Money creates a chain reaction; the more you have, the more you can earn. But it can have an exponentially adverse effect if you don’t have it. This holds true for data as well. Vast amounts of information improve banks’ ability to support customers, but financial institutions must know how to use it.

Today’s banking customer is in serious need of guidance from banks, whether it’s about spending, saving, borrowing, planning or all of the above. After all, two in three Americans today struggle with their finances.

In addition, their loyalty shifts easily, considering that neobanks are more accessible with instantaneous onboarding processes. Modern banks are challenged to familiarize themselves with their customers, dig deeper into the reasoning behind their financial decisions and enhance their fidelity.

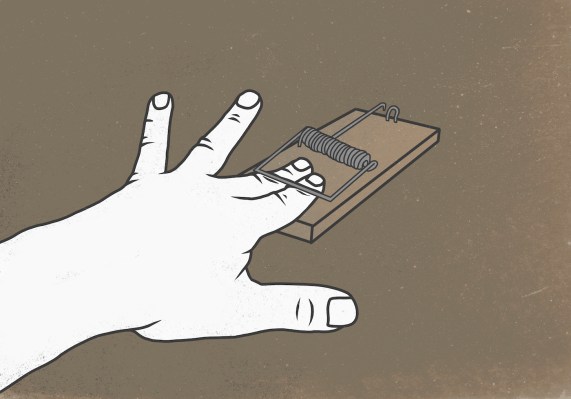

Yet, without knowing what data to look for and how to understand their customer’s individual needs, blanket approaches and loosely categorized consumer profiles leave customers excluded from adequate financial support and the same financial position, if not worse.

For a consumer to share their life with you, they first need to understand the real benefit of doing so.

Let’s look at how modern banks can use data and build trust to improve consumer financial health.

Key pain points for modern banks

Banks must recognize that past financial history and characteristics of those categorized as similar represent merely preliminary reflections of the customer at hand.

Say a young woman took an interest in a $1,000 coat. Algorithms told you that women her age bought this, and your system began to push notifications for BNPL. However, what happens if the woman loses her job? What if she can’t make her BNPL payment?

BNPL can be a convenient way to make large purchases with attractive interest rates, but in an emergency, she might resort to making payments with a credit card. This would extend the life of that BNPL debt while adding additional interest on top. Even if she finds a new job, she might have put herself through more financial struggles, which negates the benefit of BNPL.

It’s all about the whole picture. Open banking provides fintech banks with information from their customers’ primary accounts to inform you where they shop, how much they spend on certain products, whether they have a car and insights into their family. However, staying on top of the latest data protection regulations means you have to constantly readjust operations.

Modern banks need to ensure they are in compliance with privacy and security regulations to make their customer data safe. Under the consumer data rights legislation and the Gramm-Leach-Bliley Act (GLBA), banks must strictly use data for reasons agreed upon with the person’s consent. They need to ensure consumers understand how their bank uses their personal information with third parties.

Here are three steps modern banks can follow to tackle their pain points with data.

Data to determine financial aptitude

It’s essential that banks understand the right metrics to identify each individual’s capabilities. By looking at customers’ transactional data, spending habits and behaviors, banks can acknowledge recurring patterns and better align their products.

No matter the financial status of a customer, if they can pay all their loans and bills at the right time, they are an ideal candidate for a financial institution. Banks can offer digestible loans that benefit the bank and the customer instead of initiating high-interest rates and everlasting debt victims.

In cases of low credit scores or no transactional data, innovative businesses find ways to understand their customers’ financial strengths. For example, the Consumer Financial Protection Bureau designed a survey to test individual financial well-being. The manual process uses a set number of cognitive interviews to ensure people know what they are being asked, and scales users each time they take the test to compare their performance.

Think about when you start a new language on Duolingo — financial aptitude tests can take a similar framework. Like the CFPB, you provide the onboarding customer with content, and they answer the questions to the best of their ability.

Machine learning then assesses users’ aptitude levels based on their responses and will accordingly increase the difficulty levels for the following questions. The length of time it takes to gain complete customer comprehension depends on the variability of the answers. After a few days or weeks, responses start to balance out, and banks can provide suitably manageable loans to their customers.

However, banks cannot test aptitude without training the person doing the onboarding. Depending on your customer base and behavioral data, you may find your customers have a particular set of knowledge, and you should tailor your assessment to them.

Let’s say you are a bank for truck customers. Many truckers take advance pay loans. So in the training you offer, you would explain advance pay, and then question whether they need it in the aptitude test. You may also ask whether they think the help of this loan will reduce their absenteeism.

The answers would show a deeper understanding of the benefits of the loan and increase their aptitude. As a bank, it’s essential to check the consumer’s relationship with the problem to understand their needs and capacities fully.

Banks can stop relying on outdated credit scores by using transactional data, financial well-being surveys or AI-driven aptitude tests.

Drive consumer-centric products with data

Financial institutions that succeed will focus on consumer-centric, rather than product-centric, support. By enabling data to generate the persona instead of categorizing customers based on predetermined groups and judgment calls, banks can pinpoint behaviors and capabilities to provide personalized products.

There are hundreds of data points that enable AI to build a client profile and incorporate new units of information in real time. However, there will be transaction patterns that don’t make sense, and the need for human intervention remains.

Imagine a customer who flew to Atlanta three times in June. They may have been visiting a sick relative, going to a work conference or just setting up a new office, and it’s this reason that will determine the frequency of their travel in the future, and why additional information is needed. Without context, personalization cannot work effectively.

But it’s not just about the data that’s already there. Sales advisers need to actively ask their customers why they make these trips. Diverse groups of people better recognize various customer pain points. For example, if the customer flying to Atlanta visits a sick relative and only speaks Spanish, a compassionate Spanish speaker will receive much better results than what may come across as a misunderstood English-spoken sales pitch.

There needs to be integration between platforms and diversity within banks’ risk organizations to improve the financial health of today’s eclectic market. A diverse workforce can also better train conversational bots to capture contextual information, and humans can read the pattern logic. As a fintech bank, you may rely on sales advisers or chatbots to gain personal responses, but in either case, you need trust.

Build consumer trust and protect their data

For a consumer to share their life with you, they first need to understand the real benefit of doing so. Building trust takes time.

Let’s go back to our Atlanta example. The customer asks: What is the best credit card I can use? An adviser may respond: This is the most suitable product for a,b,c. But, we’ve noticed you’ve been traveling a lot. What is your favorite airline? We have a card that offers x,y,z air miles.

Trust and relationships don’t develop overnight. By making small contextual nudges over time, you can understand your audience and customize products. Focusing on your existing customer evolves loyalty to advocacy, and that’s how you gain your best leads — they start to trust you to support their friends and family, too.

Trust is built on solid pillars, so make those particularly strong when it comes to data. APIs connect organizations and govern how information is shared, displayed and protected. Having a governing interface will help you keep data safe with third parties by monitoring its use based on mandatory security levels and additional requirements you agree to with your customer.

Another way modern banks can protect their customers is with behavioral analytics. Tracking typing speed and tone of voice will detect suspicious behavior, while companies like Innovatrics provide biometric technology with accurate fingerprint and face recognition. This way, you can identify your customer from multiple perspectives, making their persona much more complex to replicate.

You must reassure your customer why you track their typing speed or ask personal questions, and how you will communicate with them — this way, they can know what to expect from your services. Onboarding processes where sales advisers or chatbots prompt the customer to answer questions or approve their apprehension at stages throughout the terms and conditions will ensure clarity. And when you meet your customers’ expectations, they will increase their trust in you.

Financial institutions already have the most valuable data at their disposal. They have broader details on consumer spending, behaviors, needs and desires than any other institution. Open banking provides banks with more efficient solutions for their customers, but this is only possible with strict security regulations or APIs to govern fair use and transparency. Institutions taking the lead in diversity within their team are making more attuned hypotheses on their data and are profiting at a higher rate.

Modern banks’ data used to build accurate consumer profiles and personalized products vary by individual and require customer input and trust. But remember, building trust in an untrusted playing field requires transparency and putting the customer’s, and the employee’s, uniqueness first.