Today, Uber followed Lyft in reporting its Q1 2021 earnings this week. And like its rival, its results take a little bit of work to understand. So, this afternoon, we’re going to parse them as a pair so that we both understand what’s going on at the ride-hailing and food-delivery giant.

Let’s start with the big numbers: Uber’s revenue missed sharply, while its profitability beat expectations.

Let’s start with the big numbers: Uber’s revenue missed sharply, while its profitability beat expectations. In numerical terms, Uber reported $2.9 billion in revenue for the three-month period, sharply under the $3.28 billion investors had expected. However, while the street had anticipated that the company would post a $0.54 loss per share, Uber’s GAAP results actually came to a far more modest $0.06 per-share loss.

How did investors vet Uber’s performance? The company’s stock is off around 4% in after-hours trading.

Surprised by the revenue miss? Shocked by the profit beat? Startled by the sharp drop in the value of Uber’s stock? Let’s unpack the numbers.

Uber’s quarter

A number of things impacted Uber’s quarter. The first, of course, was COVID-19. The pandemic shows up in a host of ways across Uber’s results, but most critically it continued to negatively impact Uber’s ride business and positively impact its delivery business.

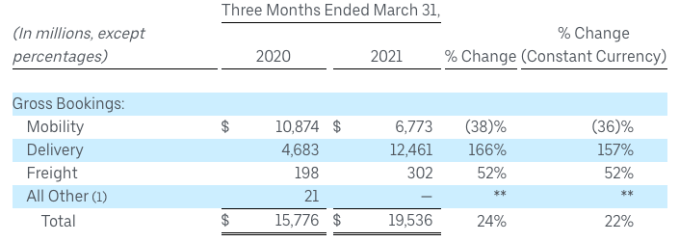

Turning to numbers, here’s the company’s gross bookings data, which includes both segments:

Image Credits: Uber

A few things to note. First, Uber’s total platform spend went up in aggregate on a year-over-year basis. That’s good. And as we look at the year-over-year changes, that delivery’s growth compared to the year-ago period was nearly legendary. (Postmates is in there, so take that into account.) The ride-hailing business’s decline feels somewhat modest in comparison. And we’d note that Uber’s freight efforts are very nearly material.

Now let’s take a peek at Uber’s revenue over the same timeframe. Recall that Uber’s gross bookings are how much money Uber users spent in a quarter through Uber’s apps. The company’s revenue is its takings from those gross results.

Here’s the data:

Image Credits: Uber

This is where gross bookings results start to feel a bit less sunny. Delivery revenue growth was spectacular, coming in at a higher rate of growth than its gross bookings managed, but its ride-hailing business did the opposite. Impacting the company’s Q1 2021 ride-hailing revenue, however, was a “$600 million accrual made for the resolution of historical claims in the U.K. relating to the classification of drivers.”

What’s that? Uber had to start treating its U.K. drivers as employees. TechCrunch reported on the shake-up in March, writing that “all drivers in the U.K. will be paid holiday time based on 12.07% of their earnings, which will be paid out every two weeks. Drivers will also be paid at least the minimum wage (called the National Living Wage) after accepting a trip request and after expenses,” along with a pension plan of sorts.

If we discount the U.K. accrual matter, Uber’s ride-hailing revenue came in at $1.453 billion, putting its aggregate revenues at $3.5 billion for the period, ahead of expectations. (Don’t give up yet, this gets even more complicated!)

Turning to adjusted profits, here’s the company’s scorecard from the quarter:

Image Credits: Uber

I want to focus on Uber’s adjusted profits today over its GAAP results because the latter were juiced by a one-time, $1.6 billion sale of its self-driving business. So, in terms of a year-over-year comparisons, this is probably a bit more fair. However, bear in mind that Uber’s adjusted EBITDA results discount the impact of the U.K. accrual. If you find that annoying, well, welcome to the club when it comes to Uber’s results, which should be taught in business school as a case study in complexity.

Back to the data itself. Uber’s adjusted EBITDA loss improved by 41% to just $359 million. Recall that Uber intends to reach positive adjusted EBITDA this year. So, that’s a number to watch. Looking more closely, we can see that as the food delivery game is still unprofitable, even in adjusted terms for Uber, its declining ride-hailing adjusted income mattered. Happily the company’s corporate losses fell sharply compared to the year-ago period, so the company managed an aggregate decrease in adjusted losses.

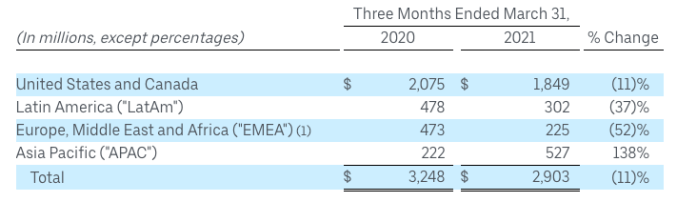

Can we see Uber’s results start to peek out from the COVID-induced hit it took last year? Yes, we can. Recall that COVID first hit Asian markets before spreading to other parts of the world. That means that they got to lockdowns earlier than other markets. And, in some cases, back to normal more quickly. So when we observe the following data:

Image Credits: Uber

We can quickly see that Uber’s APAC business is soaring. If you are an über Uber bull, that should be heartening to your view of the company’s future.

If you are asking yourself what to make of all the numbers, it’s the right question. And it’s hard to answer. A few things to keep in mind:

- Uber isn’t just hitting regulatory headwinds in the U.K., it has also seen its driver setup change in California, a key market for the company.

- The company fielded a bunch of questions about its driver supply; that could be an issue moving forward. That said, despite safety concerns, the company said that driver supply was rising. As Uber’s trips fell 13% year over year, it’s something to keep in mind.

- Until its delivery business starts to kick off adjusted EBITDA, the company is going to have a hard time generating aggregate adjusted profitability, unless ride-hailing comes roaring back.

How you sum that should give you a gut check on Uber’s coming quarterly results. Before its earnings, investors expected Q2 2021 at Uber to bring a $0.45 per share loss off of $3.68 billion in revenue. Let’s see what it can manage.

TechCrunch and Extra Crunch will have more on both Uber and Lyft earnings, and what they mean for the greater startup mobility sector tomorrow.