So-called “Deep Tech” venture capital has been experiencing a wave of interest in the couple last years, with several new funds launching. Many are focused on the European market, which has a deep bench (no pun intended) of talent and innovation, thanks in part to its many excellent universities.

The latest is Outsized Ventures, a new European deep tech focused fund, which has now hit the first close of its inaugural fund of €60 million.

The new fund will focus at “Seed+”, be that shortly after a seed round or just before a Series A round for a startup. The fund aims to invest in roughly 25 companies.

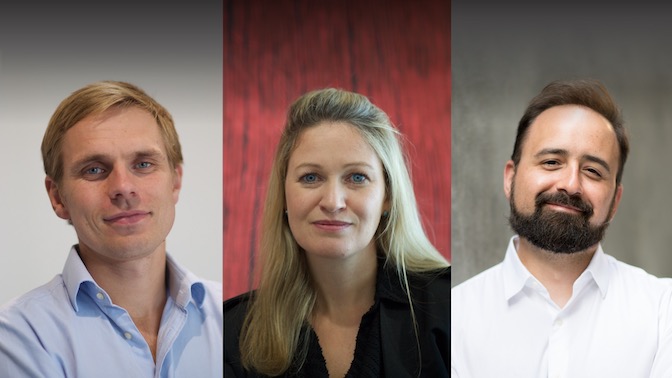

Outsized was founded in March 2021 by Rodrigo Mallo, Isabel Fox and Lomax Ward (formerly of Luminous Ventures and SOSV). The aim is to “back founders pushing the boundaries of science and technology to solve the world’s greatest challenges around the future of health, planet and society.”

“We’ve believed for some time that the next wave of great companies will be at the intersection of scientific disciplines and that Europe is well placed to lead that charge”, commented Isabel Fox, general partner at Outsized Ventures.

Limited Partners in the fund include family offices, angel investors, European founders, global investors and experienced tech startup operators.

Rodrigo Mallo, general partner at Outsized Ventures, added: “We’ve built an incredible community of limited partners as passionate as us and the founders we back, that we can turn big ideas into massive companies to make the world safer, cleaner, healthier and fairer for us all.”

Saul Klein, co-founder of LocalGlobe and one of the LPs in the new Outsized fund said: “There is still much to be done to encourage more women to be founders or investors in science and innovation. Consequently, we’re delighted to support Izzy on this journey and will be working together on key initiatives supporting greater diversity in deep tech and frontier technology. Together we can help make innovation and science more open to diversity and inclusion, whilst generating significant returns.”

Klein has invested via the LP fund he shares with his father, Robin, dubbed Basecamp, which supports seed-stage and micro-funds. This is not to be confused the famous startup of the same name, however.

Another LP, Robert Paull, co-founder and venture partner at Lux Capital, healthcare entrepreneur and Outsized senior advisor and LP, said: “Outsized Ventures is poised to be one of the next great venture firms in Europe. I’m delighted to help them build the firm and assist their portfolio companies, especially expanding into the U.S. market.”

Founders are often faced with the decision of who to bring onto the cap table, especially at the early stage. VCs often promise the earth in order to get onto this all important cap table. So Outsized has come up with what it calls an “Equity Back Guarantee”. This means that if Outsized Ventures turns out to be something other than what was promised, for a three-month period the founder can return the cash and keep their equity.

Lomax ward, general partner at Outsized Ventures, commented: “When you are mis-sold something, you can get a refund. This applies to goods, meals, holidays — why not venture capitalists? Simply put, the most valuable thing a founder has is equity and if we take a piece of that by overselling ourselves, then the founder can take the equity back. It’s as fair as it can be.”

It’s certainly an interesting innovation, and might turn the heads of a few founders, assuming Outsized can get that message out there loud enough.