Like many of us during COVID-19, I’ve found myself watching a bit more TV than I’m typically accustomed to. My latest binge? “The Karate Kid” series continuation “Cobra Kai” on Netflix.

A long-time fan of “The Karate Kid,” I find my style’s a bit more Miyagi-Do, but, in reflecting upon my last few years as a founding GP at a young VC firm, I see some parallels between what it takes to win as an emerging manager and the mantras by which the Cobra Kai school abides.

Before diving into that, let me quickly set the stage for what the competitive landscape looks like for emerging managers these days. I’ll focus primarily on the seed landscape here, but the Cobra Kai framework applies just as readily to later stage funds as well.

Leading up to the coronavirus pandemic, the venture industry saw a record number of dollars raised by seed funds less than $100 million in size. As is the case across stages however, there has been a notable decline in seed volume in the wake of COVID-19.

U.S. fundraising activity for sub-$100M seed rounds. Data source: PitchBook-NVCA Venture Monitor. Image Credits: Fika Ventures

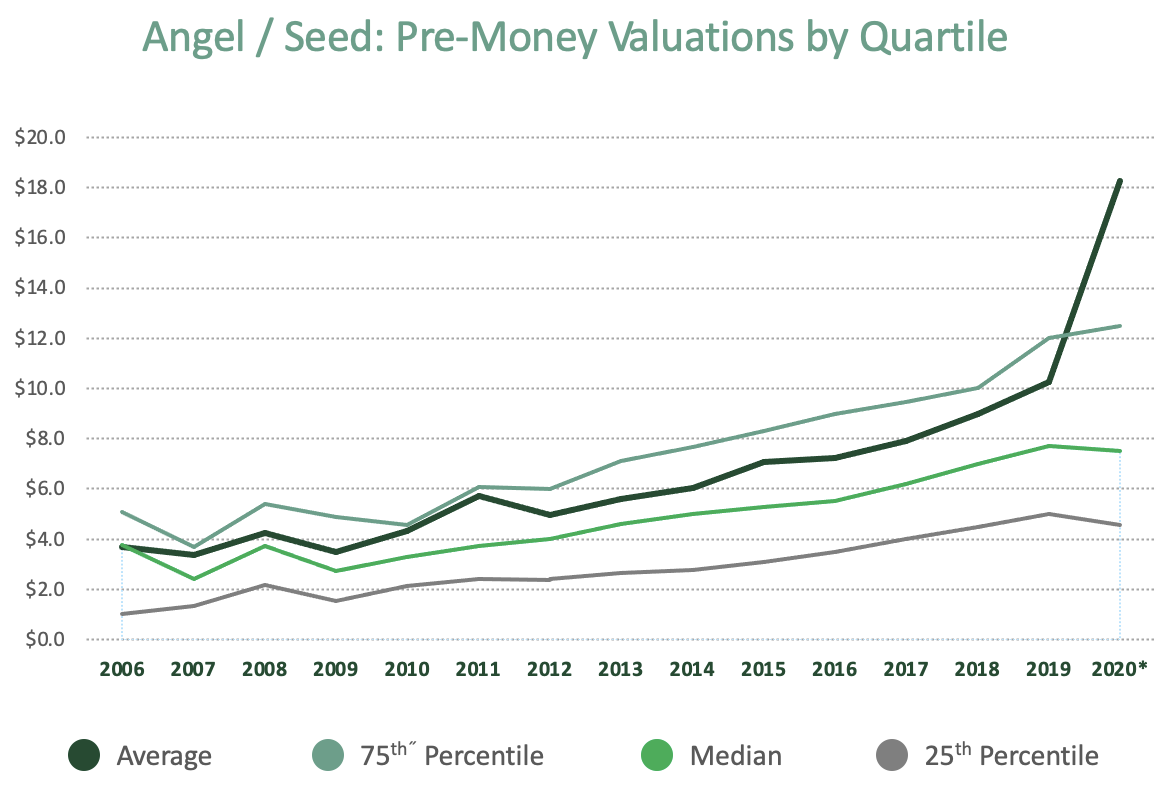

The opposing dynamics of a contraction in deal volume and an unprecedented amount of readily available investable capital has led to a tremendous amount of competition for the highest-quality deals. This flight to quality can be clearly seen in the rise of seed valuations in the upper quartile compared to the decline in other cohorts. Amid a backdrop of COVID chaos, upper quartile valuations have hit an all-time high.

Angel/seed pre-money valuations by quartile. Data source: PitchBook-NVCA Venture Monitor. Image Credits: Fika Ventures

Due to their smaller fund size and prescriptive portfolio construction mandates, emerging managers have little leeway in terms of the valuations at which they can invest — their ownership requirements and check size limits impose a hard ceiling to which their investors hold them strictly accountable.

If budging on valuation is not a viable tactic to compete against established firms — which, in addition to their ability to be less price sensitive also boast more recognizable brand names, larger teams and higher AUM that affords them higher budgets for platform resources — how can emerging managers win? Enter Cobra Kai.

Strike first

Let’s face it. As an emerging manager, the chances of you winning a deal once the established players start to circle drops precipitously. In order to win, you need to have a first-mover advantage.

On a practical level, there are two windows of opportunity to achieve this:

1. Build a relationship with founders early before the formal fundraise process

- Leverage programmatic tools that allow you to identify founders as close to the point of company formation as possible.

- Build relationships with would-be founders before they leave their current role to start their next venture.

- Prove value before the fundraise. Of course, it isn’t feasible for a small team to spend multiple hours with prospective investments, so focus is key. Execute on the one or two ways where you can add significant value in a lower touch way, such as key customer intros or talent referrals.

2. During the deal process, move quickly

- Larger firms tend to have more layers of review before a deal reaches decision-makers. Use nimbleness to your advantage — have multiple deal calls per week to keep diligence pace up and reach conviction quickly.

- Focus diligence by distilling down to the top two or three concerns you are trying to get comfortable with on a deal early. Then execute to address those concerns efficiently.

- Use weekends to your advantage. Most funds have investment committee meetings on Monday. Strike on Sundays.

Strike hard

To be a good partner to founders, you have to understand the space in which their businesses operate. Larger firms have the resources to research a broad range of industries and technologies quickly, a luxury which is rarely enjoyed by emerging managers. It is easier to compete if you develop certain domain expertise and keep a narrower focus on the types of deals you pursue. The more content you are able to produce in those domains, the easier it’ll be to prove your expertise to founders. Wax on, wax off.

Beyond just understanding though, entrepreneurs want to see conviction and dedication. These days it is a weak position to say you’ll come in if the company finds a strong lead or if the company gets to a certain level of capital commitments. To win, you need to show that you have personal conviction around the founders and the company, and are not reliant on external signals.

No matter how much conviction you have, or even how much founders may like you personally, ultimately founders have to do what’s best for their business and their employees. It’s crucial then, to prove what value you can bring to the table, especially when your competition can afford dedicated teams and software to assist in providing operational support. There are a variety of tactics that can be employed here, from founder reference calls to customer intro lists or reverse pitches. What matters though is earnestly communicating your dedication and efficacy.

No mercy

Perhaps the most hyperbolic of the three Cobra Kai mantras, a more level phrasing might be “don’t let up.” The only way you build brand equity as an emerging manager is through consistency. Maintaining analytical rigor in diligence and needle-moving operational support over time and as you scale is no small feat. The key is in crafting a process that is both effective and scalable, and sticking to it.

Together, the Cobra Kai mantras might lead to more deals won, but deserve a word of caution. In the pursuit of striking first, striking hard and never letting up, it’s critical to avoid getting caught up in the day-to-day execution and losing sight of the bigger picture.

These mantras may help you win more deals, but history shows that VC is a cyclical game in which all but a few managers come and go. So, as an emerging manager, even if your early wins lead to success and help you raise a couple of funds, it is important to both maintain the discerning eye that got you there, as well as to continually improve your processes and evolve as a firm. If you’re resting, you’re not hunting; but if you’re always hunting, then you’re not building.