Most businesses by now are well versed with the consequences of the COVID-19 pandemic: Faltering offline sales, flexible work-from-anywhere options, fluctuating foot traffic with lockdown mandates and e-commerce becoming a channel many brands wished they had built infrastructure for earlier.

As a record number of consumers in Southeast Asia move from shopping malls to online platforms like Shopee, Lazada, Tiki and Tokopedia, the advertising dollars are naturally flowing in. Emerging markets are witnessing the advent of retail media right now.

Amazon paved the way in North America in 2018 by launching Amazon Advertising to become the first bid-and-buy marketplace. BCG now estimates retailers have a $100 billion business opportunity to capture, if they can keep up.

The money is where the consumer is

To understand why retailers will capture more ad spend, it’s important to evaluate what modern day marketing has become.

Is it bus stop advertisements? Bidding on Google keywords or a Clubhouse session? Or is it a viral TikTok video? As the world becomes more connected and the lines between offline and online blur even more, modern day marketing is a mix of all the channels tied to key performance metrics.

The main goal of marketing, no matter the medium, is to highlight a business or product to the right consumers to score a potential sale. And like most things, there is a bad, a good and a much better way of doing things.

E-commerce as an advertising channel is unique, because it encapsulates the entire consumer journey from start to finish, especially as marketplaces continue to steal the share of search from search engines.

Traditional marketing channels were primarily linear TV, radio and print, because the mediums were highly popular at the time. However, with the birth of the internet newer platforms emerged such as email, websites and streaming. Then came the rise of social media and apps that shook up the advertising landscape. But regardless of these shifts, there has always been one constant: The business went where the consumer was.

So when sources of traffic and revenue once again change, let’s say due to a pandemic, the marketing mix follows. In the next 12 months alone, many marketers are planning to decrease spending in cinema, print and out of home (OOH), while the majority will increase budgets in social and search, according to Nielsen.

The search for superior advertising channels

So which channels will benefit as money flows out of outdated buckets? A good indicator is ad revenue trends in mature markets like the U.S. While Google and Facebook remain the dominant advertising players, Amazon has eaten into the duopoly’s ad revenue pie in the U.S., growing its share from 7.8% to 10.3% in 2020 alone, according to eMarketer.

How? Because the most valuable advertising channel is the one that has the most measurable touch points with the consumer.

TV, radio and print lose the consumer after the first point of contact, whereas websites and emails track your clicks, but lose you once you’re off the medium. Ad networks and social media became industry titans because they not only monitor a consumer’s interests and movement across multiple mediums, but can re-target that consumer with various personalized ad content to chase a conversion goal.

While many advertising tools continue to be highly effective in conjunction to reach shoppers, some do so through third-party cookies, which are becoming obsolete with heightened scrutiny on digital surveillance. The downfall of cookie-based tracking means advertisers are further limited in their ability to re-target, build lookalike audiences and personalize ads.

As competition increases and performance marketing becomes more commonplace, the ability to track return on ad spend (ROAS) is crucial to reaching scale and profitability. As of early this year, almost 50% of marketers globally were still not confident in measuring ROI, because they’re either looking at metrics like awareness and reach, or the conversion takes place off the advertising channel, making accurate attribution an oxymoron, according to Nielsen.

Whatever the reason, lack of ROI transparency leads to slower executive decision-making, wasted marketing dollars and lost potential sales.

The new advertising titan

The rise of Amazon as a dominant e-commerce player isn’t anything new, but its rise as an advertising giant has been overshadowed by its successes in logistics and cloud. E-commerce as an advertising channel is unique, because it encapsulates the entire consumer journey from start to finish, especially as marketplaces continue to steal the share of search from search engines.

The marketplace knows what a shopper wants, how frequently certain products are bought, average spend per category, location, and can regularly communicate with the end user through email, notifications, games, chat, livestreams and shipping updates. Digital retailers are now rich with first-party data.

With on-site marketing tools, a brand can finally place its products one step before the checkout point to a target customer profile. Based on the feedback, the brand can determine which keyword was most effective in driving sales, at what price point, during which days in a month, and which product thumbnail improved the click-through rate (CTR).

This is why even Netflix recently launched an online store. The more touch points with the end consumer, the more valuable the channel becomes.

The hurdles to striking retail gold

The pressure on businesses in Southeast Asia to adopt e-commerce increased after the onset of the COVID-19 pandemic, which led to hiring sprees for talent. Newly imposed lockdowns in Singapore, Malaysia, Thailand, Vietnam and Indonesia even a year later make it even more important to gain a first-mover advantage in retail marketing to accelerate online success.

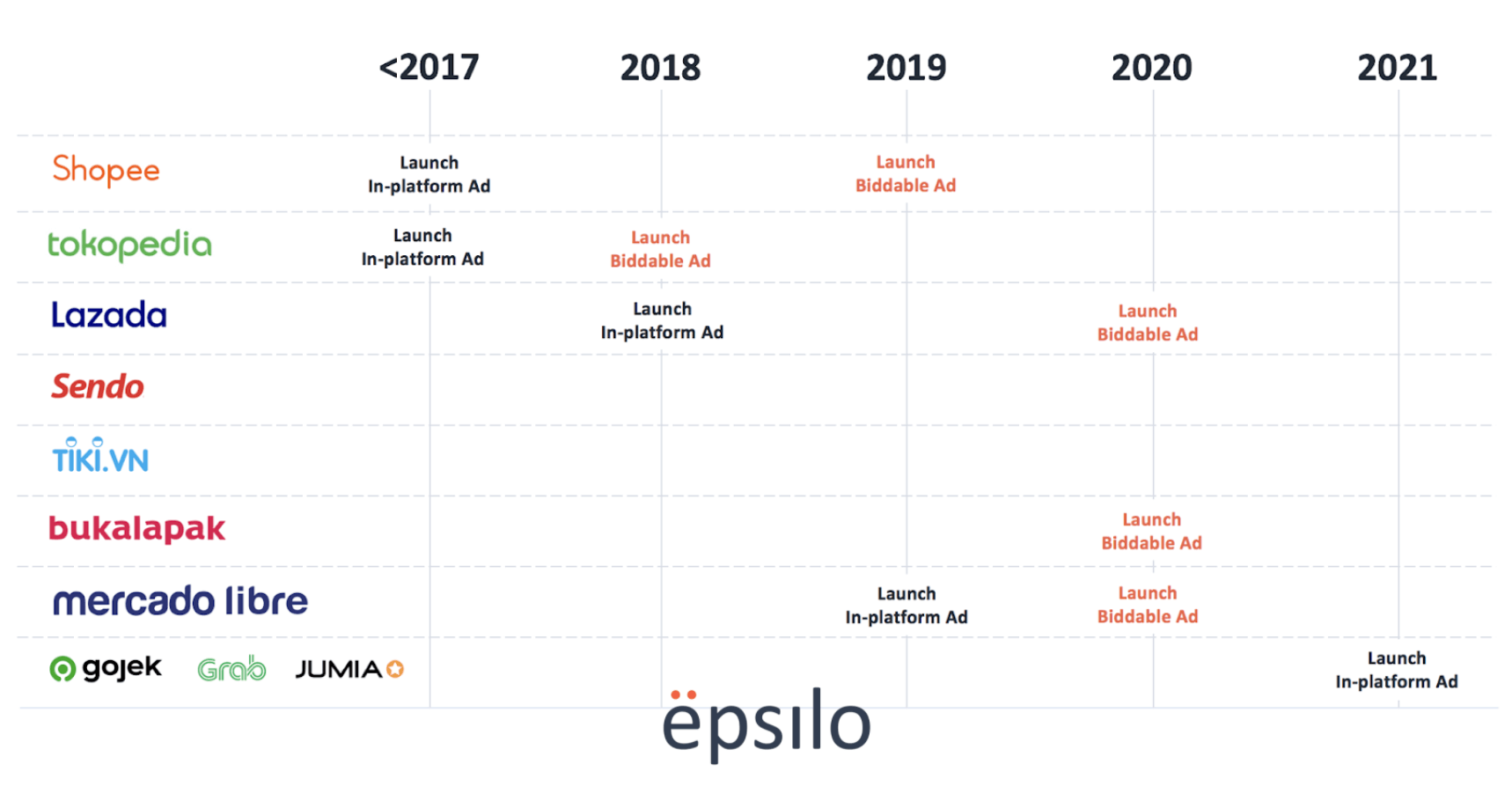

As e-commerce turns into a dream marketing channel, reaping the benefits of retail marketing is only possible if the marketplace equips brands with the right tools and data sets. In Southeast Asia, Shopee, Lazada and Tokopedia have already made marketing solutions such as keyword bidding and sponsored products available for sellers (e.g., MyAds and Sponsored Search), but these solutions are still works in progress.

Image Credits: Epsilo Research July 2021

Southeast Asian sellers also struggle to scale, unlike their Amazon counterparts in the West. This is because the region boasts nine marketplaces each with strengths in local markets. In order to win e-commerce in Southeast Asia, sellers need to be present and active on all of the retailers.

“Unlike other markets where Amazon is dominant, merchants here [Southeast Asia] sell across more than three to four marketplaces in six major markets, because there’s no one dominant player. With large portfolios, busy campaign calendars and feature-poor tools, clients often tell us their marketers are overwhelmed,” says Quang Tran, founder and CEO of Epsilo, an e-commerce marketing SaaS solution backed by Sequoia India’s Surge Accelerator aimed at solving the retail media problem for sellers in the region.

In Amazon-dominant markets like Europe and the U.S., similar businesses, such as Helium10, Stackline and Jungle Scout are already being hired to automate advertising, boost ROAS, gain competitive intelligence and unify e-commerce analytics under one platform.

To tap into the next marketing wave in Southeast Asia, three key ingredients are required to leverage retail media:

- Software: Which specialized tools can help a business execute faster and provide customized reports with metrics for quick decision-making? While many technologies perform the same tasks no matter the client, look for positional software that is customizable and feature rich.

- Data: What data is available from the marketplace? Are the right KPIs being measured to understand how to improve campaign on campaign or an always-on basis? GMV and ROAS are important, but so is CVR (conversion), CTR, IS (items sold), etc.

- Talent: Are the right people in place to assess the insights and change course if performance isn’t up to standard? If talent is too difficult or costly to secure, can technology be used to automate manual tasks?

The COVID-19 pandemic reignited the e-commerce flame, but it will be the players who adapt quickly to a tech and data-driven world that can turn retail media into a $100 billion reality.