve ever seen, it won’t be able to capture every dollar.

A couple of quick Google searches seem to suggest that influencer marketing is worth $3 billion, and that the overall creator economy is worth $20 billion. Now, I’m just a lowly journalist with Google; investors have access to more sophisticated tools and reports from analysts and will probably be able to get more useful data.

Regardless, the slide doesn’t tell us where the numbers are sourced from, and it’s too easy to poke holes in. Adding a source reference to the slide might be helpful, and I’d argue strongly that the professional A/V sales and rental market is a better TAM to list rather than the entire creator economy.

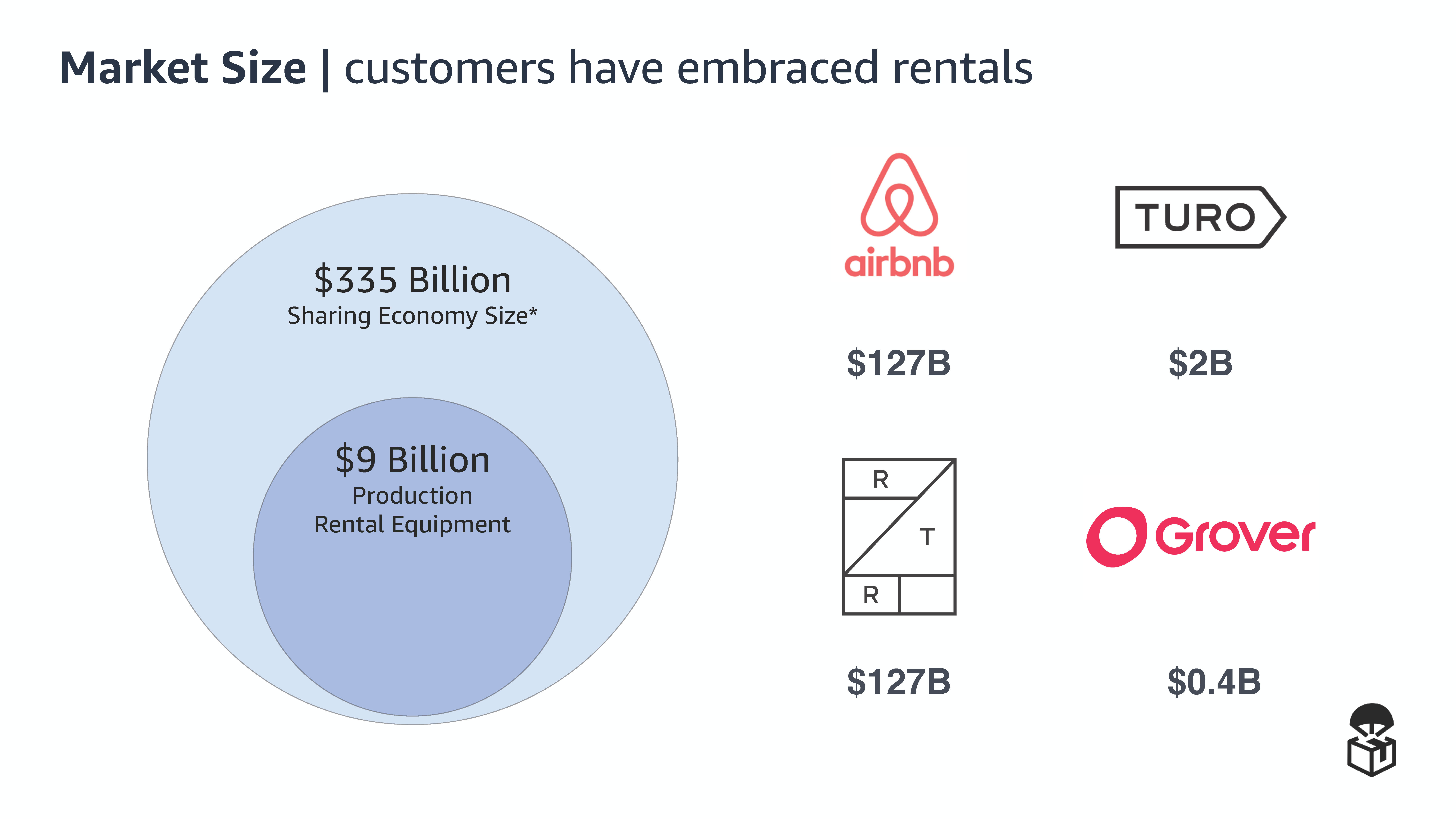

The company makes the same mistake again when listing the market size for the entire sharing economy as its TAM:

[Slide 17] The company lists its TAM as $335 billion. I’d argue the real TAM is the $9 billion production rental equipment number. Image Credits: BoxedUp

Road map surprise

[Slide 19] The roadmap and selection slide goes from A/V equipment into some surprise territory. Image Credits: BoxedUp

As we discussed above, the equipment rental market is a $9 billion market. I don’t hate that the founders are potentially thinking about market expansion, but going from cameras and quadcopters to lawnmowers, personal watercraft and heavy earth-moving equipment in less than a year strikes me as unrealistic.

Diggers and bulldozers are specialized equipment, and companies like U-Haul have the trailer market sown up. There’s certainly space for the sharing economy in these markets, but it seems very ambitious to take this on in the next couple of years when the core business hasn’t yet been proven.

A better way of telling this part of the story might be to make a plan for gradual market expansion and put it in the appendix. That way, you can say, “Right now, we are focusing on high-end A/V equipment, which is a $9 billion dollar market. In due time, we think there are opportunities in markets A, B and C, and we may choose to expand into those markets by acquiring a niche competitor in this space and roll it into the BoxedUp brand.” That seems a lot less scary.

Ambition is great, but it’s a double-edged sword: On one hand, it shows that you are thinking big, but on the other hand, almost every investor I know has been quite seriously bitten by a startup that wasn’t able to focus on its core business. Yes, a million opportunities present themselves to every entrepreneur, but the trick is to stay focused and on mission. Stand-up paddleboards and baby seats seem like a significant departure.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice.