Milana Lewis, CEO and co-founder of music tech startup Stem, started the fundraising process long before she actually asked any investors for money (dig the well before you’re thirsty — it’s the best way). She recommends that other founders do the same.

Ten years ago, Milana started working at United Talent Agency (UTA), one of the world’s leading talent agencies. When tasked with finding the best tools and technologies that UTA’s clients could use to self-distribute their work, she discovered a glaring gap.

“There were all these tools built for the distribution of content, monetization of content and audience development,” she says. “The last piece missing was the financial aspect.” The entertainment industry desperately needed a platform that would help artists manage the financial side of their business — and that’s how the idea for Stem was born.

Because UTA had its own investment branch, called UTA Ventures, Milana’s job also introduced her to some brilliant investors. Years later, when it was time to fundraise for Stem, those connections played a pretty big role.

In an episode of How I Raised It, Milana shared how Stem has landed some superstar investors and raised a little under $22 million.

1. Bring investors along for the ride — from the very start

Milana’s involvement with UTA Ventures exposed her to the investor experience and put her in the same room as people like Gary Vaynerchuk, Jonathon Triest from Ludlow Ventures, Anthony Saleh from Wndrco and Scooter Braun.

After meeting them the first time, she made sure to nurture those relationships, and she was “honest and vulnerable” about the fact that she wanted to be an entrepreneur one day.

“It’s amazing how much people will help and support you along in that journey,” Milana says. Investors “get excited about making early-stage investments because they want to identify that person before anyone else does.”

As her idea for Stem came together, she shared that with them, too. Over the course of a year, she provided regular updates on her vision, like how she was building out her team, and she also called them for occasional advice.

By the time she approached some of them for funding, she didn’t even need to present a full pitch. By then, they already knew enough about Stem, and about Milana as a businesswoman. Her pitch meeting with Gary Vaynerchuk — the first person to invest — ended up being just 15 minutes long.

“I brought people on my entrepreneurial journey in the beginning,” Milana says. “The biggest piece of advice I could give is to start raising a year before you start raising. Start building relationships and data points.”

Image Credits: Nathan Beckord (opens in a new window)

2. Become best friends with systems and deadlines

For each round, Milana put together a lead list — a list of potential investors who she either met socially or through business. Each time, she wanted to have at least 100 names on this list.

Before she even tried to pitch these 100 people, she asked them the following discovery questions, making sure to track all the responses in a Google Sheet.

- What are you excited about?

- What have you recently invested in?

- What are some open market opportunities you see?

- What check sizes do you write?

Then, she prioritized the list by people who invested in the stage Stem was in and who were most likely to say yes because they’d built a relationship with her over time — for them, the leap of faith was the shortest. She needed to identify those who’d be willing to take a blind bet. Because at the beginning, “You have no proof points, in most cases, unless you bootstrap the business to revenue,” Milana says. “All I had was a deck.”

Also at the top of the list? Investors who, if she could get them on board, would be a good signal to other future investors.

Once her list was prioritized, she set her deadlines and started meeting with people. For the first round, she gave herself 60 days to close. During a four-week period in that time frame, she spent three days each in New York, San Francisco and Los Angeles, meeting with investors back to back.

You can leverage this type of strategy to put extra pressure on investors. If they know you have limited time and your schedule is tightly packed with investor meetings, there will be a sense of FOMO and urgency. They’ll move quickly to make sure they don’t pass on a great opportunity.

3. Don’t take rejection personally — turn it into intelligence

As she’d done before, for Stem’s most recent round of funding, Milana had a lead list of 100 people.

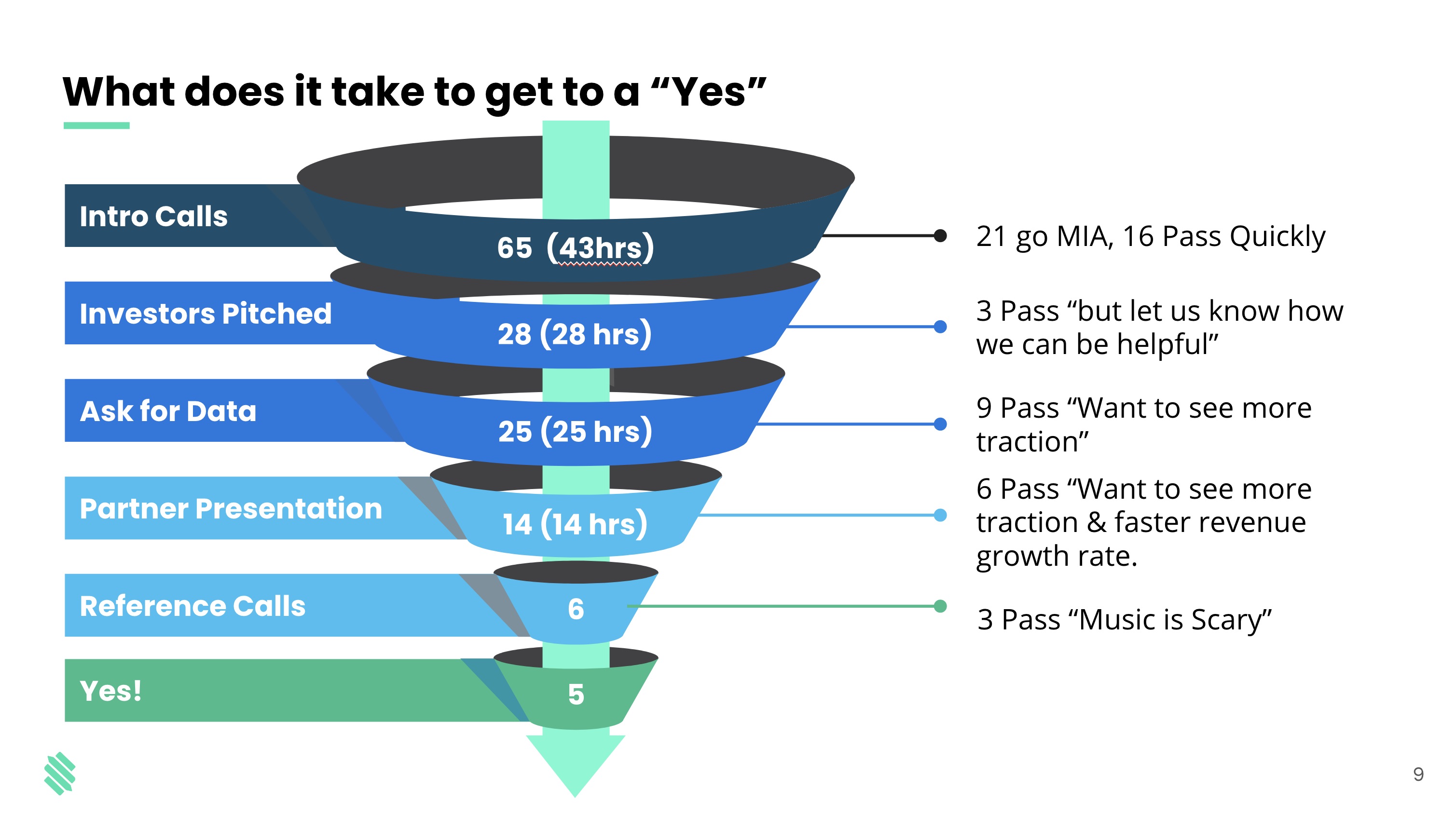

She did 30-minute introductory calls with 65 people on the list right as the world went into lockdown due to COVID-19. These calls were purely discovery — she wanted to suss out whether Stem and the investor were a good fit. Of those, 16 passed, 21 ghosted her and 28 wanted to move forward.

There wasn’t much she could do about the 21 who stopped responding, but she did ask those who passed if there were any other investors they thought she should talk to.

She cautions that you should only ask for recommendations if the investor passed because it’s too early, but that they’d be interested in a later round. This future interest is a good sign for other firms. If the investor who passed actively invests in the same stage you’re raising for and said no for a different reason, don’t ask for a referral.

When three of the remaining 28 said no, Milana requested detailed feedback on her pitch. She wanted to know what was clear, what was unclear and if they could give her any pointers on her materials. Make each interaction meaningful, especially if they turn you down. This sort of intel is invaluable.

Ultimately, after a few more rounds of conversations, Stem successfully closed the round with five final yeses.