One thing I love about fintech is the promise of unlocking more tools for more people. In a broad sense, the current era of fintech has done just that — people around the world now have access to financial services that were earlier either completely out of reach before, or, at a minimum, prohibitively expensive.

Neobanks, fintech APIs, new savings programs, infinite cards for different payment methods, stablecoins for cross-border payments, cheaper fiat transfers and, of course, zero-cost trading have improved how the average person can use, store and interact with money. It pretty much rules.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The tech has proved darn neat, but there are some issues on the business model side of things. As it turns out, not charging for what was once a paid service is a great way to accrete customers, but it’s also an at-times tricky way of making money. This is a lesson that Robinhood is in the process of learning — and as a public company, sharing with the rest of the world.

This week, Robinhood reported Q1 earnings that were far under street expectations. CNBC notes that the company’s per share loss of $0.45 was $0.09 worse than analysts’ expectations, and that the company’s revenue result of $299 million was off by around $57 million. Shares of Robinhood are trading sharply lower this morning.

This week, Robinhood reported Q1 earnings that were far under street expectations. CNBC notes that the company’s per share loss of $0.45 was $0.09 worse than analysts’ expectations, and that the company’s revenue result of $299 million was off by around $57 million. Shares of Robinhood are trading sharply lower this morning.

Parsing the Robinhood earnings presentation this morning, it’s clear that the equities trading boom that powered its hypergrowth has passed. And, of all the company’s products, the most durable remains its most controversial — yes, Robinhood’s options trading revenues once again accounts for the majority of its transaction income, following declines in the value of stock trades and crypto trading activity.

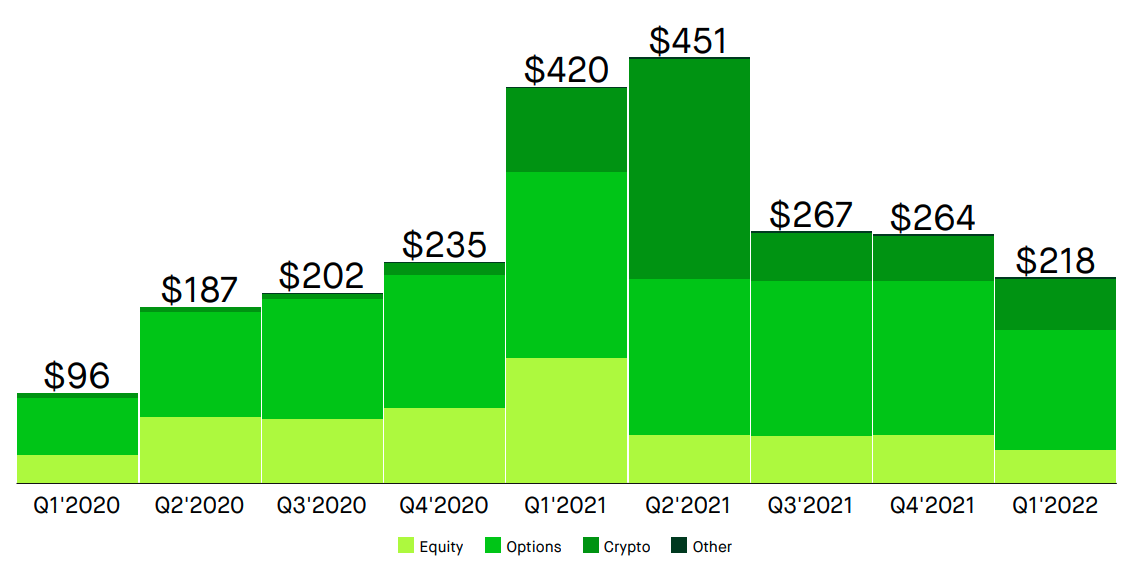

Here’s a chart of Robinhood’s transaction-based revenues since 2020:

Image Credits: Robinhood IR

You can clearly see the rise of crypto trading incomes at Robinhood and their decline from the early 2021 peak. Also observe how equities trading incomes are now modest, descending steeply from prior highs set during the memestock boom.

Notably, Robinhood’s revenue mix shifted significantly to crypto from equities in Q2 2021 before the former also lost its luster in the following quarter. Since then, its trading income has declined consistently.

This chart explains why Robinhood’s value is not only far below its all-time high as a public company, but also less than its IPO price, and its highest private valuation. To a degree, it also explains why Coinbase is setting new record lows in terms of valuation this week.

The trading frenzy that powered both has passed, as consumers appear to be less interested in buying and selling assets.

I can hear your complaint, so let’s answer it. Yes, Robinhood and Coinbase have very different models; Robinhood uses payment for order flow incomes to make trades free, while Coinbase offers trades for set fees. True! But both make money from trading volume, so it makes sense when we see their public-market values move in something akin to tandem.

Back to our initial point: There is something amazing about lower consumer costs for accessing financial tooling. Robinhood remains a great piece of technology for many people who want to buy some shares in companies and save on trading fees. Coinbase is actually under fire due to similar dynamics, with its competitors offering free trades or lower-cost transactions as a bid to lure its users away.

So, consumers are getting more, better and cheaper access to a wider array of assets than ever before, even if the companies offering those services haven’t posted stellar business results recently.

What about startups?

All of the above is interesting perhaps, but not super core to our remit of upstart tech companies. So let’s apply what we’ve discussed to that cohort.

Here’s a list of some Robinhood and Coinbase competitors that have yet to go public, and their known fundraising numbers (Crunchbase data):

- FTX: $1.8 billion raised (source).

- FTX US: $400 million raised (source).

- eToro: $322.7 million raised (source).

- CoinDCX: $244 million raised (source).

- Binance.US: $200 million raised (source).

- Freetrade: $96.3 million raised (source).

- Gotrade: $22.7 million raised (source).

We also have Alpaca (APIs that allow others to build zero-cost trading into their fintech services) or lemon.markets, which offers a similar service. These companies have raised nearly $90 million between them.

The Robinhood issue of seeing zero-cost services endure volume declines and lead to falling revenue is therefore not merely an academic question about a handful of public companies. Instead, it’s perhaps a harbinger of the pain that will afflict the host of yet-private companies with huge valuations, as well as fee pressure stemming from a crowded market.

At a minimum, the collapsing public-market value of both Robinhood and Coinbase make a harsh backdrop for their private competitors to be valued against when they next raise money. The failure of the two public companies to retain market cap could also harm the exitability of our above listed startups. Not good!