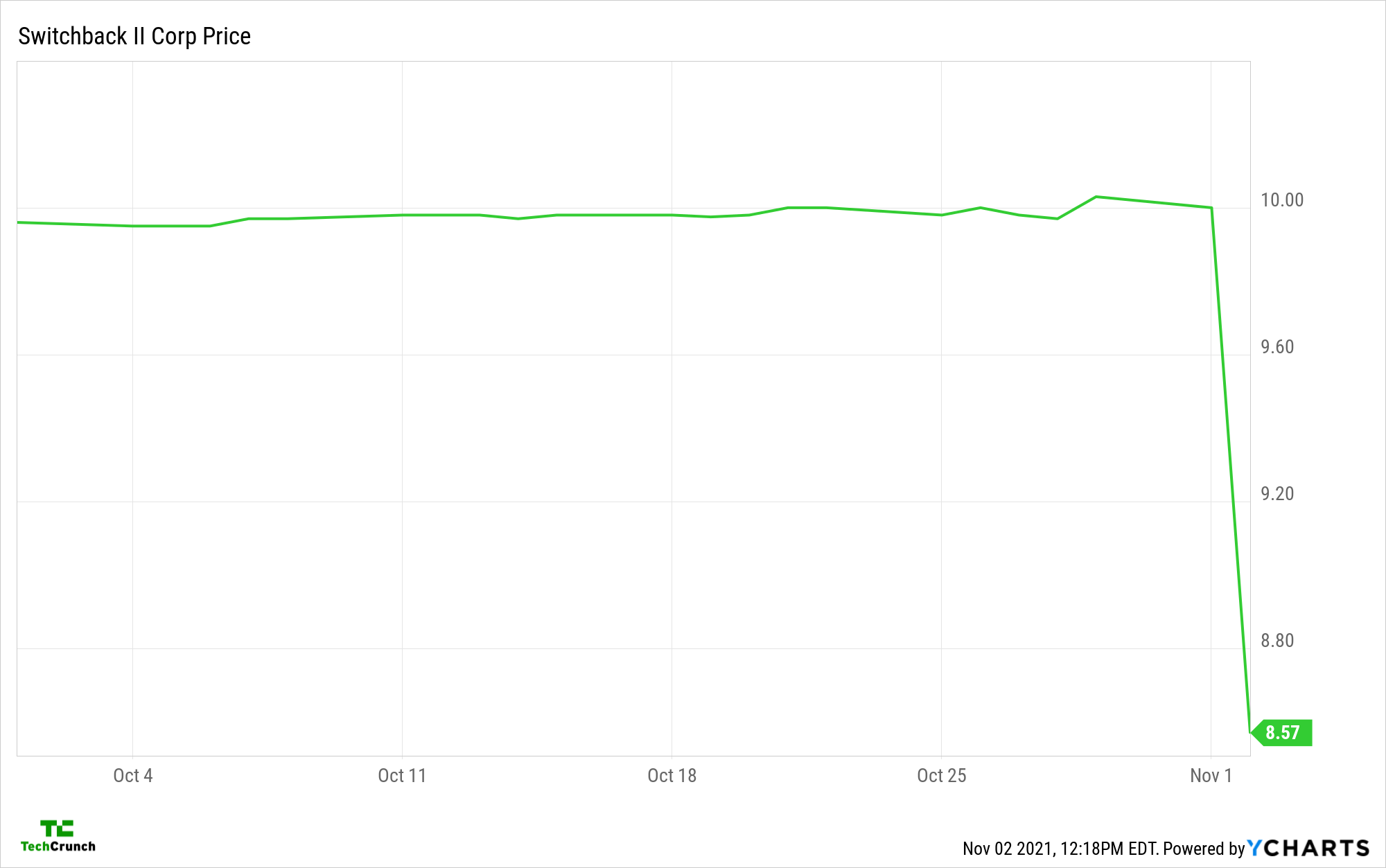

Shares of Switchback II Corporation are off more than 14% in morning trading today, appearing to sell off sharply in the wake of news that the blank-check company’s merger with scooter company Bird has been approved by shareholders. Shares of the SPAC were off as far as 20% before recovering.

dot.LA first spotted the vote news; Bird is based in the Los Angeles metropolitan agglomeration.

News broke in May that Bird was looking at a SPAC-led debut on the public markets. A few days later, the deal was confirmed, including an expected valuation of around $2.3 billion for Bird when it began to trade. That’s precisely what the company will be worth in light of Switchback II’s share price declines, but the number could be lower than the headline figure from early merger disclosures.

Image Credits: TechCrunch/YCharts

When the Bird deal was first announced, TechCrunch was broadly skeptical of its historical economics. The company’s early business model of buying scooters and renting them out led to staggering losses.

However, Bird has shaken up its model in recent quarters, leveraging a partner network to handle scooter deployment, which has generated more attractive results. For example, Bird had gross margins that were negative in 2018, 2019 and 2020. This year, the company expects — looking at predictions that included results through Q2 2021 — to post positive gross margins.

Other figures are looking up, too. Ride profit inclusive of depreciation, to pick another example, rose to $15.4 million in Q2 2021, its best result ever, and one of only four quarters in which the result was positive.

Under Bird’s new business model, scooters go directly to indie operators, who take on a bulk of the operational work that the company once centralized. The company’s model changed around when the pandemic hit, which, accompanied with improved scooter designs that promise to last longer and so improve depreciation results, have provided a positive boost.

So what?

We lack Q3 2021 results from Bird, at least per SEC filings as of the time of writing, so it’s hard to say how the company’s recovery has proceeded since the second quarter. However, investors are giving the deal a thumbs down despite the transaction passing its democratic muster.

It’s not great to have your blank-check deal approved only to have investors drop your stock. You may wonder if some investors expected the deal to fall through and so sold their shares when it passed. Perhaps they had been asleep for some time.

It would be easy at this juncture to snark at Bird and its historical results that were, to put it mildly, lacking. But the company’s model shake-up has posted legitimately interesting results. What Q3 shows will help set investor interest after the combination is consummated later this week and Bird formally begins to trade under its own moniker.

Until then, we wait.

Bird’s impending debut is pretty important for startups like Tier, which are busy raising nine-figure rounds for their own scooter operations. If Bird manages to post strong Q3 results and recover lost ground in terms of its public-market value, Tier et al. will have a public offering to point private-market investors to. If Bird’s Q3 numbers are slack or its market cap dips regardless, it won’t bode well for startups hoping to also secure a multibillion dollar exit in time.

We have almost closed the chapter on Bird’s private-market life, a tumultuous run that included huge capital raises and a pretty stark early pandemic business period. But Bird refused to stop flapping its wings, made progress in righting its economics and overall financial performance and will achieve exit velocity later this week.

More when it begins to trade.