Edtech giant Duolingo set an initial price range for its impending IPO today. The unicorn expects to price in its public debut at $85 to $95 per share, selling 3,700,000 in the deal.

Another 1,406,113 shares are being sold by existing shareholders, and 765,916 shares are being offered to underwriting banks as part of the transaction. All told, the company may see 5,872,029 shares trade hands in its IPO, worth some $557,842,755. Duolingo itself can raise as much as $424,262,020 in gross proceeds at its current range, provided that its underwriting banks exercise their option.

The IPO is a material fundraising event for the company. Before its public offering, the largest single hit of capital that Duolingo raised was a $45 million Series D from 2015.

Let’s dig into what Duolingo, which we profiled in much more detail here, is worth at its IPO price and peek at its preliminary second-quarter results. Our goal will be to understand its valuation in the context of its growth. From there, we’ll be able to draw some general conclusions about the larger edtech startup market.

What’s it worth?

After its IPO, Duolingo will have 35,892,152 shares outstanding, sans its underwriter’s option. At the lower and upper bounds of its simple IPO valuation, Duolingo is worth $3.1 billion to $3.4 billion.

As with every company going public, Duolingo’s IPO valuation rises if we include shares that have vested in RSU or options form, but have yet to be exercised. In the case of Duolingo, its share count rises to 43,776,271, per an initial TechCrunch analysis of the company’s RSU and options details provided in its S-1 filing. At that share count, Duolingo is worth $3.7 billion to $4.2 billion.

For every number provided, the company’s underwriter’s option adds modestly.

All valuations listed above are a premium over the company’s final private price set during its November 2020 Series H round of funding. That $35 million round valued the company at around $2.4 billion.

At first blush, then, the company’s IPO price range feels strong, regardless of whether we lean on simple or fully diluted share counts to come to a new price for the firm. But how do its new valuations stack against its recent revenue? Let’s find out.

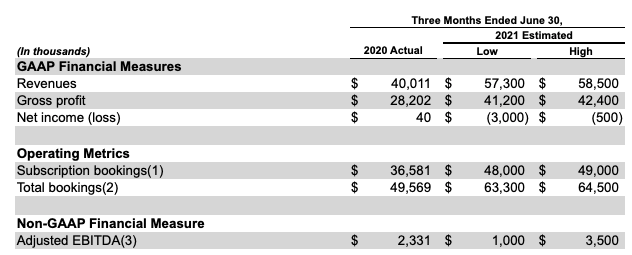

Here are the company’s preliminary Q2 2021 results:

Image Credits: Duolingo S-1/A

For reference, in Q1 2021, Duolingo recorded revenues of $55.4 million, gross profit of $40.3 million and a net loss of $13.5 million. The company managed sequential-quarter growth in Q2, it appears, while also trimming its net losses to near breakeven levels in the same period.

In the first quarter of the year, the company grew at a torrid 97% rate compared to the year-ago quarter. How quickly did Duolingo grow in the second quarter? At the midpoint of its anticipated Q2 results, just 45%.

Why the dramatic slowdown? Because Duolingo posted bonkers-good Q2 2020 revenue growth, boosted in part thanks to COVID-19 and the larger market’s embrace of digital education tooling. Not that 45% growth is something to sneer at, but we are now seeing what growth will look like at the company after its COVID-bump was digested.

At midpoint Q2 revenues of $57.9 million, Duolingo has a run rate of $231.6 million. At the top end of its simple IPO price range, the company would sport a roughly 15x run-rate multiple. That’s strong, but not nearly top-of-the-market for software companies. Indeed, as with Robinhood earlier today, we’re seeing a consumer software company trade at a multiple-discount to what we’ve become accustomed to seeing attached to enterprise software companies.

The gap is at least partially formed by the fact that consumer-derived revenue can prove more fickle than top line generated by selling to other companies. So, although both Duolingo and Robinhood can point to strong growth rates and improving margins — to varying degrees — they are not set to command the eye-watering prices that some software firms expect on today’s public markets.

Public market fluency

While selling to individuals may be a more volatile revenue model than B2B, edtech startups have long leaned on going straight to consumers to avoid dealing with the logistical woes of selling to schools and universities. It’s why many U.S.-based edtech unicorns are B2C, with Duolingo joined in the model by startups like Udacity and Course Hero. The consumer-first mindset was only augmented by the pandemic, which sent millions of students home to pursue remote learning. Parents, spending on tools that could enhance their children’s education, made startups like Outschool and Quizlet into billion-dollar businesses over the last 12 months.

Despite these examples, edtech’s presence on the public markets has an enterprise focus. For example, 2U and Stride, which have seen stock prices struggle recently, both sell to institutions rather than individuals. Coursera, which went public in March, is leaning heavily on its enterprise revenues in the long term as well.

There may be a disconnect between the public markets, which seem to agree that consumer revenues may be too churn-impacted for their own good, and the private markets, which see consumer revenues as the way to get edtech to venture-like scale. This all leads up to one broad takeaway: Duolingo is carrying a lot of weight on its shoulders as a rare exit for a once underserved sector.

If Duolingo poses a strong debut, consumer edtech startups will be able to add a golden data point to their pitch decks. A strong Duolingo listing could also signal that mission-driven startups can have impressive turns.

If Duolingo struggles when it gets to the market, the wave of consumer edtech apps may lose some enthusiasm about going public. Edtech’s enterprise unicorns, which include Newsela and Guild Education, may be able to provide a lucrative contrast with their financials when they list.

When a sector begins to mature, emphasis is placed on massive events such as IPOs. In India, we’re seeing that play out with Zomato and Paytm. In edtech, a sector spotlighted and propelled forward by the pandemic’s boom in remote learning, we’re seeing it with Duolingo.