Checkout technology company Bolt continues to make quick work of attracting new capital. The company announced Friday $355 million in Series E financing to give Bolt an $11 billion valuation, according to sources close to the company.

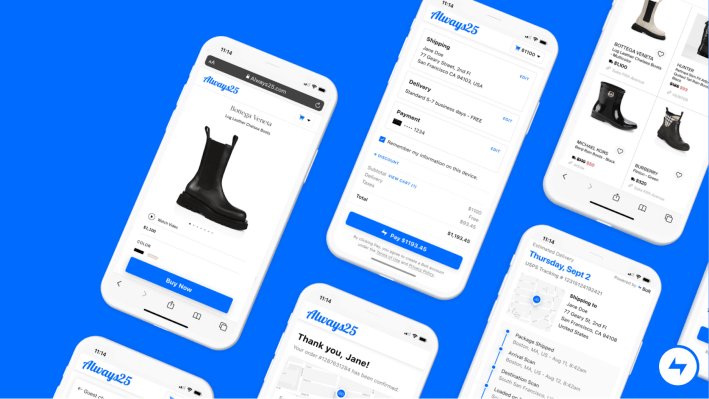

Bolt’s one-click checkout product aims to give businesses the same technology Amazon has been known for since 1997, and at the same time, incorporates payments and fraud services meant to ensure transactions are real and payments can be accepted. In addition, shoppers can create an account once and then use those credentials across a network of hundreds of Bolt network brands.

This newest raise comes just three months after Bolt took in a sizable $393 million in Series D funding. Including the Series E, Bolt’s total funding to date is nearly $1 billion. The company’s valuation is nearly double what it was at the Series D, Ryan Breslow, founder and CEO, told TechCrunch.

In discussing Bolt’s rise to total funding near the $1 billion mark, Breslow explained that the company operates in a space with competitors that are actually worth hundreds of billions of dollars. Depending on the source, that’s companies like Stripe, Shopify and Checkout.com.

“It may seem like a lot of money raised, but actually no, this is capital for us to be competitive,” he added. “We don’t just want to be on par with competitors, but be better. The capital will enable us to bring in the best talent, make strategic acquisitions and expand into Europe, which is important to us.”

On the international front, the company got a head start there in November after securing agreements with both Benefit Cosmetics and PrestaShop, and when Bolt made its first-ever acquisition (of Tipser, a Swedish-based technology company enabling direct checkout on any digital surface).

“We saw how significant Tipser could be for Bolt,” Breslow said at the time. “They had been perfecting their embedded commerce technology for a decade and were the only formidable player. They were stronger than us in areas where we were weaker. It is very strategic to have them on our team.”

Two months later, he says the integration of Bolt’s native checkout and shopper experience with Tipser’s embedded commerce technology continues and that, together, they are already signing up some big customers.

Meanwhile, funds and accounts managed by BlackRock and new investors Schonfeld, Invus Opportunities, CreditEase and H.I.G. Growth, joined existing investors, Activant Capital and Moore Strategic Ventures, in the Series E round.

Ben Tsai, partner at Invus Opportunities, said via email that the e-commerce landscape provides “a huge opportunity to improve the online checkout experience, and retailers are realizing that they are losing customers as a result.”

“Bolt has a growing network of millions of shoppers who benefit from the ease of one-click checkout across Bolt’s expanding network of retailers,” he added. “We’re pleased to support Ryan and the ambitious Bolt team and see tremendous opportunity in the space that Bolt is disrupting.”

Over the past year, Bolt grew its gross merchandise value per merchant by 80% and saw increased accounts by 180% over 2020, while transactions grew 200% year over year. The company also says 100 million shoppers are poised to join the Bolt network over the next 18 months.

Finally, after launching Conscious Culture, a playbook aimed at helping businesses create people-first work cultures, last May, it now counts nearly 80 companies and hundreds of customers in the collective.

Bolt currently has more than 550 employees working remotely across over 200 cities. In addition to talent, acquisitions and international expansion, the new funding will also accelerate Bolt’s goals of putting out a flurry of new products this year.

Within the pipeline are key investments into areas like social commerce, where native embedded commerce will be able to go on any channel: websites, chat bots, in-venue, video streams, games, you name it. Breslow expects this move will put Bolt’s checkout capabilities everywhere. Funding will also be pumped into expansion of consumer products to help shoppers shop more efficiently across Bolt’s network.

Going forward, Breslow sees Bolt unbundling the “Amazon gold standard” buying experience as it launches new products so that any business can not only have the one-click checkout, but also the seamless order tracking, fast returns, fast shipping and membership benefits — all technologies that gave Amazon an early advantage.

When asked if becoming a public company was near, Breslow said that it was not in the immediate horizon nor the end goal.

“We have one goal, and that is to build the greatest company ever,” he added.

Editor’s note, Jan. 26, 2022, 8:56 a.m. PST: BlackRock clarified that funds and accounts managed by BlackRock did not lead the investment.