As Warby Parker, Freshworks, Amplitude and Toast look to list in the coming weeks, we shouldn’t forget the SPAC boom. This week, for example, Forge Global (Forge), a technology startup that operates a market for secondary transactions in private companies, announced that it would go public via a blank-check combination.

And while we’re not unpacking every single SPAC combination that crosses our radar, the Forge deal is a good one to spend time parsing.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Why? Several reasons. First, we’re curious about how the company generates revenue and how diversified its revenue is. We’re also interested in how big the market may prove to be for trading secondary shares in unicorns — late-stage tech startup equity is popular on secondary exchanges. Additionally, we want to know whether the deal feels expensive, because that may help us get a heat-check on the SPAC market more broadly.

First, some details concerning the transaction. Then we get to have fun. To work!

First, some details concerning the transaction. Then we get to have fun. To work!

The Forge SPAC

Forge is merging with Motive Capital, a blank-check company that raised $360 million in December 2020.

Per the company’s calculations, the combined entity will sport a roughly $2 billion valuation on a “fully diluted equity value on a pro forma basis.” The company’s anticipated enterprise value is a smaller $1.6 billion thanks to an expected $435 million in cash after the deal’s completion, though that number will change some before it trades.

Skipping the nuances of the transaction — there’s a PIPE, 90% equity rollover from existing shareholders and more, in case you wanted to get into it — what matters is that Forge will be worth around $2 billion in equity terms and have hundreds of millions of dollars in the bank after the deal.

The resulting valuation is notable not only for making Forge a unicorn, but also for representing a dramatic upward movement in the worth of the company. PitchBook and Crunchbase data agree that Forge was last valued at $700 million (post-money) when raising $150 million earlier this year. So, the company appears set to provide a solid return to more than just its early backers; even the private investors who put capital into the company rather recently should do well in the deal.

That brings us to the company’s business, and business model. Forge helps pre-IPO companies trade before they float. It’s somewhat ironic that price discovery is something that the company claims its platform can help companies with before they debut, while the company is set to see its private valuation quickly beaten by a public debut.

Regardless, let’s talk unicorns.

A solution to the unicorn traffic jam?

One of my favorite long-term issues with the late-stage startup market is that it is far better at creating value than it is at finding an exit point for that accreted value. More simply, the startup market is excellent at creating unicorns but somewhat poor at taking them public.

That antitrust regulatory concerns have made it harder for wealthy tech companies to snap up promising startups that could challenge them is only part of the matter. There just aren’t enough IPOs, even this year, to counterbalance the growth in the number of global unicorns.

That pressure is a good bit of why Forge is an interesting firm. The more unexited unicorns there are in the world, the more demand, presumably, there is for marketplaces like the one it operates, which allows existing shareholders in valuable private companies to drive liquidity for themselves ahead of eventual public-market debuts.

Forge agrees, as the following slides from its investor deck make clear. The first details just how much value is locked up in private unicorns, along with their numerical growth:

Image Credits: Forge Global

The second helps explain the pressure that secondary exchanges like Forge may be able to help alleviate, with time to IPO rising and companies being worth more when they do eventually list:

Image Credits: Forge Global

Those charts are a bit SPAC-y, but in this case, we don’t mind because Forge is not merely pitching future results; it has found scale already.

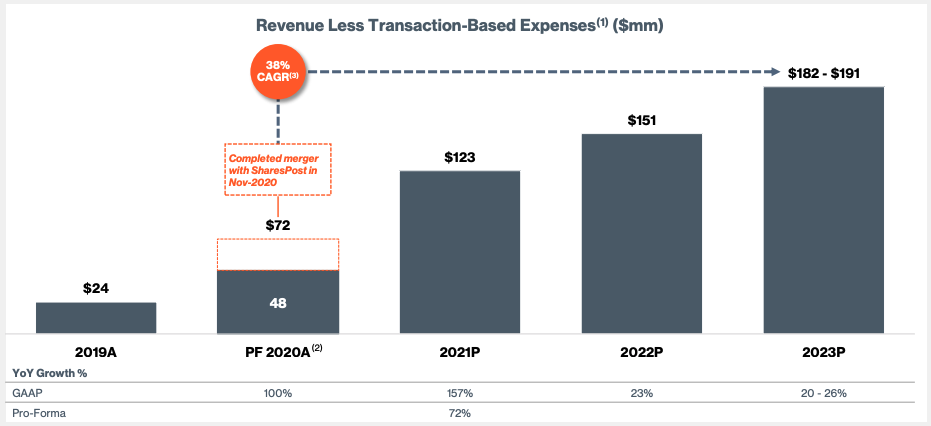

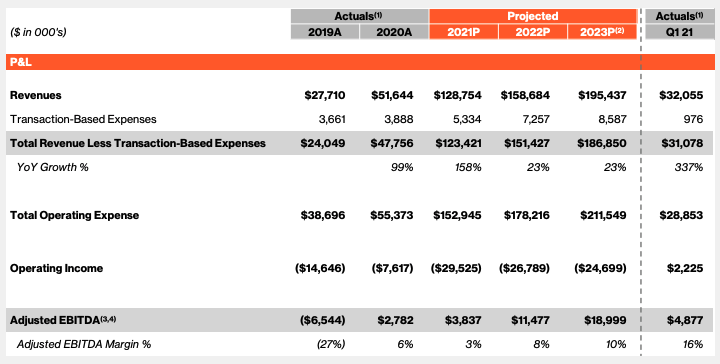

Forge generated $27.7 million in revenues in 2019, a figure that rose to $51.6 million in 2020. Those figures do not exclude transaction-based expenses, which would lower the results to $24 million and $47.8 million, respectively. The latter number rises to around $72 million if we include full-year revenues from SharesPost in 2020; Forge and SharesPost completed a merger in November of last year.

The company generates revenues in three ways: transaction-based revenue (a take rate on transaction volume), fees from the company’s “Trust” service and subscriptions sold to Forge’s data.

Transactions are the key revenue element in Forge’s story, at least to date. For example, the company generated some $3 billion in transaction volume in the 12 months concluding June 30, 2021, up from $1.3 billion in the 12 months concluding June 30, 2020 (inclusive of SharesPost). At the same time, the company’s take rate for transactions rose from 2.4% to 3.1%.

That’s a jump — loosely — from $31.2 million in expected transaction-based revenue in the year ending June 30, 2020, to $93 million in the same time period concluding June 30, 2021. Of course, Forge would deduct transaction expenses from those figures, but the gains help explain how the company can project the following:

Image Credits: Forge Global

How do we know that transaction revenues are the future at Forge? The company’s Trust revenues were largely flat from 2019 to 2020, narrowing slightly from $22.5 million to $22.4 million. And Trust revenues in Q1 2021 set the company on an even more modest run rate for the revenue line item. Forge Data was not broken out, as far as we could tell this morning.

The Forge story is one of rising trading volume, then, bringing us back to our notes regarding the sheer number of unexited unicorns in the market and how long they are taking to go public. The total addressable market that Forge serves is growing by the day, with more and more unicorns being born and a steady drumbeat of unicorn IPOs doing little to clear the decks. So there could be a secular tailwind blowing in the company’s sails.

Sadly, Forge doesn’t anticipate as much operating leverage as we might have hoped given that boost.

The company projects years of GAAP operating losses, despite managing to scoot that particular metric into the black during the first quarter of the year:

Image Credits: Forge Global

Sure, the firm has rising adjusted EBITDA numbers, but who really wants to depend on that metric?

Regardless, Forge is valued at just over 16x its 2021 projected revenues after transaction-based expenses are excised. That doesn’t seem incredibly unreasonable.

There are some quirks in the document that caught our eye, however. The company’s Q1 annualized revenue run rate was $124.3 million (excluding transaction-based expenses). That’s actually greater than the company’s full-year expected revenues calculated in a similar fashion. So, Forge expects to post quarters smaller than its first quarter the rest of the year?

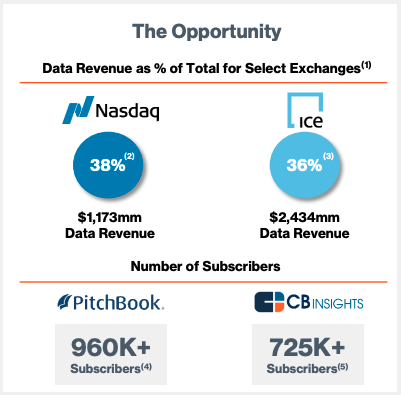

And when discussing how its data products could generate 15% to 20% of its long-term revenue mix, Forge included the following:

Image Credits: Forge Global

The top two data points are very fair. Other exchanges make money on data. Forge can, too!

The bottom two data points, however, are hilarious. Here’s what those numbers are, per the deck:

4) Source: PitchBook website – newsletter subscribers

5) Source: CB Insights website – newsletter subscribers

Newsletter subscribers are, of course, famously good indicators of future data revenues.

All told, the Forge SPAC deal seems perfectly reasonable. It’s a real company, operating in a problem space that is only expanding. With a rising take rate, the company could enjoy improved economics over time. Now it’s up to public-market investors to decide just what they are willing to pay for Forge shares.