The Exchange is technically off today, but we’re here anyway because there’s neat stuff in the world of startups and money to talk about. So, let’s yammer this morning about Slack’s new valuation and what the market is telling us about what the venerable SaaS company is really worth.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Recall that on Wednesday, news broke that Salesforce is considering buying Slack, a move that has potential merit and some question marks.

The merits could include bringing Slack’s startup mindshare to Salesforce and bringing Salesforce’s enterprise reach to Slack. In terms of questions, precisely how Slack fits into Salesforce’s CRM-and-platform play isn’t clear; Salesforce’s own Slack-ish competitor, Chatter, hasn’t taken control of its market in the 10-plus years since its release (here’s TechCrunch covering its launch back in 2009), making the possible home of Slack inside Salesforce slightly suspect.

Still, Slack investors cheered the concept of Salesforce paying up for their company, while investors in the latter company knocked nearly $20 off its share price, perhaps worried about the very thing that Slack’s owners were stoked to consider.

Still, Slack investors cheered the concept of Salesforce paying up for their company, while investors in the latter company knocked nearly $20 off its share price, perhaps worried about the very thing that Slack’s owners were stoked to consider.

So, price. What’s Slack worth? This is a question that’s fun in both academic terms and also for understanding the current dynamics in the software M&A market — what do you have to pay to take a large chess piece off the software market’s board?

Let’s take a look at what we can learn from Slack’s pre-news price, and its current, changed valuation.

What’s it worth?

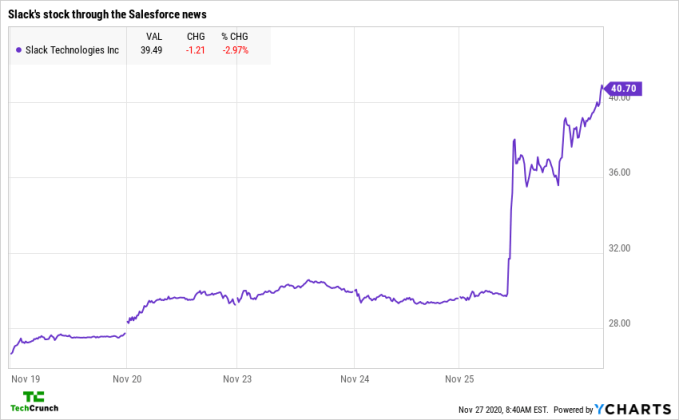

Here’s a chart of Slack’s value before and after the Salesforce news, just to give you a taste of how big an impact the reporting had:

More simply, Slack was worth just under $30 per share before and is worth just over $40 now that the market has digested the news. Or more precisely, per YCharts data, Slack was worth $16.88 billion before the news and $22.58 billion now in market cap terms.

Are either of those prices expensive? Let’s get some more data to find out (data via YCharts):

- Slack trailing twelve months’ revenue: $768.14 million.

- Slack last quarter revenue: $215.86 million (implied run rate: $863.44 million).

- Slack current fiscal year revenue estimate: $877.25 million (through January 31, 2020).

From here we can easily get the revenue multiples that we need, looking at Slack’s pre-Salesforce news valuation:

- Slack’s revenue multiple at its trailing twelve months’ revenue: 22x.

- Slack’s revenue multiple at its last quarter’s annualized run rate: 19.5x.

- Slack’s revenue multiple at its current fiscal year revenue estimate: 19.2x.

And, with the company’s new valuation:

- Slack’s revenue multiple at its trailing twelve months’ revenue: 29.4x.

- Slack’s revenue multiple at its last quarter’s annualized run rate: 26.2x.

- Slack’s revenue multiple at its current fiscal year revenue estimate: 25.7x.

Digging into this particular story, I expected Slack to look overpriced at its new valuation. Why? Because the market was no longer pricing along the lines of what it might pay for the company by itself, but instead what Salesforce might have to pay up for it to take it over. I expected a comfortable premium.

However, after digging through the constituent members of the Bessemer cloud index this morning, for companies that sport similar multiples to Slack’s new metrics, it doesn’t seem super wild. Twilio is priced around the same on an annualized basis for example, with similar growth and efficiency results.1 But Twilio’s gross margins are inferior to Slack’s, which nearly makes the workplace chat app seem cheap.

Avalara is also nearby in multiples terms, but has lesser results to lean on in percentage-growth terms. Other local comps in the index can, at points, make Slack appear not inexpensive, but I can’t find anything that makes Slack feel expensive at its new valuation, given today’s market norms.

There’s more going on in Slack’s old valuation than pure revenue counting, of course. Microsoft has come gunning for Slack in recent years, to some effect. The market expects that battle to be expensive and long; perhaps with Salesforce behind it Slack would have a better shot at taking on Redmond?

That perspective helps explain some of the company’s valuation gains, why its new valuation doesn’t seem too far off reasonable given its core metrics, and why the company was, I suppose, a little cheap before the acquisition talks news dropped.

So you have to nod your head a bit at all of this, provided that Salesforce is being serious, and that the two pieces can fit together. Wild!

- We’ve switched to enterprise value multiples at this point, because that’s what Bessemer uses. You and I calculated multiples using market cap as we could get all of that data; for some reason getting a today-correct enterprise valuation for Slack was hard while keeping to a single data source. So, I’ve guided us from the latter to the former. This doesn’t matter for our argument’s sake, but I wanted you to know in case you were reading carefully and thought that I fucked up. Hugs!