Enterprise software companies are suddenly focused firmly on healthcare. If you want proof, look at how Oracle and Microsoft both backed up trucks loaded with money to buy health tech companies this year.

At the moment, I’m compiling the top 10 M&A deals of the year, and the top two transactions are today’s $28.3 billion agreement by Oracle to buy Cerner and Microsoft’s $19.7 billion deal to buy Nuance Communications in April. That comes to just under $50 billion for two health-related companies.

Other majors are circling the health market. Amazon has been quieter about it, but over the last year, it too has been looking at healthcare, with partnerships, hirings and programs galore focused on the lucrative vertical. Google’s approach was less certain, as its healthcare vertical leader, David Feinberg, jumped in October to Cerner, the company Oracle bought this morning.

There’s lots of interest because healthcare is a simply huge market. In its announcement, Oracle quoted a popular figure that the U.S. healthcare business alone is worth $3.8 trillion annually. When you extrapolate that figure to the entire world, it’s no wonder big companies are willing to make enormous bets to get a piece of it.

But beyond the obvious market potential, what is Oracle getting for its money? We spoke to some industry experts to get their take.

Let’s start with some numbers. In its most recent earnings report, Cerner produced revenue of $1.47 billion in the third quarter, a rather modest 7% growth on a year-on-year basis. So the company wasn’t exactly growing in leaps and bounds, making it a good takeover target. If you figure Cerner was on a $6 billion run rate, that makes the deal worth just under 5x revenue, which is kind of the middle of the road these days.

In terms of U.S. medical record market share, according to data from Klas Research, Epic leads the pack with 28%, while Cerner is a close second with 26%. While we don’t know how Epic compares in terms of revenue because it is a private company, based on Cerner’s numbers and its relative market shares, Epic should be on a roughly $6.3 billion run rate, per TechCrunch calculations.

Gregg Pessin, senior research director at Gartner, said the deal shows that Oracle plans to be all-in on the healthcare market.

“Oracle has been supporting healthcare for a while with their traditional products. This acquisition demonstrates full strategic commitment to the healthcare provider industry,” Pessin told me.

Anshu Sharma, who runs Skyflow, a data privacy company, and who previously co-founded a healthcare startup called Suki.ai, believes this gives Oracle a big boost in the healthcare records space, putting a big chunk of electronic health record (EHR) data in Oracle’s hands while creating what he calls “shock waves” at Google, IBM and AWS.

“Epic and Cerner/Oracle will end up with all the data, which [puts] Google, Microsoft, [AWS] and IBM in a weird place. They spent hundreds of millions (billions) on AI, Watson, Nuance, Quantum, etc., to be health data players. They are kinda screwed,” he told me.

Sharma says that it also means that Oracle can now offer “Cerner as a service” through Oracle Cloud, which Patrick Moorhead, founder and principal analyst at Moor Insight & Strategies, said should help open up new opportunities for the company’s SaaS and IaaS plays.

“Oracle has had strong software plays horizontally with Fusion and NetSuite. Recently, it has fielded a competitive IaaS with OCI Gen2. Cutting vertically into healthcare would be a powerful move for Oracle, as once you choose a healthcare IT provider, rarely do you change,” said Moorhead, who previously was chairman of the board at St. David’s Medical Center in Austin, Texas.

But John Dinsdale, principal analyst at Synergy Research, a firm that watches cloud market share, doesn’t think it’s going to make an appreciable difference to Oracle’s SaaS or IaaS business.

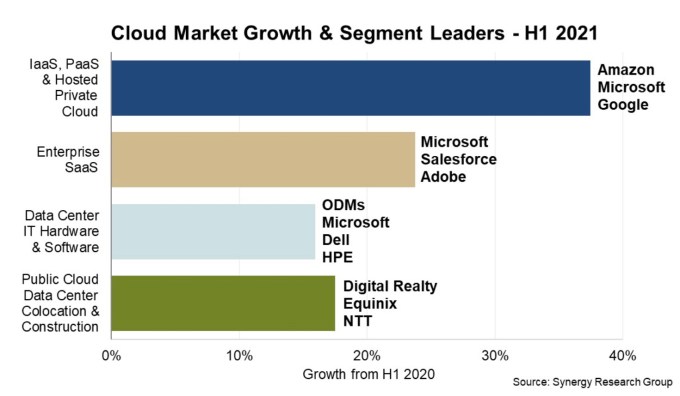

For starters, Oracle’s infrastructure business has been stuck at around 2% share for the last three years, compared with 33% for Amazon and 20% for Microsoft. Meanwhile, its SaaS business has been fixed at around 6% market share over the same period, according to Synergy. Dinsdale said that while Oracle’s cloud revenue has increased, it hasn’t been at a rate high enough to move the market share percentages.

Image Credits: Synergy Research

“Cloud infrastructure services are a game of scale and Oracle has simply lagged far behind the market leaders. Oracle has increased its capex substantially in the last two quarters and launched new cloud regions, but its current investment levels remain dwarfed by the spending of Amazon, Microsoft and Google,” Dinsdale told me.

What impact could the Cerner deal have on those numbers? “In SaaS, Oracle would have to much more aggressively transition its on-premise client base to a cloud consumption model while also sucking up a higher share of new accounts. I don’t see how Cerner makes much of a difference in either of these cases.”

Even if the deal pushes EHR data to Oracle, something that regulators may take a closer look at as the deal progresses, it doesn’t mean it will have an appreciable impact on the company’s overall SaaS and infrastructure market share. If the deal eventually passes muster, that may not matter if it becomes a cash cow, as NetSuite has for the company.

If it eventually feeds the revenue engine every quarter, investors might not care about the rest, but right now they don’t seem to be terribly optimistic, with the stock down over 5% on the deal news. Cerner stock, on the other hand, is up around 1%.