By the time CapitalG signed on for Webflow’s Series B, the no code web design service was already profitable — a rarity for an early-stage company. It was a good position for the company and investors alike. For CapitalG, it was clear that the startup was already on the right path. And for Webflow, it meant a bit of leverage and — perhaps more importantly — an opportunity to be choosier about who it brought on as investors.

Of course, this isn’t an option for every company. For a variety of reasons, it’s not always possible to take such a deliberate approach to launching a company — and profitability can seem like a downright pipe dream in those early days. If there’s one thing we’ve learned from doing these TechCrunch Live chats week in, week out, it’s that there’s no one-size-fits-all solution.

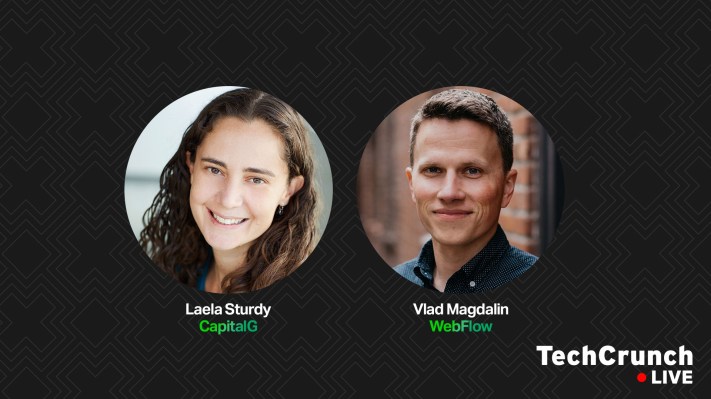

That said, there are some universal takeaways when it comes to finding the right investment firm. To hear CapitalG General Partner Laela Sturdy and Webflow co-founder and CEO Vlad Magdalin tell it, the investor/startup relationship has become a kind of genuine friendship. It’s a quality both parties point to as key for making these sorts of deals. At the very least, neither side benefits if the other is looking for a quick out.

As great as Zoom is, to me, that in-person experience takes you to the next level of getting to know someone. Laela Sturdy

In-person is still important

Look, I recognize the irony of talking about how important in-person meetings are during a Zoom interview. And it’s likely true that a significant number of the biggest deals are happening in a virtual forum these days, but it also seems likely that the in-person meeting isn’t going anywhere in the long run — even if the handshake part of the deal is on the way out.

“We started to exchange some emails and had a couple of Zooms,” Sturdy said. “We were still in the heart of the pandemic. I was conducting most of my business on Zoom and just starting to see some friends and family outside, six feet at a distance. Our first couple of conversations over Zoom, I was enjoying getting to know Vlad and the business. I floated the idea that we could maybe get together in real life, which, at that time, sounded like a very unusual thing.”

“I know we had some great conversations over Zoom, but feeling that shared chemistry to get to know each other and continue that excitement and confidence that we want to start a partnership, I think that’s what made me really excited to meet Vlad in person,” she added. “As great as Zoom is, to me, that in-person experience takes you to the next level of getting to know someone.”

And while virtual meetings will almost certainly continue to have their place for an increasingly distributed workforce, Magdalin described a kind of intangible human experience that’s lost with remote meetings: “There are people who work at Webflow on our leadership team who have never met in person before but are still hungry to when the world opens up. One of the things we used to do were annual retreats as a thing, and there’s no way you can replace that with the virtual world. There’s just too many human aspects. You need that energy in person.”

Getting to know you

Chemistry is important. Sturdy admitted that she has turned down deals with promising startups over not being able to gel on a personal level. Like hiring a new colleague, looking at long-term outcomes requires finding people you’re going to want to work with through the countless ups and downs of fostering a startup.

“For me, it’s really important that the investment is a partnership,” Sturdy said. “We’re investing money, but we want to invest much more than that. We want to invest our own blood, sweat and tears and the resources of CapitalG and our own network into helping make the company, founders and team successful. … Teams have always been the foundation of what I care about and what motivates me — people that I’m showing up every day to solve problems with. I’ve also been investing and operating long enough that I’ve been through a lot of ups and downs, and particularly in the downs, if you are not really locked arms with people and there’s not mutual respect and trust, it’s a really miserable place to be.”

Webflow’s slow and deliberate growth afforded the company the opportunity to be more mindful about entering into partnerships that would define the startup for years to come. In many ways, the move runs counter to common practice in a world where founders have a fundraising-first approach to growth.

“When I started, the common knowledge about venture partnerships was you optimize for check size or there’s this board you’re going to be accountable to, and they’re there to return money on capital,” Magdalin said. “It almost made it really scary. It made it a more one-sided equation. What I wish that others had told me earlier is that it is a marriage in many ways. There are so many ups and downs that knowing the other person cares about you and consider you their equal — it’s so much better when it’s a partnership.”

“There are a lot of horror stories where investors come in and control the business or kick out founders,” he added. “That relationship wasn’t built from the ground up in a mutually beneficial way. For any founders listening, I encourage you to get to know the people you’re going to partner with, because, like Laela said, it’s a multidecade journey.”

False starts

Of course, that slow growth wasn’t entirely by choice. Magdalin explained that he started the company four different times, finally gaining sufficient momentum this last time out.

“It took us six or seven years to get to a place where we felt like we could control our own destiny. We didn’t feel desperate to raise,” he said. “Founders always have that leverage, potentially, where they might have to live out smaller ambitions for a while, but they can have a lot of time to consider the right next step. Sometimes founders take too big a shortcut to get the biggest check and then they get themselves into a situation where they’re potentially over their heads.”

Asked whether four false starts constitutes a red flag for a startup, Sturdy said not necessarily. As with any other big investment, a company needs to be assessed as the sum of its parts.

“When I looked into why this was happening, it made a lot of sense to me,” she explained. “It was actually a huge advantage that they built this bottom-up growth. And now they’re at a point where it’s a great opportunity for a growth investor like CapitalG to come in and say, ‘There’s ways we can do this even faster, because our foundation is so, so strong.’ Every company is unique. UiPath was around for 10 years before I invested in their Series B and had a similar trajectory. There are some great examples of companies that have really built into their best-in-class product and market position.”