AWS, Amazon’s flourishing cloud arm, has been growing at a rapid clip for more than a decade. An early public cloud infrastructure vendor, it has taken advantage of first-to-market status to become the most successful player in the space. In fact, one could argue that many of today’s startups wouldn’t have gotten off the ground without the formation of cloud companies like AWS giving them easy access to infrastructure without having to build it themselves.

In Amazon’s most-recent earnings report, AWS generated revenues of $11.6 billion, good for a run rate of more than $46 billion. That makes the next AWS milestone a run rate of $50 billion, something that could be in reach in less than two quarters if it continues its pace of revenue growth.

The good news for competing companies is that in spite of the market size and relative maturity, there is still plenty of room to grow.

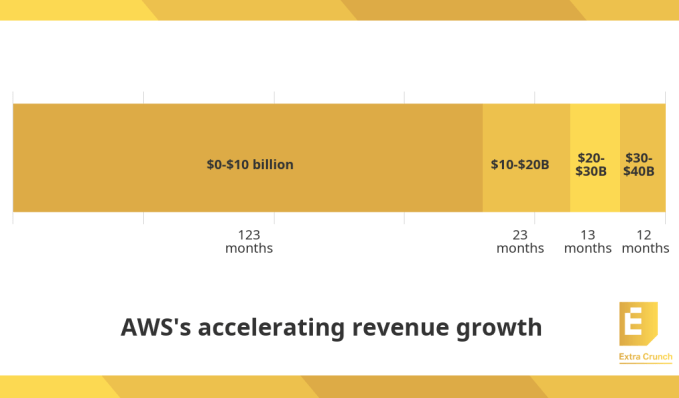

While the cloud division’s growth is slowing in percentage terms as it comes firmly up against the law of large numbers in which AWS has to grow every quarter compared to an ever-larger revenue base. The result of this dynamic is that while AWS’ year-over-year growth rate is slowing over time — from 35% in Q3 2019 to 29% in Q3 2020 — the pace at which it is adding $10 billion chunks of annual revenue run rate is accelerating.

At the AWS re:Invent customer conference this year, AWS CEO Andy Jassy talked about the pace of change over the years, saying that it took the following number of months to grow its run rate by $10 billion increments:

Image Credits: TechCrunch (data from AWS)

Extrapolating from the above trend, it should take AWS fewer than 12 months to scale from a run rate of $40 billion to $50 billion. Stating the obvious, Jassy said “the rate of growth in AWS continues to accelerate.” He also took the time to point out that AWS is now the fifth-largest enterprise IT company in the world, ahead of enterprise stalwarts like SAP and Oracle.

What’s amazing is that AWS achieved its scale so fast, not even existing until 2006. That growth rate makes us ask a question: Can anyone hope to stop AWS’ momentum?

The short answer is that it doesn’t appear likely.

Cloud market landscape

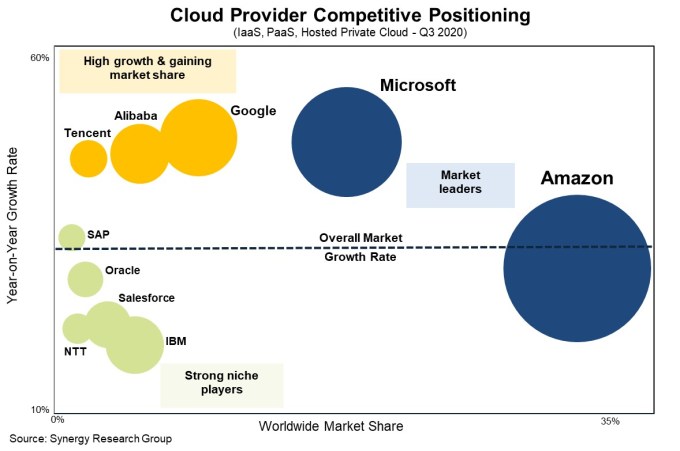

A good place to start is surveying the cloud infrastructure competitive landscape to see if there are any cloud companies that could catch the market leader. According to Synergy Research, AWS remains firmly in front, and it doesn’t look like any competitor could catch AWS anytime soon unless some market dynamic caused a drastic change.

Image Credits: Synergy Research

With around a third of the market, AWS is the clear front-runner. Its closest and fiercest rival Microsoft has around 20%. To put that into perspective a bit, last quarter AWS had $11.6 billion in revenue compared to Microsoft’s $5.2 billion Azure result. While Microsoft’s equivalent cloud number is growing faster at 47%, like AWS, that number has begun to drop steadily while it gains market share and higher revenue and it falls victim to that same law of large numbers.

The good news for competing companies is that in spite of the market size and relative maturity, there is still plenty of room to grow, something Jassy acknowledged at his re:Invent keynote this year.

“If you look at the total amount of global IT spend that’s in the cloud, it’s only 4% at this point. All that said, If you believe like we do, that the vast majority of computing is moving to the cloud in the fullness of time, in the next 10-20 years, [even though] you’ve seen incredible growth in the cloud, it means that there’s a lot of growth ahead of us,” he said.

While AWS wants to grab big chunks of that remaining market, Microsoft has the resources to grab some of its own — in spite of giving its rival a head start in the market. Still, when you consider the sheer amount of spend still untapped in the cloud, it means that there is plenty of room for other players in this space to also make headway over time and still build substantial cloud businesses. It’s just unlikely that any of them will catch AWS if that’s the ultimate goal.

Continuous innovation

While the cloud market has plenty of room to grow, it would require a remarkable level of complacency from AWS for them to cede their market advantage, something we have yet to see. In fact, the cloud infrastructure leader continues to add new features at a remarkable rate. Consider that at this year’s re:Invent, Jassy announced 27 new products and enhancements in his three-hour keynote.

Overall, the company reports it announced 180 new features or products at its three-week virtual conference this year. While there have been years with even more news, the pace of change continues fairly rapidly for an organization the size and maturity of AWS, which given its size really could be its own company (see the next section).

It’s also important to remember that up until the last few years, AWS has always been focussed on pure cloud, leaving the hybrid space to competitors like Microsoft, Google and IBM. But in recent years, it has made inroads of its own in that area as well with offerings like Outposts, where customers install a fully managed AWS box in their own data centers. This lets IT admins keep workloads onsite and in the AWS cloud and manage them in the same way.

It’s all part of trying to appeal to as much of the market as possible and wherever it sees a need — or a customer asks for something — it’s not shy about building it (or buying it if need be). While competitors are doing much the same, AWS has the leader’s advantage.

Just how much of an advantage is worth considering. So, let’s return to the idea of AWS as a stand-alone company. How impressive would its historical growth be?

If AWS were a company

The concept of AWS as a solo company is akin to considering where California’s GDP would rank globally if it were a country. Both are whimsical exercises as there would be no AWS without Amazon, and no Californian economic miracle without the United States.

But as a thought experiment, we can still learn from the question. In the case of AWS, we want to understand how quickly it grew and if its historical growth was anomalous when compared to other business results. Why? The better we understand how quickly AWS grew in its early years, the better we’ll be able to understand how hard it will prove to catch.

So we’ll want to use AWS’ historical results to answer our questions. Unfortunately, Amazon only began to break out AWS revenues and operating profit in 2015, providing data reaching back to 2013. So the first data we have on the effort comes from a period seven years after the collection of cloud services was born. We’ll have to work with the data we have.

In 2013, AWS had revenues of $3.108 billion and operating income of $673 million. In 2014 those numbers grew to $4.644 billion on operating income of $660 million. That’s growth of around 50% for AWS at age 8.

How does that stack up compared to other companies that we can use as comparison? Let’s use Salesforce as a comp. Salesforce was a pioneer, similar to how AWS helped create its own business category. Born in 1999, about seven years later Salesforce wrapped its fiscal 2007 (which mostly corresponds with calendar 2006) with revenues of $497 million, generating under $1 million in operating income.

Salesforce is a business icon with a current run rate of almost $22 billion. It too has been a trendsetter for its industry and a guiding light for SaaS companies. Yet AWS is twice as big today and was more than nine times as big by the time they both turned 7. That should help you understand just how incredible Amazon’s cloud business has been at generating scale and income.

Perhaps more important than catching Amazon is reaching sufficient scale to survive as a thriving player in the PaaS and IaaS spaces. Clearly Microsoft and Google have the chops to do that, even without catching AWS. Past those two the list gets thinner. But unless Azure can boost its percentage-growth advantage over AWS, Amazon will dominate the public cloud for years to come.