The tax code contains provisions that encourage investments in the technology startup ecosystem and small businesses by rewarding founders, VCs and investors for taking high levels of risk in founding or investing in a startup. One of these provisions is the Qualified Small Business Stock (QSBS) or Section 1202 stock, which offers the opportunity to eliminate capital gains tax entirely if specific requirements are met.

It is important to note that this 100% capital gains exclusion, made permanent by the Obama administration, has been included in the draft legislation by the House Ways and Means Committee, and includes a proposed cut from 100% exclusion to a 50% exclusion for gains recognized on the sale of QSBS. For the purpose of this article, I’ll speak specifically to the 100% exclusion.

You can learn more about the QSBS rules and requirements here. One rule we discuss today is that stockholders must meet a five-year holding period to qualify. However, not everyone can time when to sell their company. The fact that many acquisitions happen before five years leaves some founders and investors short of qualifying for these powerful tax savings.

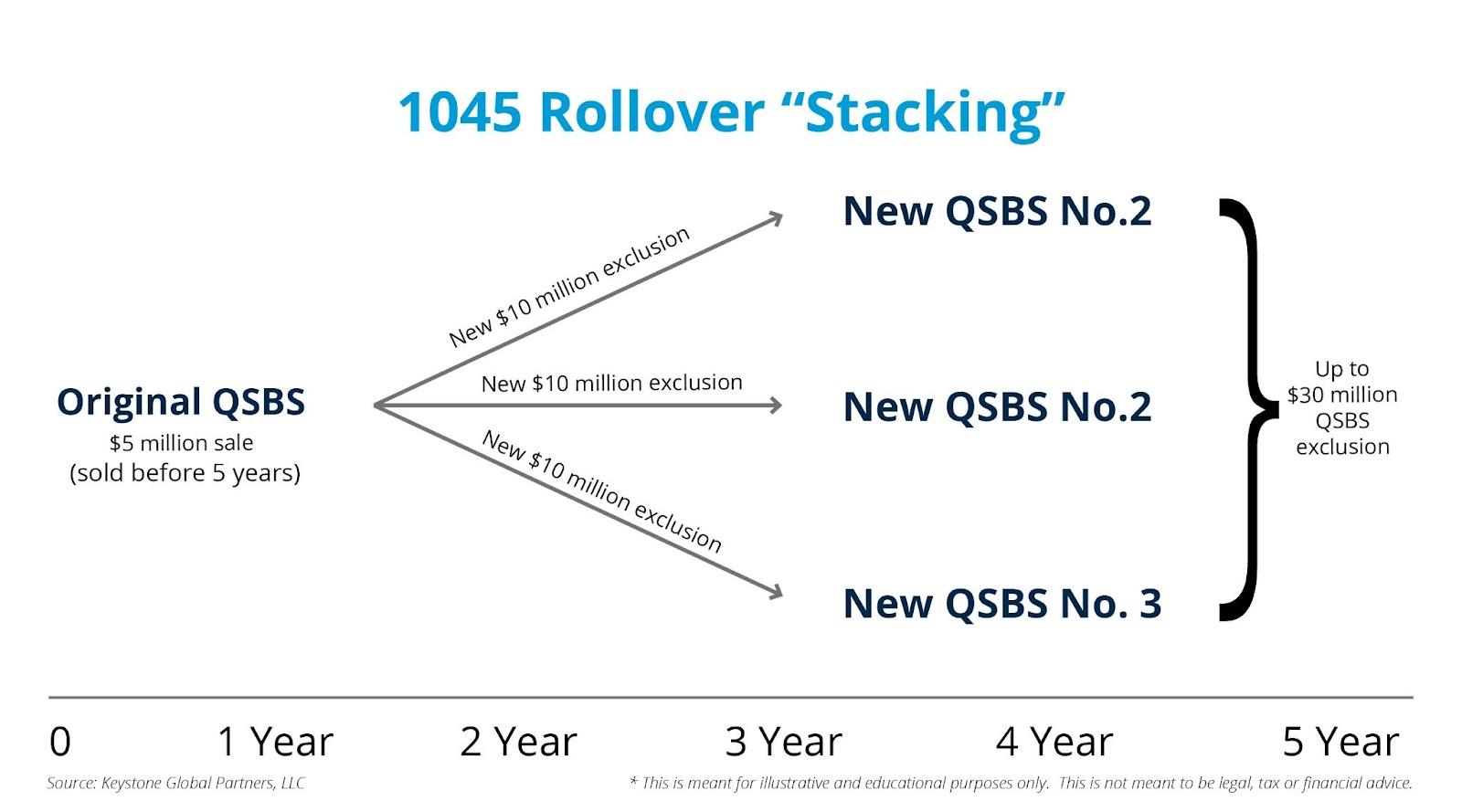

Stockholders can multiply — or “stack” — the benefit of a 1045 rollover by spreading the QSBS exclusion to more than one new investment.

Section 1045 can salvage the opportunity in some cases.

What is Section 1045?

Section 1045 allows a founder or stockholder whose company has been sold before the five-year holding period to defer the capital gains by rolling the sale proceeds into a replacement QSBS.

Benefits and opportunities

A 1045 rollover enables founders and investors to take advantage of multiple tax benefits and opportunities they would otherwise miss.

Extended tax deferral

With a 1045 rollover, the stockholder can defer taxes on the sale of the original QSBS by investing in a replacement QSBS. Under the right circumstances, tax can be deferred until the replacement QSBS is sold.

If the combined holding period is five years and other requirements (discussed below) are met, no federal capital gains taxes are due. But if the requirements are not met, then taxes will be due upon the sale of the replacement QSBS.

Shortened holding period

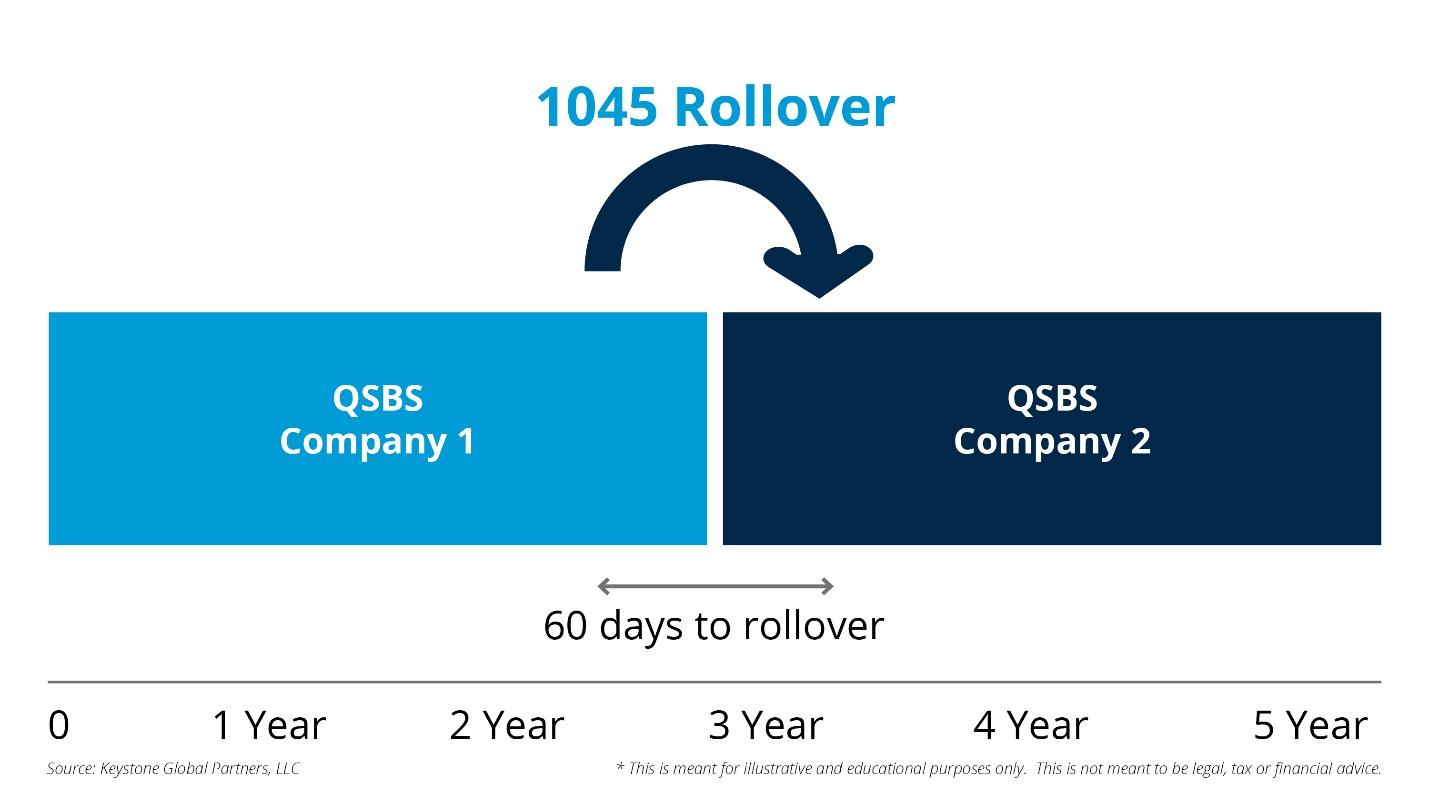

Typically, the holding period for all taxable exchanges will begin the day after the exchange. However, the holding period for the replacement QSBS includes the holding period of the original QSBS, avoiding a reset of the five-year requirement. This means a 1045 rollover shortens the next QSBS holding period requirement and allows the clock to continue ticking.

1045 Rollover. Image Credits: Keystone Global Partners

QSBS exclusion stacking

Stockholders can multiply — or “stack” — the benefit of a 1045 rollover by spreading the QSBS exclusion to more than one new investment. Specifically, Section 1045 allows for one $10 million exclusion per company. By rolling proceeds into more than one company, the seller qualifies for the $10 million exclusion multiple times over, stacking the benefit in their favor.

Section 1045 rollover requirements

To qualify for the tax-deferred rollover of a QSBS gain into a replacement QSBS under Section 1045, specific requirements need to be met. The original company must qualify for QSBS, and the new company must qualify for QSBS both at the time of rollover and after the rollover is complete. In addition, you’ll need to pay close attention to timelines and other key qualifying measures.

Section 1045 rollover timeline

It’s important to note that the Section 1045 election is made on the tax return for the year in which the initial qualified business stock is sold — not when it’s rolled over into a new investment — even if the process extends into the following year. But you can’t delay for long. You only have 60 days from the sale of the original QSBS to roll the gain into a new QSBS investment.

Further, not only must the original QSBS be owned for more than six months prior to the sale, but the replacement QSBS must also meet requirements for at least six months to qualify for the deferral on the original QSBS sale. To avoid missteps, you’ll need to pay attention to the calendar.

The pro-rata rule

In order to defer 100% of the tax, you must roll 100% of sale proceeds into the new QSBS. Just rolling the gain isn’t an option.

So if you want to defer the entire gain, you have to roll 100% of the proceeds to the new investment(s). If you roll less than 100% of the proceeds, you only defer a pro-rata portion of the gain.

Section 1045 rollover requirements might seem restrictive. But by diving deeper, you’ll see that what could’ve been a heavy tax burden now opens you up to a whole new world of potential tax savings opportunities.

Section 1045 QSBS strategies for founders

Now that you know more about Section 1045, you might wonder if this would be beneficial for you. It depends on your circumstances, big-picture financial plan, timing considerations and willingness to implement advanced tax and business investment strategies. Like with all advanced tax strategies, you’ll need to run this by your professional advisers, CPA or lawyer.

Below, we highlight the most relevant Section 1045 strategies for founders.

Invest in QSBS eligible companies

As someone involved in the tech ecosystem, you likely already invest in other startups. So if you have a desire to continue to invest, you’ll need to know how to proceed to leverage these tax provisions.

At the most basic level, you’re simply rolling your sale proceeds into one or multiple QSBS startup companies.

For example, let’s say you’ve been running your company for three years, and it is now being acquired. Congratulations! The sale proceeds are $5 million, and you decide to reinvest the proceeds into three new QSBS eligible startups via a 1045 exchange. By stacking the benefit — with $10 million in exclusions for each company — you now have $30 million of total QSBS exclusion. This also applies to angel investors or VCs who have an exit on one of their investments.

1045 rollover stacking. Image Credits: Keystone Global Partners

Tip: If you already have investments lined up, this could be a good strategy. But don’t rush to invest in questionable deals just to meet the 1045 rollover requirements. We always tell our clients not to let the tax tail wag the investment dog.

Acquire one or more QSBS companies

If your startup or the one you invested in is being acquired, maybe you don’t just want to invest in a new venture, but you’d like to acquire a controlling stake in a company or multiple companies yourself.

If you are going to use your 1045 rollover to acquire one or more QSBS companies, you’ll need to implement the strategy within 60 days. However, the following strategy creates more time to actually find and make your acquisition.

A newly formed C corporation could be created, and you would need to roll the proceeds of the original QSBS into the new company. This newly formed C-corp can then acquire a new QSBS eligible company.

For QSBS to apply, the holding period of the actively engaged new company must be at least 80% of the total holding time period, including the search time frame.

For example, let’s say it takes eight months to acquire a company. To meet the 80% requirement, the holding period of the actively running QSBS company must be 32 months.

Tip: It’s possible to leverage multiple C-corp entities for diversification and stack the QSBS to claim multiple $10 million exclusions.

Start a new QSBS company

For founders ready to start a new company soon after an exit, this strategy could be useful.

To implement this, you’ll need to form a new C-corp and roll some or all of your sale proceeds into the company. By doing this, you can tack on the holding period, get a new $10 million exemption and defer the gain.

Tip: This strategy can also serve as a layer of protection. If the business fails, you have the option to wind down the company and possibly qualify to exclude the capital gain from the original QSBS for any funds returned. This assumes that the new holding period combined with the tacked-on initial holding period is greater than five years.

Conclusion

This portion of the tax code is written to encourage job creation, innovation and reward entrepreneurship, which always involves a high degree of personal risk. You’re playing a vital role in the economy, and you have a variety of options to stay in the game, fund your fellow founders or step back and use the insights you’ve acquired to put your money to work for you.

Before considering any of these strategies, be sure to work closely with your legal counsel or accountant.