You’ve heard of SPACs, meme stocks and buy now, pay later, but have you heard of the LTSE, First Women’s Bank and Upsolve?

Through the pandemic, a trove of attention has been paid to new market structures and activity that are deemed short term, risky or speculative. Whether they are and what net outcomes they yield for various stakeholders are useful questions.

But the noise has muted analysis and coverage of other highly ambitious technology ventures — ones that aim to uplift and correct financial markets by encouraging longevity, community and empowerment.

Longevity: More choices to go and stay public

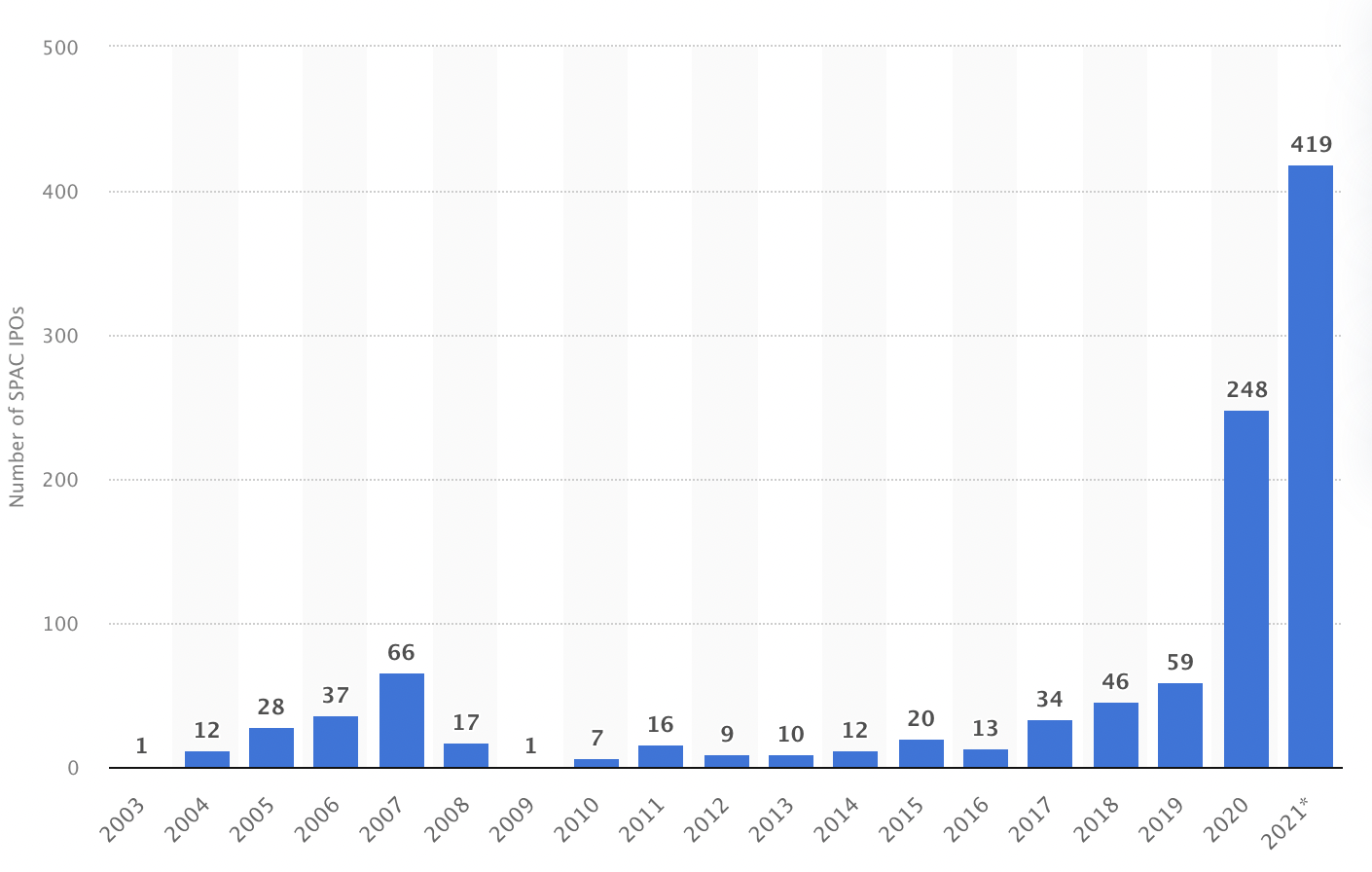

The volume of special purpose acquisition company (SPAC) IPOs we have seen through the pandemic is astounding in historical terms.

Image Credits: Statista (opens in a new window)

Leaving out the sponsors, private market investors and participating startups, reactions to SPACs have been largely negative. The binary views are reminiscent of those we saw during the ICO frenzy in 2018.

Debates on whether the pandemic’s cohort of SPACs or their status as a liquidity structure are net positives or negatives have overshadowed other ambitious initiatives that aim to encourage more long-term planning and participation in markets. One example is the Long-Term Stock Exchange (LTSE).

This August, Eric Ries’ LTSE listed its first two companies, Asana and Twilio. Companies that list on the exchange must adhere to its five principles, which aim to maximize diversity and inclusion, environmental and social impact, employee welfare and long-term conviction.

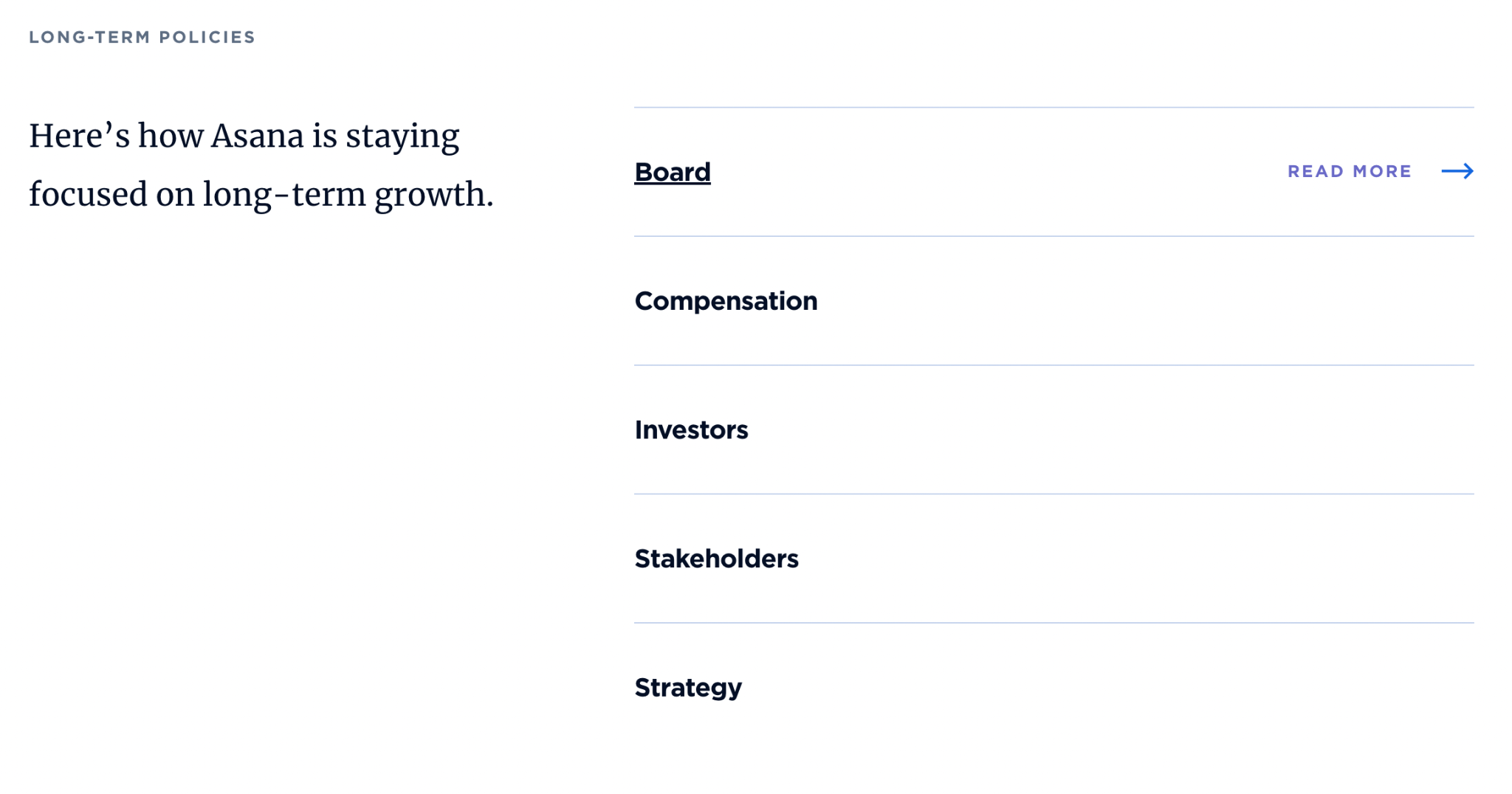

The LTSE emphasizes a focus on transparency — for instance, when an LTSE user searches for information on Asana, they’ll first find information about the company’s values, long-term principles and growth metrics.

Screenshot of a search for Asana on the LTSE. Image Credits: LTSE

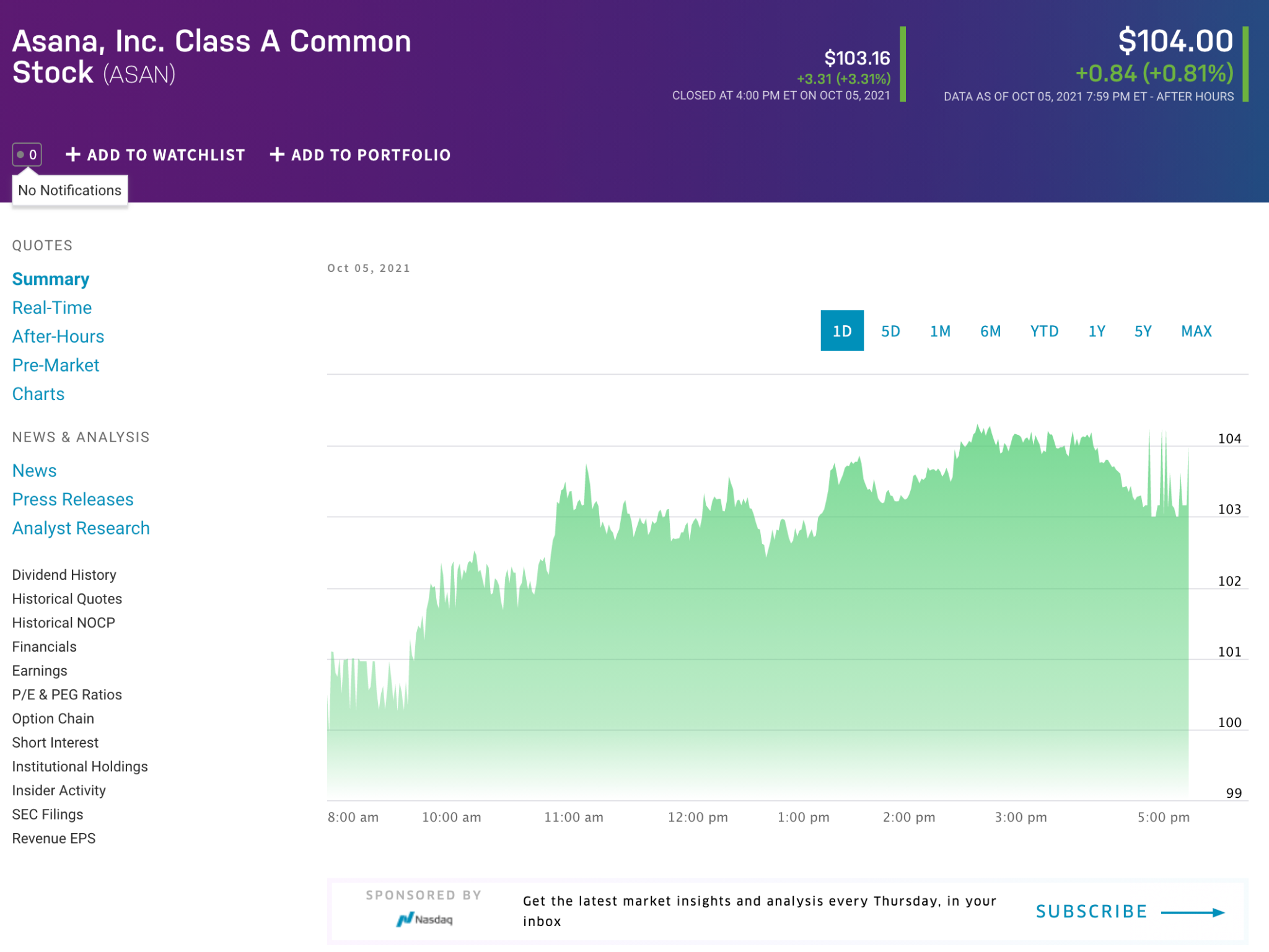

Search for Asana on the Nasdaq, in contrast, and a user will find an emphasis on price performance over various time horizons, as well as prompts to subscribe to the exchange’s media.

Screenshot of a search for Asana on Nasdaq. Image Credits: Nasdaq

The LTSE wasn’t the only exchange to launch during the pandemic. The Members Exchange (MEMX), backed by a consortium of financial conglomerates like JP Morgan and BlackRock, recently celebrated its first anniversary and capture of 4% market share.

And it isn’t just new exchanges like the LTSE and MEMX that have made meaningful headway during the pandemic. The Nasdaq in December, for example, filed a proposal to the SEC requiring that the companies listed on its exchange must have at least one diverse board member. The SEC approved the rule this past August.

Companies who are or plan to go public now have a varied pool of choices, each differentiating on scale, cost and mission-driven measures like longevity, stability, diversity and sustainability.

The how, when and with whom questions for companies are now more meaningful than they were a decade ago. The resulting world looks like the liquidity options and signals we now have in private markets, where a company’s partners signals to the rest of the market about what type of company they are.

Community: More than an internet of memes

Community became a core economic theme during the pandemic, when “meme stocks” entered common parlance and created strange bedfellows among distant political ideologues.

Although the turn of events was interesting, probably most so in its relationship to discussions of narrative economics, community-driven innovation also arose to repair systemic problems of economic access.

In Chicago, a group of women were quietly navigating the pandemic to raise money, file for regulatory approval and build the product stack for First Women’s Bank, which opened two weeks ago. Through its flagship, brick-and-mortar commercial bank in Chicago, the upstart will focus on banking for and lending to women-owned businesses.

Their goal is to uplift businesses hurt by COVID and also solve systemic issues. The bank’s president and CEO, Marianne Markowitz, said, “First Women’s Bank formed intentionally to address the gender lending gap and to provide not only access to much-needed capital, but also to advisers, mentors, networks and resources.”

Community-led platform innovations aren’t limited to brick-and-mortar institutions. Some of the most notable funding events during the pandemic have been driven through new funding ecosystems like Republic, which aim to democratize economic access to investment opportunities across startups, real estate, cryptocurrencies and more.

In less than 30 minutes, Cere Network raised $28 million on the platform, while Backstage Capital raised $5 million for its fund in a similar amount of time. Highlighting Republic’s community-driven approach, their head of Venture Growth and Partnerships, Cheryl Campos, shared, “It’s in our name to ensure we continue to democratize access to capital no matter who or where you are. This can only happen when we engage mission-aligned individuals and come together to support founders and work toward a more diverse venture ecosystem.”

Empowerment: Debt remediation

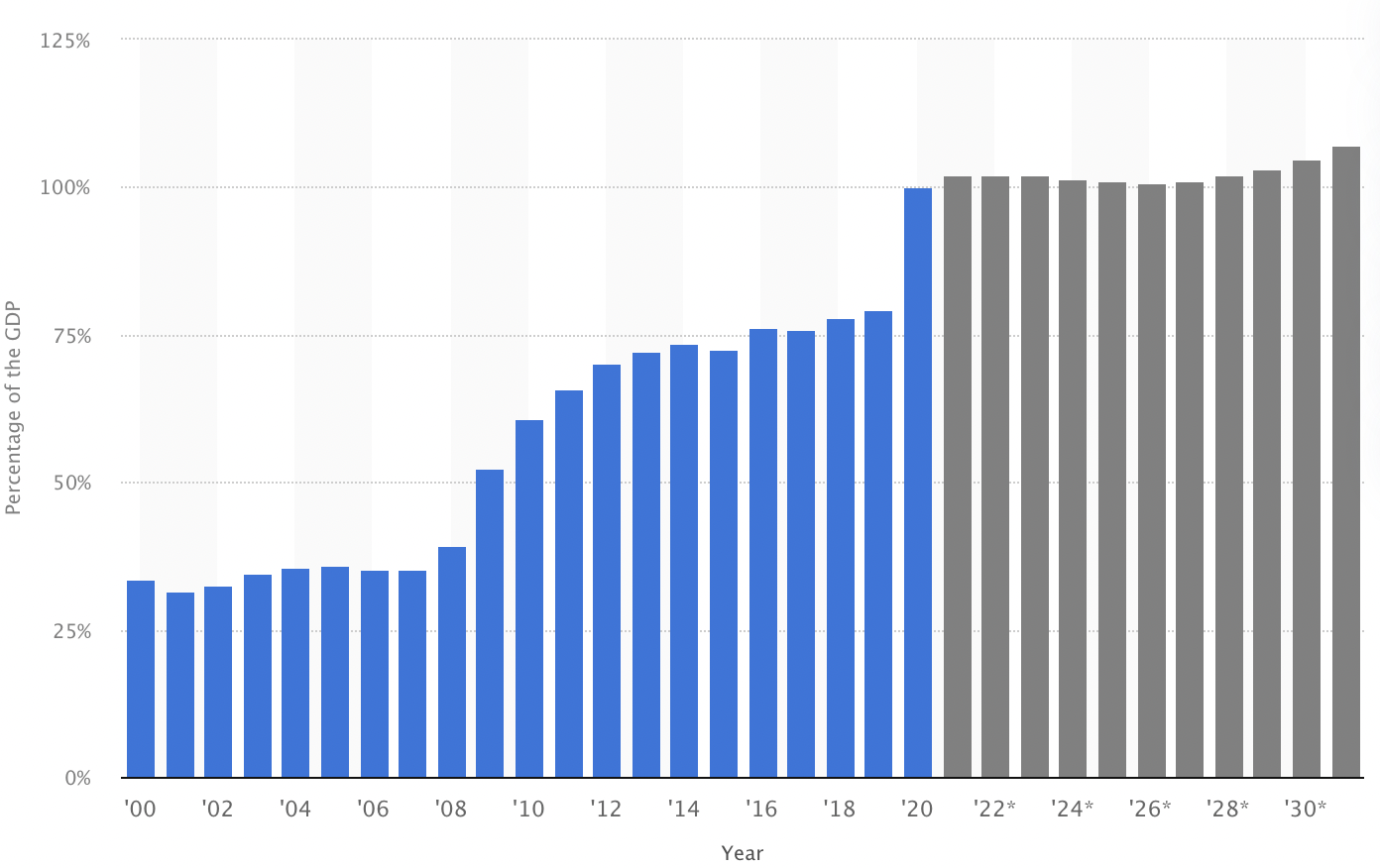

The multibillion dollar rise of buy now, pay later (BNPL) companies Affirm, Klarna and Afterpay have fueled discussions of whether these business models may cause unexpected, crippling debt for consumers. Specifically, their popularity among younger consumers and streamlined underwriting could exacerbate the already troubling debt picture below, which highlights that in 2020 the amount of U.S. debt held by the public exceeded 100% of the country’s GDP.

U.S. consumer debt as a percentage of GDP 2000-2030. Image Credits: Statista

In an economy where most publicity tends to be good publicity, perhaps the attention would be better served for tools that are actively mitigating debt. Upsolve leverages technology, financial literacy and leading talent to enable consumers to file for bankruptcy and erase their debt. The 501(c)(3) nonprofit, started in 2016, is completely free to use and has now cleared over $400 million in consumer debt.

The structure and success of Upsolve, in many ways, exemplifies that large chests of venture capital and high valuations are not needed to make a real and disruptive impact. The company’s scale is, instead, funded by Congressional initiatives, private philanthropy and revenue from attorneys who offer free advice through Upsolve.

As recognition of Upsolve’s success rises, accompanied by the general increase in venture philanthropy sources to help support organizations, new efforts to solve real problems will see less need and pressure to aspire toward unicorn status.

In conclusion

Most of the world has not been up and to the right through the pandemic. But there have been silver linings in the innovation that have quietly marched forward to improve longevity, community and empowerment in technology and financial markets.

We should hope for, enable and recognize more mission-driven ventures like the LTSE, First Women’s Bank and Upsolve, which demonstrate that the quietest efforts often have the loudest impacts.