When Zendesk spurned a $17 billion acquisition offer earlier this month, it did so partially on the basis that the proposed transaction undervalued the company, especially in light of its then-pending $4.13 billion attempt to purchase Momentive/Survey Monkey.

But after investors rejected that deal on Friday, it left open questions about how the company proceeds from here.

On February 10, Zendesk declined a major offer from a consortium of private equity firms, partially because it projected that it would have $5 billion in revenue by 2025. With the Momentive deal off the table, the company now anticipates $3.4 billion worth of revenue in the same year, a significant $1.6 billion difference.

Was Momentive’s potential revenue sufficient to justify the price tag that Zendesk was ready to pay, its plunge into the customer experience market, and the fact that it would have led the acquirer away from its core customer service orientation?

Brent Leary, founder and principal analyst at CRM Essentials, says it’s unlikely that SurveyMonkey will become a big player in the customer experience market. “From a CX perspective, I didn’t really see this as an acquisition that would have any real significant impact on the competitive landscape of the industry,” he said.

A product change at Zendesk appears to have helped the company reach more, larger customers, and accelerate its growth while improving its margins.

But you could argue that customer experience is still a logical area for Zendesk to move into, as company CEO and founder Mikkel Svane indicated in a blog post announcing the end of the Momentive deal.

“We believe true understanding comes from taking billions of customer interactions and transforming it all into actionable insights for our customers. We remain as committed as ever to creating value for customers by empowering them with rich, multi-dimensional customer intelligence capabilities and insights,” he wrote.

Leary doesn’t disagree, but says he sees survey technology becoming a smaller part of it as more automated signal gathering takes hold. “While surveys are an important tool to leverage in understanding the current mindset of customers, the acceleration of signals automatically created by digital interactions coming from human exchanges, as well as from using devices will continue to grow exponentially,” he said.

Independent analyst Anand Thaker, who told us at the time of the $17 billion Zendesk acquisition offer that he thought the Momentive acquisition took the company too far off course, says customer experience is an area the company could attack, just in a different way.

“With a robust community as its core asset, Zendesk must invest in value CX expansion options that more seamlessly integrate and rapidly execute throughout their ecosystem,” he said. “Even if that takes more time, Mikkel Svane has repeatedly demonstrated he is a solid and resilient leader and will uncover a more optimal outcome for all stakeholders.”

Regardless of which direction Zendesk takes from here, it’s worth taking a closer look at the company’s growth trajectory in view of the now-defunct Momentive deal.

The growth question

The company’s lower 2025 top line projection confirms that its failed attempt to purchase SurveyMonkey will harm revenue growth. But there’s reason to be optimistic about Zendesk, even without its attempted bolt-on deal. There’s also cause to wonder if adding a slower-growing collection of revenues to Zendesk would have been as valuable as the deal’s price implied.

Let’s talk through the Zendesk positives to start, and then compare the company to what Momentive/SurveyMonkey would have brought to the table.

Zendesk sells its products largely as a bundle today, in what it calls a “Suite” offering. Launched in Q1 2021, Suite has since grown to more than $500 million worth of annual recurring revenue (ARR), per the company’s Q4 2021 report. In the third quarter, Zendesk said that 85% of its new bookings were Suite deals, a figure that rose to 90% in its most recent three-month period.

The future of Zendesk revolves around the suite business, and the early results from the push appear pretty strong. What’s more, the company’s revenue base is tilting increasingly towards large accounts, for example, with some 38% of ARR at Zendesk coming from customers with more than $250,000 worth of annual spend in the last quarter of 2021.

That’s up from about 30% in late 2020. Zendesk had over 100 accounts with more than $1 million in yearly spend by Q3 2021 — to add another datapoint, that was about double its Q3 2020 level.

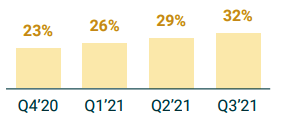

The move to selling its products as a collected unit (Suite) is also helping other company metrics improve. Zendesk’s net expansion rate was 122% in both Q3 and Q4 2021, up from 112% and 114% in Q4 2020 and Q1 2021, respectively. Most importantly, Zendesk posted 32% revenue growth in the last quarter of 2021, tying its Q3 2021 growth rate, each better than preceding rates of expansion by some margin.

The company’s now-dated deck discussing its plans to buy SurveyMonkey had a graph showing Zendesk’s accelerating growth.

Zendesk growth, quarterly, presented on a year-over-year basis. Image Credits: Zendesk

It’s also worth noting that the company’s accelerating revenue growth has come with modest improvements to gross margins. So the company is not only growing more quickly today than it has in recent quarters, the revenue it is collecting at a faster clip is also of slightly higher quality.

To summarize, a product change at Zendesk appears to have helped the company reach more, larger customers, and accelerate its growth while improving its margins. This is why Zendesk rejected the recent takeover attempt. The company has good reason to believe that it is doing well — or at least, better than it was before — and to sell today would be to grant someone else the upside to its improving results.

As for Momentive/Survey Monkey, what would that revenue base have brought to Zendesk? We discussed above that the tie-up didn’t excite the analyst world from a product perspective. But what about from a financial viewpoint? As with product, the numbers aren’t incredibly enticing.

Momentive’s revenue rose 22% in 2020, up from 21% in 2019. That’s far slower than what Zendesk is managing on its own, meaning that if the pair had been smushed together, their resulting aggregate revenue base would be slower-growing than what Zendesk could manage all by itself.

So, perhaps it’s not surprising to see investors balk at Zendesk spending so much to buy a slower-growing bucket of revenue. What matters the most in today’s market? Growth. And slowing growth is worth a fraction of accelerating growth. In a very real sense, then, the reasons that Zendesk rejected its own sale are the same reasons that its investors may have voted down the Momentive deal.

Ironic? Sure, but not unfair.

Zendesk now has to prove to investors that it can keep up its improving growth rates while defending its gross margins. And it has to avoid getting acquired while it does so.