ZestMoney, a Bangalore-based buy now, pay later platform, said on Wednesday it has raised $50 million in a new financing round from Australia’s Zip as the Indian firm looks to double down on a trend that has shown early signs of traction in several global markets.

The eight-year-old Australian firm, which has a presence in 12 markets across five continents, is acquiring a minority stake in ZestMoney as part of the new Series C financing round, the two said.

ZestMoney said in a statement the new financing round hasn’t closed as existing investors will be participating in it as well. The startup, which has raised over $110 million to date, counts Goldman Sachs, Quona Capital, PayU and Xiaomi among its early backers.

The buy now, pay later market remains at a nascent stage in India, where only a fraction of the population has a credit card. But a handful of startups including ZestMoney, Capital Float and LazyPay are beginning to show traction in a market largely dominated by traditional giant Bajaj Finance.

The low penetration of credit cards in India has meant that very few people in the nation have a traditional credit score that banks heavily rely on to establish one’s credit worthiness before issuing them a loan. Moreover, small loans don’t generate lucrative returns for banks, giving them less incentive to write such cheques.

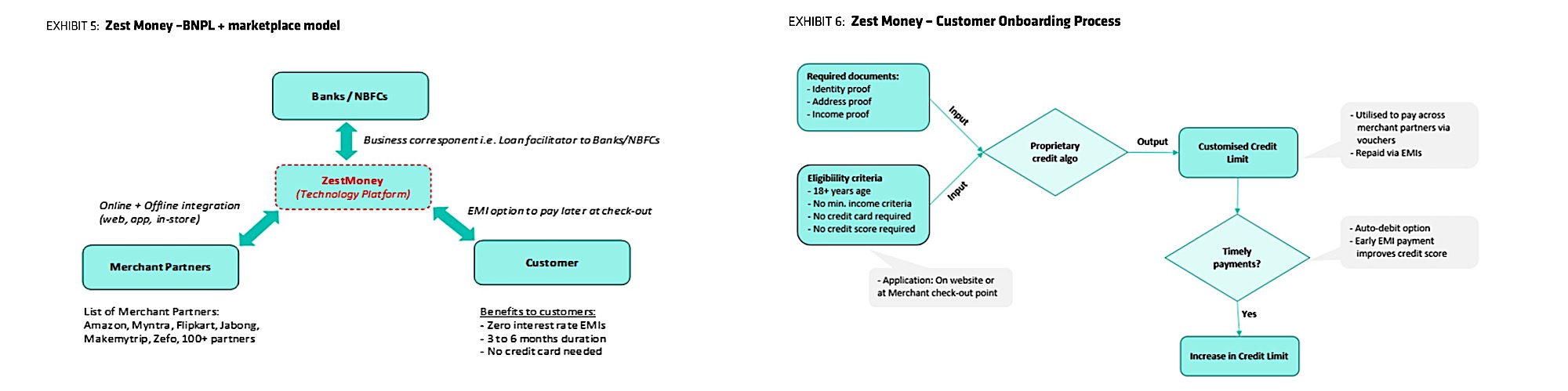

Image Credits: Bernstein Research

ZestMoney says it assesses other data points and uses AI to help these people build a profile and become credit-worthy.

The startup, which said it has amassed over 11 million users and has 25 banking and non-banking financial partners, works with large merchants such as Amazon, Flipkart, Google Pay, Apple and Xiaomi to offer its BNPL services to customers. ZestMoney has presence across over 75,000 physical stores and more than 10,000 online sites, it said.

The startup’s offering starts as low as 50 Indian rupees (68 cents) to $6,777 and the duration of the payback period ranges between a month to two years.

“This is a deep validation of our position as market leader in the buy now, pay later category in India. The shift toward pay later solutions is a global phenomenon and represents young digital consumers looking for transparency, honesty and no hidden charges in financial products,” said Lizzie Chapman, co-founder and chief executive of ZestMoney, in a statement.

“We believe India will leapfrog traditional products like credit cards, along with many other emerging markets, going straight to digital payment solutions. Over the last year we have seen applications for BNPL go up by 5x on our platform. We continue to invest in deepening partnerships with our merchant network and hiring the best talent. We strongly believe India will emerge as the largest BNPL market in the world over the next five years.”